Teekay Tankers Ltd. Reports Fourth Quarter and Annual Results

HAMILTON, BERMUDA--(Marketwired - Feb 20, 2014) -

Highlights

- Declared a cash dividend of $0.03 per share for the quarter

ended December 31, 2013.

- Reported fourth quarter 2013 adjusted net loss attributable to

shareholders of Teekay Tankers(1) of $2.4 million, or $0.03 per

share (excluding specific items which increased GAAP net income by

$16.5 million, or $0.20 per share, including a $14.9 million

reversal of a loss provision previously recorded on the Company's

investment in term loans).

- Based on approximately 65 percent of days booked in the

quarter, average spot time-charter equivalent, or TCE, rate to date

for the first quarter of 2014 of approximately $34,300 and $25,300

per day for Teekay Tankers' spot Suezmax and Aframax vessels,

respectively, compared to $15,200 and $13,900 per day for the

fourth quarter of 2013.

- In January 2014, Teekay Tankers and Teekay Corporation jointly

created a new tanker company, Tanker Investments Limited, and each

invested $25 million for a combined 20 percent ownership interest;

and agreed in principle for Teekay Tankers to acquire Teekay

Corporation's conventional tanker commercial and technical

management operations.

- In December 2013, the detained VLCC tanker that secures one of

Teekay Tankers' term loan investments was released from Egypt and

is currently trading in the spot tanker market.

Teekay Tankers Ltd. (Teekay Tankers or the

Company) (NYSE:TNK) today reported an adjusted net loss

attributable to shareholders of Teekay Tankers(1) (as detailed in

Appendix A to this release) of $2.4 million, or $0.03 per

share, for the quarter ended December 31, 2013, compared to

adjusted net loss attributable to shareholders of Teekay Tankers of

$7.8 million, or $0.09 per share, for the same period in the prior

year. The decrease in adjusted net loss attributable to

shareholders of Teekay Tankers is primarily due to stronger Suezmax

and Aframax spot rates in the fourth quarter of 2013 compared to

the same period of the prior year and a decrease in depreciation

expense as a result of vessel impairments recorded in the fourth

quarter of 2012, partially offset by the change in employment of

certain of the Company's vessels from fixed rates to lower spot

rates upon expiry of their fixed-rate charters, lower average

realized spot tanker rates for the Company's LR2 fleet and a

reduction in interest income from the Company's investment in term

loans. Adjusted net loss attributable to shareholders of Teekay

Tankers excludes a number of specific items that had the net effect

of increasing net income attributable to shareholders of Teekay

Tankers by $16.5 million, or $0.20 per share, for the three months

ended December 31, 2013 and increasing the net loss by $348.8

million, or $4.18 per share, for the three months ended December

31, 2012, as detailed in Appendix A to this release.

Including these items, the Company reported, on a GAAP basis, net

income attributable to shareholders of Teekay Tankers of $14.1

million, or $0.17 per share, for the quarter ended December 31,

2013, compared to a net loss attributable to shareholders of Teekay

Tankers of $356.6 million, or a loss of $4.27 per share, for the

quarter ended December 31, 2012. Net revenues(2) were $39.7 million

and $44.5 million for the quarters ended December 31, 2013 and

December 31, 2012, respectively.

For the year ended December 31, 2013, the Company reported an

adjusted net loss attributable to shareholders of Teekay Tankers of

$16.3 million, or $0.20 per share, compared to adjusted net loss

attributed to the shareholders of Teekay Tankers of $11.4 million,

or $0.14 per share, for the prior year. The increase in adjusted

net loss attributable to shareholders of Teekay Tankers is

primarily due to a decrease in the Company's net voyage revenues

due to the change in employment of certain of the Company's vessels

from fixed rates to lower spot rates on expiry of their fixed-rate

charters, lower average realized spot tanker rates for the year

ended 2013 compared to the prior year and a reduction in interest

income from the Company's investment in term loans. This was

partially offset by the decrease in depreciation expense as a

result of vessel impairments recorded in the fourth quarter of

2012. Adjusted net loss attributable to shareholders of Teekay

Tankers excludes a number of specific items that had the net effect

of decreasing net loss attributable to shareholders of Teekay

Tankers by $8.2 million, or $0.10 per share, for the year ended

December 31, 2013 and increasing net loss by $349.6 million, or

$4.40 per share, for the year ended December 31, 2012, as detailed

in Appendix A to this release. Including these items, the

Company reported, on a GAAP basis, a net loss attributable to

shareholders of Teekay Tankers of $8.1 million, or $0.10 per share,

for the year ended December 31, 2013, compared to a net loss

attributable to shareholders of Teekay Tankers of $361.0 million,

or $4.54 per share, for the year ended December 31, 2012. Net

revenues(2) were $161.8 million and $192.8 million for the years

ended December 31, 2013 and December 31, 2012, respectively.

The Company's financial statements for prior periods include the

historical results of the 13 vessels acquired by the Company from

Teekay Corporation in June 2012, referred to herein as the

Dropdown Predecessor, for the periods when these vessels

were owned and operated by Teekay Corporation, which includes the

period from January to June 2012.

