As filed with the Securities and Exchange Commission on March 3, 2014

Registration No. 333-190040

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 3

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MANNKIND CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

13-3607736

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

28903 North Avenue Paine

Valencia, CA 91355

(661)

775-5300

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Alfred E. Mann

Chief

Executive Officer and Chairman

MannKind Corporation

28903 North Avenue Paine

Valencia, CA 91355

(661)

775-5300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

David Thomson, Esq.

MannKind Corporation

28903 North Avenue Paine

Valencia, CA 91355

(661)

775-5300

|

|

L. Kay Chandler, Esq.

Sean M. Clayton, Esq.

Cooley LLP

4401

Eastgate Mall

San Diego, CA 92121-1909

(858) 550-6000

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration

Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box:

¨

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box:

x

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box:

x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box:

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

¨

|

|

|

|

|

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, $0.01 par value per share

|

|

19,852,474(1)

|

|

$6.14(2)

|

|

$121,894,190.36(2)

|

|

$15,700(3)

|

|

|

|

|

|

(1)

|

This registration statement relates to the resale by the selling stockholders named herein of the shares of common stock, par value $0.01 per share, of the registrant issuable upon conversion of convertible notes held

by the selling stockholders named herein pursuant to a Facility Agreement dated July 1, 2013, as amended on February 28, 2014. The number of shares reflected in the table above includes 7,852,474 of the total 12,000,000 shares of

common stock previously registered in connection with the filing of this registration statement on July 19, 2013, which have been sold under this registration statement by the selling stockholders named herein prior to the date hereof. Pursuant

to Rule 416(a) under the Securities Act of 1933, as amended, or the Securities Act, this registration statement also registers an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or

similar transactions.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee under Rule 457(c) under the Securities Act, based on the average of the high and low trading prices of our common stock reported on The NASDAQ

Global Market on February 28, 2014.

|

|

(3)

|

Of this amount, $11,327 was previously paid in connection with the filing of this registration statement on July 19, 2013.

|

PROSPECTUS

MANNKIND CORPORATION

Common Stock

This prospectus

relates to the sale or disposition from time to time of up to a maximum of 12,000,000 shares of our common stock that may be issued upon conversion of senior secured convertible notes, or Notes, held by the selling stockholders named in this

prospectus. The selling stockholders acquired the Notes from us in private placements that closed on July 1, 2013 and December 9, 2013, as more fully described in the section entitled “Prospectus Summary—Private Placements.”

We are not selling any common stock under this prospectus and will not receive any of the proceeds from the sale of our common stock by the selling stockholders.

The selling stockholders may resell or dispose of the shares of our common stock at fixed prices, at prevailing market prices at the time of

sale or at prices negotiated with purchasers, to or through underwriters, broker-dealers, agents, or through any other means described in this prospectus under “Plan of Distribution.” The selling stockholders will bear all commissions and

discounts, if any, attributable to the sale or disposition of the shares. We will bear all costs, expenses and fees in connection with the registration of the shares. We will not receive any of the proceeds from the sale by the selling stockholders

of these shares of common stock. We provide more information about how the selling stockholders may sell their shares of common stock in the section entitled “Plan of Distribution” beginning on page 8 of this prospectus.

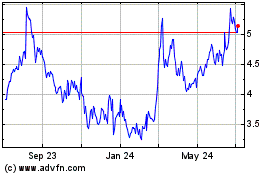

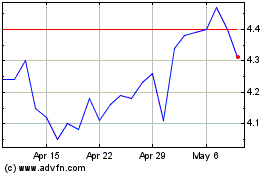

Our common stock is traded on The NASDAQ Global Market under the symbol “MNKD.” On February 28, 2014, the last reported sale

price of our common stock was $6.19 per share.

An

investment in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties referred to under the heading “Risk Factors” beginning on page 2 of this prospectus and under any similar headings

in any amendment or supplement to this prospectus or in any filing with the Securities and Exchange Commission that is incorporated by reference herein.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 3, 2014

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on

Form S-3

(Registration

No. 333-190040)

that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process as a “well-known seasoned issuer,” as defined in Rule 405 under

the Securities Act of 1933, as amended, or the Securities Act. Under this registration statement, the selling stockholders may sell from time to time in one or more offerings the common stock described in this prospectus.

We have not authorized anyone to provide you with information other than the information that we have provided or incorporated by reference in

this prospectus and your reliance on any unauthorized information or representation is at your own risk.

This document may only be used

where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only as of the date of this prospectus and that any information we have incorporated by reference is accurate only as of the

date of the document incorporated by reference, regardless of the time of delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed since those dates.

This prospectus and the information incorporated herein by reference contain summaries of certain provisions contained in some of the

documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed,

will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find

Additional Information.”

