- Achieved record fourth-quarter oil

production exceeding company guidance

- Delivered 32 percent growth in

fourth-quarter U.S. oil production

- Increased fourth-quarter operating cash

flow by 26 percent

- Repatriated $4.3 billion of foreign

cash during 2013

- Increased proved oil reserves to

highest level in company history

Devon Energy Corporation (NYSE:DVN) today reported net earnings

of $207 million or $0.51 per common share ($0.51 per diluted share)

for the quarter ended December 31, 2013. This compares with a

fourth-quarter 2012 net loss of $357 million or $0.89 per common

share ($0.89 per diluted share).

Adjusting for items securities analysts typically exclude from

their published estimates, the company earned $447 million or $1.10

per diluted share in the fourth quarter. This represents a 49

percent increase in adjusted earnings compared to the fourth

quarter of 2012.

Operating cash flow in the fourth quarter of 2013 totaled $1.4

billion, a 26 percent increase compared to the year-ago period. For

the year ended December 31, 2013, Devon generated operating cash

flow of $5.4 billion. Including $419 million of cash received from

asset sales, the company’s total cash inflows reached $5.9 billion

for 2013.

“2013 was a year of strong execution and exciting change for

Devon,” said John Richels, president and chief executive officer.

“Our drilling programs not only drove impressive oil production

growth, but also expanded margins and improved operating cash flow.

Additionally, we high-graded our portfolio through an accretive

Eagle Ford Shale acquisition, an innovative midstream combination,

and initiated an asset divestiture program. These actions provide a

platform for Devon to achieve attractive high-margin growth in 2014

and for many years to come.”

Key Operating Highlights

Permian Basin – Production averaged a record 86,000

oil-equivalent barrels (Boe) per day in the fourth quarter, a 29

percent increase compared to the fourth quarter of 2012. Light oil

production accounted for approximately 60 percent of Devon’s total

Permian production.

The Bone Spring oil play in the Delaware Basin was a significant

contributor to the company’s growth in the Permian. Devon added 21

new Bone Spring wells to production in the fourth quarter, with

initial 30-day rates averaging 800 Boe per day, of which 70 percent

was light oil. These outstanding initial production rates exceeded

the company’s Bone Spring type curve by about 40 percent.

Also in the Delaware Basin, Devon commenced production on its

first horizontal Wolfcamp well in Ward County, Texas. Initial

30-day production from the Martinsville 120-4H averaged 950 Boe per

day, including 800 barrels of light oil per day. The company has

identified more than 100,000 net acres prospective for the Wolfcamp

within its Delaware Basin position and will continue to derisk this

emerging oil opportunity in 2014.

In the Southern Midland Basin, Devon delivered strong results

from its oil development program in the Wolfcamp Shale. During the

fourth quarter, the company brought 24 Wolfcamp Shale wells online

with initial 30-day rates averaging 410 Boe per day.

Canadian Thermal Oil – Gross production from Devon’s

Jackfish 1 and Jackfish 2 thermal oil projects averaged 58,000

barrels of oil per day in the fourth quarter, or 53,000 barrels per

day after royalties. This represents a 16 percent increase in net

production compared to the third quarter of 2013. The growth in

fourth-quarter production was attributable to the resumption of

operations at Jackfish 2 after scheduled maintenance downtime

during the third quarter.

Construction of the company’s Jackfish 3 thermal oil project is

now nearly complete. Plant startup at Jackfish 3 is expected in the

third quarter of this year. At peak production, Devon’s three 100

percent-owned Jackfish projects are expected to generate nearly $1

billion of free cash flow annually for the company.

Barnett Shale – Net production averaged 1.4 billion cubic

feet of natural gas equivalent per day in 2013. Barnett liquids

production increased to an average of 57,000 barrels per day in

2013, a 17 percent increase compared to 2012.

Anadarko Basin – Fourth-quarter Anadarko Basin production

averaged a record 85,000 Boe per day. Growth from Devon’s

Cana-Woodford Shale and Granite Wash plays drove a 10 percent

year-over-year increase in net production. With drilling focused in

the most liquids-prone acreage, oil and natural gas liquids

production increased to more than 40 percent of total production in

the Anadarko Basin.

