Company Exceeds Q4 Revenues, Meets Top

End of Gross Margin and EPS Guidance and Provides Q1 2014 Guidance

Revenues Flat to Slightly Down Sequentially, GAAP EPS 8.0 to 9.5

Cents

- Sales increased

1.3%

sequentially to $195.2

million, exceeding 4Q 2013

guidance. Full year 2013

revenues increased

4.5% year-over-year to

$770.7 million.

- Small and medium-sized panel driver

sales and

non-driver sales increased

32.3% and 28.1%

year-over-year

respectively, achieving

record-high quarterly revenues.

- Gross margin for the quarter

increased 180 bps

to

25.1%

from Q4 2012.

- Q4 2013 GAAP net income increased by 7.2% to $15.8

million from Q4 2012. GAAP earnings per diluted ADS grew 6.4% to

9.2 cents from Q4 2012.

- Q4 2013 Non-GAAP net income

increased by 5.7% to

$16.6 million from Q4 2012. Non-GAAP earnings per diluted ADS grew

4.9% to 9.7 cents from Q4 2012.

- FY 2013 GAAP net

income increased by 19.1% to

$61.5 million from

$51.6 million in

FY 2012. GAAP earnings

per diluted ADS increased 18.4%

to 35.8 cents from

30.2 cents in FY

2012.

- Company maintains positive full year 2014 outlook and

expects revenues and earnings growth to continue.

Himax Technologies, Inc.

(Nasdaq:HIMX) ("Himax" or

"Company"), a leading supplier and fabless manufacturer of

display drivers and other semiconductor products, today announced

financial results for the fourth quarter and full year ended

December 31, 2013.

SUMMARY FINANCIALS

| Fourth Quarter 2013

Results Compared to Fourth Quarter 2012 Results

(USD in millions)

(unaudited) |

| |

| |

Q4 2013 |

Q4 2012 |

CHANGE |

| Net Revenues |

$195.2 million |

$190.6 million |

+2.4% |

| Gross Profit |

$49.0 million |

$44.4 million |

+10.4% |

| Gross Margin |

25.1% |

23.3% |

+1.8% |

| GAAP Net Income Attributable to

Shareholders |

$15.8 million |

$14.8 million |

+7.2% |

| Non-GAAP Net Income Attributable to

Shareholders |

$16.6 million (1) |

$15.7 million (2) |

+5.7% |

| GAAP EPS (Per Diluted ADS, USD) |

$0.092 |

$0.086 |

+6.4% |

| Non-GAAP EPS (Per Diluted ADS, USD) |

$0.097 (1) |

$0.092 (2) |

+4.9% |

| |

| (1) Non-GAAP Net income

attributable to common shareholders and EPS excludes $0.3 million

of share-based compensation expenses, net of tax and $0.5 million

non-cash acquisition related charges, net of tax. |

| (2) Non-GAAP Net income

attributable to common shareholders and EPS excludes $0.4 million

of share-based compensation expenses, net of tax and $0.6 million

non-cash acquisition related charge, net of tax. |

| |

| Fourth Quarter 2013

Results Compared to Third Quarter 2013 Results

(USD in millions)

