East West Petroleum Provides Operational Update

February 18 2014 - 7:00AM

Marketwired Canada

East West Petroleum Corp. (TSX VENTURE:EW) (the "Company" or "East West") is

pleased to provide the following operational update on its operations in the

Taranaki Basin of New Zealand and in Romania. The Company's joint venture

partner, TAG Oil Ltd. ("TAG"), is the operator of all licenses in New Zealand,

while in Romania the Company's partner Naftna Industrija Srbije ("NIS") is the

operator of all concessions.

Update on production from Cheal E-site, New Zealand

The Company is pleased to report that to Feb. 15, 2014 the gross production from

the Cheal E-site totaled over 50,000 boe. The Cheal-E1 well is currently

producing at a rate of over 500 boepd (87% oil) through a 17/64" choke. The

Cheal-E4 has been on test production since January 1, 2014, with an average

production rate of over 280 boepd (83% oil). The Cheal-E4 well will soon be

placed on permanent production following a temporary shut-in period to allow for

temperature and pressure analysis while other E-site wells are flow tested,

starting with Cheal-E5. The initial production testing data is being used to

determine the long-term production scheme for the site.

Under the joint operating agreement with TAG, East West paid 100% of the first

C$5 million in drilling costs on the Cheal E site and is entitled to receive

100% of the first C$5 million in revenue, while paying 100% of the costs to

produce that revenue, after which all revenue and costs will be shared 70:30

between TAG and EW. To date, over 23,000 barrels of oil have been sold at an

average price of over US$109/b from which the Company estimates it will receive

cash netbacks of over US$80 per barrel. East West expects to have recovered the

$5 million in revenue by the end of Q1 2014.

2014 Proposed Capital Budget

The Company also announces that the minimum committed 2014 capital expenditures

in New Zealand for East West are expected to total C$10.4 million, which will

include the drilling of three wells from the Cheal G-site, one well at Southern

Cross, and at least one well from the Cheal E-site. In addition, seismic

acquisition and reprocessing is planned for the Taranaki and East Coast permits

in 2014. Further wells to the 2014 drilling program are expected to be added

following the completion and interpretation of the results of the current

drilling program. Capex for the 2014 committed work program and any additional

wells will be financed from the Company's existing cash balance and from

production from Taranaki Basin permits.

In Romania (15% working interest), seismic acquisition is ongoing on the Tria

licence in preparation for spudding the first of three wells in the committed

Phase I work program later this year. Seismic acquisition will commence on the

Baile Felix, Periam and Biled concessions following the award of contracts for

2D and 3D seismic acquisition on the respective blocks. Under the farm out

agreement with NIS, East West will be fully carried through to commerciality

which includes all Phase I and Phase II work on the concessions. NIS and the

Company will be targeting conventional resources and all work will be done in

accordance with local and international regulations and best practices.

Further details on the East West's 2014 planned capex and work program can be

found in the Company's corporate presentation available at

www.eastwestpetroleum.ca.

About East West Petroleum Corp.

East West Petroleum (http://www.eastwestpetroleum.ca) is a TSX Venture Exchange

listed company established in 2010 to invest in international oil & gas

opportunities. East West has built a diverse platform of attractive exploration

assets covering a gross area of approximately 1.8 million acres. In New Zealand,

East West holds an interest in three exploration permits near to existing

commercial production in the Taranaki Basin with a nine well drilling campaign,

operated by TAG Oil Ltd. (TSX:TAO), is in progress; in December 2013, the

Company was awarded one block in the emerging East Coast Basin of New Zealand

when covers over 100,000 acres. The Company also interests in four exploration

concessions covering 1,000,000 acres in the prolific Pannonian Basin of western

Romania with a subsidiary of Russia's GazpromNeft; a joint venture exploration

program covering 8,000 gross acres in the San Joaquin Basin of California; an

oil-prone exploration block of 100,000 acres in the Assam region of India with

the three largest exploration and production Indian firms ONGC, Oil India and

GAIL; and a 100% interest in a 500,000 acre exploration block onshore Morocco.

The Company has now entered operational phases in Romania, where it will be

fully carried by its partner Gazprom-controlled Naftna Industrija Srbije in a

seismic and 12-well drilling program which is underway.

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company's actual results, level of

activity, performance or achievements to be materially different from those

expressed or implied by such forward-looking information. Such factors include,

but are not limited to: the ability to raise sufficient capital to fund

exploration and development; the quantity of and future net revenues from the

Company's reserves; oil and natural gas production levels; commodity prices,

foreign currency exchange rates and interest rates; capital expenditure programs

and other expenditures; supply and demand for oil and natural gas; schedules and

timing of certain projects and the Company's strategy for growth; competitive

conditions; the Company's future operating and financial results; and treatment

under governmental and other regulatory regimes and tax, environmental and other

laws.

Prospective Resources are those quantities of petroleum estimated, as of a given

date, to be potentially recoverable from undiscovered accumulations by

application of future development projects. Prospective resources have both an

associated chance of discovery and a chance of development. Prospective

Resources are further subdivided in accordance with the level of certainty

associated with recoverable estimates assuming their discovery and development

and may be subclassified based on project maturity. Best estimate resources are

considered to be the best estimate of the quantity that will actually be

recovered from the accumulation. If probabilistic methods are used, this term is

a measure of central tendency of the uncertainty distribution (most likely/mode,

P50/median, or arithmetic average/mean). As estimates, there is no certainty

that any portion of the resources will be discovered. If discovered, there is no

certainty that it will be commercially viable to produce any portion of the

resources that the estimated reserves or resources will be recovered or

produced.

This list is not exhaustive of the factors that may affect our forward-looking

information. These and other factors should be considered carefully and readers

should not place undue reliance on such forward-looking information. The Company

disclaims any intention or obligation to update or revise forward-looking

information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

East West Petroleum Corp.

Chris Beltgens

Corporate Development Manager

+1 604 682 1558

+1 604 682 1568 (FAX)

www.eastwestpetroleum.ca

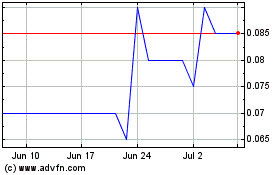

East West Petroleum (TSXV:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

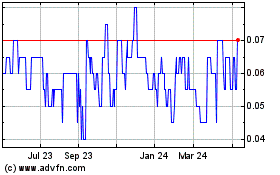

East West Petroleum (TSXV:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024