Mississippian-Woodford Trend – Net production from

Devon’s emerging Mississippian-Woodford Trend averaged 16,000 Boe

per day in December, representing a 47 percent increase from the

September average and exceeding the company’s projected exit

rate.

Record Oil Production Driven by Permian Basin

Devon delivered strong oil production growth in the fourth

quarter of 2013. Companywide oil production set a new quarterly

record averaging 177,000 barrels per day, exceeding the top end of

the company’s guidance range. This represents a 17 percent increase

in oil production compared to the fourth quarter of 2012 and a 7

percent increase over the third quarter of 2013. Led by the Permian

Basin, the most significant growth came from the company’s U.S.

operations, where oil production increased 32 percent year over

year. Total production increased to an average of 696,000 Boe per

day in the fourth quarter of 2013, surpassing the midpoint of the

company’s previous forecast by 6,000 Boe per day.

In November, the company announced an initiative to monetize

non-core assets in both the U.S. and Canada, sharpening its focus

on high-growth retained properties. The assets identified for

divestiture averaged 144,000 Boe per day in the fourth quarter, of

which almost 80 percent was natural gas. Excluding production

associated with these non-core assets, top-line production in the

fourth quarter from Devon’s retained asset base increased 7 percent

compared to the fourth quarter of 2012. Reconciliations of retained

and non-core asset production are provided later in this

release.

Upstream Revenue Increases 19 Percent; Cash Margins

Expand

Revenue from oil, natural gas and natural gas liquids sales

totaled $8.5 billion in 2013, a 19 percent increase compared to

2012. The significant growth in revenue was attributable to higher

oil production and improved natural gas realizations. In 2013, oil

sales accounted for more than 50 percent of Devon’s total upstream

revenues.

Devon’s marketing and midstream operating profit reached $513

million in 2013. This result represents a 25 percent increase

compared to the previous year. The increase in operating profit was

attributable to higher natural gas prices and strong cost

management.

The company’s pre-tax cash costs totaled $14.96 per Boe in 2013,

a 4 percent increase compared to 2012. The higher unit cost is

attributable to Devon’s dramatic increase in oil production. In

general, oil wells have higher operating costs than gas wells, but

also have higher margins in the current commodity price

environment. In the fourth quarter, the company’s cash margin per

Boe increased 15 percent year over year, reflecting the benefits of

the increase in higher-margin oil production.

Foreign Cash Repatriated; Balance Sheet Remains

Strong

During the fourth quarter, Devon repatriated $2.3 billion of

foreign cash to the U.S. For the full-year 2013, the company

repatriated $4.3 billion of foreign cash to the U.S. at an

estimated effective tax rate of 4 percent. At December 31, 2013,

the company’s cash balances totaled $6.1 billion, and its

investment-grade balance sheet had a net debt to adjusted

capitalization ratio of only 23 percent.

In December, Devon issued $2.25 billion of senior notes through

a combination of two-, three- and five-year offerings and entered

into an undrawn $2 billion senior term loan facility. Proceeds from

the senior notes, the term loan facility, and a portion of the

company’s cash on hand will fund Devon’s recently announced Eagle

Ford acquisition.

Oil Reserves Climb to Record Levels

At December 31, 2013, Devon increased its proved oil reserves to

a record 837 million barrels. During the year, the company’s

oil-focused drilling program added 112 million barrels of oil

reserves through successful drilling (extensions, discoveries and

revisions other than price). This represents a replacement rate of

approximately 180 percent of the oil produced during 2013.

In aggregate, Devon’s estimated proved reserves of oil, natural

gas and natural gas liquids were 3.0 billion oil-equivalent barrels

at year end. Extensions and discoveries through successful

drilling, combined with price revisions related to higher natural

gas prices, increased proved reserves by 355 million Boe compared

to year-end 2012. Divestitures and revisions other than price

decreased proved reserves by 103 million Boe in 2013. Revisions

other than price were primarily attributable to proved undeveloped

gas-weighted locations no longer expected to be drilled given the

commodity price environment.

