February 27, 2014 / Corona, CA / ACCESSWIRE / Extreme Biodiesel

Inc. (XTRM) wholly owned subsidiary XTRM Cannabis Ventures

announced today that the legal marijuana marketplace in Colorado is

exceeding the states tax expectations.

Colorado's legal marijuana market is far exceeding tax

expectations, according to a budget proposal released this month by

Gov. John Hickenlooper that gives the first official estimate of

how much the state expects to make from pot taxes.

The proposal outlines plans to spend some $99 million next

fiscal year on substance abuse prevention, youth marijuana use

prevention and other priorities. The money would come from a

statewide 12.9 percent sales tax on recreational pot. Colorado's

total pot sales next fiscal year were estimated to be about $610

million.

Retail sales began Jan. 1 in Colorado. Sales have been very

strong, though exact figures for January sales won't be made public

until sometime early next month.

The governor predicted sales and excise taxes next fiscal year

would produce some $98 million, far above a $70 million annual

estimate given to voters when they approved the pot taxes last

year. The governor also includes taxes from medical pot, which are

subject only to the statewide 2.9 percent sales tax.

In Colorado, Hickenlooper's proposal listed six priorities for

spending the pot sales taxes.

The spending plan included $45.5 million for youth use

prevention, $40.4 million for substance abuse treatment and $12.4

million for public health.

"We view our top priority as creating an environment where

negative impacts on children from marijuana legalization are

avoided completely," Hickenlooper wrote in a letter to legislative

budget writers, which must approve the plan.

The governor also proposed a $5.8 million, three-year "statewide

media campaign on marijuana use," presumably highlighting the

drug's health risks. The state Department of Transportation would

get $1.9 million for a new "Drive High, Get a DUI" campaign to tout

the state's new marijuana blood-limit standard for drivers.

Also, Hickenlooper has proposed spending $7 million for an

additional 105 beds in residential treatment centers for substance

abuse disorders.

"This package represents a strong yet cautious first step" for

regulating pot, the governor wrote. He told lawmakers he'd be back

with a more complete spending prediction later this year.

The Colorado pot tax plan doesn't include an additional 15

percent pot excise tax, of which $40 million a year already is

designated for school construction. The governor projected the full

$40 million to be reached next year.

The initial tax projections are rosier than those given to

voters in 2012, when state fiscal projections on the

marijuana-legalization amendment would produce $39.5 million in

sales taxes next fiscal year, which begins in July.

The rosier projections come from updated data about how many

retail stores Colorado has (163 as of Feb. 18) and how much

customers are paying for pot. There's no standardized sales price,

but recreational pot generally is going for much more than the $202

an ounce forecasters guessed last year.

Mason Tvert, a legalization activist who ran Colorado's 2012

campaign, said other states are watching closely to see what legal

weed can produce in tax revenue.

"Voters and state lawmakers around the country are watching how

this system unfolds in Colorado, and the prospect of generating

significant revenue while eliminating the underground marijuana

market is increasingly appealing," said Tvert, who now works for

the Marijuana Policy Project.

Meanwhile, The Denver Post reported Wednesday that banks holding

commercial loans on properties that lease to Colorado marijuana

businesses say they don't plan to refinance those loans when they

come due. Bankers say property used as collateral for those loans

theoretically is subject to federal drug-seizure laws, which makes

the loans a risk.

Colorado's two largest banks, Wells Fargo Bank and FirstBank,

say they won't offer new loans to landowners with preexisting

leases with pot businesses. And Wells Fargo and Vectra Bank have

told commercial loan clients they either have to evict marijuana

businesses or seek refinancing elsewhere.

"Our policy of not banking marijuana-related businesses and not

lending on commercial properties leased by marijuana-related

businesses is based on applicable federal laws," Wells Fargo

spokeswoman Cristie Drumm told the Post.

XTRM President Joseph Spadafore stated “We are interested, and

are currently looking into potential investments in Colorado

whereas XTRM would purchase Commercial Notes from institutions not

wishing to lend to landlords any longer. There’s plenty of

opportunity in the cannabis industry and we intend to be there for

it.”

Recent XTRM Update

40 Acre Hemp / Medical Marijuana Land Project Update

The Company is pleased to report that it plans to close escrow

on the property on or before March 20th, 2014.

The project, when built out is expected to use the 40 acres to

accommodate up to five 20,000 sqft warehouses for indoor marijuana

/ cannabis growth, 20 acres for outdoor Hemp cultivation for

biodiesel, and an industrial center to process marijuana / cannabis

into smokeless products.

President Joseph Spadafore stated “The passage of the Farm Bill

and Marijuana Legalization Progress has really generated vast

opportunities for XTRM. We have already identified two additional

parcels of land in California that are candidates for our planned

Hemp To Biodiesel project and Marijuana cultivation once approved

by any state and/or federal authorities. Once the 40 acre parcel is

closed next month we plan to acquire at least 1 more parcel of

land”

About Extreme Biodiesel and XTRM Cannabis

Ventures

Extreme Biodiesel is an alternative fuel and recycling company.

Our mission is to provide a cost-effective, high-quality

alternative diesel fuel, create "green" jobs, reduce the

environmental impact of fossil fuels and diminish US reliance on

foreign oil. Extreme Biodiesel is currently repositioning itself

into a holdings corporation with focuses on Bio Diesel, Real

Estate, Technology and Cannabis Sectors.

XTRM Cannabis Ventures is a wholly owned subsidiary of Extreme

Biodiesel focused in the sector of Medical Marijuana, Cannabis and

Hemp related products.

XTRM Cannabis Ventures Disclaimer

The Company would like to assure all investors that in all

cannabis related actions the Company is conferring with counsel to

be sure any business activities are deemed legal. XTRM advises all

investors to see the website being developed

at http://xtrmcannabisventures.com/

Investor Relations Contact

info@extremebiodiesel.com

855-736-7360

Safe Harbor

Disclaimer

Forward-Looking Statements are included within the meaning of

Section 27A of the Securities Act of 1933, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements

regarding our expected future financial position, results of

operations, cash flows, financing plans, business strategy,

products and services, competitive positions, growth opportunities,

plans and objectives of management for future operations, including

words such as "anticipate," "if," "believe," "plan," "estimate,"

"expect," "intend," "may," "could," "should," "will," and other

similar expressions are forward-looking statements and involve

risks, uncertainties and contingencies, many of which are beyond

our control, which may cause actual results, performance, or

achievements to differ materially from anticipated results,

performance, or achievements. XTRM is under no obligation to (and

expressly disclaim any such obligation to) update or alter our

forward-looking statements, whether as a result of new information,

future events or otherwise.

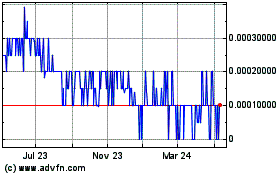

Extreme Biodiesel (PK) (USOTC:XTRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

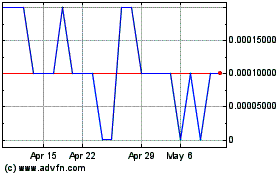

Extreme Biodiesel (PK) (USOTC:XTRM)

Historical Stock Chart

From Apr 2023 to Apr 2024