Overview

Utility services play a vital role in a nation’s economic progress

as cheap and abundant supply of power keeps the wheels of

development rolling. With development comes the need for more

power, as cities expand, and the use of new gadgets increases.

However, everything comes at a price, as green-house gases emitted

by large utilities cause immense damage to the environment.

As per a U.S. Energy Information Administration (EIA) report, total

energy use in the U.S. will increase to 106.3 quadrillion Btu in

2040 from 95 quadrillion Btu in 2012. Most of this demand is

expected to come from the Industrial sector followed by the

Commercial sector. While demand for energy from the Industrial

sector is expected to increase 25.5% over the aforesaid period, the

Commercial sector is improving at a clip of 18.6% year over

year.

Even so, the utilities have been under review for a long time. The

climate action plan of the U.S. President followed by the U.S.

Environmental Protection Agency's (EPA) proposal for tightening the

rules to set up new power plants are putting immense pressure on

power producing units.

Utilities are now gradually shifting their emphasis towards natural

gas and alternate energy sources to produce power. Global concerns

about the pitfalls of green-house gas emissions supported by

increasingly stringent government regulations have brought

alternative energy into the limelight.

In such a scenario, progressive steps from the U.S. alone will not

be enough to counter the negative impact of global greenhouse gas

emissions. The variance in the socio-economic structure of

different countries and the quest for cheaper sources of

electricity are making the task difficult, if not impossible. In

fact, emission from power generators in the developing nations is

undermining the positive steps taken in the U.S. and Europe to curb

pollution.

Zacks Rank

Within the Zacks Industry classification, Utilities are a

stand-alone sector, one of 16 Zacks sectors. The rural wire-line

telephone companies are also grouped within the Zacks Utility

sector, but the three major industries within this sector include

Electric Power, Gas Distribution and Water Supply.

The Utility sector’s defensive attributes reflect the group’s lack

of correlation with the broader market/economy. Of course, the

sector’s reputation as a dividend payer also adds to its perceived

defensiveness.

We rank all of the more than 260 industries in the 16 Zacks sectors

based on the earnings outlook for the constituent companies in each

industry. This ranking is available in the Zacks Industry Rank.

http://www.zacks.com/rank/industry.php

The way to look at the complete list of Zacks Industry Rank for the

260+ industries is that the outlook for industries with Zacks

Industry Rank of #88 and lower is 'Positive,’ between #89 and #176

is 'Neutral' and #177 and higher is 'Negative.’

Scanning the industries in the Utility sector, three prominent

industries under this sector are currently ranked in three

different categories. Water Supply has a Zacks Industry Rank #40,

Gas Distribution has a Zacks Industry Rank #92 while Electric Power

is at Zacks Industry Rank #161.

Earnings Trends

The utilities on the whole recorded growth of 4.7% year over year

in the third quarter of 2013 as compared to 5.0% registered by the

S&P 500. Utilities hardly surpass expectations by a large

margin, primarily due to the regulated nature of their operation.

For 2014 and 2015, earnings from this sector are expected to

increase at rates of 6.5% and 4.8% year over year, lower than the

9.1% and 11.2% growth expected from the S&P 500 in these two

years.

Annual net margins of the utilities are expected to increase from

8.9% in 2013 to 9.3% and 9.6% in 2014 and 2015 respectively.

However, margins at the S&P 500 are expected to expand at a

brisker pace of 9.6% in 2013, 10.4% in 2014 and 11.1% in 2015.

S&P 500 net margins will be primarily driven by the Technology,

Finance and Business Services sectors. The defensive nature of the

Utility sector is well reflected in its margin expansion forecast.

Of the 16 sectors, margin improvement projection for the Utility is

ranked at 8th over the 2013-2015 time frame.

For more information about earnings for this sector and others,

please read our 'Earnings Trends' report.

http://www.zacks.com/commentary/31310/

New Trends

The emergence of Microgrids for power generation could threaten the

dominance of the age-old power distribution system in the U.S.

Microgrids have evolved from simple power backup systems to small

smart grids. The swift and cost effective installation of Micro

grids could help distribute electricity among the masses. These

rooftop solar systems meet the energy needs of the customers. In

addition, the customers are allowed to sell excess power back to

the utilities.

A report from American Society of Civil Engineers estimated that

utilities need to spend $763 billion by 2040 to properly modernize

and harden the existing grids against natural disasters. We believe

that rather than going for a very costly maintenance, it will be

economical to develop these Microgrids, which could lend support to

the existing system.

Electric Utilities

The EIA reported that electricity consumption in the U.S. will

increase from 3,826 billion kilowatt hours in 2012 to 4,954 billion

kilowatt hours in 2040, implying an average annual rise of 0.9%.

For the fuel type in energy generation, renewables and natural gas

will play an increasing role while coal and nuclear power will

gradually fall out of favor.

The new proposal from the EPA directs a new coal-based power plant

to limit carbon emission to 1,100 pounds of CO2 per megawatt-hour.