Overall, the company’s reserve life index (proved reserves

divided by annual production) remained at approximately 12 years,

and its proved undeveloped reserves accounted for only 24 percent

of proved reserves. Proved reserves associated with assets

identified for divestiture totaled 381 million Boe at December 31,

2013, of which approximately 70 percent were natural gas.

Eagle Ford and EnLink Midstream Update

In November, Devon announced the acquisition of GeoSouthern

Energy’s assets in the Eagle Ford oil play. The acquired Eagle Ford

acreage includes 82,000 net acres located in DeWitt and Lavaca

counties. This acreage is located in the best part of the Eagle

Ford, consistently yielding some of the highest initial production

rates and estimated ultimate recoveries in the entire play.

The Eagle Ford transaction is on track to close by the end of

the first quarter of 2014. Net production is expected to grow at a

compound annual growth rate of 25 percent over the next several

years, reaching a peak production rate of approximately 140,000 Boe

per day. Devon’s development program in 2014 is self-funding and

expected to generate significant free cash flow beginning in 2015.

The risked recoverable resource associated with this position is

estimated at 400 million barrels of oil equivalent, of which more

than 60 percent is classified as proved reserves.

Also in 2013, Devon announced the strategic combination of its

U.S. midstream assets with Crosstex to form EnLink Midstream.

EnLink Midstream will consist of two publicly traded entities: the

master limited partnership, EnLink Midstream Partners LP, and a

publicly traded general partner entity, EnLink Midstream LLC. This

transaction is expected to close in the first quarter of 2014. The

common units of both EnLink Midstream Partners LP and EnLink

Midstream LLC will trade on the New York Stock Exchange under the

symbols “ENLK” and “ENLC”, respectively.

Non-GAAP Reconciliations

Pursuant to regulatory disclosure requirements, Devon is

required to reconcile non-GAAP financial measures to the related

GAAP information (GAAP refers to generally accepted accounting

principles). Adjusted earnings, net debt and adjusted

capitalization are non-GAAP financial measures referenced within

this release. Reconciliations of these non-GAAP measures are

provided later in this release.

Conference Call to be Webcast Today

Devon will discuss its fourth-quarter and full-year 2013

financial and operating results in a conference call webcast today.

The webcast will begin at 10 a.m. Central (11 a.m. Eastern ) and

may be accessed from Devon’s home page at www.devonenergy.com.

This press release includes "forward-looking statements" as

defined by the Securities and Exchange Commission (SEC). Such

statements are those concerning strategic plans, expectations and

objectives for future operations. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that the company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the company. Statements regarding future

drilling and production are subject to all of the risks and

uncertainties normally incident to the exploration for and

development and production of oil and gas. These risks include, but

are not limited to, the volatility of oil, natural gas and NGL

prices; uncertainties inherent in estimating oil, natural gas and

NGL reserves; the extent to which we are successful in acquiring

and discovering additional reserves; unforeseen changes in the rate

of production from our oil and gas properties; uncertainties in

future exploration and drilling results; uncertainties inherent in

estimating the cost of drilling and completing wells; drilling

risks; competition for leases, materials, people and capital;

midstream capacity constraints and potential interruptions in

production; risk related to our hedging activities; environmental

risks; political changes; changes in laws or regulations; our

limited control over third parties who operate our oil and gas

properties; our ability to successfully complete mergers,

acquisitions and divestitures; and other risks identified in our

Form 10-K and our other filings with the SEC. Investors are

cautioned that any such statements are not guarantees of future

performance and that actual results or developments may differ

materially from those projected in the forward-looking statements.

The forward-looking statements in this press release are made as of

the date of this press release, even if subsequently made available

by Devon on its website or otherwise. Devon does not undertake any

obligation to update the forward-looking statements as a result of

new information, future events or otherwise.

