SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 11, 2013

Global Digital Solutions, Inc.

(Exact name of registrant as specified in its charter)

New Jersey

(State or other jurisdiction of incorporation)

|

000-26361

|

|

22-3392051

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

777 South Flagler Drive, Suite 800 West

West Palm Beach, Florida

|

|

33401

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(561) 515-6163

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

The Company has entered into two non-binding letters of intent relating to proposed acquisitions, and has submitted a non-binding proposal for another acquisition, as described below. As such letters of intent and proposal are subject to various conditions, the Company is not able to predict the likelihood of completion of any or all such transactions. However, if these transactions are completed, they will materially affect the business and financial condition of the Company.

The Company is also providing an update on the status of its transactions with Airtronic USA, Inc.

The Company does not intend or undertake to update the information set forth below in respect of any such transaction unless and until a more definitive and/or binding arrangement is entered into by the Company in respect of any such transaction, and subject to any obligations of confidentiality which may be undertaken by the Company with respect thereto.

The Freedom Group Proposal. The Company submitted a non-binding proposal, dated January 27, 2014, for the acquisition of the Remington Outdoor Company, Inc., also known as Freedom Group, Inc. (“Freedom”). The Company received no response to such proposal and, by its terms, it expired on February 17, 2014. In order to facilitate discussions, the Company has revised its proposal by leaving certain basic terms open for future negotiations and submitted a revised non-binding proposal, dated March 10, 2014. Under the proposal, the Company would offer consideration valued at eight times the 2013 consolidated EBITDA of Freedom and its specified subsidiaries less long term indebtedness. The Company estimates such EBITDA at $237.5 million and such long- term indebtedness at $818 million, which would result in total consideration of $1,082 million. Such amount would be subject to determination and adjustment as described in the proposal. Freedom has estimated that its net sales for 2013 will be in the range of $1,250.0 million to $1,275.0 million and that its adjusted EBITDA will be in the range of $235.0 million to $240.0 million.

Freedom describes itself as the world's leading innovator, designer, manufacturer and marketer of firearms, ammunition and related products for the hunting, shooting sports, law enforcement and military markets. It indicates that, as one of the largest manufacturers in the world of firearms and ammunition, it has some of the most globally recognized brands including Remington®, Bushmaster® Firearms, DPMS/Panther Arms™, Marlin®, H&R®, The Parker Gun™, Mountain Khakis®, Advanced Armament Corp. ®, Dakota Arms®, Para™ USA and Barnes® Bullets. Additional information concerning Freedom is available on its website at http://www.freedom-group.com. Information on that website shall not be deemed to be incorporated in, or to be a part of, this report.

The Company estimates that there are 166,989 shares of common stock of Freedom outstanding. On this basis, the consideration per share offered in the transaction would be cash in the amount of $ 4,479.67 plus 1,000 shares of the Company’s common stock. Total consideration would be approximately $750 million in cash and 160 million shares of the Company’s common stock.

The proposal is subject to various conditions, including (1) satisfactory completion of due diligence by the Company, (2) mutual agreement on the terms of an acquisition agreement, (3) successful completion by the Company of equity and debt offerings to provide necessary funding for the transaction, (4) receipt of required governmental and other third party approvals and (5) other customary conditions.

The Company has not received a response to this proposal. However, the Company intends to continue efforts to enter into discussions with a view to moving forward with this proposal. As indicated above, the Company is not able to predict the likelihood of completion of this transaction or of any other transaction involving Freedom.

Private Company 1 Letter of Intent. The Company entered into a non-binding letter of intent with a private company (“PC1”), in Q4 2013, under which the Company would acquire PC1 at a price, to be paid in cash, equal to six times PC1’s 2013 EBITDA, determined as described in the letter of intent, and subject to adjustment based on the audited financial statements of PC1 for 2013. PC1’s unaudited revenue for 2013 was approximately $30 million and unaudited EBITDA was approximately $2.6 million. Based on the Company’s estimate of the EBITDA determined pursuant to the letter of intent, the purchase price would be $15.62 million.

PC1 is involved in the supply of military and law enforcement equipment. The PC1 acquisition is subject to satisfactory completion of due diligence by the Company, which the Company recently completed, completion of a satisfactory acquisition agreement and other customary conditions. As indicated above, the Company is not able to predict the likelihood of completion of this transaction or of any other transaction involving PC1.

Private Company 2 Letter of Intent. The Company also entered into a non-binding letter of intent with another private company (“PC2”), in Q4 2013, under which the Company would initially acquire 80% of the outstanding shares of PC2 for a purchase price, payable partly in cash and partly in shares of the Company, based on a ten times multiple of the EBITDA of PC2 for specified fiscal years, to be determined, and subject to adjustment, as described in the letter of intent.

PC2 offers product technology and development services in various industries, including military, aerospace, alternative energy and aviation, among others. PC2 had unaudited revenue of approximately $25 million in 2013 and unaudited EBITDA of approximately $4.5 million in 2013. Based on the Company’s estimate of the EBITDA of PC2 for the applicable period, an initial payment of $30 million would be made at the closing, of which $24 million would be paid in cash and $6 million in shares of common stock of the Company, valued at $1 per share for this purpose. Additional payments of up to $5 million each would be made on the first and second anniversaries of the closing, subject to specified EBITDA targets, which would be paid 80% in cash and 20% in shares of the Company, valued at $1 per share.