During the fourth quarter of 2013, the Company generated $10.4

million, or $0.12 per share, of Cash Available for Distribution(3),

compared to $8.7 million, or $0.10 per share, in the third quarter

of 2013. On January 3, 2014, Teekay Tankers declared its fixed

dividend of $0.03 per share for the fourth quarter of 2013, which

was paid on January 31, 2014 to all shareholders of record on

January 17, 2014. Since the Company's initial public offering in

December 2007, it has declared dividends in 25 consecutive

quarters, which now total $7.305 per share on a cumulative

basis.

"Crude tanker rates in December 2013 and January 2014 reached

their highest levels since the third quarter of 2008, mainly as a

result of higher crude oil imports into China, an increase in

long-haul crude oil movements from the Atlantic basin to Asia and

seasonal factors, most of which will be reflected in the financial

results for the first quarter of 2014," commented Bruce Chan,

Teekay Tankers' Chief Executive Officer. "Based on approximately 65

percent of spot revenues days booked to date in the first quarter

of 2014, the Company has earned an average time-charter equivalent,

or TCE, rate of approximately $34,300 and $25,300 per day for its

spot Suezmax and Aframax vessels, respectively, compared to $15,200

and $13,900 per day for the fourth quarter of 2013. "While rates

have softened somewhat in recent weeks, we believe stronger oil

demand, limited tanker fleet growth and improving global economic

conditions will continue to support a general firming of average

spot tanker rates starting in 2014."

Mr. Chan added, "Teekay Tankers' co-investment in Tanker

Investments Limited, or TIL, provides an additional way for Teekay

Tankers' shareholders to benefit from a potential tanker market

recovery while complementing our existing strategy of directly

owning and in-chartering conventional tankers. Teekay Tankers can

now either invest in secondhand tankers or newbuildings directly or

seek to invest further in TIL. In addition, Teekay Tankers' planned

acquisition of Teekay Corporation's conventional tanker commercial

and technical management operations represents the final step in

Teekay Tankers' evolution into a full-service conventional tanker

platform, which we believe will allow us to better serve our

customers and generate greater value for our shareholders."

|

(1) |

Adjusted net loss attributable to shareholders of Teekay Tankers is

a non-GAAP financial measure. Please refer to Appendix A

to this release for a reconciliation of this non-GAAP measure as

used in this release to the most directly comparable financial

measure under United States generally accepted accounting

principles (GAAP) and for information about specific items

affecting net loss that are typically excluded by securities

analysts in their published estimates of the Company's financial

results. |

|

(2) |

Net revenues is a non-GAAP financial measure used by certain

investors to measure the financial performance of shipping

companies. Please refer to Appendix C included in this

release for a reconciliation of this non-GAAP measure to the most

directly comparable financial measure under GAAP. |

|

(3) |

Cash Available for Distribution represents net income (loss), plus

depreciation and amortization, unrealized losses from derivatives,

non-cash items and any write-offs or other non-recurring items,

less unrealized gains from derivatives and net income attributable

to the historical results of vessels acquired by the Company from

Teekay Corporation, for the period when these vessels were owned

and operated by Teekay Corporation. Please refer to Appendix

B to this release for a reconciliation of Cash Available for

Distribution (a non-GAAP measure) as used in this release to the

most directly comparable GAAP financial measure. |

Summary of Recent

Events

First Priority VLCC Mortgage Loans

Due to an increase in tanker vessel values, in the fourth

quarter of 2013, the Company recognized $2.0 million of interest

income and recorded a $14.9 million reversal of the loss provision

on its investment in term loans secured by two 2010-built Very

Large Crude Carrier (VLCC) vessels. As a result of this

reversal, as of December 31, 2013 there is no remaining loan loss

provision associated with the term loans secured by these vessels.

The Company expects to recover the carrying value of the term

loans, including the original loan principal balance, from a

combination of the future operating cash flows of the two VLCC

vessels and the net proceeds from their eventual sale. The actual

amount recoverable from the Company's investment in the term loans

may vary from the Company's current estimates depending on various

factors, including the vessels' actual future operating cash flows

and actual net proceeds realized from the eventual sale of the

vessels.

In December 2013, the previously detained VLCC was released by

the Egyptian authorities. Currently, both VLCC vessels securing the

investment in term loans are trading in the spot tanker market

under Teekay Tankers' management. The Company continues to work

closely with the borrowers and the second priority mortgagees of

the vessels to realize on its security for the loans.

Investment in Tanker Investments Ltd.

In January 2014, Teekay Tankers and Teekay Corporation

(Teekay) jointly created Tanker Investments Limited

(TIL), which will seek to opportunistically acquire,

operate, and sell modern secondhand tankers to benefit from an

expected recovery in the current cyclical low of the tanker market.

TIL completed a $250 million equity private placement in which

Teekay Tankers and Teekay co-invested $25 million each for a

combined 20 percent ownership in the new company. The balance of

the privately placed TIL shares, which are listed on the Norwegian

over-the-counter market under the symbol "TIL", were purchased by a

group of institutional investors.

