Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

February 28 2014 - 12:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF

REGISTERED MANAGEMENT COMPANY

Investment Company Act file number:

811-05628

Name of Registrant:

Vanguard Malvern Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Date of fiscal year end: September 30

Date of reporting period: December 31, 2013

Item 1:

Schedule of Investments

|

|

|

|

|

|

Vanguard U.S. Value Fund

|

|

|

|

|

|

Schedule of Investments

|

|

|

|

As of December 31, 2013

|

|

|

|

|

|

|

|

|

Market

|

|

|

|

|

Value

|

|

|

|

Shares

|

($000)

|

|

Common Stocks (99.5%)

1

|

|

|

|

Consumer Discretionary (7.0%)

|

|

|

|

|

Comcast Corp. Class A

|

119,089

|

6,188

|

|

|

Gannett Co. Inc.

|

193,600

|

5,727

|

|

|

CBS Corp. Class B

|

85,587

|

5,455

|

|

*

|

Jack in the Box Inc.

|

108,200

|

5,412

|

|

|

Macy's Inc.

|

91,600

|

4,891

|

|

|

Walt Disney Co.

|

56,100

|

4,286

|

|

|

Dillard's Inc. Class A

|

42,100

|

4,093

|

|

|

Dana Holding Corp.

|

183,600

|

3,602

|

|

*

|

Starz

|

123,000

|

3,597

|

|

|

Brinker International Inc.

|

73,900

|

3,425

|

|

|

Whirlpool Corp.

|

20,100

|

3,153

|

|

|

Lowe's Cos. Inc.

|

50,800

|

2,517

|

|

|

Ford Motor Co.

|

132,500

|

2,044

|

|

|

Home Depot Inc.

|

22,600

|

1,861

|

|

|

Columbia Sportswear Co.

|

20,900

|

1,646

|

|

|

Time Warner Inc.

|

19,600

|

1,367

|

|

|

GameStop Corp. Class A

|

25,700

|

1,266

|

|

*

|

Red Robin Gourmet Burgers Inc.

|

16,400

|

1,206

|

|

|

Lear Corp.

|

13,500

|

1,093

|

|

|

Johnson Controls Inc.

|

20,700

|

1,062

|

|

|

Gap Inc.

|

18,400

|

719

|

|

|

Best Buy Co. Inc.

|

7,000

|

279

|

|

|

|

|

64,889

|

|

Consumer Staples (6.4%)

|

|

|

|

|

Procter & Gamble Co.

|

188,769

|

15,368

|

|

|

CVS Caremark Corp.

|

158,450

|

11,340

|

|

|

Tyson Foods Inc. Class A

|

170,400

|

5,702

|

|

|

Archer-Daniels-Midland Co.

|

124,700

|

5,412

|

|

|

Kimberly-Clark Corp.

|

50,600

|

5,286

|

|

*

|

Pilgrim's Pride Corp.

|

277,100

|

4,503

|

|

|

Kroger Co.

|

103,100

|

4,075

|

|

|

Energizer Holdings Inc.

|

35,700

|

3,864

|

|

|

Altria Group Inc.

|

56,600

|

2,173

|

|

|

Kraft Foods Group Inc.

|

19,500

|

1,051

|

|

|

Mondelez International Inc. Class A

|

13,268

|

468

|

|

|

|

|

59,242

|

|

Energy (13.8%)

|

|

|

|

|

Exxon Mobil Corp.

|

350,500

|

35,471

|

|

|

Chevron Corp.

|

135,130

|

16,879

|

|

|

ConocoPhillips

|

173,990

|

12,292

|

|

|

Occidental Petroleum Corp.

|

119,400

|

11,355

|

|

|

Anadarko Petroleum Corp.

|

93,100

|

7,385

|

|

|

Devon Energy Corp.

|

109,700

|

6,787

|

|

|

Hess Corp.

|

79,500

|

6,598

|

|

|

Chesapeake Energy Corp.

|

221,200

|

6,003

|

|

|

Helmerich & Payne Inc.

|

65,000

|

5,465

|

|

*

|

Ultra Petroleum Corp.

|

224,900

|

4,869

|

|

|

EOG Resources Inc.

|

28,600

|

4,800

|

|

|

|

|

|

Cimarex Energy Co.

|

31,900

|

3,347

|

|

Marathon Oil Corp.

|

89,800

|

3,170

|

|

Frank's International NV

|

71,500

|

1,931

|

|

Murphy Oil Corp.

|

11,700

|

759

|

|

* Matador Resources Co.

|

32,300

|

602

|

|

|

|

127,713

|

|

Financials (29.0%)

|

|

|

|

Wells Fargo & Co.

|

541,523

|

24,585

|

|

JPMorgan Chase & Co.

|

254,240

|

14,868

|

|

* Berkshire Hathaway Inc. Class B

|

121,800

|

14,441

|

|

Goldman Sachs Group Inc.

|

69,117

|

12,252

|

|

Bank of America Corp.

|

752,476

|

11,716

|

|

Citigroup Inc.

|

216,161

|

11,264

|

|

Morgan Stanley

|

281,300

|

8,822

|

|

PNC Financial Services Group Inc.