(unaudited) |

| |

| |

Q4 2013 |

Q3 2013 |

CHANGE |

| Net Revenues |

$195.2 million |

$192.8 million |

+1.3% |

| Gross Profit |

$49.0 million |

$ 48.7 million |

+0.6% |

| Gross Margin |

25.1% |

25.3% |

-0.2% |

| GAAP Net Income Attributable to

Shareholders |

$15.8 million |

$ 12.3 million |

+29.0% |

| Non-GAAP Net Income Attributable to

Shareholders |

$16.6 million (1) |

$ 19.3 million (2) |

-14.0% |

| GAAP EPS (Per Diluted ADS, USD) |

$0.092 |

$0.072 |

+28.5% |

| Non-GAAP EPS (Per Diluted ADS, USD) |

$0.097 (1) |

$0.113 (2) |

-14.3% |

| |

|

|

|

| (1) Non-GAAP Net income

attributable to common shareholders and EPS excludes $0.3 million

of share-based compensation expenses, net of tax and $0.5 million

non-cash acquisition related charges, net of tax. |

| (2) Non-GAAP Net income

attributable to common shareholders and EPS excludes $6.5 million

of share-based compensation expenses, net of tax and $0.5 million

non-cash acquisition related charge, net of tax. |

"A couple of years ago in 2011, our fourth quarter marked the

transition point of our business," began Mr. Jordan Wu, President

and Chief Executive Officer of Himax. "In 2011 we announced that

our fourth quarter began a turning point in the diversification of

our product lines and customer bases. After nine successful

quarters reporting to our shareholders on this strategy, we are

happy that 2013 was another successful year for Himax. This

accomplishment illustrated the successful execution of our

long-term growth strategies to diversify our customer base as well

as product portfolio. Looking into 2014, we are seeing strong

fundamentals across all our business segments and we are positive

about our full year outlook for continued revenues and earnings

growth."

Fourth Quarter 2013 Financial Results

Breakdown by Product Line (USD in millions)

(unaudited)

| |

Q4 2013 |

% |

Q4 2012 |

% |

% Change |

| Display drivers for large-sized panels |

$46.8 |

24.0% |

$77.5 |

40.7% |

-39.7% |

| Display drivers for small/medium-sized

panels |

$113.0 |

57.9% |

$85.4 |

44.8% |

+32.3% |

| Non-driver products |

$35.4 |

18.1% |

$27.7 |

14.5% |

+28.1% |

| |

|

|

|

|

|

| |

Q4 2013 |

% |

Q3 2013 |

% |

% Change |

| Display drivers for large-sized panels |

$46.8 |

24.0% |

$57.7 |

29.9% |

-18.9% |

| Display drivers for small/medium-sized

panels |

$113.0 |

57.9% |

$100.5 |

52.1% |

+12.4% |

| Non-driver products |

$35.4 |

18.1% |

$34.6 |

18.0% |

+2.4% |

Fourth quarter 2013 revenues of $195.2 million represented a

2.4% increase from the fourth quarter of 2012 and a 1.3% increase

sequentially. Fourth quarter revenues exceeded guidance and was

mainly driven by better-than-expected sales in smartphone and

tablet applications for Chinese and Korean markets and also

non-driver products.

Revenues from large panel display drivers were $46.8 million,

down 39.7% from a year ago and down 18.9% sequentially, and

accounted for 24.0% of total revenues for the fourth quarter. On

the back of the soft global demands for TV, laptop, and monitor,

the Company's large panel driver IC revenues from Innolux declined,

while revenues from other customers increased.

Sales for small and medium-sized drivers were $113.0 million, up

32.3% from the same period last year and up 12.4% sequentially, and

accounted for 57.9% of total revenues for the fourth quarter. Sales

for small and medium-sized drivers were another record-high and are

the fourth consecutive quarter that the Company's small and

medium-sized driver sales accounted for over half of total

revenues. The strong growth was driven by robust sales to Chinese

and Korean customers in the smartphone and tablet segments.

Revenues from Himax's non-driver businesses were $35.4 million,

up 28.1% from the same period last year and up 2.4%

sequentially, and accounted for 18.1% of total revenues for the

fourth quarter. Non-driver product sales reached another record

high in terms of both absolute value and percentage of total

revenues. Timing controllers, programmable Gamma OP, touch panel

controllers, CMOS image sensors, power management ICs, LED drivers

and ASIC services were the main contributors to the growth of

non-driver segment. Also adding to this growth were Himax's pilot

shipments of LCOS microdisplays for new and exciting head-mounted

display applications.

Gross margins were 25.1% for the three months ended December 31,

2013, up 180 basis points from 23.3% in the fourth quarter of 2012

and down 20 basis points from 25.3% in the third quarter of 2013.

The slight sequential decrease was caused by a slightly unfavorable

product mix in the quarter. However, Himax's gross margin for the

quarter yet improved significantly year-over-year.

Fourth quarter 2013 GAAP operating expenses were $29.6 million,

up 17.6% from a year ago and down 13.6% sequentially. The

sequential decrease was primarily the result of the difference in

RSU charges. As a yearly protocol, the Company grants annual RSUs

to its staff at the end of September each year. This distribution

leads to higher third quarter GAAP operating expenses compared to

other quarters of the year. Excluding the RSU charge, the Company's

fourth quarter operating expenses increased from the previous year

and last quarter due to anticipated salary expenses for headcount,

annual pay raises and certain new product tape-outs during the

quarter.

