Mutual Fund Summary Prospectus (497k)

February 28 2014 - 2:56PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

February 28, 2014

|

Schwab Government Money Fund

™

Ticker

Symbol: SWGXX

Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the

fund’s prospectus, Statement of Additional Information (SAI) and other information about the fund online at

www.schwabfunds.com/prospectus.

You can also obtain this information at no cost by calling

1-866-414-6349

or by sending an email request to

orders@mysummaryprospectus.com.

If you purchase or hold fund shares through a financial intermediary, the

fund’s prospectus, SAI, and other information about the fund are available from your financial intermediary.

The fund’s prospectus

dated April 30, 2013, as supplemented October 4, 2013, and SAI dated April 30, 2013, as supplemented October 4, 2013 and February 28, 2014, include a more detailed discussion of fund investment policies and the risks associated with

various fund investments. The prospectus and SAI are incorporated by reference into the summary prospectus, making them legally a part of the summary prospectus.

Investment objective

The fund’s goal is to seek the highest current income consistent with stability of capital and liquidity.

Fund fees and expenses

This table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

|

|

|

|

|

|

Shareholder fees

(fees paid

directly from your investment)

|

|

|

|

|

|

None

|

|

|

|

|

|

|

|

Annual fund operating expenses

(expenses that you pay each year

as a % of the value of your investment)

|

|

|

Management fees

|

|

|

0.31

|

|

|

Distribution (12b-1) fees

|

|

|

None

|

|

|

Other expenses

|

|

|

0.42

|

|

|

|

|

|

|

|

|

Total annual fund operating expenses

|

|

|

0.73

|

|

|

|

|

|

|

|

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time

periods indicated and then redeem all of your shares at the end of those time periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The figures are based on

total annual fund operating expenses. The expenses would be the same whether you stayed in the fund or sold your shares at the end of each period. Your actual costs may be higher or lower.

|

|

|

Expenses on a $10,000 investment

|

|

|

|

|

|

|

|

|

|

1 year

|

|

3 years

|

|

5 years

|

|

10 years

|

|

$75

|

|

$233

|

|

$406

|

|

$906

|

Principal investment strategies

To pursue its goal, the fund invests in U.S. government securities, such as:

|

|

—

|

|

U.S. Treasury bills and notes

|

|

|

—

|

|

other obligations that are issued by the U.S. government, its agencies or instrumentalities, including obligations that are

|

|

|

|

not guaranteed by the U.S. Treasury, such as those issued by Fannie Mae, Freddie Mac and the Federal Home Loan Banks

|

|

|

—

|

|

obligations that are issued by private issuers that are guaranteed as to principal or interest by the U.S. government, its agencies or

instrumentalities.

|

Under normal circumstances, the fund will invest at least 80% of its net assets in U.S. government

securities including repurchase agreements. The fund will notify its shareholders at least 60 days before changing this policy. Obligations that are issued by private issuers that are guaranteed as to principal or interest by the

U.S. government, its agencies or instrumentalities are considered U.S. government securities under the rules that govern money market funds.

In choosing securities, the fund’s manager seeks to maximize current income within the limits of the fund’s investment objective and credit, maturity and diversification policies. Some of these

policies may be stricter than the federal regulations that apply to all money funds.

The investment adviser’s credit research department

analyzes and monitors the securities that the fund owns or is considering buying. The manager may adjust the fund’s holdings or its average maturity based on actual or anticipated changes in interest rates or credit quality. To preserve its

investors’ capital, the fund seeks to maintain a stable $1.00 share price.

Principal risks

The fund is subject to risks, any of which could cause an investor to lose money. The fund’s principal risks include:

Investment Risk.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the

fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

Interest

Rate Risk.

Interest rates rise and fall over time. As with any investment whose yield reflects current interest rates, the fund’s yield will change over time. During periods when interest rates are low, the fund’s yield (and total

return) also will be low. In addition, to the extent the fund makes any reimbursement payments to the investment adviser and/or its affiliates, the fund’s yield would be lower.

Repurchase Agreements Risk.

When the fund enters into a repurchase agreement, the fund is exposed to

the risk that the other party (i.e., the counter-party) will not fulfill its contractual obligation. In a repurchase agreement, there exists the risk that, when the fund buys a security from a counter-party that agrees to repurchase the security at

an agreed upon price (usually higher) and time, the counter-party will not repurchase the security.

Credit Risk.

The fund is

subject to the risk that a decline in the credit quality of a portfolio investment could cause the fund to lose money or underperform. The fund could lose money if the issuer of a portfolio investment fails to make timely principal or interest

payments or if a guarantor, liquidity provider or counterparty of a portfolio investment fails to honor its obligations. Even though the fund’s investments in repurchase agreements are collateralized at all times, there is some risk to the fund

if the other party should default on its obligations and the fund is delayed or prevented from recovering or disposing of the collateral. Negative perceptions of the ability of an issuer, guarantor, liquidity provider or counterparty to make

payments or otherwise honor its obligations, as applicable, could also cause the price of that investment to decline. The credit quality of the fund’s portfolio holdings can change rapidly in certain market environments and any downgrade or

default on the part of a single portfolio investment could cause the fund’s share price or yield to fall.