We urge you to read carefully this prospectus, together with the information incorporated herein by

reference as described under the heading “Information Incorporated by Reference,” before deciding whether to invest in any of the common stock being offered.

References in this prospectus to the “registrant,” “we,” “us” and “our” refer to MannKind Corporation,

together with our wholly-owned subsidiaries. References to “Deerfield” in this prospectus refer to Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P.

AFREZZA

®

, MedTone

®

,

Dreamboat™ and Technosphere

®

are our trademarks in the United States. We have also applied for and have registered company trademarks in other jurisdictions, including Europe and Japan.

This document also contains trademarks and service marks of other companies that are the property of their respective owners.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus. Because it is a summary, it

does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including the section entitled “Risk Factors,” any prospectus supplement and the

documents that we incorporate by reference into this prospectus, before making an investment decision.

MannKind Corporation

We are a biopharmaceutical company focused on the discovery, development and commercialization of therapeutic products for diseases

such as diabetes. Our lead product candidate, AFREZZA (insulin human [rDNA origin]) inhalation powder, is an ultra rapid-acting insulin that is intended to improve glycemic control in adults with type 1 or type 2 diabetes. In August 2013,

we announced positive preliminary results from our two recently-completed Phase 3 clinical studies of AFREZZA for the treatment of adults with type 1 or type 2 diabetes for the control of hyperglycemia. In October 2013, we resubmitted

our new drug application, or NDA, to the United States Food and Drug Administration, or FDA, seeking approval of AFREZZA.

AFREZZA is

absorbed into the bloodstream more quickly than subcutaneously injected rapid acting insulin analogs and regular human insulin. The time to maximum plasma insulin concentration is 12-15 minutes after administration of AFREZZA compared to

45-90 minutes for rapid acting insulin analogs and 90-150 minutes for regular human insulin. The time action profile of AFREZZA mimics the early phase insulin response observed in healthy normal individuals after a meal, which is

characteristically absent in patients with type 2 diabetes.

AFREZZA utilizes our proprietary Technosphere formulation technology;

however, this technology is not limited to insulin delivery. We believe it represents a versatile drug delivery platform that may allow pulmonary administration of certain drugs that currently require administration by injection. Beyond convenience,

we believe the key advantage of drugs inhaled as Technosphere formulations is that they can be absorbed very rapidly into the arterial circulation, essentially mimicking intra-arterial administration. Currently, we are actively working with several

parties to assess the feasibility of formulating different active ingredients on Technosphere particles. Additionally, our inhaler technology has the potential to be utilized for the administration of dry powder formulations for various other

applications.

Corporate Information

We were incorporated in the State of Delaware on February 14, 1991. Our principal executive offices are located at 28903 North

Avenue Paine, Valencia, California 91355, and our telephone number at that address is (661) 775-5300. MannKind Corporation and the MannKind Corporation logo are our service marks. Our website address is http://www.mannkindcorp.com. The

information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this prospectus.

The Offering

|

Common stock to be offered by the selling stockholders

|

Up to 12,000,000 shares issuable upon conversion of the Notes held by the selling stockholders.

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the shares of common stock covered by this prospectus. However, our outstanding principal indebtedness under the Notes will be cancelled upon the conversion of the Notes.

|

|

NASDAQ Global Market Symbol

|

MNKD

|

The selling stockholders named in this prospectus may offer and sell up to 12,000,000 shares of our common

stock that may be issued upon conversion of the Notes. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders, we are referring to the shares of common stock that may be

issuable upon conversion of the Notes sold in the private placements described below.

1

Private Placements

We have entered into a Facility Agreement with Deerfield, dated July 1, 2013, as amended on February 28, 2014, pursuant to which we

have sold $120.0 million aggregate principal amount of Notes to Deerfield as of the date of this prospectus and pursuant to which Deerfield may purchase up to an additional $40.0 million of Notes following the date of this prospectus

subject to the satisfaction of certain conditions. As of the date of this prospectus, $40.0 million aggregate principal amount of the Notes issued under the Facility Agreement have been converted into an aggregate of 7,852,474 shares of

our common stock and $80.0 million aggregate principal amount of Notes remain outstanding.

On February 28, 2014, we amended the

Facility Agreement to increase by $60.0 million the aggregate principal amount of Notes held by the selling stockholders that may be converted into shares of our common stock. The selling stockholders may convert a portion of the Notes into

shares of our common stock at a conversion price equal to the average of the volume weighted average prices per share during the three trading days immediately preceding the date of conversion, provided that the Notes will not be convertible at a

conversion price below $5.00 per share unless we otherwise consent. Unless we otherwise consent to a reduction in the $5.00 per share minimum conversion price, the number of shares that may be issued upon conversion of the Notes following the date

of this prospectus is limited to an aggregate of 12,000,000 shares or such lesser number of shares as may be determined pursuant to the conversion limitations contained in the Notes. In addition, the Notes may not be converted to the extent

conversion would result in the holder’s beneficial ownership exceeding 9.985% of our outstanding common stock following such conversion. Pursuant to the amendment to the Facility Agreement, we agreed to file this registration statement to

register for resale the shares issuable upon conversion of the Notes.