GAAP operating income in the fourth quarter of 2013 was $19.4

million, or 9.9% of sales, up 0.9% year-over-year and 34.3%

sequentially.

Reported GAAP net income was $15.8 million, or 9.2 cents per

diluted ADS, for the fourth quarter of 2013, up from $14.8 million,

or 8.6 cents per diluted ADS in the corresponding quarter a year

ago, and up from $12.3 million, or 7.2 cents per diluted ADS, in

the previous quarter. As the Company reported in its last earnings

release, it has taken into account for a possible negative impact

for its income tax due to depreciation of NT dollar. The Company

has taken an additional $1.1 million, or 0.6 cents per diluted ADS,

of income tax charge to reflect the NT dollar depreciation against

the US dollar in the fourth quarter of 2013. While the Company's

reporting currency is the US dollar, the vast majority of taxes are

incurred in its NT dollar book, which is the required reporting

currency for Taiwan tax authorities. The NT dollar depreciation

resulted in foreign exchange gains for the Company's US dollar

assets and therefore higher tax payable in Taiwan. As a result, the

Company's tax payable will be lower if the NT dollar appreciates

against the US dollar.

GAAP net income grew 7.2% year-over-year and 29.0% from the

previous quarter. GAAP EPS per diluted ADS grew 6.4% from the same

period last year and 28.5% over the previous quarter. The

sequential net income growth was mainly a result of the difference

in RSU charge as the third quarter RSU expense was $7.8 million

while only $0.4 million in the fourth quarter of 2013.

Excluding the share-based compensation, acquisition-related

charges and income tax provisions, the Company's non-GAAP adjusted

pre-tax income for the fourth quarter decreased 10.0% sequentially,

but it still grew 13.9% from the same period of previous year,

reaching $22.5 million. The sequential decline was due to $3.2

million of higher operating expenses. Amid a slow market conditions

during the quarter, the Company achieved bottom-line improvement

year-over-year due to better-than-expected revenues from smartphone

and tablet segments as well as 180 bps of gross margin

expansion.

Non-GAAP net income in the fourth quarter was $16.6 million, or

9.7 cents per diluted ADS, representing growth of 5.7%

year-over-year and a decline of 14.0% sequentially. Non-GAAP EPS

per diluted share increased 4.9% from the same period last year and

declined 14.3% over the previous quarter.

| Full Year 2013

Results (USD in millions)

(unaudited) |

| |

| |

FY 2013 |

FY 2012 |

CHANGE |

| Net Revenues |

$770.7 million |

$737.3 million |

+4.5% |

| Gross Profit |

$191.9 million |

$170.6 million |

+12.5% |

| Gross Margin |

24.9% |

23.1% |

+1.8% |

| GAAP Net Income Attributable to

Shareholders |

$ 61.5 million |

$51.6 million |

+19.1% |

| Non-GAAP Net Income Attributable to

Shareholders |

$ 71.0 million (1) |

$60.3 million (2) |

+17.8% |

| GAAP EPS (Per Diluted ADS) |

$0.358 |

$0.302 |

+18.4% |

| Non-GAAP EPS (Per Diluted ADS) |

$0.414 (1) |

$0.353 (2) |

+17.1% |

| |

|

|

|

| 1) Non-GAAP Net income

attributable to common shareholders and EPS excludes $7.5 million

of share-based compensation expenses, net of tax and $2.0 million

non-cash acquisition related charges, net of tax. |

| (2) Non-GAAP Net income

attributable to common shareholders and EPS excludes $6.9 million

of non-cash share-based compensation expenses, net of tax and $1.8

million non-cash acquisition related charges, net of tax. |

Full Year 2013

Financial Results

Breakdown by Product Line (USD in millions)

(unaudited)

| |

FY

2013 |

% |

FY

2012 |

% |

% Change |

| Display drivers for large-sized panels |

$228.9 |

29.7% |

$305.2 |

41.4% |

-25.0% |

| Display drivers for small/medium--sized

panels |

$415.6 |

53.9% |

$328.9 |

44.6% |

+26.4% |

| Non-driver products |

$126.2 |

16.4% |

$103.2 |

14.0% |

+22.4% |

Himax affirms 2013 was another successful year for Himax. The

Company's small and medium-sized driver IC segment, the largest

source of sales, delivered the strongest growth during the year.