|

108,500

|

8,417

|

|

State Street Corp.

|

97,700

|

7,170

|

|

Travelers Cos. Inc.

|

79,000

|

7,153

|

|

Discover Financial Services

|

125,100

|

6,999

|

|

Ameriprise Financial Inc.

|

59,800

|

6,880

|

|

Allstate Corp.

|

122,300

|

6,670

|

|

Fifth Third Bancorp

|

312,300

|

6,568

|

|

US Bancorp

|

160,600

|

6,488

|

|

Invesco Ltd.

|

168,200

|

6,122

|

|

Lincoln National Corp.

|

116,900

|

6,034

|

|

Regions Financial Corp.

|

598,500

|

5,919

|

|

Everest Re Group Ltd.

|

36,300

|

5,658

|

|

XL Group plc Class A

|

159,900

|

5,091

|

|

Aflac Inc.

|

74,500

|

4,977

|

|

Platinum Underwriters Holdings Ltd.

|

77,500

|

4,749

|

|

KeyCorp

|

272,200

|

3,653

|

|

Washington Federal Inc.

|

145,300

|

3,384

|

|

Nelnet Inc. Class A

|

79,800

|

3,363

|

|

Host Hotels & Resorts Inc.

|

166,300

|

3,233

|

|

American International Group Inc.

|

56,100

|

2,864

|

|

ING US Inc.

|

77,900

|

2,738

|

|

BlackRock Inc.

|

8,400

|

2,658

|

|

Ventas Inc.

|

43,600

|

2,497

|

|

Comerica Inc.

|

50,000

|

2,377

|

|

Kimco Realty Corp.

|

117,200

|

2,315

|

|

ACE Ltd.

|

21,500

|

2,226

|

|

* Howard Hughes Corp.

|

17,500

|

2,102

|

|

RLJ Lodging Trust

|

82,600

|

2,009

|

|

* Realogy Holdings Corp.

|

40,400

|

1,999

|

|

Brandywine Realty Trust

|

141,600

|

1,995

|

|

Hospitality Properties Trust

|

71,300

|

1,927

|

|

Public Storage

|

12,800

|

1,927

|

|

Spirit Realty Capital Inc.

|

191,800

|

1,885

|

|

Geo Group Inc.

|

58,300

|

1,878

|

|

Corrections Corp. of America

|

55,900

|

1,793

|

|

Retail Properties of America Inc.

|

140,000

|

1,781

|

|

Weingarten Realty Investors

|

64,400

|

1,766

|

|

Regency Centers Corp.

|

37,900

|

1,755

|

|

Inland Real Estate Corp.

|

166,200

|

1,748

|

|

Lexington Realty Trust

|

161,800

|

1,652

|

|

Omega Healthcare Investors Inc.

|

51,800

|

1,544

|

|

* Popular Inc.

|

51,100

|

1,468

|

|

Susquehanna Bancshares Inc.

|

105,300

|

1,352

|

|

|

|

|

|

East West Bancorp Inc.

|

37,200

|

1,301

|

|

Ashford Hospitality Trust Inc.

|

150,900

|

1,249

|

|

Capital One Financial Corp.

|

16,300

|

1,249

|

|

Simon Property Group Inc.

|

7,600

|

1,156

|

|

* World Acceptance Corp.

|

12,500

|

1,094

|

|

Legg Mason Inc.

|

23,900

|

1,039

|

|

Huntington Bancshares Inc.

|

100,500

|

970

|

|

* KCG Holdings Inc. Class A

|

67,000

|

801

|

|

RenaissanceRe Holdings Ltd.

|

7,600

|

740

|

|

* FelCor Lodging Trust Inc.

|

85,500

|

698

|

|

General Growth Properties Inc.

|

30,600

|

614

|

|

Assurant Inc.

|

7,300

|

485

|

|

Protective Life Corp.

|

8,500

|

431

|

|

American National Insurance Co.

|

3,300

|

378

|

|

Associated Banc-Corp

|

17,800

|

310

|

|

|

|

267,247

|

|

Health Care (13.0%)

|

|

|

|

Johnson & Johnson

|

238,450

|

21,840

|

|

Pfizer Inc.

|

448,825

|

13,747

|

|

Medtronic Inc.

|

175,500

|

10,072

|

|

Merck & Co. Inc.

|

173,101

|

8,664

|

|

Eli Lilly & Co.

|

156,500

|

7,981

|

|

WellPoint Inc.

|

78,900

|

7,290

|

|

Cigna Corp.

|

81,300

|

7,112

|

|

Cardinal Health Inc.

|

100,200

|

6,694

|

|

Omnicare Inc.

|

92,500

|

5,583

|

|

* CareFusion Corp.

|

126,500

|

5,037

|

|

* Mylan Inc.

|

110,300

|

4,787

|

|

AbbVie Inc.

|

84,200

|

4,447

|

|

* Charles River Laboratories International Inc.

|

82,100

|

4,355

|

|

* Covance Inc.

|

41,400

|

3,646

|

|

* Quintiles Transnational Holdings Inc.

