Mutual Fund Summary Prospectus (497k)

February 18 2014 - 5:19PM

Edgar (US Regulatory)

JPMorgan SmartRetirement Funds

JPMorgan

SmartRetirement

®

Income Fund

JPMorgan SmartRetirement

®

2010 Fund

(All Share Classes)

(each, a series of JPMorgan Trust I)

Supplement dated February 18, 2014

to the Prospectuses, Summary Prospectuses and Statement of Additional Information

dated November 1, 2013, as supplemented

Reorganization of JPMorgan SmartRetirement

®

2010 Fund into JPMorgan

SmartRetirement

®

Income Fund

The JPMorgan SmartRetirement 2010 Fund (the “2010 Fund”) has changed its asset allocations over time in accordance with its glide path. Since the 2010 Fund’s target retirement date

(2010) has passed, the 2010 Fund has reached the end of its glide path and its strategic target allocations are the same as those of the JPMorgan SmartRetirement Income Fund (the “Income Fund”). As described in the Funds’

prospectus, once the strategic target allocations of the 2010 Fund are substantially the same as those of the Income Fund, the 2010 Fund may be merged into the Income Fund upon the approval of the Board of Trustees. The Board of Trustees has

approved the reorganization of the 2010 Fund into the Income Fund (the “Reorganization”). The Reorganization will consist of the transfer of all or substantially all of the 2010 Fund’s assets, subject to its liabilities, to the Income

Fund in exchange for Income Fund shares; and (2) the distribution of Income Fund shares to 2010 Fund shareholders in complete liquidation of the 2010 Fund.

The Reorganization does not require shareholder approval.

The Board of Trustees, including the Trustees not deemed to be “interested persons” pursuant to Section 2(a)(19) of the Investment Company Act

of 1940, as amended, carefully considered the proposed Reorganization and determined that it is in the best interests of each Fund and would not dilute the interests of either Fund’s shareholders. Among other factors, the Board noted that the

investment objectives and main investment strategies of the two Funds are the same in all material respects and that the estimated annual fund operating expense ratios, on both a gross and net fee basis, for the Income Fund are less than the expense

ratios for the corresponding classes of the 2010 Fund.

The Reorganization is expected to occur on June 20, 2014, or on such later date as

the officers of the Trust determine (the “Closing Date”). Purchases of the 2010 Fund shares will be accepted up to and including the Closing Date. After the close of business on the Closing Date, each 2010 Fund shareholder will become the

owner of a number of full and fractional shares of the Income Fund of the same class of shares of the 2010 Fund that they held in the 2010 Fund immediately prior to the Reorganization and will no longer own shares of the 2010 Fund. The number of

full and fractional shares of the Income Fund a 2010 Fund shareholder will receive in the Reorganization will be equal in value to the value of such shareholder’s shares in the 2010 Fund as of the close of business of the NYSE, usually

4:00 p.m. New York time, on the Closing Date, on a class-by-class basis. All issued and outstanding shares of the 2010 Fund will simultaneously be canceled on the books of the 2010 Fund. 2010 Fund shareholders who do not wish to own Income Fund

shares may: (1) redeem 2010 Fund shares or (2) exchange 2010 Fund shares for shares of another J.P. Morgan Fund prior to the Closing Date by contacting us at

1-800-480-4111.

It is anticipated that the Reorganization will qualify as a tax-free

reorganization for federal income tax purposes and that shareholders will not recognize any gain or loss in connection with the reorganization.

Comparison of the Funds

This section

compares certain important aspects of the two Funds. It provides a summary only. For additional information about the Funds, please refer to the Funds’ prospectus and Statement of Additional Information, which are available at jpmorganfunds.com

and also can be obtained by calling us at

1-800-480-4111.

Investment Objectives and Policies

The investment objective of the 2010 Fund and the Income Fund

are currently identical in all material respects. The 2010 Fund’s investment objective is to seek total return with a shift to current income and some capital appreciation over time as the 2010 Fund approaches and passes its target retirement

date. Because the 2010 target date has passed, the 2010 Fund has shifted to an objective of seeking current income and some capital appreciation. The Income Fund’s investment objective is to seek current income and some capital appreciation.

The investment strategies of the 2010 Fund and the Income Fund are identical in all material respects. Both Funds are designed to provide

exposure to a variety of asset classes through investments in underlying funds, with an emphasis on fixed income funds over equity funds and other funds. The 2010 Fund and the Income Fund implement their investment strategies in the same manner. The

Funds have the same strategic target allocations, which represents how J.P. Morgan Investment Management, Inc. (the Funds’ adviser) believes the Funds’ investments should be

SUP-SRI-SR2010-214

allocated among asset classes over the long term, and the same ability to make tactical changes to its strategic target allocations through a combination of positions in underlying funds and

direct investments. In addition, each Fund has the same ability to invest directly in securities and other financial instruments, such as derivatives.