We relied on the exemption from registration contained in

Section 4(a)(2) of the Securities Act and Regulation D, Rule 506 thereunder, for the offer, sale and issuance of the Notes and expect to rely on such exemptions for any issuance of the shares of common stock issuable upon conversion

of the Notes.

RISK FACTORS

An investment in our common stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should

consider carefully the specific risk factors discussed in the sections entitled “Risk Factors” contained in our most recent Annual Report on

Form 10-K

or Quarterly Report on

Form 10-Q,

as filed with the SEC, which are incorporated in this prospectus by reference in their entirety, as well as any amendment or updates to our risk factors reflected in subsequent filings with the SEC,

including any prospectus supplement hereto. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our

business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations could be materially and adversely affected. In that case,

the trading price of our common stock could decline and you might lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, and the documents incorporated by reference herein and any prospectus supplement hereto may contain, forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future financial performance and

involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the

forward-looking statements. Forward-looking statements may include, but are not limited to statements about:

|

|

•

|

|

the progress or success of our research, development and clinical programs, including the application for and receipt of regulatory clearances and approvals, and the timing or success of the commercialization of

AFREZZA, if approved, or any other products or therapies that we may develop;

|

2

|

|

•

|

|

our ability to market, commercialize and achieve market acceptance for AFREZZA, or any other products or therapies that we may develop;

|

|

|

•

|

|

our plans and expectations regarding collaboration or licensing transactions;

|

|

|

•

|

|

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others;

|

|

|

•

|

|

our estimates for future performance;

|

|

|

•

|

|

our estimates regarding anticipated operating losses, future revenues, capital requirements and our needs for additional financing; and

|

|

|

•

|

|

scientific studies and the conclusions we draw from them.

|

In some cases, you can identify

forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,”

“project,” “predict,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and

subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk Factors” in our SEC filings,

and may provide additional information in any prospectus supplement hereto. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

You should read this prospectus, the registration statement of which this prospectus is a part, the documents incorporated by reference

herein, and any prospectus supplement hereto completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these

cautionary statements.

You should rely only on the information contained, or incorporated by reference, in this prospectus and any

applicable prospectus supplement hereto. We have not authorized anyone to provide you with different information. The common stock offered under this prospectus is not being offered in any state where the offer is not permitted. You should not

assume that the information provided by this prospectus or any prospectus supplement hereto is accurate as of any date other than the date on the front of this prospectus or the prospectus supplement, as applicable, or that any information

incorporated by reference in this prospectus or in any prospectus supplement hereto is accurate as of any date other than the date given in the document incorporated by reference. Unless required by law, we undertake no obligation to update or

revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking

statements.

USE OF PROCEEDS

All proceeds from the sale of our common stock covered by this prospectus will belong to the selling stockholders who offer and sell such

shares of common stock. We will not receive any proceeds from the resale of the common stock by the selling stockholders. However, our outstanding principal indebtedness under the Notes will be cancelled upon conversion of the Notes. Each selling

stockholder will pay any underwriting discounts and commissions and any expenses incurred by the selling stockholder for brokerage, accounting, tax or legal services or any other expenses incurred by such selling stockholder in disposing of shares

covered by this prospectus.

3

DESCRIPTION OF CAPITAL STOCK

General

Our authorized capital stock

consists of 550,000,000 shares of common stock, $0.01 par value per share, and 10,000,000 shares of preferred stock, $0.01 par value per share. As of February 28, 2014, there were [377,375,591] shares of common stock outstanding and no shares

of preferred stock outstanding.

The following summary description of our capital stock is based on the provisions of our certificate of

incorporation and bylaws and the applicable provisions of the Delaware General Corporation Law, or DGCL. This information is qualified entirely by reference to the applicable provisions of our certificate of incorporation, bylaws and the Delaware

General Corporation Law. For information on how to obtain copies of our certificate of incorporation and bylaws, which are exhibits to the registration statement of which this prospectus is a part, see “Where You Can Find Additional

Information” and “Information Incorporated by Reference.”

Common Stock

Voting Rights

Each holder of our common

stock is entitled to one vote for each share on all matters submitted to a vote of our stockholders, including the election of our directors. Under our certificate of incorporation and bylaws, our stockholders will not have cumulative voting rights.

Accordingly, the holders of a majority of our outstanding shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose. In all other matters, an action by our

common stockholders requires the affirmative vote of the holders of a majority of our outstanding shares of common stock entitled to vote.