A portion of the net proceeds from the equity private placement

will be used to acquire four 2009 and 2010-built Aframax crude oil

tankers for an aggregate purchase price of approximately $116

million, which are expected to be acquired between March and June

2014, and four 2009-built Suezmax crude oil tankers for an

aggregate purchase price of approximately $163 million, which TIL

will pay for by the assuming an equal amount of indebtedness

already secured by those vessels. The four Suezmax vessels are

expected to be acquired from Teekay in late-February 2014. The

remaining proceeds will be used to acquire additional tankers and

for general corporate purposes. TIL expects to list its shares on

the Oslo Stock Exchange in March 2014.

The Teekay and Teekay Tankers' Boards of Directors have also

agreed in principle to the sale of Teekay's conventional tanker

commercial and technical management operations (Teekay

Operations) to Teekay Tankers, including direct ownership in

three commercially managed tanker pools, which currently generate

income from commercially managing a fleet of 82 vessels and

technically managing a fleet of 49 vessels. The TIL fleet also will

be managed by Teekay Operations and, upon completion of the sale of

Teekay Operations, the corresponding fees associated with the

management of TIL's vessels will be earned by Teekay Tankers.

Fixed-Rate Time-Charter Coverage

During December 2013, Teekay Tankers commenced new time-charter

out contracts for two Aframax tankers. The Erik Spirit has

been time-chartered out for a period of 12 months at a rate of

$14,100 per day and the Esther Spirit has been

time-chartered out for a period of 24 months at a time-charter rate

of $16,500 per day.

Teekay Tankers recently extended its time-charter in contract

with BM Breeze for a period of 12 months at a rate of

$12,000 per day, with options to extend up to an additional 24

months at escalating rates.

Tanker

Market

Global oil demand is expected to average 92.5 million barrels

per day (mb/d) in 2014, representing an increase of 4.1

mb/d, or 4.6 percent, compared to 2010 oil demand of 88.4 mb/d. In

recent years, oil demand growth has been more than offset by high

levels of fleet growth with the global tanker fleet growing by a

net 70.8 million deadweight tonnes (mdwt), or 16.3

percent, from the start of 2010 until January 2014. Moderate oil

demand growth, combined with high tanker fleet growth resulted in a

significant decline in crude tanker spot rates and second-hand

tanker values during the period from 2010 to the fourth quarter of

2013.

In December 2013 and January 2014, crude tanker spot rates

increased significantly, reaching their highest levels since the

third quarter of 2008, although rates for 2013 as a whole were

comparatively low on a historical basis. This recent increase was

primarily due to strong Chinese crude oil imports, an increase in

long-haul movements from the Atlantic basin to Asia, and seasonal

factors.

There are currently 61.6 mdwt of tankers on order, or

approximately 12.3 percent of the existing fleet. The tanker

orderbook has been shrinking since it peaked at 190 mdwt, or

approximately 49 percent of the fleet, in September 2008. As a

result of the smaller orderbook, the global tanker fleet is

expected to grow by only 1.2 percent in 2014 and 1.3 percent in

2015, net of removals, which is the smallest fleet growth rate

since 2001. The pace of new tanker ordering increased in 2013, with

a total of 33.6 mdwt ordered, compared to just 13.9 mdwt ordered

during 2012. From 2000 to 2012, annual orders averaged 35.8 mdwt.

However, the majority of orders placed in 2013 were for

Medium-Range (MR) and Long Range 2 (LR2) product

tankers.

In its January 2014 "World Economic Outlook", the International

Monetary Fund (IMF) raised its global GDP growth forecast

for 2014 to 3.7 percent, an increase of 0.1 percent over its

previous forecast for 2014. Global oil demand is projected to grow

by 1.2 million mb/d in 2014 based on the average of the forecasts

of the International Energy Agency, the Energy Information

Administration, and OPEC, an increase from the 1.0 mb/d of oil

demand growth in 2013. The forecasted increase in demand is based

on the cautiously positive sentiment for global economic growth,

which continues to be driven by China, although at a slower pace

than previous years. The call on OPEC is expected to decline by

around 0.6 mb/d in 2014, as non-OPEC supply, mostly driven by the

United States, continues to grow.

A combination of improving global economic conditions and

expected stronger oil demand growth coupled with limited tanker

fleet growth for 2014 and 2015, is expected to drive an increase in

tanker fleet utilization and therefore improved spot tanker rates

over the next two years.

Operating

Results

The following table highlights the operating performance of the

Company's time-charter and spot vessels measured in net voyage

revenue per revenue day, or time-charter equivalent (TCE)

rates, before related-party pool management fees, related-party

commissions and off-hire bunker expenses:

