Q4 Loss Widens at Amedisys - Analyst Blog

March 13 2014 - 9:00AM

Zacks

Home healthcare provider

Amedisys Inc. (AMED) recorded adjusted loss from

continuing operations per share of 5 cents in the fourth quarter of

2013, a massive downfall from the adjusted income from continuing

operations of 25 cents earned in the year-ago quarter. Reported

loss was also wider than the Zacks Consensus Estimate of loss of 3

cents a share.

Per management, three factors led

to the earnings downfall: higher cost per visit in home health,

higher-than-expected employee healthcare cost and an accrual of

$450,000 related to one of the company’s care centers. For the full

year, adjusted net income from continuing operations came in at 27

cents per share, deteriorating significantly from the year-ago

figure of $1.15.

Quarter in

Detail

Amedisys primarily derives revenues

from its home health and hospice agencies. Fourth-quarter net

service revenue grossed $303.5 million, down 13.7% year over year.

However, the top line fared better than the Zacks Consensus

Estimate of $295 million. Total revenue in 2013 came in at $1,249.3

million, down 13.3%.

Within the company’s Home Health

division, net service revenue was $238.4 million (down 14.7% year

over year) with Medicare revenues of $193.1 million and

non-Medicare revenues of $45.3 million.

Within the hospice division, net

service revenue was $65.1 million (down 9.5% year over year)

including Medicare revenues of $67.8 million and non-Medicare

revenues of $4.1 million in the quarter.

The company reported a 252 basis

points (bps) contraction in gross margin to 40.9% in the quarter.

Expenses on salaries and benefits declined 9.3% to $74.6 million,

while other expenses decreased 11.6% to $41.5 million. Amedisys

posted adjusted operating margin contraction of 401 bps to 4.9% in

the quarter.

Amedisys exited the fiscal with

cash and cash equivalents of $17.3 million compared with $14.5

million at the end of 2012. The company’s long-term obligations

(including current portion) were $46.9 million as against $102.7

million at the end of 2012. Net cash provided by operating

activities in the quarter was $8.4 million, down 48.0% year over

year.

Our Take

Amedisys posted yet another weak

quarter with sustained volume pressure. Although the company’s

revenues surpassed the Zacks Consensus Estimate, the bottom line

missed the same. The company also failed to meet its guidance for

another quarter. We believe that poor segment performance, sluggish

growth trend and the adverse impact from sequestration led to the

dismal fourth-quarter results. Moreover, the fact that no guidance

was provided for the upcoming fiscal, failed to inspire

confidence.

We believe that the highly

uncertain home nursing reimbursement environment, coupled with

significant reduction in Medicare reimbursement in the recent past

has affected Amedisys’ performance over the past few quarters. We

expect the healthcare reimbursement pressure to persist even in

2014, thereby weakening the company’s performance further.

Currently, the stock carries a

Zacks Rank #3 (Hold). On the other hand, medical sector stocks such

as Covidien plc (COV), Stryker

Corporation (SYK) and SurModics, Inc.

(SRDX) are expected to do well. All the three stocks hold a Zacks

Rank #2 (Buy).

AMEDISYS INC (AMED): Free Stock Analysis Report

COVIDIEN PLC (COV): Free Stock Analysis Report

SURMODICS (SRDX): Free Stock Analysis Report

STRYKER CORP (SYK): Free Stock Analysis Report

To read this article on Zacks.com click here.

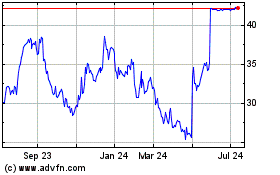

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

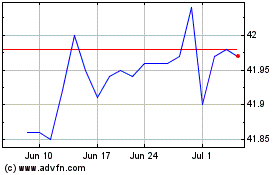

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024