The SEC permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves that

meet the SEC's definitions for such terms, and price and cost

sensitivities for such reserves, and prohibits disclosure of

resources that do not constitute such reserves. This release

may contain certain terms, such as resource potential

and exploration target size. These estimates are by their

nature more speculative than estimates of proved, probable and

possible reserves and accordingly are subject to substantially

greater risk of being actually realized. The SEC guidelines

strictly prohibit us from including these estimates in filings with

the SEC. U.S. investors are urged to consider closely the

disclosure in our Form 10-K, available at www.devonenergy.com. You

can also obtain this form from the SEC by calling 1-800-SEC-0330 or

from the SEC’s website at www.sec.gov.

Devon Energy Corporation is an Oklahoma City-based independent

energy company engaged in oil and gas exploration and production.

Devon is a leading U.S.-based independent oil and gas producer and

is included in the S&P 500 Index. For more information about

Devon, please visit our website at www.devonenergy.com.

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

PRODUCTION (net of royalties) Quarter Ended

Year Ended December 31, December 31,

Total Period

Production:

2013 2012 2013

2012 Natural Gas (Bcf) United States 174.3

186.7 708.7 751.9 Canada 39.9 43.3 164.9 186.1 Total Natural Gas

214.2 230.0 873.6 938.0 Oil / Bitumen (MMBbls)

United States 7.9 6.0 28.3 21.5

Canada 8.4 7.9 33.1 32.0 Total Oil / Bitumen 16.3 13.9 61.4 53.5

Natural Gas Liquids (MMBbls)

United States 11.3 9.3 42.3 36.1

Canada 0.8 0.9 3.6 3.8 Total Natural Gas Liquids 12.1 10.2 45.9

39.9 Oil Equivalent (MMBoe)

United States 48.2 46.4 188.8 182.9

Canada 15.9 16.0 64.1 66.8 Total Oil Equivalent 64.1 62.4 252.9

249.7

Quarter Ended Year Ended

December 31, December 31,

Average Daily

Production:

2013 2012 2013 2012 Natural Gas (MMcf)

United States 1,894.7 2,029.0 1,941.8 2,054.5 Canada 433.3 471.2

451.6 508.3 Total Natural Gas 2,328.0 2,500.2 2,393.4 2,562.8 Oil /

Bitumen (MBbls) United States 85.3 64.8 77.7 58.7 Canada 91.4 86.2

90.6 87.4 Total Oil / Bitumen 176.7 151.0 168.3 146.1 Natural Gas

Liquids (MBbls) United States 122.4 101.4 116.0 98.6 Canada 9.1 9.5

9.7 10.5 Total Natural Gas Liquids 131.5 110.9 125.7 109.1 Oil

Equivalent (MBoe) United States 523.4 504.4 517.3 499.7 Canada

172.8 174.2 175.6 182.6 Total Oil Equivalent 696.2 678.6 692.9

682.3

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

KEY OPERATING STATISTICS BY REGION Quarter Ended

December 31, 2013 Avg. Production Gross Wells

Operated Rigs at (MBOED) Drilled December

31, 2013 Permian Basin 85.7 73 24 Canadian Heavy Oil 84.5 58 2

Barnett Shale 223.9 31 5 Anadarko Basin 85.3 22 11

Mississippian-Woodford Trend 14.1 88 15 Rockies 21.2 8 3 Other

Assets 37.3 5 -

Core & Emerging Assets - Total 552.0 285

60 Canadian Conventional (Non-Core) 88.2 31 4 Rockies (None-Core)

29.7 - 2 Gulf Coast (Non-Core) 18.6 3 1 Mid-Continent (Non-Core)

7.7 - -

Devon - Total 696.2 319 67

Year

Ended December 31, 2013 Avg. Production Gross

Wells (MBOED) Drilled Permian Basin 78.0 348

Canadian Heavy Oil 83.1 186 Barnett Shale 227.7 172 Anadarko Basin

81.7 184 Mississippian-Woodford Trend 7.9 232 Rockies 21.5 37 Other

Assets 39.6 5

Core & Emerging Assets - Total 539.5 1,164

Canadian Conventional (Non-Core) 92.5 82 Rockies (None-Core) 32.1

13 Gulf Coast (Non-Core) 20.4 16 Mid-Continent (Non-Core) 8.4

- Devon - Total 692.9 1,275

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

BENCHMARK PRICES Quarter Ended Year

Ended (average prices)