|

|

Three Months Ended |

|

|

December 31, 2013 |

September 30, 2013 |

December 31, 2012 |

|

Time-Charter Out Fleet |

|

|

|

|

|

|

|

Suezmax revenue days |

|

176 |

|

134 |

|

362 |

|

Suezmax TCE per revenue day(i) |

$ |

19,490 |

$ |

20,448 |

$ |

21,036 |

|

Aframax revenue days |

|

804 |

|

825 |

|

714 |

|

Aframax TCE per revenue day (i) |

$ |

17,189 |

$ |

17,542 |

$ |

17,769 |

|

MR revenue days |

|

92 |

|

92 |

|

276 |

|

MR TCE per revenue day(ii) |

$ |

35,054 |

$ |

35,633 |

$ |

25,287 |

|

|

|

|

|

|

|

|

|

Spot Fleet |

|

|

|

|

|

|

|

Suezmax revenue days |

|

683 |

|

716 |

|

538 |

|

Suezmax spot TCE per revenue day |

$ |

15,221 |

$ |

13,799 |

$ |

11,515 |

|

Aframax revenue days |

|

276 |

|

284 |

|

424 |

|

Aframax spot TCE per revenue day |

$ |

13,893 |

$ |

13,583 |

$ |

13,384 |

|

LR2 revenue days |

|

276 |

|

275 |

|

276 |

|

LR2 spot TCE per revenue day |

$ |

12,901 |

$ |

12,488 |

$ |

15,889 |

|

MR revenue days |

|

181 |

|

184 |

|

- |

|

MR spot TCE per revenue day |

$ |

15,772 |

$ |

15,067 |

|

- |

|

|

|

|

|

|

|

|

|

Total Fleet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suezmax revenue days |

|

859 |

|

850 |

|

900 |

|

Suezmax TCE per revenue day(i) |

$ |

16,096 |

$ |

14,845 |

$ |

15,345 |

|

Aframax revenue days |

|

1,080 |

|

1,109 |

|

1,138 |

|

Aframax TCE per revenue day(i) |

$ |

16,347 |

$ |

16,528 |

$ |

16,141 |

|

LR2 revenue days |

|

276 |

|

275 |

|

276 |

|

LR2 TCE per revenue day |

$ |

12,901 |

$ |

12,488 |

$ |

15,889 |

|

MR revenue days |

|

273 |

|

276 |

|

276 |

|

MR TCE per revenue day(ii) |

$ |

22,279 |

$ |

21,923 |

$ |

25,287 |

|

|

|

|

|

|

|

|

|

(i) |

Excludes profit share amounts relating to certain vessels which are

employed on fixed-rate time-charter contracts that include a

profit-sharing component. |

|

(ii) |

The

charter rate on one of the MR tankers includes approximately

$14,000 per day for the additional costs relating to Australian

crew versus international crew. |

Teekay Tankers'

Fleet

The following table summarizes the Company's fleet as of

February 1, 2014:

|

|

Owned Vessels |

Chartered-in Vessels |

Total |

|

Fixed-rate: |

|

|

|

|

Suezmax Tankers |

2 |

- |

2 |

|

Aframax Tankers |

9 |

- |

9 |

|

MR Product Tankers |

1 |

- |

1 |

|

VLCC Tanker(i) |

1 |

- |

1 |

|

Total Fixed-Rate Fleet |

13 |

- |

13 |

|

Spot-rate: |

|

|

|

|

Suezmax Tankers |

8 |

- |

8 |

|

Aframax Tankers(ii) |

2 |

1 |

3 |

|

LR2 Product Tankers |

3 |

- |

3 |

|

MR Product Tankers |

2 |

- |

2 |

|

Total Spot Fleet |

15 |

1 |

16 |

|

Total Teekay Tankers Fleet |

28 |

1 |

29 |

|

(i) |

The

Company's ownership interest in this vessel is 50 percent. |

|

(ii) |

The

Aframax tanker BM Breeze is currently time-chartered in

for a 12-month period ending in January 2015, with options to

extend up to an additional 24 months. |

Liquidity

As of December 31, 2013, the Company had total liquidity of

$173.9 million (which consisted of $25.6 million of cash and $148.3

million in an undrawn revolving credit facility), compared to total

liquidity of $226.1 million as at September 30, 2013.

Conference

Call

The Company plans to host a conference call on Thursday,

February 20, 2014 at 1:00 p.m. (ET) to discuss its results for the

fourth quarter and fiscal year of 2013. An accompanying investor

presentation will be available on Teekay Tankers' website at

www.teekaytankers.com prior to the start of the call. All

shareholders and interested parties are invited to listen to the

live conference call by choosing from the following options:

- By dialing (800) 711-9538 or

(416) 640-5925, if

outside of North America, and quoting conference ID code

6530002.

- By accessing the webcast, which will be available on Teekay

Tankers' website at www.teekaytankers.com (the archive will remain

on the website for a period of 30 days).

The conference call will be recorded and available until

Thursday, February 27, 2014. This recording can be accessed

following the live call by dialing (888) 203-1112 or

(647) 436-0148, if

outside North America, and entering access code 6530002.

About Teekay

Tankers

Teekay Tankers currently owns a fleet of 27 double-hull vessels,

including 11 Aframax tankers, 10 Suezmax tankers, three Long Range

2 (LR2) product tankers, three Medium-Range (MR)

product tankers and has one time-chartered in Aframax tanker, all

of which vessels an affiliate of Teekay Corporation (NYSE:TK)

manages through a mix of short- or medium-term fixed-rate

time-charter contracts and spot tanker market trading. The Company

also owns a Very Large Crude Carrier (VLCC) through a 50

percent-owned joint venture. Teekay Tankers was formed in December

2007 by Teekay Corporation as part of its strategy to expand its

conventional oil tanker business.

