Vertex' Kalydeco Approved for an Additional Indication - Analyst Blog

February 24 2014 - 1:00PM

Zacks

Vertex Pharmaceuticals

Inc. (VRTX) received encouraging news when the U.S. Food

and Drug Administration (FDA) approved Kalydeco for an additional

indication. Kalydeco was approved for treating patients (age ≥ 6

years) suffering from cystic fibrosis (CF) who have one of eight

additional mutations in the cystic fibrosis transmembrane

conductance regulator (CFTR) gene.

Kalydeco is currently marketed for treating CF patients (age ≥ 6

years) who have at least one copy of the G551D mutation. Following

the approval for the new indication, Kalydeco can be used to treat

CF patients with the following nine mutations: G551D, G178R, S549N,

S549R, G551S, G1244E, S1251N, S1255P and G1349D.

Kalydeco’s approval for the new indication was based on phase III

data that demonstrated statistically significant improvements in

lung function in patients on Kalydeco monotherapy. The safety

profile was similar to that seen in earlier phase III studies.

Approval in the U.S. for the new indication was sought in Oct 2013.

Similar submissions for Kalydeco were also made in Europe, Canada

and Australia for the same indication.

Vertex Pharma is also evaluating Kalydeco in children with CF in

the age group of 2–5 years who have a gating mutation. The study is

fully enrolled and currently ongoing. The company expects data from

the study in the second quarter of 2014. The company intends to

seek U.S. approval in this indication in the second half of 2014.

However, in December last year, Vertex Pharma suffered a setback

when its phase III study on Kalydeco for the indication of cystic

fibrosis (CF) in patients (age ≥ 6 years) with R117H mutation,

failed to meet its primary endpoint. The company is also evaluating

Kalydeco for other indications.

Meanwhile, Vertex Pharma has been witnessing encouraging Kalydeco

sales since its launch. The company reported Kalydeco sales of

$371.3 million in the year 2013, an increase of 116.4% from the

year-ago period. Kalydeco sales are expected in the range of $470

million to $500 million in 2014.

Vertex Pharma maintained its total revenue guidance for 2014 in the

range of $570 million to $600 million. The Zacks Consensus Estimate

of $603 million is slightly above the company’s guidance range.

Vertex Pharma carries a Zacks Rank #3 (Hold). Some better-ranked

stocks include Alexion Pharmaceuticals, Inc.

(ALXN), Actelion Ltd. (ALIOF) and

Alkermes (ALKS). While Alexion holds a Zacks Rank

#1 (Strong Buy), Actelion and Alkermes carry a Zacks Rank #2

(Buy).

ACTELION LTD (ALIOF): Get Free Report

ALKERMES INC (ALKS): Free Stock Analysis Report

ALEXION PHARMA (ALXN): Free Stock Analysis Report

VERTEX PHARM (VRTX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

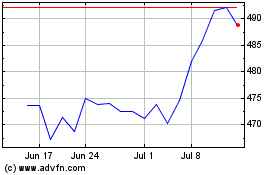

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

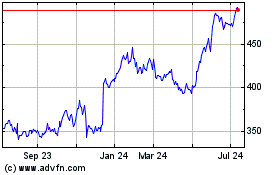

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024