In addition, coal based power generators would have to meet a

somewhat tighter limit if they opt for an average emission over

multiple years. Going forward, we expect regulations to get more

and more stringent for power generation from coal fired units.

In this context, we believe fresh investments in the power sector

would go more to the development of natural gas based combined

cycle power plants. An EIA report indicates that natural gas will

become the largest fuel source for power production in the U.S. by

2040 thereby displacing coal.

EIA report indicates coal-fired power generation to drop from 310

gigawatts (GW) in 2012 to 262 GW in 2040. The decline is a function

of greater dependence on natural gas, usage of alternate energy

sources and stricter regulations. The utility operators

are implementing new technologies for the generation and

distribution of power. The introduction of smart meters will

benefit customers while the smart-grid technology is likely to

increase efficiency.

The electric utilities which would play an important role in

meeting this increased demand for power are

American

Electric Power Inc. (AEP),

Duke Energy

Corp. (DUK),

Pinnacle West Capital

Corporation (PNW),

NextEra Energy Inc.

(NEE),

PPL Corporation (PPL) and

Southern

Company (SO) among others.

The utilities are in the process of releasing their fourth quarter

earnings results. Among the current releases, American Electric

Power and PPL Corporation surpassed earnings expectation by 7.1%

and 17.6% respectively, while

Exelon Corporation

(EXC) and

Dominion Resources Inc. (D) missed

expectation by a respective 5.7% and 9.1%.

Among the 76 electric utilities in our coverage, 2 stocks sports a

Zacks Rank#1 (Strong Buy), 11 stocks have a Zacks Rank #2 (Buy), 48

stocks hold a Zacks Rank #3 (Hold) and the remaining 15 stocks have

either a Zacks Rank #4 (Sell) or a Zacks Rank #5 (Strong

Sell).

Natural Gas Utilities

The country has huge volumes of natural gas reserves and the new

fracking technology has multiplied natural gas production from rock

and rock structures previously considered uncommercial. A

study from NaturalGas.org pointed out that the natural gas reserve

in the U.S. increased by 39% in? from 2006 levels, thanks to the

implementation of new exploration techniques.

The natural gas utilities are not only expected to benefit from the

steady increase in domestic demand but also from exports that are

expected to rise significantly. We noticed positive movements in

the U.S. Industrial and Commercial sectors, which could drive

demand for natural gas.

Given the abundance of natural gas in the U.S. , after much

consideration, the U.S. Department of Energy (DOE) has granted

permission to export liquefied natural gas (LNG). To date, the DOE

has granted export licenses for LNG from four terminals, while

there are 21 pending applications awaiting approval. In Sep 2013,

electric and natural gas supplier Dominion Resources Inc. received

an approval from the DOE to export 770 million cubic feet of

natural gas a day (mmcf/d) for 20 years.

We believe the decision will allow U.S. nat gas producers to

channelize their production volumes (after meeting domestic demand)

to feed the ever increasing appetite for power in the global

market.

LNG export could turn out to be a potential game changer for the

natural gas sector. Multi-fuel producer

CONSOL Energy

Inc. (CNX) has shifted its focus to concentrate more on

natural gas and has thus divested a few of its coal assets. After

increasing natural gas production, this company might also explore

the possibility of LNG export.

The EIA forecasts the use of natural gas in the U.S. to increase

from 25.6 trillion cubic feet (Tcf) in 20112 to 31.6 trillion cubic

feet in 2040.

The positive dynamics are going to benefit natural gas utilities

like

AGL Resources Inc. (GAS),

Atmos

Energy Corporation (ATO),

National Fuel Gas

Company (NFG),

Southwest Gas Corporation

(SWX),

Questar Corp. (STR),

Sempra

Energy (SRE) and

MDU Resources Group

Inc. (MDU), among others.

Over the long run the spot prices for natural gas are expected to

increase further from the present level of $4.80 per million

British thermal units (MMBtu) on Feb 7. The increasing demand from

the Industrial sector, for electric power generation and export

obligation could push prices to $7.65/MMBtu in 2040 as per EIA.

With more than 71 million domestic natural gas customers, the

natural gas market has enough room for the nearly 1,200 natural gas

utilities presently operating in the country.

We track 22 gas utilities, of which 4 stocks have a Zacks Rank #2

(Buy), 16 stocks hold a Zacks Rank #3 (Hold) while 2 stocks aren't

doing well at all with a Zacks Rank #4 (Sell).

Water Utilities

The major challenge ahead for water utility operators is the aging

water and sewer infrastructure. Maintenance and development of

facilities play a crucial role and will test the financial

capabilities of the water utilities.

A report from Economic Development Research Group Inc. suggests an

alarming gap between the water infrastructural requirement and

actual investments planned for the coming years. The gap is

expected to reach $84 billion in 2020 and widen to $144 billion in

2040. The report also revealed that without proper renewal or

replacement, nearly 44% of the existing pipelines will become too

poor for operation by 2020.

The utility operators have begun to invest in their ageing

infrastructure, but it appears the initiatives are inadequate to

bridge the gap. The government should consider taking adequate

measures before things blow out of proportion.

