Constellation Brands Hits 52-Week High - Analyst Blog

March 11 2014 - 10:00AM

Zacks

Shares of Constellation

Brands Inc. (STZ) reached a new 52-week high of $84.33

yesterday and closed the trading session at $83.95. Apart from

strong third-quarter fiscal 2014 results and an upbeat guidance,

the company has been performing well on the back of brand building

and inorganic growth strategies. Notably, the stock price of this

beverage company rose approximately 21.2% year-to-date.

The average volume of shares traded

over the last 3 months was approximately 1,513K. Moreover, the

company currently trades at a forward P/E of 21.1x, slightly higher

than the peer group average of 21.06x. Further, the company’s

long-term estimated earnings per share (EPS) growth rate of 16.5%

is substantially higher than the peer group average of 7.8%.

Investors are optimistic about this

Zacks Rank #3 (Hold) stock after it posted EPS of $1.10 on Jan 8,

which handily surpassed the Zacks Consensus Estimate of 91 cents

and rose 74.6% year over year. Constellation Brands reported net

sales of $1,443.3 million, marking a rise of 88.2% from the

prior-year quarter and handily beating the Zacks Consensus Estimate

of $1,386 million.

The year-over-year top-line growth

was primarily attributable to complete consolidation of the Crown

Import business. Moreover, Constellation Brand’s history of

positive earnings surprises makes investors bullish about the

stock. We observe that the company has beaten the Zacks Consensus

Estimate in the past 3 out of 4 quarters by an average of 6.5%.

Constellation Brands’ sustained

focus on brand building and introduction of new products in the

wine and spirits business are the major factors behind the stock’s

momentum. Additionally, last year, the company acquired the Grupo

Modelo SAB de C.V.’s U.S. beer business, which included full

ownership of Crown Imports from Anheuser-Busch InBev

SA/NV (BUD). Moreover, Constellation Brands is enhancing

its distribution channels in retail and effectively implementing

strategic merchandising initiatives to augment sales.

Considering the positive impact

from the full consolidation of Grupo Modelo and strong

third-quarter results, management raised its guidance for fiscal

2014. Constellation Brands expects fiscal 2014 adjusted earnings to

be in the range of $3.10–$3.20 per share, compared with $2.80–$3.10

projected earlier. Currently, the Zacks Consensus Estimate stands

at $3.19, which lies near the higher end of the guidance range.

Apart from Constellation Brands,

other stocks like McGraw Hill Financial, Inc.

(MHFI) and Skechers USA Inc. (SKX) achieved new

52-week highs of $82.29 and $36.47 respectively, on Mar 10,

2014.

ANHEUSER-BU ADR (BUD): Free Stock Analysis Report

MCGRAW HILL FIN (MHFI): Free Stock Analysis Report

SKECHERS USA-A (SKX): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

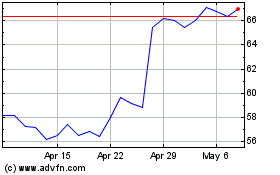

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Apr 2023 to Apr 2024