|

53,000

|

2,456

|

|

UnitedHealth Group Inc.

|

28,600

|

2,154

|

|

* Omnicell Inc.

|

36,800

|

939

|

|

* HCA Holdings Inc.

|

19,600

|

935

|

|

* Boston Scientific Corp.

|

75,300

|

905

|

|

Abbott Laboratories

|

16,900

|

648

|

|

* WellCare Health Plans Inc.

|

7,000

|

493

|

|

|

|

119,785

|

|

Industrials (10.4%)

|

|

|

|

General Electric Co.

|

1,003,140

|

28,118

|

|

Raytheon Co.

|

86,900

|

7,882

|

|

Northrop Grumman Corp.

|

64,700

|

7,415

|

|

General Dynamics Corp.

|

75,800

|

7,243

|

|

Delta Air Lines Inc.

|

219,700

|

6,035

|

|

Towers Watson & Co. Class A

|

47,000

|

5,998

|

|

L-3 Communications Holdings Inc.

|

56,000

|

5,984

|

|

Lockheed Martin Corp.

|

36,100

|

5,367

|

|

Boeing Co.

|

36,900

|

5,037

|

|

Oshkosh Corp.

|

83,100

|

4,187

|

|

RR Donnelley & Sons Co.

|

178,000

|

3,610

|

|

Trinity Industries Inc.

|

38,600

|

2,104

|

|

Southwest Airlines Co.

|

96,100

|

1,811

|

|

Emerson Electric Co.

|

18,300

|

1,284

|

|

Crane Co.

|

15,100

|

1,015

|

|

Exelis Inc.

|

52,100

|

993

|

|

|

|

|

|

Manpowergroup Inc.

|

11,000

|

944

|

|

Alaska Air Group Inc.

|

11,700

|

858

|

|

|

|

95,885

|

|

Information Technology (9.0%)

|

|

|

|

Hewlett-Packard Co.

|

360,200

|

10,078

|

|

* Micron Technology Inc.

|

319,500

|

6,952

|

|

Western Digital Corp.

|

81,300

|

6,821

|

|

Xerox Corp.

|

557,300

|

6,782

|

|

Apple Inc.

|

11,750

|

6,593

|

|

Cisco Systems Inc.

|

275,800

|

6,192

|

|

Intel Corp.

|

230,500

|

5,984

|

|

Computer Sciences Corp.

|

93,100

|

5,202

|

|

Texas Instruments Inc.

|

116,300

|

5,107

|

|

Symantec Corp.

|

204,200

|

4,815

|

|

Motorola Solutions Inc.

|

68,842

|

4,647

|

|

Booz Allen Hamilton Holding Corp. Class A

|

168,200

|

3,221

|

|

* Freescale Semiconductor Ltd.

|

176,303

|

2,830

|

|

Anixter International Inc.

|

25,500

|

2,291

|

|

CA Inc.

|

41,100

|

1,383

|

|

* Electronic Arts Inc.

|

45,000

|

1,032

|

|

* Electronics For Imaging Inc.

|

26,300

|

1,019

|

|

Lexmark International Inc. Class A

|

26,400

|

938

|

|

Applied Materials Inc.

|

34,300

|

607

|

|

LSI Corp.

|

41,000

|

452

|

|

|

|

82,946

|

|

Materials (3.1%)

|

|

|

|

Westlake Chemical Corp.

|

43,300

|

5,286

|

|

International Paper Co.

|

103,700

|

5,084

|

|

LyondellBasell Industries NV Class A

|

62,600

|

5,026

|

|

Avery Dennison Corp.

|

96,800

|

4,858

|

|

* Louisiana-Pacific Corp.

|

250,200

|

4,631

|

|

Dow Chemical Co.

|

49,900

|

2,216

|

|

Schweitzer-Mauduit International Inc.

|

27,500

|

1,415

|

|

|

|

28,516

|

|

Telecommunication Services (2.4%)

|

|

|

|

AT&T Inc.

|

618,310

|

21,740

|

|

|

|

Utilities (5.4%)

|

|

|

|

Exelon Corp.

|

241,100

|

6,604

|

|

Edison International

|

126,900

|

5,876

|

|

AES Corp.

|

392,800

|

5,700

|

|

Public Service Enterprise Group Inc.

|

166,900

|

5,348

|

|

AGL Resources Inc.

|

107,800

|

5,091

|

|

UGI Corp.

|

118,000

|

4,892

|

|

PG&E Corp.

|

113,000

|

4,552

|

|

Atmos Energy Corp.

|

98,600

|

4,478

|

|

UNS Energy Corp.

|

45,100

|

2,699

|

|

Black Hills Corp.

|

43,500

|

2,284

|

|

Dominion Resources Inc.

|

21,200

|

1,371

|

|

Vectren Corp.

|

25,700

|

912

|

|

|

|

49,807

|

|

Total Common Stocks (Cost $746,908)

|

|

917,770

|

|

|

|

|

|

|

|

|

Coupon

|

|

|

|

|

Temporary Cash Investments (0.7%)

