New Connectivity Solutions from Skyworks - Analyst Blog

March 11 2014 - 5:00PM

Zacks

Leading semiconductor manufacturer

Skyworks Solutions Inc. (SWKS) recently introduced

a series of wireless networking products that incorporate flip-chip

packaging to augment its existing mobile connectivity portfolio.

With these revolutionary products, the company expects to increase

functionality and ubiquitous connectivity as well as reduce the

front-end circuit board footprint of smartphones and tablets.

Flip-chip technology incorporates the strengths of various

packaging technologies to reduce production costs and improve

electrical and thermal performance. This easy-to-assemble lighter

packaging technology occupies lesser front-end circuit board space

and thickness as compared to other conventional packaging

materials. Consequently, this enables smartphone and tablet OEMs

(original equipment manufacturers) to fit in smaller, thinner

solutions for 802.11ac system-in-package (SiP) modules.

Skyworks continues to capitalize on increasing global mobile

connectivity and demand for high-performance solutions across a

diverse set of vertical markets. The company supports connectivity

across a number of strategic applications including medical

devices, wearable technologies, home automation and hybrid vehicles

as well as smartphones and tablets.

Skyworks aims to fuel its growth engine on the back of three

thriving business segments − mobile Internet, vertical markets and

analog components. Demand for mobile Internet applications is

exploding with the broad proliferation of smartphones, net books,

note books, caplets and other forms of embedded wireless devices.

Skyworks also continues to consolidate its share across the mobile

Internet spectrum. This covers everything from net books and data

cards to smartphones, and even entry-level handsets.

The market is estimated to have 50 billion connections by 2020.

Some of the fastest-growing segments include medical, industrial,

automotive and smart energy where connectivity is being adopted for

the very first time. Perfect quality, environmentally friendly

products and sustainable business practices are key differentiators

for this company in a very competitive environment. Consequently,

we expect Skyworks to post solid operating results in the near

future.

Skyworks currently has a Zacks Rank #1 (Strong Buy). Other stocks

in the industry that look promising and are worth looking into now

include Integrated Device Technology, Inc. (IDTI),

FormFactor Inc. (FORM) and Himax

Technologies, Inc. (HIMX), each carrying a Zacks Rank #2

(Buy).

FORMFACTOR INC (FORM): Free Stock Analysis Report

HIMAX TECH-ADR (HIMX): Free Stock Analysis Report

INTEGR DEVICE (IDTI): Free Stock Analysis Report

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

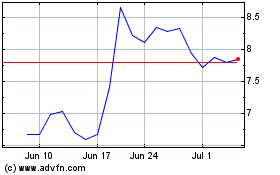

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

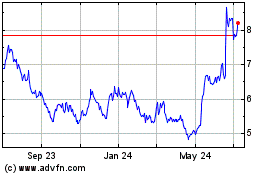

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Apr 2023 to Apr 2024