- 4Q Operating Income of $32.1 Million

Drives 4Q Adjusted EBITDA of $49.3 Million and Free Cash Flow of

$32.7 Million -

- Record Full Year Operating Income of

$103.2 Million, Adjusted EBITDA of $166.7 Million and Free Cash

Flow of $84.9 Million -

Nexstar Broadcasting Group, Inc. (NASDAQ: NXST) (“Nexstar”)

today reported financial results for the fourth quarter and

year-ended December 31, 2013 as summarized below:

Summary 2013 Fourth Quarter Highlights

($ in thousands)

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

2013 2012

Change 2013

2012 Change Local Revenue

$ 75,106 $ 52,633 +42.7 % $ 265,376 $ 190,168 +39.5 %

National Revenue $ 32,827 $ 20,580 +59.5 % $

113,423 $ 76,123 +49.0 %

Local and National

Core Revenue $ 107,933 $ 73,213

+47.4 %

$ 378,799 $ 266,291 +42.3 %

Political Revenue $ 1,537 $ 27,347 (94.4 )% $ 5,152 $ 46,276

(88.9 )% Digital Media Revenue $ 6,623 $ 5,322 +24.4 % $ 30,846 $

18,363 +68.0 % Retransmission Fee Revenue $ 26,815 $ 16,052 +67.1 %

$ 101,119 $ 60,933 +66.0 % Management Fee Revenue $ 0 $ 0

-

$ 0 $ 1,961 (100.0 )% Network Comp, Other $ 1,070 $ 1,363 (21.5 )%

$ 4,280 $ 3,708 +15.4 % Trade and Barter Revenue $ 8,347

$ 6,353 +31.4 % $ 31,529 $ 21,920

+43.8 %

Gross Revenue $ 152,325

$ 129,650 +17.5 %

$ 551,725 $

419,452 +31.5 % Less Agency Commissions $ 14,203

$ 13,476 +5.4 % $ 49,395 $ 40,820

+21.0 %

Net Revenue $ 138,122 $

116,174 +18.9 %

$ 502,330 $

378,632 +32.7 %

Gross Revenue

Excluding Political

Revenue

$ 150,788 $ 102,303

+47.4

%

$ 546,573

$

373,176

+46.5

%

Income from Operations $ 32,078 $ 35,380 (9.3 )% $

103,241 $ 99,905 +3.3 %

Broadcast Cash Flow(1)

$ 55,311 $ 56,294 (1.7 )% $ 193,008 $ 170,980 +12.9 %

Broadcast

Cash Flow Margin(2) 40.0 % 48.5 % 38.4 % 45.2 %

Adjusted EBITDA(1) $ 49,266 $ 48,082 +2.5 % $

166,669 $ 146,344 +13.9 %

Adjusted EBITDA Margin(2)

35.7 % 41.4 % 33.2 % 38.7 %

Free Cash Flow(1)

$ 32,706 $ 28,652 +14.1 % $ 84,921 $ 80,515 +5.5 %

(1)

Definitions and disclosures regarding non-GAAP

financial information are included on page 4, while reconciliations

are included on page 7.

(2)

Broadcast cash flow margin is broadcast cash flow as a percentage

of net revenue. Adjusted EBITDA margin is Adjusted EBITDA as a

percentage of net revenue.

CEO Comment

Perry A. Sook, Chairman, President and Chief Executive Officer

of Nexstar Broadcasting Group, Inc. commented, “Nexstar’s strong

fourth quarter and full year financial results mark the conclusion

of another active and successful year of growth for the Company.

During 2013, we generated record free cash flow, EBITDA, BCF and

net revenue, completed or entered into agreements to strategically

expand our operating base in accretive transactions to 108

stations, lowered our weighted average cost of capital and

strengthened our balance sheet, and initiated the payment of a

quarterly cash dividend.

“Our near- and long-term path to growth and the enhancement of

shareholder value remains on plan and 2014 will see another period

of record financial results as Nexstar will benefit from its

expanded scale, new operating efficiencies and synergies related to

recent and soon-to-be-completed acquisitions, the renewal in the

2013 fourth quarter of a significant number of retransmission

consent agreements, an expansion of our digital media initiatives

and the return of the political cycle and highly rated special

event programming such as the winter Olympics.

“Fourth quarter results benefited from accretive station

acquisitions completed in 2013, our revenue diversification

initiatives, and ongoing focus on building new local direct

advertising. Reflecting growth in seven of our top ten ad

categories as well as a 19% year-over-year increase in new business

development, fourth quarter core ad revenue rose 47.4%, marking the

Company’s highest growth rate in this metric in 2013. Nexstar’s

strong core television ad growth was complemented by a 67.1% rise

in retransmission fee revenue and a 24.4% increase in digital media

revenue which collectively more than offset the impact of a $25.8

million, or 94.4%, year-over-year reduction in political

revenue.