Many of the

U.S. government securities that the fund invests in are not backed by the full faith and credit of the United States government, which means they are neither issued nor guaranteed by the U.S. Treasury. Although maintained in

conservatorship by the Federal Housing Finance Agency since September 2008, Fannie Mae (FNMA) and Freddie Mac (FHLMC) maintain only limited lines of credit with the U.S. Treasury. The Federal Home Loan Banks (FHLB) also only maintain limited

access to credit lines from the U.S. Treasury. Other securities, such as obligations issued by the Federal Farm Credit Banks Funding Corporation (FFCB), are supported solely by the credit of the issuer. There can be no assurance that the

U.S. government will provide financial support to securities of its agencies and instrumentalities if it is not obligated to do so under law. Also, any government guarantees on securities the fund owns do not extend to shares of the fund

itself.

Management Risk.

Any actively managed mutual fund is subject to the risk that its investment adviser will make poor

security selections. The fund’s investment adviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results. The investment

adviser’s maturity decisions will also affect the fund’s yield, and in unusual circumstances potentially could affect its share price. To the extent that the investment adviser anticipates interest rate trends imprecisely, the fund’s

yield at times could lag those of other money market funds.

Liquidity Risk.

Liquidity risk exists when particular investments are

difficult to purchase or sell. The market for certain investments may become illiquid due to specific adverse changes in the conditions of a particular issuer or under adverse market or economic conditions independent of the issuer. The fund’s

investments in illiquid securities may reduce the returns of the fund because it may be unable to sell the illiquid securities at an advantageous time or price. Further, transactions in illiquid securities may entail transaction costs that are

higher than those for transactions in liquid securities.

Redemption Risk.

The fund may experience periods of heavy redemptions that could cause the

fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets. Redemptions by a few large investors in the fund may have a significant adverse effect on the

fund’s ability to maintain a stable $1.00 share price. In the event any money market fund fails to maintain a stable net asset value, other money market funds, including the fund, could face a market-wide risk of increased redemption

pressures, potentially jeopardizing the stability of their $1.00 share prices.

Regulatory Risk.

The Securities and Exchange

Commission (SEC) and other regulators may adopt additional money market fund regulations in the future, which may impact the operation and performance of the fund.

Money Market Risk.

The fund is not designed to offer capital appreciation. In exchange for their emphasis on stability and liquidity, money market investments may offer lower long-term

performance than stock or bond investments.

Performance

The bar chart below shows how the fund’s investment results have varied from year to year, and the following table shows the fund’s average annual total returns for various periods. This

information provides some indication of the risks of investing in the fund. All figures assume distributions were reinvested. Keep in mind that future performance may differ from past performance. For current performance information, please see

www.schwab.com/moneyfunds

or call toll-free

1-800-435-4000

for a current

seven-day

yield.

|

|

|

Annual total returns

(%) as of

12/31

|

Best quarter: 1.16% Q4 2006

Worst quarter: 0.00% Q4 2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average annual total returns

(%) as of 12/31/12

|

|

|

|

|

1 year

|

|

|

5 years

|

|

|

10 years

|

|

|

Fund

|

|

|

0.01

|

%

|

|

|

0.42

|

%

|

|

|

1.45

|

%

|

Investment adviser

Charles Schwab Investment Management, Inc.

Purchase and sale of fund shares

The fund is open for business each day that the New York Stock Exchange is open except when the following federal holidays are observed: Columbus Day and

Veterans Day.

The fund is designed for use in conjunction with certain accounts held at Charles Schwab & Co., Inc. (Schwab) and is

subject to the eligibility terms and conditions of your Schwab account agreement,

as amended from time to time. If you designate the fund as the sweep fund on your Schwab account, your uninvested cash balances will be invested in the fund according to the terms and conditions

of your account agreement. Similarly, when you use your account to purchase other investments or make payments, shares of the fund will be sold to cover these transactions according to the terms and conditions of your account agreement. You may make

purchase, exchange and redemption requests in accordance with your account agreement.

Tax information

Distributions received from the fund will generally be taxable as ordinary income or capital gains, unless you are investing through an IRA, 401(k) or

other

tax-advantaged

account.

Payments to financial intermediaries

The fund pays Schwab for shareholder and sweep administration services. These payments may create a conflict of interest by influencing Schwab and your

salesperson to recommend the fund over another investment. Ask your salesperson or visit Schwab’s website for more information.

|

|

|

|

|

REG54651-13 00112449

|

|

Schwab Government Money Fund

TM

; Ticker Symbol: SWGXX

|

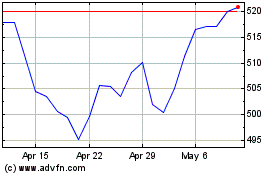

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

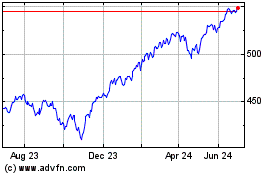

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024