The investment objective for each Fund is fundamental, which means it cannot be changed without the approval of Fund shareholders. The Funds’ fundamental policies (i.e., those investment policies

that cannot be changed without the approval of Fund shareholders) are identical in all material respects.

Comparison of Sales Load,

Distribution and Shareholder Servicing Arrangements

The distribution and shareholder servicing arrangements for each class of the Funds are

identical in all material respects.

Comparison of Purchase, Redemption and Exchange Policies and Procedures

The purchase, redemption and exchange policies and procedures for each class of the Funds are identical in all material respects.

Comparison of Fees and Expenses

The total

annual operating expenses both on a gross fee basis and net fee basis (after fee waivers and expense reimbursements) for the Income Fund are less than those expenses for the 2010 Fund on a class by class basis for each class of shares. Each Fund has

Class A, Class C, Select Class, Institutional Class and Class R2 Shares.

The total annual operating expenses on a gross fee basis

of the 2010 Fund are 1.13% for Class A Shares, 1.62% for Class C Shares, 0.87% for Select Class Shares, 0.73% for Institutional Class Shares and 1.37% for Class R2 Shares, compared to total annual operating expenses on a gross fee

basis of the Income Fund of 1.11% for Class A Shares, 1.61% for Class C Shares, 0.86% for Select Class Shares, 0.71% for Institutional Class Shares and 1.36% for Class R2 Shares.

Each Fund’s adviser, administrator and distributor (the Service Providers) have contractually agreed to waive fees and/or reimburse expenses until

October 31, 2014 to the extent that total annual fund operating expenses (excluding acquired fund fees and expenses (underlying fund), dividend expenses related to short sales, interest, taxes, expenses related to litigation and potential

litigation, extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed a certain percentage of the average daily net assets of the Class A, Class C, Select Class, Institutional Class, and

Class R2 Shares, respectively. After taking into account any contractual fee waivers and/or expense reimbursements, the total annual operating expenses of the 2010 Fund are 0.82% for Class A Shares, 1.47% for Class C Shares, 0.72% for

Select Class Shares, 0.57% for Institutional Class Shares and 1.07% for Class R2 Shares, compared to total annual operating expenses of the Income Fund of 0.81% for Class A Shares, 1.46% for Class C Shares, 0.71% for Select Class

Shares, 0.56% for Institutional Class Shares and 1.06% for Class R2 Shares.

The discussion above compares the current total annual operating

expenses (both gross and net) of each Fund as of June 30, 2013.

The Service Providers have contractually agreed to waive their fees and/or

reimburse the expenses of the Income Fund, as needed, in order to maintain the total annual fund operating expenses after fee waivers and expense reimbursements (excluding acquired fund fees and expenses (underlying fund), dividend expenses related

to short sales, interest, taxes, expenses related to litigation and potential litigation and extraordinary expenses) of Class A, Class C, Select Class, Institutional Class and Class R2 Shares of the Income Fund at the level in effect

immediately prior to the Reorganization of Class A, Class C, Select Class, Institutional Class and Class R2 Shares, respectively. These contractual fee waivers and/or reimbursements will stay in effect until October 31, 2015.

There is no guarantee that such waivers and/or reimbursements will be continued after October 31, 2015. The expenses of the Income Fund’s classes may be higher than disclosed if the expense limitation expires after October 31, 2015.

Additional Tax Information

Following the Reorganization, the expiration date of the 2010 Fund’s capital loss carry forwards, which may be used to offset the distribution of future

realized capital gains of the Income Fund, will be reduced by one year, and the amount of the 2010 Fund’s capital loss carry forwards that can be used in any taxable year by the Income Fund, other than the short tax year ending immediately

after the Reorganization, will be subject to an annual limitation equal to the long-term tax-exempt rate at time of Reorganization, multiplied by the aggregate net asset value of the 2010 Fund at the time of Reorganization. However, capital loss

carry forwards are not expected to be forfeited given that the 2010 Fund’s total outstanding capital loss carry forwards are currently under such annual limitation.

INVESTORS SHOULD RETAIN THIS SUPPLEMENT

FOR FUTURE REFERENCE

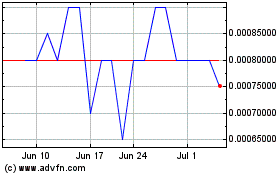

Seven Arts Entertainment (PK) (USOTC:SAPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

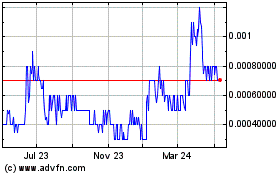

Seven Arts Entertainment (PK) (USOTC:SAPX)

Historical Stock Chart

From Apr 2023 to Apr 2024