1

|

|

|

|

|

|

Money Market Fund (0.6%)

|

|

|

|

|

|

2 Vanguard Market Liquidity Fund

|

0.125%

|

|

5,838,559

|

5,839

|

|

|

|

|

|

|

Face

|

|

|

|

|

Maturity

|

Amount

|

|

|

|

|

Date

|

($000)

|

|

|

U.S. Government and Agency Obligations (0.1%)

|

|

|

|

|

|

3,4

Fannie Mae Discount Notes

|

0.050%

|

1/22/14

|

100

|

100

|

|

4,5

Federal Home Loan Bank Discount Notes

|

0.070%

|

3/12/14

|

200

|

200

|

|

3,4

Freddie Mac Discount Notes

|

0.085%

|

3/12/14

|

100

|

100

|

|

|

|

|

|

400

|

|

Total Temporary Cash Investments (Cost $6,239)

|

|

|

|

6,239

|

|

Total Investments (100.2%) (Cost $753,147)

|

|

|

|

924,009

|

|

Other Assets and Liabilities-Net (-0.2%)

|

|

|

|

(1,719)

|

|

Net Assets (100%)

|

|

|

|

922,290

|

* Non-income-producing security.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After

giving effect to futures investments, the fund's effective common stock and temporary cash investment positions

represent 100.0% and 0.2%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by

Vanguard. Rate shown is the 7-day yield.

3 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations

have been managed by the Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as

needed to maintain a positive net worth, in exchange for senior preferred stock.

4 Securities with a value of $400,000 have been segregated as initial margin for open futures contracts.

5 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S.

Treasury nor backed by the full faith and credit of the U.S. government.

A.

Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund's pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

B.

Various inputs may be used to determine the value of the fund's investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1

—

Quoted prices in active markets for identical securities.

Level 2

—

Other significant observable inputs (including quoted prices for similar securities, interest

rates, prepayment speeds, credit risk, etc.).

Level 3

—Significant unobservable inputs (including the fund's own assumptions used to determine

the fair value of investments).

U.S. Value Fund

The following table summarizes the market value of the fund's investments as of December 31, 2013, based on the inputs used to value them:

|

|

|

|

|

|

|

Level 1

|

Level 2

|

Level 3

|

|

Investments

|

($000)

|

($000)

|

($000)

|

|

Common Stocks

|

917,770

|

—

|

—

|

|

Temporary Cash Investments

|

5,839

|

400

|

—

|

|

Futures Contracts—Assets

1

|

25

|

—

|

—

|

|

Futures Contracts—Liabilities

1

|

(4)

|

—

|

—

|

|

Total

|

923,630

|

400

|

—

|

|

1 Represents variation margin on the last day of the reporting period.

|

|

|

|

C.

Futures Contracts: The fund may use index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate notional amounts of the contracts are not recorded in the Schedule of Investments. Fluctuations in the value of the contracts are recorded in the Schedule of Investments as an asset (liability).

At December 31, 2013, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

|

|

|

|

|

|

|

|

|

|

|

($000)

|

|

|

|

|

Aggregate

|

|

|

|

|

Number of

|

Settlement

|

Unrealized

|

|

|

|

Long (Short)

|

Value Long

|

Appreciation

|

|

Futures Contracts

|

Expiration

|

Contracts

|

(Short)

|

(Depreciation)

|

|

E-mini S&P 500 Index

|

March 2014

|

25

|

2,301

|

21

|

|

S&P 500 Index

|

March 2014

|

5

|

2,301

|

91

|

|

|

|

|

|

112

|

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

D.

At December 31, 2013, the cost of investment securities for tax purposes was $753,147,000. Net unrealized appreciation of investment securities for tax purposes was $170,862,000, consisting of unrealized gains of $176,076,000 on securities that had risen in value since their purchase and $5,214,000 in unrealized losses on securities that had fallen in value since their purchase.

|

|

|

|

|

|

Vanguard Capital Value Fund

|

|

|

|

|

|

Schedule of Investments

|

|

|

|

As of December 31, 2013

|

|

|

|

|

|

|

|

|

Market

|

|

|

|

|

Value

|

|

|

|

Shares

|

($000)

|

|

Common Stocks (99.2%)

|

|

|

|

Consumer Discretionary (14.3%)

|

|

|

|

*

|

Groupon Inc.

|

3,222,906

|

37,934

|

|

|

GameStop Corp. Class A

|

447,134

|

22,026

|

|

*

|

Fifth & Pacific Cos. Inc.

|

613,980

|

19,690

|

|

|

PulteGroup Inc.

|

628,429

|

12,801

|

|

*,^

Outerwall Inc.

|

182,315

|

12,264

|

|

*

|

General Motors Co.

|

273,579

|

11,181

|

|

|

Dana Holding Corp.

|

488,060

|

9,576

|

|

*

|

Francesca's Holdings Corp.

|

498,310

|

9,174

|

|

|

Electrolux AB Class B

|

328,902

|

8,595

|

|

|

Lennar Corp. Class A

|

196,400

|

7,770

|

|

*

|

Restoration Hardware Holdings Inc.

|

114,920

|

7,734

|

|

*,^

Vera Bradley Inc.