Dividends

Subject to preferences that may be applicable to any outstanding shares of our preferred stock, holders of our common stock are

entitled to receive ratably any dividends our board of directors declares out of funds legally available for that purpose. Any dividends on our common stock will be non-cumulative.

Liquidation, Dissolution or Winding Up

If we liquidate, dissolve or wind up, the holders of our common stock are entitled to share ratably in all assets legally available for

distribution to our stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any outstanding shares of our preferred stock.

Rights and Preferences

Our common stock

has no preemptive, conversion or subscription rights. There are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely

affected by, the rights of the holders of any outstanding shares of our of preferred stock, which we may designate and issue in the future.

Preferred

Stock

Pursuant to our certificate of incorporation, our board of directors has the authority, without further action by the

stockholders (unless such stockholder action is required by applicable law or Nasdaq rules), to designate and issue up to 10,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included

in each such series, to fix the designations, voting powers, preferences and rights of the shares of each wholly unissued series, and any qualifications, limitations or restrictions thereof, and to increase or decrease the number of shares of any

such series, but not below the number of shares of such series then outstanding.

The DGCL provides that the holders of preferred stock

will have the right to vote separately as a class (or, in some cases, as a series) on an amendment to our certificate of incorporation if the amendment would change the par value or, unless the certificate of incorporation provided otherwise, the

number of authorized shares of the class or change the powers, preferences or special rights of the class or series so as to adversely affect the class or series, as the case may be. This right is in addition to any voting rights that may be

provided for in the applicable certificate of designation.

4

Our board of directors may authorize the issuance of preferred stock with voting or conversion

rights that could adversely affect the voting power or other rights of the holders of our common stock. Preferred stock could be issued quickly with terms designed to delay or prevent a change in control of our company or make removal of management

more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock.

Anti-Takeover

Effects of Provisions of Delaware Law and Our Certificate of Incorporation and Bylaws

Delaware takeover statute

We are subject to Section 203 of the DGCL, which regulates acquisitions of some Delaware corporations. In general, Section 203

prohibits, with some exceptions, a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years following the date of the transaction in which the

person became an interested stockholder, unless:

|

|

•

|

|

the board of directors of the corporation approved the business combination or the other transaction in which the person became an interested stockholder prior to the date of the business combination or other

transaction;

|

|

|

•

|

|

upon consummation of the transaction that resulted in the person becoming an interested stockholder, the person owned at least 85% of the voting stock of the corporation outstanding at the time the transaction

commenced, excluding shares owned by persons who are directors and also officers of the corporation and shares issued under employee stock plans under which employee participants do not have the right to determine confidentially whether shares held

subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

|

on or subsequent to the date the person became an interested stockholder, the board of directors of the corporation approved the business combination and the stockholders of the corporation authorized the business

combination at an annual or special meeting of stockholders by the affirmative vote of at least 66-

2

⁄

3

% of the outstanding stock of the corporation not owned

by the interested stockholder.

|

Section 203 of the DGCL generally defines a “business combination” to include

any of the following:

|

|

•

|

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

|

any sale, transfer, pledge or other disposition of 10% or more of the corporation’s assets or outstanding stock involving the interested stockholder;

|

|

|

•

|

|

in general, any transaction that results in the issuance or transfer by the corporation of any of its stock to the interested stockholder;

|

|

|

•

|

|

any transaction involving the corporation that has the effect of increasing the proportionate share of its stock owned by the interested stockholder; or

|

|

|

•

|

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as any person who, together with the person’s affiliates and

associates, owns, or within three years prior to the determination of interested stockholder status did own, 15% or more of a corporation’s voting stock.

Section 203 of the DGCL could depress our stock price and delay, discourage or prohibit transactions not approved in advance by our board

of directors, such as takeover attempts that might otherwise involve the payment to our stockholders of a premium over the market price of our common stock.

5

Certificate of incorporation and bylaw provisions

Our certificate of incorporation and bylaws include a number of provisions that may have the effect of deterring hostile takeovers or delaying

or preventing changes in our control or our management, including, but not limited to the following:

|

|

•

|

|

Our board of directors can issue up to 10,000,000 shares of preferred stock with any rights or preferences, including the right to approve or not approve an acquisition or other change in our control.

|

|

|

•

|

|

Our certificate of incorporation and bylaws provide that all stockholder actions must be effected at a duly called meeting of holders and not by written consent.

|

|

|

•

|

|

Our bylaws provide that special meetings of the stockholders may be called only by the Chairman of our board of directors, by our Chief Executive Officer, by our board of directors upon a resolution adopted by a

majority of the total number of authorized directors or, under certain limited circumstances, by the holders of at least 5% of our outstanding voting stock.

|

|

|

•

|

|

Our bylaws provide that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors at a meeting of stockholders must provide timely notice in writing

and also specify requirements as to the form and content of a stockholder’s notice. These provisions may delay or preclude stockholders from bringing matters before a meeting of our stockholders or from making nominations for directors at a

meeting of stockholders, which could delay or deter takeover attempts or changes in our management.