“In addition to the strong core ad revenue growth, total

combined fourth quarter retransmission fee and digital media

revenue rose 56.4% to $33.4 million, representing 24.2% of 2013

fourth quarter net revenue. By comparison, total fourth quarter

retransmission fee and digital media revenue comprised 18.4% of net

revenue in the year-ago period and 16.9% of net revenue in the 2011

fourth quarter.

“The rise in fourth quarter station direct operating expenses

(net of trade expense) and SG&A primarily reflects higher

variable costs related to the significant increase in national and

local revenues and the operation of new stations. Corporate expense

declined as the year-ago period included approximately $2.6 million

in non-recurring expenses associated with personnel costs, recently

announced strategic transactions, and expenses related to capital

market activity compared to approximately $0.7 million in such

expenses in the 2013 fourth quarter. Notwithstanding these one-time

expenses, fourth quarter adjusted EBITDA grew 2.5% while fourth

quarter 2013 free cash flow was up 113.7% from the fourth quarter

of 2011, the previous non-political period, and exceeded the prior

year despite the benefit in Q4’12 of nearly $26 million of

additional political revenue.

“Throughout 2013 and in the fourth quarter, Nexstar actively

executed its long-term strategy to identify and structure accretive

transactions that expand our operating and revenue base to drive

free cash flow growth. In November, Nexstar entered into a

definitive agreement to acquire the stock of Grant Company, Inc.,

the owner of seven television stations in four markets, for $87.5

million in a transaction that is expected to be immediately

accretive to Nexstar’s free cash flow upon closing. We followed

this in December in conjunction with an agreement with Mission

Broadcasting, Inc. (“Mission”), to acquire six television stations

in two markets for $37.5 million, in transactions which are also

expected to be immediately accretive upon closing.

“Since July 2012, Nexstar has doubled the portfolio of

television stations that it owns or provides services to as we and

Mission acquired or agreed to acquire 55 television stations for a

total value of approximately $862 million. Significantly, all of

these transactions are accretive to free cash flow, strategically

diversify our and Mission’s revenue and operating base and create

additional duopolies or virtual duopolies. Upon completing all

announced transactions, and consistent with our M&A criteria

that emphasizes the development of duopolies, we will own or

provide services to multiple stations in 37 of the 56 markets where

we will operate. Our remaining pending transactions are before the

FCC and are expected to close in the second quarter.

“Pro-forma for the completion of these transactions we believe

Nexstar will generate free cash flow in excess of $350 million

during the 2014/2015 cycle, or average pro-forma free cash flow of

approximately $5.85 per share per year, in this two year period.

This level of free cash flow, which reflects continued reductions

in our cost of borrowings, is expected to result in Nexstar’s net

leverage declining to the mid-3x level at the end of 2014. With

significant and growing free cash flow Nexstar is positioned with

the financial capacity and flexibility to further consolidate

mid-sized markets and pursue accretive digital media transaction

while returning capital to shareholders and in January we announced

a 25% increase in the amount of our quarterly cash dividend.”

The consolidated total debt of Nexstar, its wholly owned

subsidiaries, and Mission (collectively, the “Company”) at December

31, 2013, was $1,071.1 million and senior unsecured debt was $545.4

million. The Company’s total net leverage ratio at December 31,

2013 was 5.84x compared to a total permitted leverage covenant of

7.25x. The Company’s first lien net indebtedness ratio at December

31, 2013 was 2.86x compared to the covenant maximum of 4.00x.

The table below summarizes the Company’s debt obligations:

($ in

millions)

12/31/13 12/31/12 First Lien Revolvers $

-

$

-

First Lien Term Loans $ 545.4 $ 288.2 8.875% Senior Second Lien

Notes due 2017 $

-

$ 319.4 6.875% Senior Notes due 2020 $ 525.7

$ 250.0

Total Debt $ 1,071.1 $ 857.6

Cash

on hand $ 40.0 $ 69.0

Dividends

On January 17, 2014 the Board of Directors approved a 25 percent

increase in the quarterly cash dividend to $0.15 per share of

Nexstar’s Class A common stock beginning with the dividend declared

for the first quarter of 2014. The dividend is payable on Friday,

February 28, 2014, to shareholders of record on Friday, February

14, 2014.