|

318,100

|

7,647

|

|

|

Advance Auto Parts Inc.

|

65,060

|

7,201

|

|

*

|

Office Depot Inc.

|

1,280,199

|

6,772

|

|

*,^

Tile Shop Holdings Inc.

|

317,610

|

5,739

|

|

|

Wyndham Worldwide Corp.

|

71,600

|

5,276

|

|

*

|

DIRECTV

|

67,400

|

4,657

|

|

*

|

Express Inc.

|

242,300

|

4,524

|

|

*,^

Aeropostale Inc.

|

450,200

|

4,092

|

|

*

|

DISH Network Corp. Class A

|

66,155

|

3,832

|

|

*,1

Allstar Co-Invest LLC Private Placement

|

NA

|

3,574

|

|

|

Abercrombie & Fitch Co.

|

101,832

|

3,351

|

|

|

Kohl's Corp.

|

53,800

|

3,053

|

|

*

|

Tenneco Inc.

|

45,360

|

2,566

|

|

|

|

|

221,029

|

|

Consumer Staples (4.0%)

|

|

|

|

|

Imperial Tobacco Group plc

|

342,315

|

13,271

|

|

|

Wal-Mart Stores Inc.

|

136,100

|

10,709

|

|

|

Bunge Ltd.

|

95,300

|

7,825

|

|

|

Molson Coors Brewing Co. Class B

|

133,300

|

7,485

|

|

|

Maple Leaf Foods Inc.

|

461,200

|

7,290

|

|

|

Treasury Wine Estates Ltd.

|

1,413,105

|

6,095

|

|

|

Mondelez International Inc. Class A

|

143,278

|

5,058

|

|

|

Ingredion Inc.

|

56,200

|

3,847

|

|

|

|

|

61,580

|

|

Energy (15.0%)

|

|

|

|

|

Pioneer Natural Resources Co.

|

232,760

|

42,844

|

|

*

|

Cobalt International Energy Inc.

|

2,141,615

|

35,230

|

|

^

|

Trican Well Service Ltd.

|

1,978,150

|

24,172

|

|

|

National Oilwell Varco Inc.

|

217,400

|

17,290

|

|

|

Canadian Natural Resources Ltd.

|

467,100

|

15,807

|

|

|

Exxon Mobil Corp.

|

142,600

|

14,431

|

|

*

|

Southwestern Energy Co.

|

322,200

|

12,672

|

|

*

|

Superior Energy Services Inc.

|

473,500

|

12,600

|

|

|

Halliburton Co.

|

226,800

|

11,510

|

|

|

QEP Resources Inc.

|

325,100

|

9,964

|

|

*

|

Karoon Gas Australia Ltd.

|

2,368,672

|

9,222

|

|

*

|

McDermott International Inc.

|

944,712

|

8,654

|

|

|

|

|

|

|

|

Anadarko Petroleum Corp.

|

82,100

|

6,512

|

|

|

Baker Hughes Inc.

|

103,900

|

5,741

|

|

*

|

Newfield Exploration Co.

|

107,900

|

2,658

|

|

|

Inpex Corp.

|

173,800

|

2,229

|

|

|

|

|

231,536

|

|

Financials (13.6%)

|

|

|

|

|

JPMorgan Chase & Co.

|

431,200

|

25,217

|

|

|

MetLife Inc.

|

463,400

|

24,987

|

|

|

Wells Fargo & Co.

|

506,800

|

23,009

|

|

*

|

Realogy Holdings Corp.

|

314,590

|

15,563

|

|

|

PNC Financial Services Group Inc.

|

177,500

|

13,771

|

|

|

American International Group Inc.

|

268,600

|

13,712

|

|

|

Reinsurance Group of America Inc. Class A

|

155,900

|

12,068

|

|

|

Julius Baer Group Ltd.

|

229,093

|

11,009

|

|

|

AvalonBay Communities Inc.

|

91,400

|

10,806

|

|

|

LPL Financial Holdings Inc.

|

210,700

|

9,909

|

|

|

Northern Trust Corp.

|

140,300

|

8,683

|

|

|

Boston Properties Inc.

|

84,200

|

8,451

|

|

|

Equity Lifestyle Properties Inc.

|

180,800

|

6,550

|

|

|

Plum Creek Timber Co. Inc.

|

127,200

|

5,916

|

|

|

Weyerhaeuser Co.

|

176,600

|

5,575

|

|

|

Citigroup Inc.

|

92,700

|

4,831

|

|

|

Hatteras Financial Corp.

|

228,900

|

3,740

|

|

|

Principal Financial Group Inc.

|

63,900

|

3,151

|

|

|

Unum Group

|

79,300

|

2,782

|

|

|

|

|

209,730

|

|

Health Care (12.0%)

|

|

|

|

|

Merck & Co. Inc.

|

868,455

|

43,466

|

|

|

Bristol-Myers Squibb Co.

|

587,038

|

31,201

|

|

*

|

Vertex Pharmaceuticals Inc.

|

283,642

|

21,075

|

|

|

Aetna Inc.

|

255,400

|

17,518

|

|

*

|

TherapeuticsMD Inc.

