UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

February 13, 2014

Document Security Systems, Inc.

(Exact Name of Registrant as Specified in

Charter)

| New York |

|

001-32146 |

|

16-1229730 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| of Incorporation) |

|

|

|

|

| First Federal Plaza, Suite 1525 |

|

|

| 28 E. Main Street |

|

14614 |

| Rochester, NY |

|

|

(Address of Principal Executive

Offices) |

|

(Zip Code) |

Registrant's telephone number, including

area code: (585) 325-3610

(Former name or former address, if changed

since last report)

Copies to:

Gregory Sichenzia, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

Phone: (212) 930-9700

Fax: (212) 930-9725

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c) |

Item 1.01 Entry into a Material

Definitive Agreement

On

February 13, 2014 (the “Effective Date”), DSS Technology Management, Inc. (the “Company”), Document Security

Systems, Inc. (“DSS”), Fortress Credit Co LLC, as collateral agent (the “Collateral Agent”), and certain

investors (the “Investors”) entered into an Investment Agreement (the “Agreement”) pursuant to which the

Company contracted to receive a series of advances (collectively, the “Advances”) from the Investors, as described

below. DSS, as parent of the Company, is a party to the Agreement only for purposes of Section 8.2.2 thereof.

On

the Effective Date, the Company issued and sold a promissory note in the amount of $1,791,000 (the “Initial Advance Note”),

fixed return equity interests in the amount of $199,000 (the “Initial Fixed Return Interests”), and contingent equity

interests in the amount of $10,000 (the “Contingent Interests”), to each the Investors, and in return received $2,000,000

in proceeds (collectively, the “Initial Advance”), to be utilized by the Company to meet its working capital and intellectual

property monetization funding needs.

Upon

the Company achieving the First Milestone as defined in the Agreement, the Company will issue and sell to the Investors a promissory

note in the amount of $900,000 (the “First Milestone Note”) and fixed return equity interests in the amount of $100,000

(the “First Milestone Fixed Return Interests”), and in turn will receive $1,000,000 (collectively, the “First

Milestone Advance”).

Upon

the Company achieving the Second Milestone as defined in the Agreement, the Company will issue and sell to the Investors a promissory

note in the amount of $1,350,000 (the “Second Milestone Note”) and fixed return equity interests in the amount of $150,000

(the “Second Milestone Fixed Return Interests”), and in turn will receive $1,500,000 (collectively, the “Second

Milestone Advance”).

The

Initial Advance Note, the First Milestone Note, and the Second Milestone Note (collectively, the “Notes”) shall bear

interest at a rate per annum equal to the Applicable Federal Rate on the unpaid principal amount thereof. The Notes will also be

subject to a Make Whole Amount calculation (as defined in the Agreement), which will result in an effective annual interest rate

of approximately 4.23% for the term thereof, assuming no prepayments. At the Company’s option, it may pay accrued interest

when due on the Notes, or elect to capitalize the accrued interest, adding it to the principal thereof. The maturity date of all

the Notes shall be the date four years after issuance of the Initial Advance Notes.

The

Company will apply any proceeds it receives in connection with the monetization of certain Patents (as defined in the Agreement)

to the payment of the Notes, the Fixed Return Interests, and the Contingent Interests, in the following order (the “Payment

Waterfall”): (i) 100% of the first $5,000,000 of Gross Receipts (as defined in the Agreement) shall be paid to the purchasers

of the Notes, until they have received payment in full thereunder (including any Make Whole Amount), then to the Fixed Return Interest

purchasers until they have received their Fixed Return (as defined in the Agreement), and then to the Contingent Interest purchasers

until they have received their 2(x) Return (as defined in the Agreement); then (ii) 100% of the next $3,300,000 of Gross Receipts

may be retained by the Company or paid to the Company’s counsel; then (iii) the Applicable Percentage (as defined in the

Agreement) of any Gross Receipts following the application of the first $8,300,000 shall be paid to the Notes purchasers until

they have received payment in full thereunder, then to the Fixed Return Interests purchasers until they have received their Fixed

Return, and then to the Contingent Interests purchasers until they have received their 2(x) Return; then (iv) after full payment

of the Notes and Fixed Interests have been made, the Company shall pay the Contingent Interest purchasers 12% of the Gross Receipts

and the Company shall be entitled to 88% of the Gross Receipts.

Pursuant

to the Agreement, the Company granted, to the Collateral Agent, for the benefit of the Secured Parties (as defined in the Agreement),

a non-exclusive, royalty-free, license (including the right to grant sublicenses subject to certain restrictions as further described

in the Agreement and Patent License) with respect to the Patents (as defined in the Agreement), which shall be governed by the

Patent License.