The Company's leading position in the business allowed it to take

advantage of the robust global demands for smartphone and tablet as

the industry trend toward higher resolution displays. For large

panel display driver business, the Company continues to expand its

sales to Chinese customers and penetrate into non-China customers.

The Company also had a strong year in its non-driver business where

it maintained its strong growth momentum and made progress

including new major customer design-wins. Many of the Company's

non-driver products have attracted interest by top-tier,

globally-recognized end customers.

Revenues totaled $770.7 million in 2013, representing a 4.5%

increase year-over-year. The Company also witnessed improvement in

customer diversification as sales to non-Innolux customers grew

23.0% year-over-year while those to Innolux declined 31.0%. Innolux

accounted for 15% to 20% of the Company's total sales by the end of

2013.

Small and medium-sized drivers grew 26.4% year-over-year,

representing 53.9% of total revenues. Excluding feature phone

sales, Himax's small-and medium sized drivers grew over 38.6%

year-over-year. The Company is among the leading suppliers to panel

makers across Taiwan, Korea, China and Japan, covering the vast

majority of leading smartphone end customer names in both China and

international markets. The strong growth momentum of the small and

medium-sized driver business will continue into this year, driven

by smartphone, tablet and automotive displays. Smartphone growth

naturally invited intense competition in the driver IC space,

especially in the lower-end segments. However, Himax's technology

and cost competitiveness, during a time of an industry trend toward

higher panel resolution, have enabled the Company to achieve gross

margin improvement in 2013.

Revenues from large panel display drivers declined 25.0%

year-over-year, representing 29.7% of the Company's total revenues

as compared to 41.4% in 2012. Sales to Innolux declined by 31.0% as

the majority of the decline went to large panel driver ICs. The

soft global demand for TVs, monitors and notebooks also attributed

to the decline in the large panel sector last year. However, the

Company's non-Innolux large panel customers still grew 14.5%

year-over-year, an illustration of the Company's continued

competitiveness.

Non-driver products grew 22.4% year-over-year, representing

16.4% of total sales for Himax, as compared to 14.0% a year ago.

The Company's CMOS image sensor, programmable gamma OP, power

management IC, WLED driver, video SOCs and ASIC service all

delivered strong growth while LCOS microdisplays continued to gain

momentum in 2013. The Company believes that this result

demonstrates its strong R&D capability and its progress to a

more diversified product portfolio.

Gross margin in 2013 was 24.9%, a 180 basis-points improvement,

from 23.1% in 2012. The significant margin improvement is a result

of the Company's combined product and customer diversification.

Gross margin improvement will continue to be one of its major

business goals on a go-forward basis.

GAAP operating expenses were $117.5 million for the year of

2013, up $14.0 million or 13.5% from the same period of 2012. As

reported early last year, the Company planned to expand its R&D

expenses to capture the new business opportunities, following

several years of stable R&D spending.

GAAP operating income of $74.3 million represented a 10.9%

increase from the full year of 2012.

GAAP net income for the twelve months of 2013 was $61.5 million,

or 35.8 cents per diluted ADS, up from $51.6 million, or 30.2 cents

per diluted ADS for the same period last year. GAAP net income and

GAAP EPS per diluted ADS grew 19.1% and 18.4% year-over-year,

respectively. The Company has taken an additional $2.3 million, or

1.3 cents per diluted ADS, of income tax charge to reflect the NT

dollar depreciation against the US dollar in the year of 2013.

Non-GAAP net income for 2013 was $71.0 million, or 41.4 cents

per diluted ADS, up from $60.3 million, or 35.3 cents per diluted

ADS, for the same period last year. Non-GAAP net income and

Non-GAAP EPS per diluted ADS grew 17.8% and 17.1% year-over-year,

respectively.

Balance Sheet and Cash Flow

The Company had $128.1 million in cash, cash equivalents and

marketable securities available for sale on December 31, 2013,

compared to $133.9 million on September 30, 2013 and $138.9 million

for the same time last year. On top of the above cash position,

restricted cash was $108.4 million on December 31, 2013. The

restricted cash is mainly used to guarantee the Company's short

term loan for the same amount. Himax continues to maintain a very

strong balance sheet with no debt.