|

2,415,071

|

12,583

|

|

*,^

Arena Pharmaceuticals Inc.

|

1,638,680

|

9,586

|

|

|

AstraZeneca plc ADR

|

158,395

|

9,404

|

|

*

|

Medivation Inc.

|

136,105

|

8,686

|

|

|

Roche Holding AG

|

30,603

|

8,573

|

|

|

Eli Lilly & Co.

|

162,800

|

8,303

|

|

|

Ono Pharmaceutical Co. Ltd.

|

70,700

|

6,197

|

|

*

|

Almirall SA

|

294,113

|

4,793

|

|

*

|

Portola Pharmaceuticals Inc.

|

166,715

|

4,293

|

|

|

|

|

185,678

|

|

Industrials (9.4%)

|

|

|

|

*

|

Owens Corning

|

456,774

|

18,600

|

|

*

|

Armstrong World Industries Inc.

|

231,694

|

13,348

|

|

*

|

WESCO International Inc.

|

133,100

|

12,121

|

|

*,^

Westport Innovations Inc.

|

604,820

|

11,860

|

|

|

Textron Inc.

|

321,910

|

11,833

|

|

*

|

HD Supply Holdings Inc.

|

448,983

|

10,780

|

|

|

Knight Transportation Inc.

|

549,500

|

10,078

|

|

|

Norfolk Southern Corp.

|

98,800

|

9,172

|

|

|

United Parcel Service Inc. Class B

|

82,500

|

8,669

|

|

|

Knoll Inc.

|

430,200

|

7,877

|

|

*

|

Hertz Global Holdings Inc.

|

250,579

|

7,172

|

|

*,^

Polypore International Inc.

|

173,500

|

6,749

|

|

|

ADT Corp.

|

140,055

|

5,668

|

|

|

KBR Inc.

|

164,025

|

5,231

|

|

|

|

|

|

|

|

Rexel SA

|

196,550

|

5,158

|

|

|

|

|

144,316

|

|

Information Technology (20.1%)

|

|

|

|

*

|

SunEdison Inc.

|

4,398,550

|

57,401

|

|

*

|

Micron Technology Inc.

|

1,812,107

|

39,431

|

|

|

Activision Blizzard Inc.

|

1,458,462

|

26,004

|

|

*

|

GT Advanced Technologies Inc.

|

2,640,115

|

23,022

|

|

*

|

Skyworks Solutions Inc.

|

768,185

|

21,939

|

|

|

EMC Corp.

|

618,000

|

15,543

|

|

*

|

Akamai Technologies Inc.

|

312,485

|

14,743

|

|

|

Maxim Integrated Products Inc.

|

448,400

|

12,515

|

|

|

Cisco Systems Inc.

|

475,400

|

10,673

|

|

|

Samsung Electronics Co. Ltd.

|

8,055

|

10,496

|

|

*

|

Yahoo! Inc.

|

241,485

|

9,766

|

|

*

|

UBISOFT Entertainment

|

679,427

|

9,623

|

|

*

|

GCL-Poly Energy Holdings Ltd.

|

24,682,220

|

7,674

|

|

|

Sumco Corp.

|

743,500

|

6,559

|

|

|

Booz Allen Hamilton Holding Corp. Class A

|

318,667

|

6,103

|

|

*

|

JDS Uniphase Corp.

|

449,621

|

5,836

|

|

*

|

NXP Semiconductor NV

|

126,980

|

5,832

|

|

|

Intel Corp.

|

206,400

|

5,358

|

|

*

|

Hollysys Automation Technologies Ltd.

|

212,969

|

4,032

|

|

|

Avago Technologies Ltd. Class A

|

74,100

|

3,919

|

|

*

|

Arrow Electronics Inc.

|

70,800

|

3,841

|

|

*

|

Juniper Networks Inc.

|

155,300

|

3,505

|

|

*

|

Fusion-io Inc.

|

391,095

|

3,485

|

|

*

|

Angie's List Inc.

|

162,600

|

2,463

|

|

|

Seagate Technology plc

|

7,680

|

431

|

|

|

|

|

310,194

|

|

Materials (7.6%)

|

|

|

|

|

Cabot Corp.

|

379,170

|

19,489

|

|

|

Norbord Inc.

|

498,720

|

15,897

|

|

|

Reliance Steel & Aluminum Co.

|

176,500

|

13,386

|

|

|

Wacker Chemie AG

|

104,498

|

11,584

|

|

|

Methanex Corp.

|

189,176

|

11,207

|

|

*

|

Louisiana-Pacific Corp.

|

592,755

|

10,972

|

|

|

Ball Corp.

|

160,700

|

8,302

|

|

|

Celanese Corp. Class A

|

118,200

|

6,538

|

|

|

AuRico Gold Inc.

|

1,494,095

|

5,468

|

|

*,^

Allied Nevada Gold Corp.

|

1,197,112

|

4,250

|

|

|

Barrick Gold Corp.

|

224,800

|

3,963

|

|

*

|

Continental Gold Ltd.

|

1,112,025

|

3,538

|

|

|

OCI Co. Ltd.