Option Grant

In January and February 2014, options to purchase 745,000 shares

of the Company’s Class A Common Stock at exercise prices of $46.03

and $46.77 per share were granted to 53 officers and directors of

the Company. The options had an aggregate fair value of $23.8

million, which will be recognized ratably over the four year

vesting period of the options. The Company anticipates that the

option grant will result in a non-cash charge of up to

approximately $5.4 million in 2014 and up to approximately $6.0

million annually in 2015, 2016 and 2017 based on the option terms

and anticipated forfeiture rate.

Fourth Quarter Conference Call

Nexstar will host a conference call at 10:00 a.m. ET today.

Senior management will discuss the financial results and host a

question and answer session. The dial in number for the audio

conference call is 719/325-2177, conference ID 1280601 (domestic

and international callers). In addition, a live audio webcast of

the call will be accessible to the public on Nexstar’s web site,

www.nexstar.tv and a recording of the webcast will be archived on

the site for 90 days following the live event.

Definitions and Disclosures Regarding non-GAAP Financial

Information

Broadcast cash flow is calculated as income from operations,

plus corporate expenses, depreciation, amortization of intangible

assets and broadcast rights (excluding barter) and loss (gain) on

asset disposal, net, minus broadcast rights payments.

Adjusted EBITDA is calculated as broadcast cash flow less

corporate expenses.

Free cash flow is calculated as income from operations plus

depreciation, amortization of intangible assets and broadcast

rights (excluding barter), loss (gain) on asset disposal, net, and

non-cash stock option expense, less payments for broadcast rights,

cash interest expense, capital expenditures and net cash income

taxes.

Broadcast cash flow, adjusted EBITDA and free cash flow results

are non-GAAP financial measures. Nexstar believes the presentation

of these non-GAAP measures are useful to investors because they are

used by lenders to measure the Company’s ability to service debt;

by industry analysts to determine the market value of stations and

their operating performance; by management to identify the cash

available to service debt, make strategic acquisitions and

investments, maintain capital assets and fund ongoing operations

and working capital needs; and, because they reflect the most

up-to-date operating results of the stations inclusive of pending

acquisitions, TBAs or LMAs. Management believes they also provide

an additional basis from which investors can establish forecasts

and valuations for the Company’s business.

For a reconciliation of these non-GAAP financial measurements to

the GAAP financial results cited in this news announcement, please

see the supplemental tables at the end of this release.

About Nexstar Broadcasting Group, Inc.

Nexstar Broadcasting Group is a leading diversified media

company that leverages localism to bring new services and value to

consumers and advertisers through its traditional media, digital

and mobile media platforms. Nexstar owns, operates, programs or

provides sales and other services to 74 television stations and 19

related digital multicast signals reaching 44 markets or

approximately 12.1% of all U.S. television households. Nexstar’s

portfolio includes affiliates of ABC, NBC, CBS, FOX, MyNetworkTV,

The CW, Telemundo, Bounce TV and independent stations. Nexstar’s 43

community portal websites offer additional hyper-local content and

verticals for consumers and advertisers, allowing audiences to

choose where, when and how they access content while creating new

revenue opportunities.

Pro-forma for the completion of all announced transactions

Nexstar will own, operate, program or provides sales and other

services to 108 television stations and related digital multicast

signals reaching 56 markets or approximately 16.0% of all U.S.

television households.

Forward-Looking Statements

This news release includes forward-looking statements. We have

based these forward-looking statements on our current expectations

and projections about future events. Forward-looking statements

include information preceded by, followed by, or that includes the

words "guidance," "believes," "expects," "anticipates," "could," or

similar expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements contained in this news release,

concerning, among other things, changes in net revenue, cash flow

and operating expenses, involve risks and uncertainties, and are

subject to change based on various important factors, including the

impact of changes in national and regional economies, our ability

to service and refinance our outstanding debt, successful

integration of acquired television stations (including achievement

of synergies and cost reductions), pricing fluctuations in local

and national advertising, future regulatory actions and conditions

in the television stations' operating areas, competition from

others in the broadcast television markets served by the Company,

volatility in programming costs, the effects of governmental

regulation of broadcasting, industry consolidation, technological

developments and major world news events. Unless required by law,

we undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. In light of these risks, uncertainties and

assumptions, the forward-looking events discussed in this news

release might not occur. You should not place undue reliance on

these forward-looking statements, which speak only as of the date

of this release. For more details on factors that could affect

these expectations, please see our filings with the Securities and

Exchange Commission.