December 31, December 31,

2013 2012 2013 2012 Natural Gas ($/Mcf)

– Henry Hub $ 3.60 $ 3.41 $ 3.65 $ 2.79 Oil ($/Bbl) – West Texas

Intermediate (Cushing) $ 97.53 $ 88.16 $ 98.02 $ 94.21

REALIZED PRICES Quarter Ended December 31,

2013 Oil / Bitumen Gas NGLs Total

(Per Bbl) (Per Mcf) (Per Bbl) (Per Boe)

United States $ 96.04 $ 3.01 $ 27.51 $ 32.96 Canada $ 48.50 $ 3.07

$ 45.00 $ 35.74 Realized price without hedges $ 71.45 $ 3.02

$ 28.73 $ 33.65 Cash settlements $ 3.33 $ 0.23 $ (0.19 ) $ 1.59

Realized price, including cash settlements $ 74.78 $ 3.25 $ 28.54

$ 35.24

Quarter Ended December 31, 2012

Oil / Bitumen Gas NGLs Total (Per

Bbl) (Per Mcf) (Per Bbl) (Per Boe) United

States $ 83.18 $ 2.93 $ 26.12 $ 27.72 Canada $ 52.31 $ 3.26 $ 47.64

$ 37.28 Realized price without hedges $ 65.56 $ 2.99 $ 27.96

$ 30.17 Cash settlements $ 8.76 $ 0.34 $ 0.07 $ 3.24

Realized price, including cash settlements $ 74.32 $ 3.33 $ 28.03

$ 33.41

Year Ended December 31, 2013

Oil / Bitumen Gas NGLs Total (Per

Bbl) (Per Mcf) (Per Bbl) (Per Boe) United

States $ 94.52 $ 3.10 $ 25.75 $ 31.59 Canada $ 57.18 $ 3.05 $ 46.17

$ 39.91 Realized price without hedges $ 74.41 $ 3.09 $ 27.33

$ 33.70 Cash settlements $ 0.90 $ 0.16 $ 0.01 $ 0.77

Realized price, including cash settlements $ 75.31 $ 3.25 $ 27.34

$ 34.47

Year Ended December 31, 2012

Oil / Bitumen Gas NGLs Total (Per

Bbl) (Per Mcf) (Per Bbl) (Per Boe) United

States $ 88.68 $ 2.32 $ 28.49 $ 25.59 Canada $ 57.01 $ 2.49 $ 48.63

$ 37.01 Realized price without hedges $ 69.73 $ 2.36 $ 30.42

$ 28.65 Cash settlements $ 4.84 $ 0.65 $ 0.04 $ 3.48

Realized price, including cash settlements $ 74.57 $ 3.01 $ 30.46

$ 32.13

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

CONSOLIDATED STATEMENTS OF OPERATIONS Quarter

Ended Year Ended (in millions, except per share amounts)

December 31, December 31, 2013

2012 2013 2012 Revenues: Oil, gas and

NGL sales $ 2,155 $ 1,883 $ 8,522 $ 7,153 Oil, gas and NGL

derivatives (96 ) 178 (191 ) 693 Marketing and midstream revenues

565 519 2,066

1,655 Total operating revenues 2,624

2,580 10,397 9,501 Expenses and

other: Lease operating expenses 584 534 2,268 2,074 Marketing and

midstream operating expenses 425 399 1,553 1,246 General and

administrative expenses 157 198 617 692 Production and property

taxes 108 108 461 414 Depreciation, depletion and amortization 711

731 2,780 2,811 Asset impairments 16 896 1,976 2,024 Other

operating items 28 39 121

92 Total operating expenses 2,029

2,905 9,776 9,353

Operating income 595 (325 ) 621 148 Net financing costs 111 98 417

370 Restructuring costs 4 74 54 74 Other nonoperating items

4 4 1 21 Earnings

(loss) from continuing operations before income taxes 475 (501 )