On the fourth anniversary of the closing, the shareholders of PC2 would have the right to put the remaining 20% of their shares in PC2 to the Company, at a purchase price per share equal to ten times the EBITDA per share of PC2 for the preceding three fiscal years, to be paid 50% in cash and 50% in shares of common stock of the Company. For this purpose, the shares of the Company would be valued at the weighted average closing price for the 20 trading days preceding the date of determination.

For any shares of the Company issued in the transaction, the Company would provide to the sellers a guarantee as to the minimum market price of the shares for the two years following receipt, and such shares would be subject to restrictions on transfer for twelve months following receipt.

Following completion of the acquisition, as long as the selling shareholders continue to hold 20% of the shares of PC2, they would be entitled to designate two of the three members of the board of PC2.

The PC2 acquisition is subject to satisfactory completion of due diligence by both parties, which is currently in progress, completion of a satisfactory acquisition agreement and other customary conditions. As indicated above, the Company is not able to predict the likelihood of completion of this transaction or of any other transaction involving PC2.

Airtronic USA, Inc. As previously disclosed, on October 22, 2012, the Company entered into an Agreement of Merger and Plan of Reorganization (“Merger Agreement”) to acquire 70% of Airtronic USA, Inc. (“Airtronic”), a debtor in possession under Chapter 11 of the Bankruptcy Code in a case pending in the US Bankruptcy Court for the Northern District of Illinois, Eastern Division (the “Court”), once Airtronic successfully reorganized and emerged from bankruptcy (the “Merger”).

Also on October 22, 2012, the Company entered into a Debtor In Possession Note Purchase Agreement (“Bridge Loan”) with Airtronic. The Company agreed to lend Airtronic up to a maximum of $2,000,000, with an initial advance of $750,000 evidenced by an 8¼% Secured Promissory Note with an original principal amount of $750,000 made by Airtronic in favor of the Company (the “Original Note”) and a Security Agreement securing all of Airtronic’s assets. In March 2013, the Company and Airtronic amended the Bridge Loan to provide for a maximum advance of up to $700,000 in accordance with draws submitted by Airtronic and approved by the Company in accordance with the budget set forth in the amendment. On August 5, 2013, the Company entered into the Second Bridge Loan Modification and Ratification Agreement with Airtronic, a new 8¼% secured promissory note for $550,000 (the “Second Note”), and a Security Agreement with the CEO of Airtronic, securing certain intellectual property for patent-pending applications and trademarks that were registered in her name. On October 10, 2013, the Company entered into the Third Bridge Loan Modification and Ratification Agreement with Airtronic, and a new 8¼% secured promissory note for $200,000 (the “Third Note”).

On October 2, 2013, Airtronic’s amended plan of reorganization (the “Plan”) was confirmed by the Court, but the Plan was never substantially consummated and has now been terminated. Under the express terms of the Plan, Airtronic needed to close the Merger with the Company within 60 days following the confirmation date—i.e., on or before December 2, 2013—to obtain the funds necessary to pay its creditors in accordance with the Plan. Nevertheless, Airtronic refused to close the Merger with the Company on or before December 2, 2013 and, as a result, the Plan terminated and the reorganized Airtronic re-vested in the bankruptcy estate of Airtronic as debtor in possession.

On December 5, 2013, the Company filed a motion with the Court to declare the Original Note, the Second Note and the Third Note to be in default, and filed a supplemental motion with the Court on January 6, 2014. On December 9, 2013 the Company filed a motion with the Court to convert Airtronic’s Chapter 11 bankruptcy to a Chapter 7 bankruptcy. Additionally, the Court has ruled that Airtronic may not use any of the cash it receives (the “Cash Collateral”) since December 2, 2013. On February 29, 2014, the Company filed a motion with the Court to hold Airtronic and its principal in contempt for the unauthorized use of the Cash Collateral, and on March 4, 2014 the Company filed a motion for the appointment of a trustee for Airtronic because of its unauthorized use of the Cash Collateral. All of these motions are scheduled for hearing on March 12, 2014.

On February 23, 2014, Airtronic filed a modified plan of reorganization (the “Modified Plan”) with funding from RPG Funding Investors, LLC. On March 3, 2014, a creditor of Airtronic, Airtronic Acquisition Company, LLC, filed its proposed plan of reorganization (the “AAC Plan”). The Court has not yet set a date or schedule for voting, acceptance, objections or confirmation of either the Modified Plan or the AAC Plan but has required that the parties provide the Court with proof that funds are available for the consummation of each of the Modified Plan and the AAC Plan. The court is expected to consider both the Modified Plan and the AAC Plan on March 12, 2014.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release dated March 11, 2014 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Global Digital Solutions, Inc.

|

| |

|

|

|

|

Date: March 11, 2014

|

By: |

/s/ Richard J. Sullivan

|

|

| |

|

Richard J. Sullivan

|

|

| |

|

Chief Executive Officer

|

|

| |

|

|

|

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release dated March 11, 2014 |

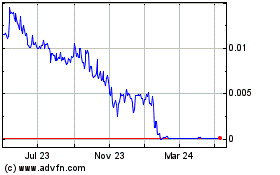

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

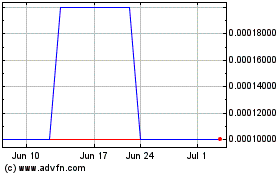

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Apr 2023 to Apr 2024