|

|

|

•

|

|

Our certificate of incorporation provides that, subject to the rights of the holders of any outstanding series of preferred stock, all vacancies, including newly created directorships, may, except as otherwise required

by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum. In addition, our certificate of incorporation provides that our board of directors may fix the number of directors by resolution.

|

|

|

•

|

|

Our certificate of incorporation does not provide for cumulative voting for directors. The absence of cumulative voting may make it more difficult for stockholders who own an aggregate of less than a majority of our

voting stock to elect any directors to our board of directors.

|

These and other provisions contained in our certificate of

incorporation and bylaws are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors.

However, these provisions could delay or discourage transactions involving an actual or potential change in control of us or our management, including transactions in which our stockholders might otherwise receive a premium for their shares over

market price of our stock and may limit the ability of stockholders to remove our current management or approve transactions that our stockholders may deem to be in their best interests and, therefore, could adversely affect the price of our common

stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Shareowner Services. Its address is 480 Washington Boulevard, Jersey

City, New Jersey, 07310.

SELLING STOCKHOLDERS

This prospectus relates to the resale by the selling stockholders of up to 12,000,000 shares of our common stock that may be issued to the

selling stockholders upon conversion of the Notes.

On July 1, 2013, we entered into a Facility Agreement with Deerfield providing

for the sale by us of up to $160.0 million of Notes to Deerfield in four equal tranches. The closing of the first tranche of $40.0 million of Notes was completed on July 1, 2013. The closing of the second tranche of $40.0 million of Notes was

completed on September 5, 2013. The closing of the third tranche of $40.0 million of Notes was completed on December 9, 2013.

6

Prior to the date of this prospectus, the entire $40.0 million principal amount of Notes issued on September 5, 2013 was converted into 7,852,474 shares of common stock, all of

which shares have been sold by the selling stockholders under the registration statement to which this prospectus forms a part.

On

February 28, 2014, we amended the Facility Agreement to provide for the issuance of tranche B notes to Deerfield in a maximum aggregate principal amount equal to (x) if the FDA approves the NDA for AFFREZZA and Deerfield purchases the

fourth tranche of Notes originally issuable pursuant to the Facility Agreement, 150% of the aggregate principal amount of Notes that Deerfield has converted into our common stock on and after the effective date of the amendment, up to

$90.0 million, and (y) otherwise, 33.33% of the aggregate principal amount of Notes that Deerfield has converted into our common stock on and after the effective date of the amendment, up to $20.0 million, in each case subject to the

satisfaction of certain other conditions. The amended Facility Agreement also provides that, subject to certain limitations, Deerfield may convert up to an additional $60.0 million of the Notes issued and outstanding on the date of the

amendment into shares of our common stock following the effective date of the amendment.

On February 28, 2014, we also amended our

Registration Rights Agreement with Deerfield dated July 1, 2013, pursuant to which we agreed to register for sale the shares issuable upon conversion of the Notes issued on July 1, 2013 and December 9, 2013. Additional information

with respect to these agreements and related agreements is contained in our current report on

Form 8-K

filed with the SEC on July 1, 2013 and under the heading “Deerfield Facility

Amendment” in Item 9B of our annual report on

Form 10-K

filed with the SEC on March 3, 2014, and is incorporated by reference herein.

The table below lists the selling stockholders and other information regarding the shares of our common stock beneficially owned by the

selling stockholders as of February 28, 2014. There were [377,375,591] shares of our common stock outstanding as of February 28, 2014. Unless otherwise indicated, beneficial ownership is determined in accordance with

Section 13(d) of the Exchange Act and the rules and regulations thereunder, and is based upon information provided by each respective selling stockholder identified below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address(1)

|

|

Shares of

Common Stock

Beneficially Owned

Before Offering(2)

|

|

|

Number of Shares

of Common Stock

Offered Hereby(3)

|

|

|

Shares of

Common Stock

Beneficially Owned

Following the Offering

|

|

|

|

|

|

|

|

Number

|

|

|

% of Class

|

|

|

Deerfield Private Design Fund II, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

780 Third Avenue, 37

th

Floor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York, NY, 10017

|

|

|

5,592,000

|

|

|

|

5,592,000

|

(4)

|

|

|

0

|

|

|

|

0

|

%

|

|

Deerfield Private Design International II, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

780 Third Avenue, 37

th

Floor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York, NY, 10017

|

|

|

6,408,000

|

|

|

|

6,408,000

|

(4)

|

|

|

0

|

|

|

|

0

|

%

|

|

(1)

|

James E. Flynn has the power to vote or dispose of the shares beneficially owned by the selling stockholders.