Teekay Tankers' common stock trades on the New York Stock

Exchange under the symbol "TNK."

|

TEEKAY TANKERS LTD. SUMMARY CONSOLIDATED STATEMENTS OF INCOME

(LOSS) (in thousands of U.S. dollars, except share data) |

|

|

Three Months Ended |

|

Year Ended |

|

|

|

December, 31 |

|

September, 30 |

|

December, 31 |

|

December, 31 |

|

December, 31 |

|

|

|

2013 |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time-charter revenues |

20,832 |

|

20,600 |

|

27,339 |

|

88,320 |

|

123,364 |

|

|

Net pool revenues |

19,205 |

|

18,879 |

|

15,241 |

|

69,675 |

|

62,328 |

|

|

Voyage charter revenue |

132 |

|

- |

|

28 |

|

4,415 |

|

238 |

|

|

Interest income from investment |

|

|

|

|

|

|

|

|

|

|

|

in term loans(1) |

1,994 |

|

- |

|

2,885 |

|

7,677 |

|

11,499 |

|

|

Total revenues |

42,163 |

|

39,479 |

|

45,493 |

|

170,087 |

|

197,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

2,492 |

|

483 |

|

1,017 |

|

8,337 |

|

4,618 |

|

|

Vessel operating expenses(2) |

21,922 |

|

21,859 |

|

25,016 |

|

91,667 |

|

96,160 |

|

|

Time-charter hire expense |

1,021 |

|

1,216 |

|

841 |

|

6,174 |

|

3,950 |

|

|

Depreciation and amortization |

12,113 |

|

11,935 |

|

18,431 |

|

47,833 |

|

72,365 |

|

|

General and administrative (2) |

2,354 |

|

3,317 |

|

2,390 |

|

12,594 |

|

7,985 |

|

|

(Reversal) loss provision on investment in |

|

|

|

|

|

|

|

|

|

|

|

term loans(1) (3) |

(14,910 |

) |

10,399 |

|

- |

|

- |

|

- |

|

|

Vessel impairment and net loss on sale |

|

|

|

|

|

|

|

|

|

|

|

of vessel |

- |

|

- |

|

352,546 |

|

71 |

|

352,546 |

|

|

|

24,992 |

|

49,209 |

|

400,241 |

|

166,676 |

|

537,624 |

|

|

Income (loss) from operations |

17,171 |

|

(9,730 |

) |

(354,748 |

) |

3,411 |

|

(340,195 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ITEMS |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

(2,468 |

) |

(2,440 |

) |

(2,840 |

) |

(10,023 |

) |

(20,009 |

) |

|

Interest income |

63 |

|

71 |

|

14 |

|

158 |

|

50 |

|

|

Realized and unrealized (loss) gain |

|

|

|

|

|

|

|

|

|

|

|

on derivative instruments(4) |

(1,014 |

) |

(2,492 |

) |

1,263 |

|

(1,524 |

) |

(7,963 |

) |

|

Equity income (loss) from joint venture |

564 |

|

458 |

|

(1 |

) |

854 |

|

(1 |

) |

|

Other expenses |

(186 |

) |

(458 |

) |

(257 |

) |

(1,014 |

) |

(2,063 |

) |

|

|

(3,041 |

) |

(4,861 |

) |

(1,821 |

) |

(11,549 |

) |

(29,986 |

) |

|

Net income (loss) |

14,130 |

|

(14,591 |

) |

(356,569 |

) |

(8,138 |

) |

(370,181 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share attributable to shareholders of Teekay