Inventories as of December 31, 2013 were $177.4 million, up from

$116.7 million a year ago and up from $159.6 million a quarter ago.

The higher inventory was prepared for the expected first quarter

sales growth of driver ICs for all panel sizes, CMOS image sensor

and a few other non-driver products. The Company expects the

inventory level to come down by the end of the first quarter as a

result of overall inventory control and expected increasing

shipments. Accounts receivable were $200.7 million on December 31,

2013 as compared to $202.2 million on September 30, 2013 and $209.0

million a year ago. Day Sales Outstanding ("DSO") was 95 days at

end of fourth quarter 2013 versus 103 days in the fourth quarter of

2012 and 96 days at end of the last quarter.

Net cash outflow from operating activities for the fourth

quarter was $1.8 million as compared to cash inflow of $52.4

million for the fourth quarter of 2012 and cash inflow of $27.4

million for the third quarter of 2013. The net outflow was caused

mainly by the relatively high year-end inventory. While Himax had

to pay for those goods in the fourth quarter, the Company will not

get paid for its sales until the first or second quarter of 2014.

Cumulative cash inflows from operations in 2013 were $52.4 million

versus $52.2 million the year before.

Capital expenditures were $3.9 million in the fourth quarter

versus $2.2 million a year ago and $3.8 million last quarter. The

capital expenditure in the fourth quarter consisted mainly of

purchases of certain equipments for WLO and LCOS product lines.

Total capital expenditures for fiscal 2013 were $18.4 million

versus $6.6 million a year ago.

Himax paid an annual cash dividend of 25 cents per ADS in July

2013, equal to 83.3% of its 2012 GAAP EPS per diluted ADS. Himax

remains committed to paying annual dividends, the amount of which

is referenced primarily on prior year's profitability. The high

payout ratio in 2013 is an illustration of the Company's confidence

for its profitability to continue to improve.

Share Buyback Update

As of December 31, 2013, the Company had 170.5 million ADS

equivalents outstanding, unchanged from the last quarter.

First Quarter 2014 Non-Deal Road Show

Ms. Jackie Chang, CFO will host investor meetings and attend

investor conferences in the US in March. If you are interested in

meeting with the Company, please contact Himax's US or Taiwan based

investor relations contact at the numbers below.

Business Updates

Following the successful transformation in 2012, the Company

delivered strong operational and financial results in 2013. While

the business from Innolux, which ceased being a related party as of

June 19th, 2013 when it disposed of all its equity holdings in

Himax, declined by 31%. Sales from other customers were up by

23% during 2013. The Company was still able to achieve some top

line growth for the whole year, which illustrated the successful

execution of its long term strategy to diversify its customer base

and product portfolio. Looking into 2014, the Company sees strong

fundamentals across all its business segments and is positive about

its full year outlook for continued revenues and earnings

growth.

Large panel driver IC remains one of the Company's major

business segments. It has maintained a leading position in China,

which now is the world's leading market for display capacity

expansion. Additionally, the Company expects a few major non-China

panel customers to contribute to its sales significantly in 2014.

On the technology front, Himax remains a market leader in providing

state-of-art large panel driver IC solutions. For example, it is

leading the market in the development of solutions to combat the

thermal issues in customers' 4K panel projects. The Company expects

some growth for its large panel drivers in the first quarter of

2014 from sales to both existing and new customers. The Company

believes that the main growth engine for large panel driver market

this year will come from 4K TV where Himax is a market leader. The

strong first quarter outlook demonstrates that the Company's past

efforts are coming into fruition starting this year as the it

expects to resume revenue growth of large panel driver business in

2014.

The Company expects continued sales growth of both smartphone

and tablet markets in 2014. However, first quarter will see some

decline in smartphone sales due to fewer working days in China.

Himax enjoys a prominent position in the smartphone sector due to

its leading technologies, competitive products and solid customer

base. It has a comprehensive coverage in both panel makers, which

are its direct customers, and end user indirect customers including

first-tier international and Chinese brands as well as those in the

fast growing China white-box market. The Company expects sales for

smartphone application to accelerate throughout 2014, partially

aided by the accelerating adoption of 4G LTE in various countries

including China. The trend toward higher panel resolution, in which

Himax benefits from better ASPs and gross margin, will also

continue in 2014. However, lower-end smartphone is a more

competitive market with intense price competition and eroding

margin. The Company will defend its margin by cost reduction

measures and leading the market in higher-end products.