|

18,427

|

3,343

|

|

|

|

|

117,937

|

|

Telecommunication Services (0.8%)

|

|

|

|

*

|

T-Mobile US Inc.

|

215,930

|

7,264

|

|

|

Vodafone Group plc

|

1,363,937

|

5,370

|

|

|

|

|

12,634

|

|

Utilities (2.4%)

|

|

|

|

|

NRG Energy Inc.

|

347,575

|

9,982

|

|

|

Entergy Corp.

|

148,700

|

9,408

|

|

|

Xcel Energy Inc.

|

326,000

|

9,109

|

|

|

Snam SPA

|

1,566,451

|

8,756

|

|

|

|

|

37,255

|

|

Total Common Stocks (Cost $1,289,003)

|

|

1,531,889

|

|

|

|

|

|

|

|

Preferred Stocks (0.4%)

|

|

|

|

|

|

*,2

Lithium Technologies Inc. Pfd. (Cost $5,828)

|

|

|

1,195,700

|

6,337

|

|

|

|

|

Coupon

|

|

|

|

|

Temporary Cash Investments (4.0%)

|

|

|

|

|

|

Money Market Fund (2.4%)

|

|

|

|

|

|

3,4

Vanguard Market Liquidity Fund

|

0.125%

|

|

37,655,150

|

37,655

|

|

|

|

|

|

|

Face

|

|

|

|

|

Maturity

|

Amount

|

|

|

|

|

Date

|

($000)

|

|

|

Repurchase Agreements (1.6%)

|

|

|

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

|

|

|

(Dated 12/31/13, Repurchase Value

|

|

|

|

|

|

$12,300,000, collateralized by U.S.

|

|

|

|

|

|

Treasury Note/Bond 0.750%, 10/31/17, with

|

|

|

|

|

|

a value of $12,549,000)

|

0.005%

|

1/2/14

|

12,300

|

12,300

|

|

Deutsche Bank Securities, Inc.

|

|

|

|

|

|

(Dated 12/31/13, Repurchase Value

|

|

|

|

|

|

$12,300,000, collateralized by Federal

|

|

|

|

|

|

Home Loan Mortgage Corp. 3.000%-

|

|

|

|

|

|

4.500%, 2/1/27-11/1/43, with a value of

|

|

|

|

|

|

$12,546,000)

|

0.030%

|

1/2/14

|

12,300

|

12,300

|

|

|

|

|

|

24,600

|

|

Total Temporary Cash Investments (Cost $62,255)

|

|

|

|

62,255

|

|

Total Investments (103.6%) (Cost $1,357,086)

|

|

|

|

1,600,481

|

|

Other Assets and Liabilities-Net (-3.6%)

4

|

|

|

|

(56,274)

|

|

Net Assets (100%)

|

|

|

|

1,544,207

|

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $35,958,000.

1 Restricted security represents 0.2% of net assets. Shares not applicable for this private placement.

2 Restricted security represents 0.4% of net assets.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by

Vanguard. Rate shown is the 7-day yield.

4 Includes $37,655,000 of collateral received for securities on loan.

ADR—American Depositary Receipt.

A.

Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund's pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund's pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields,

Capital Value Fund

maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

B.

Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund's pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

C.

Repurchase Agreements: The fund may enter into repurchase agreements with institutional counterparties. Securities pledged as collateral to the fund under repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. The fund further mitigates its counterparty risk by entering into repurchase agreements only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master repurchase agreements with its counterparties. The master repurchase agreements provide that, in the event of a counterparty's default (including bankruptcy), the fund may terminate any repurchase agreements with that counterparty, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund. Such action may be subject to legal proceedings, which may delay or limit the disposition of collateral.

D.

Various inputs may be used to determine the value of the fund's investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1

—Quoted prices in active markets for identical securities.

Level 2

—Other significant observable inputs (including quoted prices for similar securities, interest

rates, prepayment speeds, credit risk, etc.).

Level 3

—Significant unobservable inputs (including the fund's own assumptions used to determine

the fair value of investments).

The following table summarizes the market value of the fund's investments as of December 31, 2013,

based on the inputs used to value them:

|

|

|

|

|

|

|

Level 1

|

Level 2

|

Level 3

|

|

Investments

|

($000)

|

($000)

|

($000)

|

|

Common Stocks

|

1,389,768

|

138,547

|

3,574

|

|

Preferred Stocks

|

—

|

—

|

6,337

|

|

Temporary Cash Investments

|

37,655

|

24,600

|

—

|

|

Total

|

1,427,423

|

163,147

|

9,911

|

E.