149 (317 ) Income tax expense (benefit) 268

(144 ) 169 (132 ) Earnings (loss) from

continuing operations 207 (357 ) (20 ) (185 ) Earnings (loss) from

discontinued operations, net of tax - -

- (21 ) Net earnings (loss) $ 207 $

(357 ) $ (20 ) $ (206 ) Basic net earnings (loss) per share

Basic earnings (loss) from continuing operations per share $ 0.51 $

(0.89 ) $ (0.06 ) $ (0.47 ) Basic loss from discontinued operations

per share - - -

(0.05 ) Basic net earnings (loss) per share $ 0.51 $ (0.89 )

$ (0.06 ) $ (0.52 ) Diluted net earnings (loss) per share

Diluted earnings (loss) from continuing operations per share $ 0.51

$ (0.89 ) $ (0.06 ) $ (0.47 ) Diluted loss from discontinued

operations per share - - -

(0.05 ) Diluted net earnings (loss) per share $ 0.51

$ (0.89 ) $ (0.06 ) $ (0.52 ) Weighted average common

shares outstanding: Basic 406 405 406 404 Diluted 407 405 406 404

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions)

Quarter Ended Year Ended

December 31, December 31, 2013 2012

2013 2012 Cash flows from operating activities: Net

earnings (loss) $ 207 $ (357 ) $ (20 ) $ (206 ) Loss from

discontinued operations, net of tax - - - 21

Adjustments to reconcile earnings (loss)

from continuing operations to net cash from operating

activities:

Depreciation, depletion and amortization 711 731 2,780 2,811 Asset

impairments 16 896 1,976 2,024 Deferred income tax expense

(benefit) 278 (188 ) 97 (184 ) Derivatives and other financial

instruments 70 (185 ) 135 (660 ) Cash settlements on derivatives

and financial instruments 130 217 277 865 Other noncash charges

112 104 318 240

Net cash from operating activities before

balance sheet changes

1,524 1,218 5,563 4,911 Net change in working capital (194 ) (98 )

(298 ) (50 ) Change in long-term other assets 38 (14 ) 10 (36 )

Change in long-term other liabilities 69 37

161 105 Cash from operating

activities - continuing operations 1,437 1,143 5,436 4,930 Cash

from operating activities - discontinued operations -

- - 26 Net cash from

operating activities 1,437 1,143

5,436 4,956 Cash flows from investing

activities: Capital expenditures (1,539 ) (1,997 ) (6,758 ) (8,225

) Proceeds from property and equipment divestitures 103 71 419

1,468 Purchases of short-term investments - (1,137 ) (1,076 )

(4,106 ) Redemptions of short-term investments - 958 3,419 3,266

Other (86 ) (4 ) (3 ) 14 Cash

from investing activities - continuing operations (1,522 ) (2,109 )

(3,999 ) (7,583 ) Cash from investing activities - discontinued

operations - (1 ) - 57

Net cash from investing activities (1,522 )

(2,110 ) (3,999 ) (7,526 ) Cash flows from

financing activities: Proceeds from borrowings of long-term debt,

net of issuance costs 2,233 (7 ) 2,233 2,458 Net short-term debt

borrowings (repayments) (295 ) 361 (1,872 ) (537 ) Credit facility

borrowings - - - 750 Credit facility repayments - - - (750 )

Proceeds from stock option exercises 2 2 3 27 Dividends paid on

common stock (89 ) (82 ) (348 ) (324 ) Excess tax benefits related

to share-based compensation (1 ) - 4

5 Net cash from financing activities

1,850 274 20 1,629

Effect of exchange rate changes on cash (19 ) (8 )

(28 ) 23 Net change in cash and cash

equivalents 1,746 (701 ) 1,429 (918 ) Cash and cash

equivalents at beginning of period 4,320 5,338

4,637 5,555 Cash and cash

equivalents at end of period $ 6,066 $ 4,637 $ 6,066

$ 4,637

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

CONSOLIDATED BALANCE SHEETS (in millions)