|

|

(2)

|

Represents the shares of common stock issuable upon conversion of the Notes. See footnote (4) below.

|

|

(3)

|

We do not know when or in what amounts the selling stockholders may offer shares for sale following conversion of the Notes. The selling stockholders may choose not to sell any of the shares offered by this prospectus.

|

|

(4)

|

As of the date of this prospectus, the maximum number of shares of common stock that may be sold under this prospectus by the selling stockholders upon conversion of the Notes is 12,000,000 shares, assuming the

Notes are converted at a conversion price of $5.00. A lesser number of shares may be sold if the Notes are converted at a conversion price of greater than $5.00. The number of shares included in the table above for each selling stockholder is based

upon the percentage of all Notes held by that selling stockholder. The actual number of shares sold by each selling stockholder may be more than the number reflected in the table above, provided that in no event may the aggregate number of shares

hereafter sold under this prospectus by both selling stockholders exceed 12,000,000 shares.

|

7

PLAN OF DISTRIBUTION

The selling stockholders may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading

facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale.

The selling stockholders may use any one or more of the following methods when selling shares:

|

|

•

|

|

ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which a broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account under this prospectus;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

“at the market” or through market makers or into an existing market for the shares;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell

shares under Rule 144 under the Securities Act or pursuant to other available exemptions from the registration requirements of the Securities Act, if available, rather than under this prospectus.

In connection with the sale of the shares, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their

short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the

creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to

this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the

sale of the shares offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in

whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering. However, our outstanding principal indebtedness under the Notes will be cancelled upon

conversion of the Notes.

The selling stockholders and any broker-dealers that act in connection with the sale of securities may be deemed

to be “underwriters” within the meaning of Section 2(11) of the Securities Act in connection with such sales, and any commissions received by such broker-dealers and any profit on the resale of the shares of common stock sold by them

while acting as principals may be deemed to be underwriting discounts or commissions under the Securities Act. In the event that any selling stockholder is deemed to be an “underwriter” within the meaning of

8

Section 2(11) of the Securities Act, the selling stockholder will be subject to the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any

broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and

public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective

amendment to the registration statement that includes this prospectus.

To comply with the securities laws of some states, if applicable,

the shares may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or

qualification requirements is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules

of Regulation M under the Exchange Act may apply to sales of shares of our common stock in the market and to the activities of the selling stockholders and their affiliates. These rules may limit the timing of purchases and sales of the shares

by such selling stockholders. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All of the

foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of common stock.

We will bear all of the costs, expenses and fees in connection with the registration of the shares of common stock to be offered by the

selling stockholders under this prospectus, other than any commissions, discounts or other fees payable to broker-dealers in connection with any sale of shares, which will be borne by the selling stockholder selling such shares of common stock. We

have agreed to indemnify the selling stockholders against certain liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus.

There can be no assurance that any selling stockholder will sell any or all of the shares of common stock registered pursuant to the

registration statement, of which this prospectus forms a part.

LEGAL MATTERS

Cooley LLP, San Diego, California, has given its opinion to us as to certain legal matters relating to the validity of the shares of our

common stock to be offered by this prospectus.

EXPERTS

The consolidated financial statements incorporated in this prospectus by reference from our Annual Report on

Form 10-K

for the year ended December 31, 2013, and the effectiveness of our internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered

public accounting firm, as stated in their reports, which are incorporated herein by reference (which reports (1) express an unqualified opinion on the consolidated financial statements and include an explanatory paragraph relating to our

ability to continue as a going concern and (2) express an unqualified opinion on the effectiveness of internal control over financial reporting). Such financial statements have been so incorporated in reliance upon the reports of such firm

given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. We

have filed with the SEC a registration statement on

Form S-3

under the Securities Act with respect to the shares of common stock being offered under this prospectus. This prospectus, which constitutes a

part of the registration statement, does not contain all of the information set forth in the registration statement or the

9

exhibits which are part of the registration statement. For further information with respect to us and the shares of common stock being offered under this prospectus, we refer you to the

registration statement and the exhibits and schedules filed as a part of the registration statement. You may read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549.

Please call the SEC at

1-800-SEC-0330

for more information about the operation of the Public Reference Room. Our SEC filings are

also available at the SEC’s website at www.sec.gov. We maintain a website at www.mannkindcorp.com. Information contained in our website does not constitute a part of this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with it, which means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this registration statement and prospectus the

documents listed below, and any future filings we will make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus but prior to the termination of the offering of the securities covered by

this prospectus (other than current reports or portions thereof furnished under Item 2.02 or Item 7.01 of