At December 31, 2013, the cost of investment securities for tax purposes was $1,357,221,000. Net unrealized appreciation of investment securities for tax purposes was $243,260,000, consisting of unrealized gains of $281,856,000 on securities that had risen in value since their purchase and $38,596,000 in unrealized losses on securities that had fallen in value since their purchase.

|

|

|

|

|

|

|

Vanguard Short-Term Inflation-Protected Securities Index Fund

|

|

|

|

|

|

|

Schedule of Investments

|

|

|

|

|

|

As of December 31, 2013

|

|

|

|

|

|

|

|

|

|

|

Face

|

Market

|

|

|

|

Maturity

|

Amount

|

Value

|

|

|

Coupon

|

Date

|

($000)

|

($000)

|

|

U.S. Government and Agency Obligations (99.1%)

|

|

|

|

|

|

U.S. Government Securities (99.1%)

|

|

|

|

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.000%

|

1/15/14

|

425,827

|

537,874

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

1.250%

|

4/15/14

|

302,136

|

335,566

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.000%

|

7/15/14

|

376,719

|

477,034

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

1.625%

|

1/15/15

|

380,863

|

479,813

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

0.500%

|

4/15/15

|

420,493

|

463,140

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

1.875%

|

7/15/15

|

341,435

|

432,058

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.000%

|

1/15/16

|

336,753

|

422,320

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

0.125%

|

4/15/16

|

762,634

|

828,602

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.500%

|

7/15/16

|

334,786

|

424,792

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.375%

|

1/15/17

|

289,928

|

369,443

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

0.125%

|

4/15/17

|

881,444

|

931,541

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.625%

|

7/15/17

|

255,800

|

324,233

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

1.625%

|

1/15/18

|

273,121

|

330,928

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

0.125%

|

4/15/18

|

938,262

|

966,752

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

1.375%

|

7/15/18

|

288,060

|

338,159

|

|

United States Treasury Inflation Indexed

|

|

|

|

|

|

Bonds

|

2.125%

|

1/15/19

|

63,000

|

76,508

|

|

Total U.S. Government and Agency Obligations (Cost $7,763,017)

|

|

|

7,738,763

|

|

|

|

|

Shares

|

|

|

Temporary Cash Investment (0.5%)

|

|

|

|

|

|

Money Market Fund (0.5%)

|

|

|

|

|

|

1 Vanguard Market Liquidity Fund

|

|

|

|

|

|

(Cost $42,952)

|

0.125%

|

|

42,952,464

|

42,952

|

|

Total Investments (99.6%) (Cost $7,805,969)

|

|

|

|

7,781,715

|

|

Other Assets and Liabilities-Net (0.4%)

|

|

|

|

28,956

|

|

Net Assets (100%)

|

|

|

|

7,810,671

|

1 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

A.

Security Valuation: Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing

services. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund's pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

B.

Various inputs may be used to determine the value of the fund's investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1

—

Quoted prices in active markets for identical securities.

Level 2

—

Other significant observable inputs (including quoted prices for similar securities, interest rates,

prepayment speeds, credit risk, etc.).

Level 3

—Significant unobservable inputs (including the fund's own assumptions used to determine the

fair value of investments).

The following table summarizes the market value of the fund's investments as of December 31, 2013,

based on the inputs used to value them:

|

|

|

|

|

|

|

Level 1

|

Level 2

|

Level 3

|

|

Investments

|

($000)

|

($000)

|

($000)

|

|

U.S. Government and Agency Obligations

|

—

|

7,738,763

|

—

|

|

Temporary Cash Investments

|

42,952

|

—

|

—

|

|

Total

|

42,952

|

7,738,763

|

—

|

C.

At December 31, 2013, the cost of investment securities for tax purposes was $7,807,182,000. Net unrealized depreciation of investment securities for tax purposes was $25,467,000, consisting of unrealized gains of $5,574,000 on securities that had risen in value since their purchase and $31,041,000 in unrealized losses on securities that had fallen in value since their purchase.

Item 2: Controls and Procedures

(a) Disclosure Controls and Procedures. The Principal Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on their evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report.

(b) Internal Control Over Financial Reporting. During the last fiscal quarter, there was no significant change in the Registrant’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 3: Exhibits

(a) Certifications

|

|

|

|

|

VANGUARD MALVERN FUNDS

|

|

|

|

By:

|

/s/ F. WILLIAM MCNABB III*

|

|

|

F. WILLIAM MCNABB III

|

|

|

CHIEF EXECUTIVE OFFICER

|

|

|

|

Date: February 20, 2014

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

VANGUARD MALVERN FUNDS

|

|

|

|

By:

|

/s/ F. WILLIAM MCNABB III*

|

|

|

F. WILLIAM MCNABB III

|

|

|

CHIEF EXECUTIVE OFFICER

|

|

|

|

Date: February 20, 2014

|

|

|

|

|

|

VANGUARD MALVERN FUNDS

|

|

|

|

By:

|

/s/ THOMAS J. HIGGINS*

|

|

|

THOMAS J. HIGGINS

|

|

|

CHIEF FINANCIAL OFFICER

|

|

|

|

Date: February 20, 2014

|

* By:/s/ Heidi Stam

Heidi Stam, pursuant to a Power of Attorney filed on

March 27, 2012 see file Number 2-11444

, Incorporated by Reference.

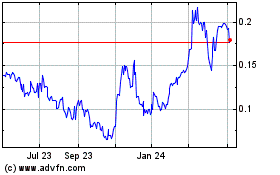

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

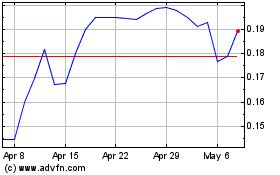

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024