December

31, December 31, 2013

2012 Current assets: Cash and cash equivalents $ 6,066 $

4,637 Short-term investments - 2,343 Accounts receivable 1,520

1,245 Other current assets 419 746

Total current assets 8,005 8,971

Property and equipment, at cost: Oil and gas, based on full cost

accounting: Subject to amortization 73,995 69,410 Not subject to

amortization 2,791 3,308 Total oil and

gas 76,786 72,718 Other 6,195 5,630

Total property and equipment, at cost 82,981 78,348 Less

accumulated depreciation, depletion and amortization (54,534

) (51,032 ) Property and equipment, net 28,447

27,316 Goodwill 5,858 6,079 Other long-term assets

567 960 Total assets $ 42,877 $

43,326 Current liabilities: Accounts payable $ 1,229

$ 1,451 Revenues and royalties payable 786 750 Short-term debt

4,066 3,189 Other current liabilities 574 613

Total current liabilities 6,655 6,003

Long-term debt 7,956 8,455 Asset retirement obligations

2,140 1,996 Other long-term liabilities 834 901 Deferred income

taxes 4,793 4,693 Stockholders' equity: Common stock 41 41

Additional paid-in capital 3,780 3,688 Retained earnings 15,410

15,778 Accumulated other comprehensive earnings 1,268

1,771 Total stockholders' equity 20,499

21,278 Total liabilities and stockholders' equity $

42,877 $ 43,326 Common shares outstanding 406 406

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

CAPITAL EXPENDITURES (in millions)

Quarter Ended

December 31, 2013 United States Canada

Total Exploration $ 158 $ 13 $ 171 Development 816

296 1,112 Exploration and development capital (1) $

974 $ 309 $ 1,283 Capitalized G&A 96 Capitalized interest 12

Midstream capital (2) 174 Other capital 51

Total

Operations $ 1,616 (1) Includes $124 million

attributable to assets identified for divestiture. (2) Includes $42

million attributable to assets that will reside within EnLink

Midstream.

Year Ended December 31, 2013

United States Canada Total Exploration $ 626 $

128 $ 754 Development 3,541 1,114 4,655

Exploration and development capital (1) $ 4,167 $ 1,242 $ 5,409

Capitalized G&A 368 Capitalized interest 42 Midstream capital

(2) 703 Other capital 121

Total Operations $ 6,643

(1) Includes $483 million attributable to assets identified

for divestiture. (2) Includes $215 million attributable to assets

that will reside within EnLink Midstream.

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

COSTS INCURRED (in millions)

Total

Year Ended December 31, 2013

2012 Property acquisition costs: Proved properties $

22 $ 73 Unproved properties 216 1,167 Exploration costs 595 666

Development costs 5,089 6,099

Costs Incurred

$ 5,922 $ 8,005 United

States Year Ended December 31, 2013

2012 Property acquisition costs: Proved properties $ 19 $ 2

Unproved properties 213 1,135 Exploration costs 443 351 Development

costs 3,838 4,408

Costs Incurred $

4,513 $ 5,896 Canada Year

Ended December 31, 2013 2012

Property acquisition costs: Proved properties $ 3 $ 71 Unproved

properties 3 32 Exploration costs 152 315 Development costs

1,251 1,691

Costs Incurred $ 1,409

$ 2,109

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

RESERVES RECONCILIATION

Total Oil / Bitumen Gas NGLs

Total (MMBbls) (Bcf)

(MMBbls)

(MMBoe) As of December 31, 2012:

Proved developed 327 8,070 451 2,123 Proved undeveloped 471

1,376 140

840

Total Proved

798 9,446

591 2,963

Revisions due to prices (11 ) 566 11 94 Revisions other than

price (2 ) (232 ) (47 ) (88 ) Extensions and discoveries 114 490 65

261 Purchase of reserves 1 1 - 1 Production (62 ) (874 ) (45 ) (253

) Sale of reserves (1 ) (89 ) - (15 )

As of December 31,

2013:

