Whole Foods Plunges on Earnings Miss, Guidance Cut - Analyst Blog

February 13 2014 - 10:50AM

Zacks

Shares of Whole Foods

Market, Inc. (WFM) fell 7.5% during the aftermarket

trading session yesterday, following the company’s

lower-than-expected first-quarter fiscal 2014 results and a

conservative stance on sales and earnings outlook, thereafter.

Increasing competition and aggressive pricing weighed upon the

company’s performance as more and more companies are entering into

the Organic & Natural food business, specifically The

Kroger Co. (KR).

Looking at the numbers, the

quarterly earnings came in at 42 cents a share falling short of the

Zacks Consensus Estimate by a couple of cents but rising

approximately 8% from 39 cents earned in the prior-year quarter.

This natural and organic foods supermarket chain operator sustained

its top-line growth momentum with revenue climbing 10% to $4,239

million in the quarter, but coming below Zacks’ expectation of

$4,289 million.

Effective inventory management and

improved store-level performance helped the company sustain the

downturn and achieve improved sales and profit. Whole Foods has

been revamping its pricing strategy and concentrating more on value

offerings, while maintaining healthy margins.

Whole Foods stated that

comparable-store sales rose 5.4% in the quarter but fell short of

its expectation, and shriveled 50 basis points sequentially. For

the first 3 weeks of the second quarter, comparable-store sales

increased 5.6%.

Whole Foods indicated that gross

profit rose 10% to $1,485 million, whereas gross margin grew 6

basis points to 35% as a fall in occupancy costs as a percentage of

sales was partly offset by a rise in cost of goods sold as a

percentage of sales.

Store contribution jumped about 11%

to $408 million. As a percentage of sales, store contribution

increased 3 basis points to 9.6%.

Adjusted EBITDA for the quarter

rose 8% to $394 million, while adjusted EBITDA margin contracted 20

basis points to 9.3%. Operating income jumped 9% to $255 million,

whereas operating margin shriveled 10 basis points to 6%.

Stores Update

Whole Foods currently operates 373

stores. The company opened 10 outlets during the first quarter of

fiscal 2014. So far in the second quarter, the company has opened 2

stores, and plans to open 1 more store with 20 to 25 outlets slated

to open in the second half of the fiscal year.

The company plans to open 33 to 38

stores in fiscal 2014 and 38 to 45 stores in fiscal 2015. The

company opened 32 stores in fiscal 2013, after opening 25 outlets

in fiscal 2012. Moreover, it believes that there exists room for

1,200 stores in the long run, and expects to surpass the count of

500 stores in 2017.

Other Financial

Details

Whole Foods ended the quarter with

cash and cash equivalents of $271 million, long-term capital lease

obligations of $31 million, and shareholders’ equity of $3,963

million.

During the quarter, Whole Foods

generated cash flow from operations of $337 million and incurred

capital expenditures of $219 million, resulting in a free cash flow

of $118 million. The company paid $37 million in quarterly

dividends and bought back $62 million worth of shares. The company

still has the authority to repurchase shares worth $738

million.

The company has been utilizing its

cash flow for opening new stores, paying down debt and returning

cash to shareholders through dividends and share repurchases.

Strolling Through

Guidance

Since Nov 2013, Whole Foods lowered

its outlook for the second time. Management now projects an

escalation of 11% to 12% in total sales for fiscal 2014 on the back

of an expected 5.5% to 6.2% rise in comparable-store sales.

Earlier, management had forecasted

11% to 13% sales growth buoyed by a 5.5% to 7% rise in

comparable-store sales.

Management provided EBITDA guidance

of $1.32 billion to $1.37 billion, and projected operating margin

between 6.7% and 7%. The company anticipates capital expenditures

between $600 million and $650 million.

Management now envisions earnings

in the band of $1.58 to $1.65 per share, portraying a

year-over-year jump of 7% to 12%, down from a range of $1.65 to

$1.69 forecasted earlier. Analysts polled by Zacks, estimate fiscal

2014 earnings at $1.68, which may witness a downward revision in

the coming days.

Zacks Rank for Whole

Foods

Currently, Whole Foods carries a

Zacks Rank #4 (Sell) indicating lower-than-anticipated results on

both the earnings and revenue front as well as trimmed guidance for

the second consecutive quarter.

However, there are certain other

stocks that warrant a look, such as The Hain Celestial

Group, Inc. (HAIN) and Kraft Foods Group,

Inc. (KRFT) both carrying a Zacks Rank #2 (Buy).

To read this article on Zacks.com click here.

Zacks Investment Research

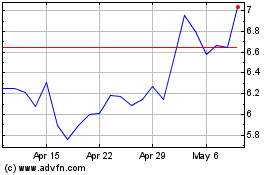

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

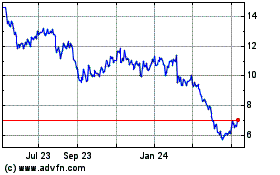

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Apr 2023 to Apr 2024