Tankers (5) |

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted |

0.17 |

|

(0.17 |

) |

(4.27 |

) |

($0.10 |

) |

($4.54 |

) |

|

Weighted-average number of Class A |

|

|

|

|

|

|

|

|

|

|

|

common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted |

71,091,030 |

|

71,091,030 |

|

71,091,030 |

|

71,091,030 |

|

67,039,605 |

|

|

Weighted-average number of Class B |

|

|

|

|

|

|

|

|

|

|

|

common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted |

12,500,000 |

|

12,500,000 |

|

12,500,000 |

|

12,500,000 |

|

12,500,000 |

|

|

Weighted-average number of total |

|

|

|

|

|

|

|

|

|

|

|

common shares outstanding |

83,591,030 |

|

83,591,030 |

|

83,591,030 |

|

83,591,030 |

|

79,539,605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

The amount recoverable from the Company's investment in term loans

is dependent on various factors, including the amount realizable

from the sale of two VLCCs held as collateral for the loans. The

amounts the Company ultimately may record in its annual 2013 filing

with the SEC on the Form 20-F as interest income and loss provision

on its investment in term loans for 2013 may vary from the amounts

shown above if there are significant changes in the Company's

current estimates of the value of its collateral that may be

realized. |

|

(2) |

In order to more closely align the Company's presentation to many

of its peers, the cost of ship management activities of $1.4

million and $1.4 million for the three months ended December 31,

2013 and September 30, 2013, respectively, and $5.6 million for the

year ended December 31, 2013 have been presented in vessel

operating expenses. Prior to 2013, the Company included these

amounts in general and administrative expenses. All such costs

incurred in comparative periods have been reclassified from general

and administrative expenses to vessel operating expenses to conform

to the presentation adopted in the current period. The amounts

reclassified were $1.4 million for the three months ended December

31, 2012 and $7.0 million for the year ended December 31,

2012. |

|

(3) |

A reversal of a loss provision on the Company's investment in term

loans of $14.9 million was recorded for the three months ended

December 31, 2013. Loss provisions on investment in term loans of

$10.4 million and $4.5 million had previously been recorded for the

three months ended September 30, 2013 and June 30, 2013,

respectively. As a result of the reversal, there was no remaining

loan loss provision recorded as of December 31, 2013. |

|

(4) |

Includes realized losses relating to interest rate swaps of $2.5

million, $2.5 million, and $2.4 million for the three months ended

December 31, 2013, September 30, 2013 and December 31, 2012,

respectively, and $9.9 million and $7.8 million for the years ended

December 31, 2013 and December 31, 2012, respectively. |

|

(5) |

Income (loss) per share attributable to shareholders of Teekay

Tankers is determined by dividing (a) net income (loss) of the

Company after adjusting for the amount of net loss attributable to

the Dropdown Predecessor by (b) the weighted-average number of

shares outstanding during the applicable period. |

|

|

|

|

TEEKAY TANKERS LTD. SUMMARY CONSOLIDATED BALANCE SHEETS (in

thousands of U.S. dollars) |

|

|

As at |

|

As at |

|

As at |

|

December 31, 2013 |

|

September 30, 2013 |

|

December 31, 2012 |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

ASSETS |

|

|

|

|

|

|

Cash |

25,646 |

|

29,168 |

|

26,341 |

|

Pool receivable from related parties |

10,765 |

|

7,962 |

|

9,101 |

|

Accounts receivable |

4,247 |

|

8,233 |

|

4,523 |

|

Vessel held for sale |

- |

|

- |

|

9,114 |

|

Prepaid assets |

10,361 |

|

12,630 |

|

9,714 |

|

Investment in term loans |

136,061 |

|

114,096 |

|

119,385 |

|

Due from affiliates |

27,991 |

|

26,791 |

|

24,787 |

|

Vessels and equipment |

859,308 |

|

861,377 |

|

885,992 |

|

Loan to joint venture |

9,830 |

|

9,830 |

|

9,830 |

|

Investment in joint venture |

8,366 |

|

7,802 |

|

3,457 |

|

Other non-current assets |

4,954 |

|

5,164 |

|

3,412 |

|

Total assets |

1,097,529 |

|

1,083,053 |

|

1,105,656 |

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

23,320 |

|

19,683 |

|

21,228 |

|

Current portion of long-term debt |

25,246 |

|

25,246 |

|

25,246 |

|

Current portion of derivative instruments |

7,344 |

|

6,219 |

|

7,200 |

|

Deferred revenue |

2,961 |

|

1,090 |

|

4,564 |

|

Due to affiliates |

11,323 |

|

11,430 |

|

3,592 |

|

Long-term debt |

719,388 |

|

720,921 |

|

710,455 |

|

Other long-term liabilities |

23,275 |

|

25,792 |

|

31,188 |

|

Equity |

284,672 |

|

272,672 |

|

302,183 |

|

Total liabilities and equity |

1,097,529 |

|

1,083,053 |

|

1,105,656 |

|

|

|

|

|

|

|

|

TEEKAY TANKERS LTD. SUMMARY CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of U.S. dollars) |

|

|

Year Ended |

|

|

December 31, 2013 |

|

December 31, 2012 |

|

|

(unaudited) |

|

(unaudited)(1) |

|

|

Cash and cash equivalents provided by (used for) |

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

Net operating cash flow |

6,202 |

|

27,542 |

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

Proceeds from long-term debt |

59,179 |

|

32,226 |

|

|

Repayments of long-term debt |

(25,246 |

) |

(13,522 |

) |

|

Prepayment of long-term debt |

(25,000 |

) |

(60,000 |

) |

|

Proceeds from long-term debt of Dropdown Predecessor |

- |

|

2,312 |

|

|

Repayment from long-term debt of Dropdown Predecessor |

- |

|

(10,372 |

) |

|

Prepayment from long-term debt of Dropdown Predecessor |

- |

|

(15,000 |

) |

|

Acquisition of 13 vessels from Teekay Corporation |

- |

|

(9,509 |

) |

|

Net advances from affiliates |

- |

|

16,913 |

|

|

Contribution of capital from Teekay Corporation |

- |

|

9,507 |

|

|

Proceeds from issuance of Class A common stock |

- |

|

69,000 |

|

|

Share issuance costs |

- |

|

(3,229 |

) |

|

Cash dividends paid |

(10,030 |

) |

(32,231 |

) |

|

Net financing cash flow |

(1,097 |

) |

(13,905 |

) |

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

Proceeds from sale of vessel and equipment |

9,114 |

|

- |

|

|

Expenditures for vessels and equipment |

(1,904 |

) |

(2,518 |

) |

|

Investment in joint venture |

(3,890 |

) |

(3,344 |

) |

|

Investment in term loans |

(9,120 |

) |

- |

|

|

Net investing cash flow |

(5,800 |

) |

(5,862 |

) |

|

|

|

|

|

|

|

(Decrease) increase in cash and cash equivalents |

(695 |

) |

7,775 |

|

|

Cash and cash equivalents, beginning of the year |

26,341 |

|

18,566 |

|

|

Cash and cash equivalents, end of the year |

25,646 |

|

26,341 |

|

|

(1) |

In

accordance with GAAP, the statements of cash flows for the year

ended December 31, 2012, include the Dropdown Predecessor amounts

for the 13 conventional tankers acquired by the Company from Teekay

Corporation in June 2012 to reflect ownership of the vessels for

the time they were owned and operated by Teekay Corporation. |

|

|

|

|

TEEKAY TANKERS LTD. APPENDIX A - SPECIFIC ITEMS AFFECTING NET

INCOME (LOSS) (in thousands of U.S. dollars, except per share

amounts) |

Set forth below is a reconciliation of the Company's unaudited

adjusted net income (loss) attributable to the shareholders of

Teekay Tankers, a non-GAAP financial measure, to net income (loss)