Proved developed 361 8,459 491

2,262 Proved undeveloped 476 849

84 701

Total Proved 837

9,308 575

2,963 United

States Oil Gas NGLs Total

(MMBbls) (Bcf)

(MMBbls) (MMBoe) As of

December 31, 2012:

Proved developed

166 7,391 431 1,829 Proved undeveloped 39

1,371 140

407

Total Proved 205

8,762 571

2,236 Revisions due to

prices 1 405 8 76 Revisions other than price (18 ) (299 ) (50 )

(117 ) Extensions and discoveries 69 471 64 212 Purchase of

reserves 1 1 - 1 Production (28 ) (709 ) (41 ) (189 ) Sale of

reserves (1 ) (81 ) - (14 )

As of December 31, 2013:

Proved developed 194 7,707 468 1,947 Proved

undeveloped 35 843

84 258

Total

Proved 229 8,550

552

2,205 Canada Oil /

Bitumen Gas NGLs Total (MMBbls)

(Bcf)

(MMBbls) (MMBoe) As of

December 31, 2012:

Proved developed

161 679 20 294 Proved undeveloped 432 5

- 433

Total Proved 593

684 20

727 Revisions due to prices (12 ) 161 3

18 Revisions other than price 16 67 3 29 Extensions and discoveries

45 19 1 49 Purchase of reserves - - - - Production (34 ) (165 ) (4

) (64 ) Sale of reserves - (8 ) - (1 )

As of December 31,

2013:

Proved developed 167 752 23 315

Proved undeveloped 441 6

- 443

Total

Proved 608 758

23

758

NON-GAAP FINANCIAL MEASURES

The United States Securities and Exchange Commission has adopted

disclosure requirements for public companies such as Devon

concerning Non-GAAP financial measures. (GAAP refers to generally

accepted accounting principles). The company must reconcile the

Non-GAAP financial measure to related GAAP information. Devon's

reported net earnings include items of income and expense that are

typically excluded by securities analysts in their published

estimates of the company's financial results. The following tables

summarize the effects of these items on fourth-quarter 2013

earnings.

RECONCILIATION TO GAAP

INFORMATION (in millions) Quarter Ended December 31,

2013 Before-Tax After-Tax Net earnings (GAAP) $

207 Derivatives and other financial instruments 105 67 Cash

settlements on derivatives and financial instruments 101 64 Cash

repatriation - 97 Asset impairments 16 10 Restructuring costs 4

2 Adjusted earnings (Non-GAAP) $ 447 Diluted share count 407

Adjusted diluted earnings per share (Non-GAAP) $ 1.10

NON-GAAP FINANCIAL MEASURES

Devon believes that using net debt for the calculation of “net

debt to adjusted capitalization” provides a better measure than

using debt. Devon defines net debt as debt less cash, cash

equivalents and short-term investments. Devon believes that netting

these sources of cash against debt provides a clearer picture of

the future demands on cash to repay debt.

RECONCILIATION TO GAAP

INFORMATION (in millions) December 31,

2013 2012 Total debt (GAAP) $ 12,022 $ 11,644

Adjustments: Cash and short-term investments 6,066

6,980 Net debt (Non-GAAP) $ 5,956 $ 4,664 Total debt $

12,022 $ 11,644 Stockholders' equity 20,499 21,278

Total capitalization (GAAP) $ 32,521 $ 32,922 Net debt $

5,956 $ 4,664 Stockholders' equity 20,499 21,278

Adjusted capitalization (Non-GAAP) $ 26,455 $ 25,942

Devon Energy CorporationInvestor Contacts:Scott Coody,

405-552-4735orShea Snyder, 405-552-4782orMedia Contact:Chip Minty,

405-228-8647

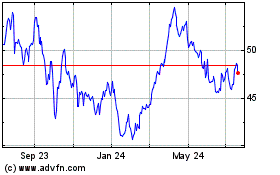

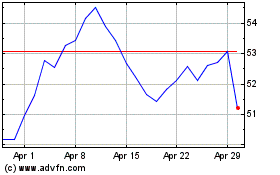

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024