A prominent water utility,

American Water Works Company,

Inc. (AWK) has lately resorted to the inorganic route to

expand its footprint. We view this as a smart move as larger

companies will likely have better provisions to address the

infrastructure needs of the industry.

Among the water utilities,

American States Water

Company (AWR),

Connecticut Water Service,

Inc. (CTWS) and

Consolidated Water Co.

Ltd. (CWCO) registered positive earnings surprises in

their latest reported quarters. The water utilities are yet to

release fourth quarter earnings results. The recent performance of

these water utilities indicates that these will register sequential

growth in the fourth quarter of 2013 as well.

We presently cover 12 water utilities, of which 2 have a Zacks Rank

#1 (Strong Buy), 2 have a Zacks Rank #2 (Buy), 5 stocks carry a

Zacks Rank #3 (Hold) and 3 stocks have a Zacks Rank #4 (Sell).

What Keeps the Utilities Going?

The biggest positive for the utilities is that there is hardly any

viable substitute for utility services. This is the most

fundamental strength of the industry. Moreover, increasing demand

drives this industry forward.

Another inherent advantage of these utilities is their size and the

requirement of huge initial capital outlay. For this reason,

we generally do not find many new entrants in the market. Also,

stringent government regulations and the hard toil for new entrants

to establish a loyal consumer base put existing players in an

advantageous position.

Finally, utilities have been known to pay dividends consistently,

thereby retaining investor confidence. This was evident during the

economic crisis of 2008-2009 when these operators continued to pay

out dividends without fail.

In Conclusion

Despite the assured demand for services, the utilities have to

constantly meet the high expectations of its wide customer base,

adapt to a changing global economic scenario, and upgrade

technologies to meet stringent environmental norms. In fact, new

technology to produce power at a cheaper rate and emerging

alternative resources for the generation of green power are likely

to drive the industry going forward.

Recently, defense major

Lockheed Martin Corp.

(LMT) along with Victorian Wave Partners Ltd decided to use ocean

wave technology developed by

Ocean Power Technologies

Inc. (OPTT) to develop the largest wave energy project.

The move skyrocketed the trading price of Ocean Power

Technologies.

The majority of new electricity in the next two decades in the U.S.

will be generated from natural gas and renewable sources. Besides

the abundance of natural gas, as many as 30 U.S. states and the

District of Columbia have enforceable renewable portfolio standards

or other renewable generation policies. We expect this count to go

up, compelling producers to generate more green power to meet the

renewable standards fixed by the states.

Population increase and the prevailing economic conditions are two

important factors which impact the demand for utility services. The

revised projection from the U.S. Census Bureau, indicates that

population growth in the U.S. will be lower by 0.2 percentage

points from the previous projection in 2040. The downward revision

could result in lower demand for utility services than previously

expected.

Moreover, utility operations globally depend on weather patterns

that determine the extent of demand. Erratic weather patterns

thereby impact the profitability of these operators, so much so

that their operational goals remain unmet.

To sum up, LNG exports will increase the profitability of the U.S.

natural gas operators. At the same time a concerted effort will

have to be made to remove the funding requirement in the water

utility sector. Otherwise the aging water infrastructure will lead

to more wastage, leading to a hike in cost of operation and a

related increase in the price of water supplied.

As for the electric utilities, we would expect more investment

in natural gas and alternate energy projects, wrenching the

initiative from the pure-play coal based electricity companies.

AMER ELEC PWR (AEP): Free Stock Analysis Report

ATMOS ENERGY CP (ATO): Free Stock Analysis Report

AMER WATER WORK (AWK): Free Stock Analysis Report

AMER STATES WTR (AWR): Free Stock Analysis Report

CONSOL ENERGY (CNX): Free Stock Analysis Report

CONN WATER SVC (CTWS): Free Stock Analysis Report

CONSOLTD WATER (CWCO): Free Stock Analysis Report

DOMINION RES VA (D): Free Stock Analysis Report

DUKE ENERGY CP (DUK): Free Stock Analysis Report

EXELON CORP (EXC): Free Stock Analysis Report

AGL RESOURCES (GAS): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

MDU RESOURCES (MDU): Free Stock Analysis Report

NEXTERA ENERGY (NEE): Free Stock Analysis Report

NATL FUEL GAS (NFG): Free Stock Analysis Report

PINNACLE WEST (PNW): Free Stock Analysis Report

PPL CORP (PPL): Free Stock Analysis Report

SOUTHERN CO (SO): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

QUESTAR (STR): Free Stock Analysis Report

SOUTHWEST GAS (SWX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

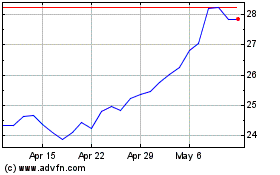

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

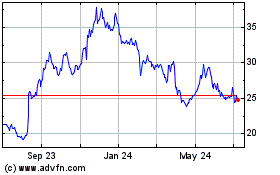

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Apr 2023 to Apr 2024