as determined in accordance with GAAP. The Company believes that,

in addition to conventional measures prepared in accordance with

GAAP, certain investors use this information to evaluate the

Company's financial performance. The items below are also typically

excluded by securities analysts in their published estimates of the

Company's financial results. Adjusted net income (loss)

attributable to the shareholders of Teekay Tankers is intended to

provide additional information and should not be considered a

substitute for measures of performance prepared in accordance with

GAAP.

|

Three Months Ended |

|

December 31, 2013 |

|

December 31, 2012 |

|

|

(unaudited) |

|

(unaudited) |

|

|

$ |

|

$ Per Share |

|

$ |

|

$ Per Share |

|

| Net income (loss) - GAAP basis |

14,130 |

|

$ |

0.17 |

|

(356,569 |

) |

$ |

(4.27 |

) |

| Net income (loss) attributable to shareholders of

Teekay Tankers |

14,130 |

|

$ |

0.17 |

|

(356,569 |

) |

|

(4.27 |

) |

| (Subtract) add specific items affecting net

income: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on interest rate swaps (1) |

(1,486 |

) |

$ |

(0.02 |

) |

(3,735 |

) |

|

(0.04 |

) |

|

Reversal of loss provision on investment term loans (2) |

(14,910 |

) |

$ |

(0.18 |

) |

- |

|

|

- |

|

|

Write-down of vessels and equipment (3) |

- |

|

|

- |

|

352,546 |

|

$ |

4.22 |

|

|

Other (4) |

(145 |

) |

|

- |

|

- |

|

|

- |

|

| Total adjustments |

(16,541 |

) |

$ |

(0.20 |

) |

348,811 |

|

$ |

4.18 |

|

| Adjusted net loss attributable to shareholders of

Teekay Tankers |

(2,411 |

) |

$ |

(0.03 |

) |

(7,758 |

) |

$ |

(0.09 |

) |

|

Year Ended |

|

December 31, 2013 |

|

December 31, 2012 |

|

|

(unaudited) |

|

(unaudited) |

|

|

$ |

|

$ Per Share |

|

$ |

|

$ Per Share |

|

| Net loss - GAAP basis |

(8,138 |

) |

$ |

(0.10 |

) |

(370,181 |

) |

$ |

(4.65 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to the Dropdown Predecessor |

- |

|

|

- |

|

9,163 |

|

$ |

0.11 |

|

| Net loss attributable to shareholders of Teekay

Tankers |

(8,138 |

) |

$ |

(0.10 |

) |

(361,018 |

) |

$ |

(4.54 |

) |

| (Subtract) add specific items affecting net

income: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on interest rate swaps (1) |

(8,363 |

) |

$ |

(0.10 |

) |

(3,810 |

) |

$ |

(0.04 |

) |

|

Write-down of vessels and equipment/ loss on sale (3) |

71 |

|

|

- |

|

352,546 |

|

$ |

4.43 |

|

|

Other (4) |

126 |

|

|

- |

|

840 |

|

$ |

0.01 |

|

| Total adjustments |

(8,166 |

) |

$ |

(0.10 |

) |

349,576 |

|

$ |

4.40 |

|

| Adjusted net loss attributable to shareholders of

Teekay Tankers |

(16,304 |

) |

$ |

(0.20 |

) |

(11,442 |

) |

$ |

(0.14 |

) |

|

(1) |

Reflects the unrealized gain or loss due to changes in the

mark-to-market value of derivative instruments that are not

designated as hedges for accounting purposes. |

|

(2) |

Reversal of the loan loss provision was recorded for the three

months ended December 31, 2013. The full reversal of the loan loss

provision was due to the increase in the value of the two VLCCs

securing the Company's investment in term loans. |

|

(3) |

The

amount for the year ended December 31, 2012 relates to impairment

charges associates with the Company's Suezmax tankers, certain of

its older Aframax tankers, and one MR product tanker. |

|

(4) |

The

amount recorded for the three months ended December 31, 2013 and

the year ended December 31, 2013, relates to the 50-percent portion

of an unrealized derivative instrument loss recorded by the High Q

Joint Venture, which owns the VLCC newbuilding that delivered in

June 2013. The amount for the year ended December 31, 2012 relates

to the transaction costs related to the acquisition costs of the 13

conventional tankers acquired in June 2012. |

|

|

|

|

TEEKAY TANKERS LTD. APPENDIX B - RECONCILIATION OF NON-GAAP

FINANCIAL MEASURE CASH AVAILABLE FOR DISTRIBUTION (in thousands of

U.S. dollars, except share and per share data) |

Description of Non-GAAP Financial Measure - Cash Available for

Distribution

Cash Available for Distribution (CAD) represents net income,

plus depreciation and amortization, unrealized losses from

derivatives, non-cash items, CAD from the VLCC joint venture and

any write-offs or other non-recurring items, less unrealized gains

from derivatives and equity income from the joint venture.