The

Agreement contains certain Events of Default which include: (i) the Company failing to make payments pursuant to the Agreement

when due; (ii) on or before the second anniversary of the Effective Date, Investors fail to have received payments from the Company

equal to the aggregate amount of Advances made (1x Return); (iii) on or before the fourth anniversary of the Effective Date, Investors

fail to have received payments from the Company equal to two times the aggregate amount of Advances made (2x Return); (iv) the

Company violates a material covenant or covenants contained in the Agreement, and thereafter fails to cure such breach for a period

of 30 days following the earlier of the Company learning of such failure or its receipt of notice of such failure; (v) the Company

makes a representation or warranty that is materially false when made; (vi) any default or event of default with respect to any

indebtedness in excess of $500,000 of Company shall occur and be continuing; (vii) a Change of Control of Company occurs (as defined

in the Agreement); (viii) any material provision of the Agreement, or any related ancillary agreements, ceases to be valid and

binding on or enforceable against the Company in accordance with its terms; (ix) any judgment against the Company which exceeds

$500,000, or that grants injunctive relief resulting in a Material Adverse Effect (as defined in the Agreement), that remains unsatisfied

for a period of 30 days from entry thereof; (x) the Company files a voluntary petition for bankruptcy, or has an involuntary bankruptcy

proceeding filed against it that is not responded to or dismissed within 60 days, or seeks other debtor relief under applicable

law other than bankruptcy law, or is declared bankrupt, or makes an assignment for the benefit of its creditors, or consents to

the appointment of a receiver or other custodian for all or a substantial portion of its property.

The

recourse available to the Investors and the Collateral Agent arising out of or in conjunction with an uncured Event of Default

or any other material breach by Company of the Agreement, or the Security Agreement entered into by and among Company, DSS and

Collateral Agent (the “Security Agreement”), or any other document, shall be as described in Sections 8.1 and 8.2 of

the Agreement.

The

foregoing description is a summary only, does not purport to set forth the complete terms of the Agreement, the Security Agreement,

the Notes, or any other related ancillary documents, and is qualified in its entirety by reference to the Agreement, the Security

Agreement, the Notes and any other related ancillary documents filed as exhibits to this Current Report.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information

contained in Item 1.01 of this Current Report is incorporated by reference into this Item 2.03.

Item 9.01 Financial

Statements and Exhibits

| (d) |

Exhibits |

| |

|

| 10.1 |

Investment Agreement dated as of February 13, 2014 by and among DSS Technology Management, Inc., Document Security Systems, Inc., Fortress Credit Co LLC, and the Investors named therein. |

| |

|

| 10.2 |

Security Agreement dated as of February 13, 2014 by and among DSS Technology Management, Inc., Document Security Systems, Inc., and Fortress Credit Co LLC as Collateral Agent for the Secured Parties under the Investment Agreement. |

| |

|

| 10.3 |

Form of Assignment and Assumption Agreement by and among DSS Technology Management, Inc. and Fortress Credit Co LLC as Collateral Agent for the Secured Parties under the Investment Agreement. |

| |

|

| 10.4 |

Patent Security Agreement dated February 13, 2014 by and among DSS Technology Management, Inc. in favor of Fortress Credit Co LLC, in its capacity as Collateral Agent for the Secured Parties under the Investment Agreement. |

| |

|

| 10.5 |

Initial Advance Note from DSS Technology Management, Inc. to Fortress Credit Co LLC, dated February 13, 2014. |

| |

|

| 10.6 |

Form of First Milestone Note from DSS Technology Management, Inc. to Fortress Credit Co LLC. |

| |

|

| 10.7 |

Form of Second Milestone Note from DSS Technology Management, Inc. to Fortress Credit Co LLC. |

| |

|

| 10.8 |

Patent License dated February 13, 2014 by and among DSS Technology Management, Inc. and Fortress Credit Co. LLC. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 18, 2014 |

|

|

|

| |

|

|

|

| |

DOCUMENT SECURITY SYSTEMS, INC. |

|

| |

|

|

|

| |

/s/ Jeffrey Ronaldi |

|

| |

By: |

Jeffrey Ronaldi |

|

| |

Title: |

Chief Executive Officer |

|

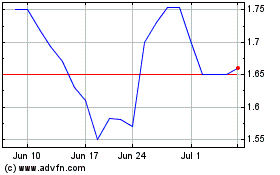

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024