Report of Foreign Issuer (6-k)

February 28 2014 - 2:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2014

Commission File Number 000-30902

COMPUGEN LTD.

(Translation of registrant’s name into English)

|

|

|

72 Pinchas Rosen Street

|

|

Tel-Aviv 69512, Israel

|

|

(Address of Principal Executive Offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-For Form 40-F:

Form 20-F

þ

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Compugen Ltd.

On February 28, 2014, Compugen Ltd. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Jefferies LLC and the other underwriters named in Schedule A to the Underwriting Agreement for which Jefferies LLC is acting as representative (the “Underwriters”), related to a public offering of 6,000,000 of the Company’s ordinary shares, nominal (par) value NIS 0.01 per share (the “Ordinary Shares”), at a public offering price of $10.50 per share less underwriting discounts and commissions (the “Offering”). Under the terms of the Underwriting Agreement, the Company has granted the Underwriters an option, exercisable for 30 days, to purchase up to an additional 900,000 ordinary shares. The Offering is expected to close on or about March 5, 2014, subject to the satisfaction of customary closing conditions.

The gross proceeds to the Company are expected to be $63 million, prior to deducting the underwriting discounts and commissions and estimated expenses associated with the Offering, assuming no exercise by the Underwriters of their option to purchase additional ordinary shares.

The Offering is being made pursuant to a prospectus supplement dated February 28, 2014 and an accompanying prospectus dated January 16, 2013, pursuant to the Company’s shelf registration statement on Form F-3 (File No. 333-185910), which was filed with the Securities and Exchange Commission (the “Commission”) on January 7, 2013 and declared effective by the Commission on January 16, 2013.

A copy of the Underwriting Agreement is filed herewith as Exhibit 1.1 and is incorporated herein by reference. The Underwriting Agreement has been included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about the Company. The representations, warranties and covenants contained in the Underwriting Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Underwriting Agreement. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Underwriting Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Underwriting Agreement, and this subsequent information may or may not be fully reflected in the Company’s public disclosures.

In connection with the issuance of the Ordinary Shares, the Company received an opinion of its Israeli counsel, Tulchinsky Stern Marciano Cohen Levitski & Co. which is attached as Exhibit 5.1 hereto.

On February 28, 2014, the Company issued a press release announcing that it had priced the Offering described above. The Company’s press release is filed as Exhibit 99.1 to this Report and is incorporated herein by reference.

The

information contained in this Report, including the exhibit hereto, is hereby incorporated by reference into the Company’s Registration Statement on Form F-3, File No. 333-185910.

Exhibits

|

Exhibit

|

|

|

Number

|

Description of Exhibit

|

|

1.1

|

Underwriting Agreement dated February 28, 2014 by and among Compugen Ltd. and Jefferies LLC, as representative of the several underwriters named in Schedule A thereto

|

|

5.1

|

Opinion of Tulchinsky Stern Marciano Cohen Levitski &Co.

|

|

23.1

|

Consent of Tulchinsky Stern Marciano Cohen Levitski &Co. (included in the opinion filed as Exhibit 5.1).

|

|

99.1

|

Press Release dated February 28, 2014

.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

COMPUGEN LTD.

|

|

|

|

Date: February 28, 2014

|

By:

|

/s/

Dikla Czaczkes Axselbrad

|

|

|

|

|

Dikla Czaczkes Axselbrad

Chief Financial Officer

|

|

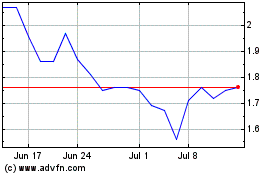

Compugen (NASDAQ:CGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

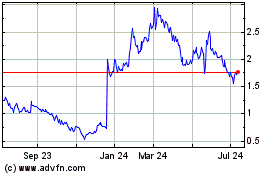

Compugen (NASDAQ:CGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024