Nexstar Broadcasting Group,

Inc.Condensed Consolidated Statements of Operations(in

thousands, except per share amounts - unaudited)

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

2013 2012

2013 2012

Net revenue

$

138,122

$

116,174

$

502,330

$

378,632 Operating expenses: Station direct operating

expenses, net of trade, depreciation and amortization

37,251

23,696 139,807 84,743 Selling, general, and administrative expenses

net of depreciation and amortization 34,271 27,552 124,594 92,899

Loss on asset disposal, net 1,245 493 1,280 468 Trade and barter

expense 8,129 6,144 30,730 20,841 Corporate expenses 6,045 8,212

26,339 24,636 Amortization of broadcast rights, excluding barter

3,068 2,102 12,613 8,591 Amortization of intangible assets 7,248

6,399 30,148 22,994 Depreciation 8,787 6,196

33,578 23,555 Total operating

expenses 106,044 80,794 399,089

278,727 Income from operations 32,078 35,380

103,241 99,905 Interest expense, net (15,891 ) (13,638 )

(66,243 ) (51,559 ) Loss on extinguishment of debt (33,676 ) (2,775

) (34,724 ) (3,272 ) Other Expense (1,207 ) -

(1,459 ) - (Loss) income from continuing

operations before income tax expense (18,696 ) 18,967 815 45,074

Income tax benefit (expense) 6,244 136,991

(2,600 ) 132,279 (Loss) income from

continuing operations (12,452 ) 155,958 (1,785 ) 177,353 Gain on

disposal of station, net of income tax expense of $3,098 -

5,139 - 5,139

Net (loss) income

(12,452

)

161,097

(1,785

)

182,492

(Loss) income per common share from continuing operations: Basic

(0.41 ) 5.36 (0.06 ) 6.13 Diluted (0.41 ) 4.99 (0.06 ) 5.77 Gain on

disposal of station, net of income tax expense, per common share:

Basic - 0.18 - 0.18 Diluted - 0.16 - 0.17 Net (loss) income per

common share: Basic (0.41 ) 5.53 (0.06 ) 6.31 Diluted (0.41 ) 5.16

(0.06 ) 5.94 Weighted average number of shares outstanding: Basic

30,465 29,117 29,897 28,940 Diluted 30,465 31,243 29,897 30,732

Nexstar Broadcasting Group,

Inc.Reconciliation of Broadcast Cash Flow and Adjusted

EBITDA (Non-GAAP Measures)(in thousands - unaudited)

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

Broadcast Cash Flow and Adjusted EBITDA: 2013

2012 2013

2012 Income from

operations:

$

32,078

$

35,380

$

103,241

$

99,905 Add: Depreciation 8,787 6,196 33,578 23,555 Amortization of

intangible assets 7,248 6,399 30,148 22,994 Amortization of

broadcast rights, excluding barter

3,068

2,102

12,613

8,591

Loss on asset disposal, net 1,245 493 1,280 468 Corporate expenses

6,045 8,212 26,339 24,636 Less: Payments for broadcast

rights 3,160 2,488

14,191 9,169 Broadcast cash flow 55,311

56,294 193,008 170,980 Less: Corporate expenses 6,045

8,212 26,339

24,636 Adjusted EBITDA $ 49,266

$ 48,082 $ 166,669 $ 146,344

Nexstar Broadcasting Group,

Inc.Reconciliation of Free Cash Flow (Non-GAAP

Measure)(in thousands - unaudited)

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

Free Cash Flow: 2013

2012 2013

2012 Income from operations:

$

32,078

$

35,380

$

103,241

$

99,905 Add: Depreciation 8,787 6,196 33,578 23,555

Amortization of intangible assets 7,248 6,399 30,148 22,994

Amortization of broadcast rights, excluding barter 3,068 2,102

12,613 8,591 Loss on asset disposal, net 1,245 493 1,280 468

Non-cash stock option expense 500 637 2,080 1,362 Less:

Payments for broadcast rights 3,160 2,488 14,191 9,169 Cash

interest expense 15,194 12,953 62,963 48,570 Capital expenditures

1,880 6,039 18,736 17,024 Cash income taxes, net of refunds

(14

)

1,075 2,129

1,597 Free cash flow $ 32,706 $ 28,652

$ 84,921 $ 80,515

Nexstar Broadcasting Group, Inc.Thomas E. Carter,

972-373-8800Chief Financial OfficerorJCIRJoseph Jaffoni,

212-835-8500nxst@jcir.comorJennifer Neuman,

212-835-8500nxst@jcir.com

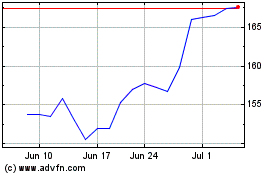

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

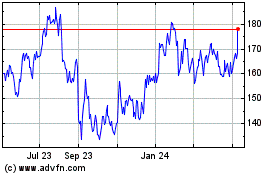

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024