OmniVision

Technologies (OVTI) reported third-quarter fiscal 2014

(ended Jan 2014) earnings of 54 cents a share, which comfortably

beat the Zacks Consensus Estimate of 21 cents. Following the

earnings results, stock surged 15.1% in afterhours trading.

Revenues

OmniVision reported revenues of

$352.0 million, down 11.4% sequentially and 16.9% over the year-ago

quarter. However, revenues were above management’s guidance range

of $310.0–$340.0 million and the Zacks Consensus Estimate of $327.0

million.

Total unit sales were down 9.7%

sequentially to $214.0 million and the blended average selling

price (ASP) decreased 1.8% sequentially and came in at $1.64. The

decrease in ASP was due to quarterly price erosion across product

lines in all regional markets.

Overall, 2-megapixel and higher

resolution sensors comprised around 44.0% of total units versus

36.0% in the prior quarter. The sequential increase in this

category was driven by increased shipment of 5-megapixel sensors.

The 1.3-megapixel category constituted 44.0% of total shipments

versus 50.0% in the prior quarter. The VGA category constituted 12%

of total shipments versus 14.0% in the prior quarter.

Revenues by End

Market

The mobile phone

market remains OmniVision’s largest, with a revenue

contribution of 52.0% compared with 60.0% in the prior quarter. The

decrease in mobile sales was due to lower volumes in smartphones

and tablet platforms in North America, partially offset by growth

in China.

Currently, China has become the

largest mobile market worldwide and the company witnessed strong

demand for 5-megapixel, 4-megapixel and 2-megapixel sensor

shipments for smartphones in the Chinese market. The company also

saw steady shipment volume for 8-megapixel products in China and

Taiwan. Additionally, the company expects strong demand for its

4-megapixel sensor in the Asian markets.

We believe the full-HD format

sensors will witness a rise in demand as all major handset original

equipment manufacturers (OEMs) are using VGA with HD sensors for

the front-facing camera in smart devices. The company has also

secured design wins for the PureCel OV13850 and OV8858 with major

OEMs in China and Taiwan.

The entertainment end

market contributed 31.0% of revenues, up from 25.0% in the

prior quarter, due to strength in the tablet segment. The ramp up

of OmniVision’s 5-megapixel BSI and BSI-2 sensors and increased

shipments of gaming consoles helped drive the demand in this

segment.

We believe that tablet sales will

pick up as all the major OEMs are planning to launch the latest

models, which may boost demand. Further, the rise in demand of

smart TVs, which come with built-in cameras, is likely to boost

demand for OmniVision’s 5-megapixel BSI-2 sensors.

Wearable computers or smart devices

are the next step in mobile electronics. The tech companies are

blending the fashion quotient to market their new unique devices

better and we believe OmniVision is well-positioned to capitalize

on this trend.

Contribution of the

notebook and webcam segment increased to 7.0% of

revenues in the third quarter from 5% in the second quarter. Though

the tablets have cannibalized the notebook market, OmniVision is

trying to develop cost-friendly products with improved performance.

Many of the OEMs are using sensors to develop human interface

solutions like gesture and eye tracking control for PC users. Also,

the company is working on various imaging-based technologies with

OEMs in order to drive growth in this segment.

Other emerging

productscontributed 10.0% of revenues in the third

quarter. Revenues from the emerging products group are now being

driven primarily by the automotive end market and the security

market. High-performance 720-P HD, 1080p and VGA sensors are the

primary products in this market. During the quarter, the company

witnessed strong growth in its security business due to the

continuing increase of IP digital camera products.

Margins

OmniVision reported gross margin of

19.6%, up 80 basis points (bps) from the previous quarter’s 18.8%

and 270 bps from 16.9% in the year-ago quarter. The increase in

gross margin was due to continued reduction in the company's

overall production costs.

Operating expenses of $51.3 million

were higher than $47.9 million incurred in the year-ago quarter.

OmniVision reported operating margin of 5.1% in the quarter, down

120 bps sequentially and 50 bps from the year-ago quarter. As a

percentage of sales, both research & development and selling,

general & administrative expenses increased from the year-ago

quarter.

Net

Profit/Loss

Total net income for the third

quarter of fiscal 2014 was $30.6 million or 54 cents per share

compared with $26.3 million or 47 cents in the previous quarter and

$21.3 million or 40 cents in the year-ago quarter.

There were no one-time items in the

quarter. Consequently, pro-forma net income was the same as GAAP

net income of $30.6 million (8.6% of sales) compared to $26.3

million or a 6.6% net income margin in the preceding quarter and

$21.3 million or 5.0% of sales in the same quarter last year.

Balance Sheet

Inventories were down 12.3% to

$342.2 million from $390.3 million in the previous quarter. DSOs

were 35 days, down from 40 days at the end of the previous

quarter.

The company ended the quarter with

cash and investments balance of $393.0 million, up from $265.6

million during the previous quarter. OmniVision has $32.2 million

in long-term debt and $122.6 million in total long-term

liabilities.

Guidance

For the fourth quarter of 2014,

OmniVision expects revenues in the range of $275.0–$305.0 million.

Analysts polled by Zacks expect revenues of $288.0 million, below

the mid-point of the guided range.

GAAP earnings per share are

expected in the range of 5–21 cents and non-GAAP earnings,

excluding share-based compensation and the associated tax impact,

in the range of 19–35 cents per share.

Conclusion

OmniVision has leveraged its

superior technology to solidify its position in the handset market

and also expanded into other areas. The company reported strong

third-quarter results with both the top and bottom lines exceeding

the Zacks Consensus Estimate.

We like its product roadmap, growth

prospects, cost structure improvement, market diversification and

management execution and believe that it will be able to deal with

the short product life cycles and temporary slowdown in the

computing and smartphone markets.

Further, we are positive about

OmniVision's pixel technology and camera-cube chip technology for

low resolution cameras, which normally forms the front-facing

camera in smart devices.

Automobile OEMs are rapidly

deploying camera sensors in vehicles such as rearview and surround

view. OmniVision has gained significant market share at major OEMs

in Europe and North America, which may boost its revenues. The

company is also seeing growth returning in the Chinese market,

which is a big positive for the company.

OmniVision’s shares sport a Zacks

Rank #1 (Strong Buy). Other stocks that are performing well at

current levels include Ambarella, Inc. (AMBA),

FormFactor Inc. (FORM) and Himax

Technologies (HIMX). All these stocks carry a Zacks Rank

#2 (Buy).

AMBARELLA INC (AMBA): Free Stock Analysis Report

FORMFACTOR INC (FORM): Free Stock Analysis Report

HIMAX TECH-ADR (HIMX): Free Stock Analysis Report

OMNIVISION TECH (OVTI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

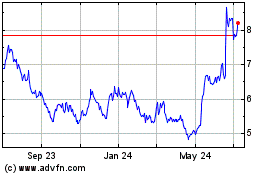

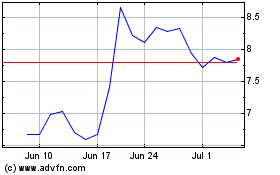

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Apr 2023 to Apr 2024