|

Three Months Ended |

|

December 31, 2013 |

|

(unaudited) |

|

|

|

| Net income for the period |

14,130 |

|

|

|

|

| Add: |

|

|

|

Depreciation and amortization |

12,113 |

|

|

Proportionate share of cash available for distribution from joint

venture |

939 |

|

|

Other |

210 |

|

| Less: |

|

|

|

Reversal of loss provision on investment in term loans |

(14,910 |

) |

|

Equity income from joint venture |

(564 |

) |

|

|

Unrealized gain on interest rate swaps |

(1,486 |

) |

| Cash Available for Distribution |

10,432 |

|

|

|

|

| Weighted average number of common shares outstanding

for the quarter |

83,591,030 |

|

|

|

|

| Cash Available for Distribution per share

(rounded) |

$0.12 |

|

|

|

|

|

|

TEEKAY TANKERS LTD. APPENDIX C - RECONCILIATION OF NON-GAAP

FINANCIAL MEASURE NET REVENUES (in thousands of U.S. dollars) |

Description of Non-GAAP Financial Measure - Net Revenues

Net revenues represents revenues less voyage expenses where

voyage expenses is comprised of all expenses relating to certain

voyages, including bunker fuel expenses, port fees, canal tolls and

brokerage commissions. Net revenues is a non-GAAP financial measure

used by certain investors to measure the financial performance of

shipping companies; however, it is not required by GAAP and should

not be considered as an alternative to revenues or any other

indicator of the Company's performance required by GAAP.

|

|

Three Months Ended |

|

Year ended |

|

|

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

2013 |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

Revenues |

42,163 |

|

39,479 |

|

45,493 |

|

170,087 |

|

197,429 |

|

|

Voyage expenses |

(2,492 |

) |

(483 |

) |

(1,017 |

) |

(8,337 |

) |

(4,618 |

) |

|

Net revenues |

39,671 |

|

38,996 |

|

44,476 |

|

161,750 |

|

192,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORWARD LOOKING STATEMENTS |

This release contains forward-looking statements (as defined in

Section 21E of the Securities Exchange Act of 1934, as amended)

which reflect management's current views with respect to certain

future events and performance, including statements regarding: the

crude oil and refined product tanker market fundamentals, including

the balance of supply and demand in the tanker market, spot tanker

rates and the potential for a tanker market recovery; the Company's

financial stability and ability to benefit from a tanker market

recovery; the Company's ability to take advantage of growth

opportunities in a future tanker market recovery; the Company's

acquisition of Teekay's conventional tanker commercial and

technical management operations and the related effect on the

Company; the Company's investment in TIL, potential benefits to the

Company, and TIL's proposed vessels acquisitions and Oslo Stock

Exchange listing; and the amount recoverable from the Company's

investments in loans secured by two 2010-built VLCCs and the timing

and certainty for the potential sale of these vessels.

The following factors are among those that could cause actual

results to differ materially from the forward-looking statements,

which involve risks and uncertainties, and that should be

considered in evaluating any such statement: changes in the

production of or demand for oil; changes in trading patterns

significantly affecting overall vessel tonnage requirements;

greater or less than anticipated levels of tanker newbuilding

orders or greater or less than anticipated rates of tanker

scrapping; changes in applicable industry laws and regulations and

the timing of implementation of new laws and regulations; the

potential for early termination of short- or medium-term contracts

and inability of the Company to renew or replace short- or

medium-term contracts; changes in interest rates and the capital

markets; failure of TIL to achieve market acceptance, obtain growth

opportunities or list its shares on the Oslo Exchange; changes in

future charter rates and the market value of the VLCCs securing the

Company's investment in term loans; the ability of Teekay Tankers

to operate or sell the VLCC tankers, and the cash flow and sale

proceeds thereof; increases in the Company's expenses, including

any dry docking expenses and associated off-hire days; failure by

the Company and Teekay to negotiate or complete the sale of the

conventional tanker technical and commercial management operations;

failure of Teekay Tankers Board of Directors and its Conflicts

Committee to accept future acquisitions of vessels that may be

offered by Teekay Corporation or third parties; and other factors

discussed in Teekay Tankers' filings from time to time with the

United States Securities and Exchange Commission, including its

Report on Form 20-F for the fiscal year ended December 31, 2012.

The Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any such statement is

based.

Teekay Tankers Ltd. - Investor Relations EnquiriesRyan

Hamilton+1 (604) 844-6654www.teekaytankers.com

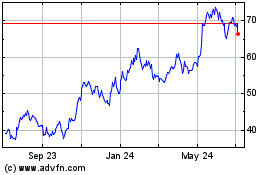

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

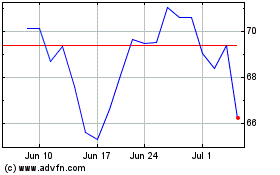

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Apr 2023 to Apr 2024