UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

March 11, 2014

DRINKS AMERICAS HOLDINGS, LTD.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

000-19086

|

|

87-0438825

|

|

State of

Incorporation

|

|

Commission

File Number

|

|

IRS Employer

I.D. Number

|

4101 Whiteside Street, Los Angeles, CA 90063

Address of principal executive offices

Registrant's telephone number: (323) 266-8765

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

|

Item 1.01

|

Entry Into A Material Definitive Agreement

|

|

Item 3.02

|

Unregistered Sale of Equity Securities

|

On March 7, 2014, the Circuit Court in the 12th Judicial Circuit in and for Sarasota County, Florida (the “Court”), entered an Order Granting Approval of Settlement Agreement (the “Order”) approving, among other things, the fairness of the terms and conditions of an exchange pursuant to Section 3(a)(10) of the Securities Act of 1933, as amended (the “Securities Act”), in accordance with a Settlement Agreement (the “Settlement Agreement”) between Drinks Americas Holdings, Ltd. (the “Company”) and IBC Funds, LLC, a Nevada limited liability company (“IBC”), in the matter entitled IBC Funds, LLC v. Drinks Americas Holdings, Ltd. , Case No. 2014 CA 001374 (the “Action”). IBC commenced the Action against the Company to recover $455,000.00 (the “Claim”), which Claim consists of the Notes (as defined below). The Order provides for the full and final settlement of the Claim and the Action. The Settlement Agreement became effective and binding upon the Company and IBC upon execution of the Order by the Court on March 7, 2014.

Pursuant to the terms of the Settlement Agreement approved by the Order, the Company agreed to issue, in one or more tranches as necessary, that number of shares sufficient to satisfy the Claim amount upon conversion to the Company’s common stock, $0.001 par value (the “Common Stock”) at a conversion price equal to 25% of the lowest sale price of the Common Stock during the ten (10) trading days preceding the share request inclusive of the day of any share request.

The Settlement Agreement provides that in no event shall the number of shares of Common Stock issued to IBC or its designee in connection with the Settlement Agreement, when aggregated with all other shares of Common Stock then beneficially owned by IBC and its affiliates (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended (the “ Exchange Act ”), and the rules and regulations thereunder), result in the beneficial ownership by IBC and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and the rules and regulations thereunder) at any time of more than 9.99% of the Common Stock.

Furthermore, the Settlement Agreement provides that, for so long as IBC or any of its affiliates hold any shares of Common Stock, the Company and its affiliates are prohibited from, among other actions, voting any shares of Common Stock owned or controlled by the Company or its affiliates, or soliciting any proxies or seeking to advise or influence any person with respect to any voting securities of the Company, in favor of: (1) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving Company or any of its subsidiaries, (2) a sale or transfer of a material amount of assets of Company or any of its subsidiaries, (3) any change in the present board or management of the Company, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board, (4) any material change in the present capitalization or dividend policy of Company, (5) any other material change in Company’s business or corporate structure, (6) a change in Company’s charter, bylaws or instruments corresponding thereto (7) causing a class of securities of the Company to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association, (8) causing a class of equity securities of Company to become eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended, (9) terminating the Company’s transfer agent (10) taking any action which would impede the purposes and objects of the Settlement Agreement or (11) taking any action, intention, plan or arrangement similar to any of those enumerated above.

The issuance of Common Stock to IBC pursuant to the terms of the Settlement Agreement approved by the Order is exempt from the registration requirements of the Securities Act pursuant to Section 3(a)(10) thereof, as an issuance of securities in exchange for bona fide outstanding claims, where the terms and conditions of such issuance are approved by a court after a hearing upon the fairness of such terms and conditions at which all persons to whom it is proposed to issue securities in such exchange shall have the right to appear.

The foregoing information is a summary of the Settlement Agreement and Order, is not complete, and is qualified in its entirety by reference to the full text of the Settlement Agreement and Order, each of which is attached as an exhibit to this Current Report on Form 8-K. Readers should review each for a complete understanding of the terms and conditions associated with this transaction.

|

Item 2.04

|

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under and Off-Balance Sheet Arrangement.

|

On March 5, 2014, the Company defaulted on 8% Convertible Unsecured Promissory Notes (the “Notes”) in principal amount of $35,000, $70,000, $150,000 and $200,000, which Notes were originally dated as of November 1, 2012 and due May 1, 2013, as amended by that certain second amendment agreement dated February 24, 2014 (“2nd Amendment”).

Pursuant to the 2nd Amendment, additional events of default were added to the Notes, including the failure (i) to file with the Securities Exchange Commission, by March 1, 2014, the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2013, which failure is not cured within 3 Business Days; and (ii) to file with the Securities Exchange Commission, by March 15, 2014, the Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended July 31, 2013 and October 31, 2013, which failure is not cured within 3 Business Days. On March 5, 2014, the Company was unable to perform the above obligations within the prescribed cure period and defaulted on the Notes.

|

Item 9.01

|

Financial Statements and Exhibits

|

| |

Exhibit No. |

Description |

| |

|

|

| |

10.1

|

|

| |

10.2

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 11, 2014

| |

DRINKS AMERICAS HOLDINGS, LTD.

|

|

| |

|

|

|

| |

|

/s/ Timothy Owens

|

|

| |

|

Timothy Owens, Chief Executive Officer

|

|

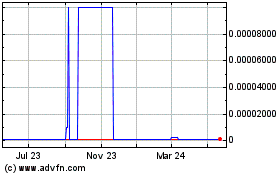

Drinks Americas (CE) (USOTC:DKAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

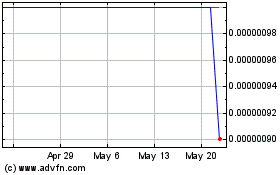

Drinks Americas (CE) (USOTC:DKAM)

Historical Stock Chart

From Apr 2023 to Apr 2024