Form 8-K

and exhibits filed on such form that are related to such items and other

portions of documents that are furnished, but not filed, pursuant to applicable rules promulgated by the SEC):

|

|

•

|

|

our annual report on

Form 10-K

for the year ended December 31, 2013, filed with the SEC on March 3, 2014;

|

|

|

•

|

|

our current report on

Form 8-K

filed with the SEC on January 10, 2014; and

|

|

|

•

|

|

the description of our common stock contained in our registration statement on

Form 8-A

dated July 23, 2004, including any amendments or reports filed for the purposes

of updating this description.

|

We will furnish without charge to you, upon written or oral request, a copy of any or all of

the documents incorporated by reference, including exhibits to these documents. You should direct any requests for documents to:

Investor

Relations

MannKind Corporation

28903 North Avenue Paine

Valencia,

CA 91355

(661) 775-5300

In

accordance with Rule 412 of the Securities Act, any statement contained in a document incorporated by reference herein shall be deemed modified or superseded to the extent that a statement contained herein or in any other subsequently filed

document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement.

10

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses, payable by us in connection with the offering of common stock being registered. All

amounts are estimates except the registration fee.

|

|

|

|

|

|

|

|

|

Amount Paid

or to

be

Paid

|

|

|

SEC registration fee

|

|

$

|

15,700

|

|

|

Legal fees and expenses

|

|

$

|

25,000

|

|

|

Accounting fees and expenses

|

|

$

|

12,000

|

|

|

Printer fees

|

|

$

|

7,500

|

|

|

Total

|

|

$

|

60,200

|

|

Item 15. Indemnification of Directors and Officers

We were incorporated under the laws of the State of Delaware. Section 145 of the DGCL generally provides that a Delaware corporation may

indemnify any person who is, or is threatened to be made, a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such

corporation), by reason of the fact that such person is or was an officer, director, employee or agent of such corporation, or is or was serving at the request of such corporation as an officer, director, employee or agent of another corporation or

enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided that such

person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her

conduct was illegal. A Delaware corporation may also indemnify any person who is, or is threatened to be made, a party to any threatened, pending or completed action or suit by or in the right of the corporation by reason of the fact that such

person was a director, officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses

(including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit, provided such person acted in good faith and in a manner he or she reasonably believed to be in or

not opposed to the corporation’s best interests, except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the corporation. Where an officer or director is successful on the

merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses which such officer or director has actually and reasonably incurred. Our certificate of incorporation and bylaws

provide for the indemnification of our directors and officers to the fullest extent permitted under the DGCL and other applicable laws.

Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation

shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duties as a director, except for liability:

|

|

•

|

|

for any transaction from which the director derives an improper personal benefit;

|

|

|

•

|

|

for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

•

|

|

for improper payment of dividends or redemptions of shares; or

|

|

|

•

|

|

for any breach of a director’s duty of loyalty to the corporation or its stockholders.

|

Our certificate of incorporation and bylaws include this provision. Expenses incurred by any officer or director in defending any such action,

suit or proceeding in advance of its final disposition shall be paid by us upon delivery to us of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director

or officer is not entitled to be indemnified by us.

II-1

As permitted by Delaware law, we have entered into indemnity agreements with each of our

directors and executive officers that require us to indemnify such persons against any and all expenses (including attorneys’ fees), witness fees, damages, judgments, fines, settlements and other amounts incurred (including expenses of a

derivative action) in connection with any action, suit or proceeding, whether actual or threatened, to which any such person may be made a party by reason of the fact that such person is or was a director, an officer or an employee of our company or

any of our affiliated enterprises, provided that such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of our company and, with respect to any criminal proceeding, had no

reasonable cause to believe his or her conduct was unlawful. The indemnification agreements also set forth certain procedures that will apply in the event of a claim for indemnification thereunder.

Item 16. Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Description of Document

|

|

|

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.5 to the registrant’s registration statement on Form S-1 (File No. 333-115020), filed with the SEC on

April 30, 2004).

|

|

|

|

|

4.2

|

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to the registrant’s current report on Form 8-K (File No. 000-50865), filed with the SEC on

December 24, 2012).

|

|

|

|

|

4.3

|

|

Amended and Restated Bylaws (incorporated by reference to Exhibit 3.1 to the registrant’s current report on Form 8-K (File No. 000-50865), filed with the SEC on November 19, 2007).

|

|

|

|

|

4.4

|

|

Form of Common Stock Certificate (incorporated by reference to Exhibit 4.4 to the registrant’s annual report on

Form 10-K

(File No. 000-50865), filed with the SEC on

March 18, 2013).

|

|

|

|

|

4.5

|

|

Registration Rights Agreement, dated as of July 1, 2013, by and among the registrant, Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P. (incorporated by reference to Exhibit 99.5 to the

registrant’s Current Report on Form 8-K filed with the SEC on July 1, 2013).

|

|

|

|

|

4.6

|

|

First Amendment to Facility Agreement and Registration Rights Agreement, dated as of February 28, 2014, by and among MannKind, Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P. (incorporated

by reference to Exhibit 4.11 to the registrant’s Annual Report on Form 10-K filed with the SEC on March 3, 2014).

|

|

|

|

|

5.1

|

|

Opinion of Cooley LLP.

