Current Report Filing (8-k)

February 19 2014 - 6:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

|

February

17, 2014

|

|

Date of report (Date of earliest event reported)

|

|

SurModics, Inc.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Minnesota

|

|

0-23837

|

|

41-1356149

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

9924 West 74th Street

Eden Prairie, Minnesota

|

|

55344

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

|

(952) 500-7000

|

|

(Registrant’s Telephone Number, Including Area Code)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

(b) On February 17, 2014, Mary K. Brainerd, a member of the board

of directors of SurModics, Inc. (the “Company”), resigned

as a director of the Company. The resignation of Ms. Brainerd was a

result of other time commitments and not as a result of any disagreement

with the Company about any matter relating to its operations, policies

or practices.

(d) On February 17, 2014, the Company’s board of directors

appointed Ronald B. Kalich and Timothy S. Nelson to the Company’s board

of directors, effective immediately. In connection with these

appointments, the Board also increased the size of the Board from eight

members to nine members. Messrs. Kalich and Nelson will both serve on

the Board’s Audit Committee and Organization and Compensation

Committee. There are no arrangements or understandings between Mr.

Kalich or Mr. Nelson and any other persons pursuant to which either was

appointed a director of the Company, and neither has a direct or

indirect material interest in any transaction required to be disclosed

pursuant to Item 404(a) of Regulation S-K.

Messrs. Kalich and Nelson will be compensated for their services on the

board in accordance with the Company’s Board Compensation Policy (the “Policy”),

which policy was amended by the Board on February 17, 2014, as further

discussed below. Pursuant to the Policy, Messrs. Kalich and Nelson will

receive an annual cash retainer of $35,000 for their service on the

board, $6,000 for their service on the Audit Committee, and $4,500 for

their service on the Organization and Compensation Committee. In

addition to the cash retainers, Messrs. Kalich and Nelson were granted

an equity award having a grant date fair value of $60,000, one-half of

such award in the form of a nonqualified stock option to purchase shares

of the Company’s common stock and the other half in the form of

restricted stock units. The stock options have a seven-year term, and

vest ratably on a monthly basis and will become fully vested on the

first anniversary of the date of grant. The restricted stock units vest

ratably on a monthly basis and will become fully vested on the first

anniversary of the date of grant.

A copy of a press release announcing the foregoing is attached hereto as

Exhibit 99.1 and is incorporated herein by reference.

Item 8.01 Other Events.

As noted above, on February 17, 2014, the Board approved an amendment to

the Policy in order to align its director compensation program with

current corporate governance best practices. Previously under the

Policy, non-employee directors received equity compensation that vests

over multiple years. Under the Policy as amended, non-employee

directors’ equity compensation will vest over a more typical one-year

period. In connection with amending the Policy, the Board also approved

amendments that allow the unvested portions of previously issued and

outstanding equity awards to vest fully if a director’s board service

ends after the one-year anniversary of the grant date of the applicable

award. If a director’s board service ends prior to the one-year

anniversary of the grant date of an applicable award, the unvested

portions will vest on a prorated monthly basis within the one-year

period following the date of grant. All previously issued and fully

vested equity awards remain unchanged. In connection with these

amendments, the Company will take a one-time non-cash charge of

approximately $0.9 million pretax, or approximately $0.04 per share, in

the second quarter of fiscal 2014. The Company will update its earnings

guidance to reflect this charge in its second quarter fiscal 2014

earnings release.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

Exhibit

Number

|

|

Description

|

|

|

|

99.1

|

|

Press Release dated February 18, 2014

|

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

SURMODICS, INC.

|

|

|

|

|

|

|

|

|

|

Date:

|

February 18, 2014

|

|

/s/ Bryan K. Phillips

|

|

|

|

|

Bryan K. Phillips

|

|

|

|

|

Sr. Vice President, General Counsel and Secretary

|

EXHIBIT INDEX

|

Exhibit

|

|

|

|

|

Number

|

|

Description

|

|

|

99.1

|

|

Press Release dated February 18, 2014

|

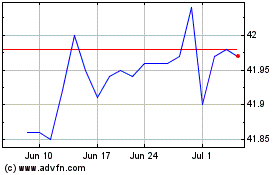

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

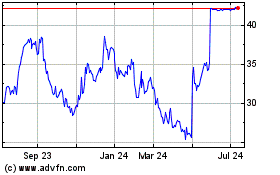

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024