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

|

|

23.2

|

|

Consent of Cooley LLP (included in Exhibit 5.1).

|

|

|

|

|

24.1

|

|

Power of Attorney (included on signature page) (previously filed).

|

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1) To file,

during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933, as amended, or the Securities Act;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a

|

II-2

|

|

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value

of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.;

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however,

that subparagraphs (i), (ii) and (iii) above do not apply if the information required to be

included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, as amended, or the

Exchange Act, that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the

offering.

|

(4)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

(i)

|

If the registrant is relying on Rule 430B:

|

|

|

(a)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

|

|

|

(b)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or

(x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used

after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date

shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however , that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that

was part of the registration statement or made in any such document immediately prior to such effective date; or

|

|

|

(ii)

|

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than

prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or

prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time

of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first

use.

|

II-3

(5) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in

the initial distribution of the securities, the undersigned registrant hereby undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to

sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such

securities to such purchaser:

|

|

(i)

|

any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

|

the portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

(6) That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to section 13(a) or

section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to

be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) That: (i) for purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as

part of the registration statement in reliance upon Rule 430A and contained in the form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of the registration

statement as of the time it was declared effective; and (ii) for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(8) To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust

Indenture Act in accordance with the rules and regulations prescribed by the SEC under Section 305(b)(2) of the Trust Indenture Act.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the registrant pursuant to the provisions of Item 15 above, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of

any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of

the requirements for filing on Form S-3 and has duly caused this Amendment No. 3 to registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Valencia, State of California, on March 3,

2014.

|

|

|

|

|

MANNKIND CORPORATION

|

|

|

|

|

By:

|

|

/s/ Alfred E. Mann

|

|

|

|

Alfred E. Mann

Chief Executive Officer and

Chairman

|

Pursuant to the requirements of the Securities Act, this Amendment No. 3 to registration statement

has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Alfred E. Mann

Alfred E. Mann

|

|

Chief Executive Officer and

Chairman of the Board of Directors

(Principal Executive Officer)

|

|

March 3, 2014

|

|

|

|

|

|

*

Hakan S. Edstrom

|

|

President, Chief Operating Officer and Director

|

|

March 3, 2014

|

|

|

|

|

|

/s/ Matthew J. Pfeffer

Matthew J. Pfeffer

|

|

Corporate Vice President and Chief Financial Officer

(Principal Financial and Accounting Officer)

|

|

March 3, 2014

|

|

|

|

|

|

*

Ronald Consiglio

|

|

Director

|

|

March 3, 2014

|

|

|

|

|

|

*

Michael Friedman, M.D.

|

|

Director

|

|

March 3, 2014

|

|

|

|

|

|

*

Kent Kresa

|

|

Director

|

|

March 3, 2014

|

|

|

|

|

|

*

David H. MacCallum

|

|

Director

|

|

March 3, 2014

|

|

|

|

|

|

*

Henry L. Nordhoff

|

|

Director

|

|

March 3, 2014

|

|

|

|

|

|

|

|

|

*By:

|

|

/s/ Matthew J. Pfeffer

|

|

|

|

Matthew J. Pfeffer

|

|

|

|

Attorney-in-Fact

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description of Document

|

|

|

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.5 to the registrant’s registration statement on Form S-1 (File No. 333-115020), filed with the SEC on

April 30, 2004).

|

|

|

|

|

4.2

|

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to the registrant’s current report on Form 8-K (File No. 000-50865), filed with the SEC on

December 24, 2012).

|

|

|

|

|

4.3

|

|

Amended and Restated Bylaws (incorporated by reference to Exhibit 3.1 to the registrant’s current report on Form 8-K (File No. 000-50865), filed with the SEC on November 19, 2007).

|

|

|

|

|

4.4

|

|

Form of Common Stock Certificate (incorporated by reference to Exhibit 4.4 to the registrant’s annual report on

Form 10-K

(File No. 000-50865), filed with the SEC on

March 18, 2013).

|

|

|

|

|

4.5

|

|

Registration Rights Agreement, dated as of July 1, 2013, by and among the registrant, Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P. (incorporated by reference to Exhibit 99.5 to the

registrant’s Current Report on Form 8-K filed with the SEC on July 1, 2013).

|

|

|

|

|

4.6

|

|

First Amendment to Facility Agreement and Registration Rights Agreement, dated as of February 28, 2014, by and among MannKind, Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P. (incorporated

by reference to Exhibit 4.11 to the registrant’s Annual Report on Form 10-K filed with the SEC on March 3, 2014).

|

|

|

|

|

5.1

|

|

Opinion of Cooley LLP.

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

|