Tablet and automotive displays are the other two growing

applications in the Company's small and medium-sized panel driver

business where it has a solid customer base, and leading market

share in both markets. In the tablet market, Himax is already a

market leader in both China and international brand markets. Its

leadership position in both smartphone and tablet markets have

enabled it to provide its customers with the most comprehensive and

optimal solutions in a market where the line between the two

product segments has become increasingly blurry. The automotive

display market, where the Company is already a market leader, is

unique in that it commands high reliability standard and special

know-how. Following a few years development, the Company reported

phenomenal growth in 2013 and set a strong foothold in the market.

Sales for both applications are expected to grow strongly during

the first quarter and the rest of the year.

The non-driver category remains its most exciting long-term

growth engine. The non-driver business is one of the Company's key

differentiators against its competition which enables it to offer

total solutions of image processing and human interface related

technologies in addition to its driver IC products. Many of its

non-driver products, including CMOS image sensor, timing

controller, touch panel controller, power management IC, WLED

driver, ASIC service, wafer level optics and LCOS microdisplay, are

anticipated to grow significantly in 2014.

CMOS image sensors delivered noticeable growth in 2013 and will

continue to be a fast-growing area for the Company in 2014. 2013

was the year when it positioned itself as one of the high-end image

sensor providers by launching its first 8 mega-pixel sensor product

in Q4. Currently, Himax's sensor products range from entry-level

qVGA and VGA to higher-end 8 mega pixel sensor products, targeting

smartphone, tablet, laptop, IP Cam, surveillance and automotive

markets. The first quarter 2014 revenue prospect for CMOS image

sensor looks positive, but gross margin of this product line will

be dampened by inventory correction of some mid to low-end

products. The Company is confident that gross margin will improve

overtime once it resolves the inventory issue and certain new

products with higher margin account for a larger proportion of

sales for this product line.

Supported by numerous new design-win projects covering both

China and international customers, the Company also expects growth

of touch panel controller sales in 2014. Himax's product line

covers both cellphone and tablet markets. It is also committed to

the development of new technologies such as on-cell and in-cell

touch sensors for next generation products. Recent customer

feedback and intensive design-in activities firmly supports the

Company's belief that touch panel controllers will be one of its

growth drivers in 2014 and beyond.

Himax further expanded its leadership in the LCOS business as it

launched its next generation technology with which it has

successfully engaged top-tier customers. The new generation

technology will enhance product performance and greatly simplify

its customers' manufacturing process. The Company remains very

excited about the new head-mounted display opportunities. It

continues to work with multiple customers, including some top-tier

names, on multiple projects, many of which involved tailor-made

designs with customers' development fees. Himax has already shipped

certain customers' pilot runs of production. Its LCOS sales are

expected to accelerate in 2014. The Company believes its LCOS

microdisplay business remains one of the most important areas for

Himax's long-term growth.

With all these new developments and the increasing business

opportunities across every business segment, Himax believes it is

positioned strongly for another successful year in 2014.

First Quarter 2014 Guidance

The Company is providing the following financial guidance for

the first quarter of 2014:

| Net Revenues: |

To be around flat or slightly down, as

compared to the fourth quarter of 2013, representing an increase of

around 11.1% from Q1 2013 |

| Gross Margin: |

To be slightly down from the fourth quarter

of 2013 |

| GAAP EPS: |

8.0 to 9.5 cents per diluted ADS, as compared

to 8.2 cents of Q1 2013 |

| Non GAAP EPS(1): |

8.3 to 9.8 cents per diluted ADS, as compared

to 8.8 cents of Q1 2013 |

| (1) Non-GAAP EPS excludes

share-based compensation and acquisition-related charges |

The first quarter is traditionally the bottom of the year in

terms of sales because the Company has fewer working days due to

Chinese New Year. The Company expects its first quarter gross

margin to be the bottom of the year as its improving product mix

will help lift gross margin beyond first quarter of 2014. The

Company also expects its revenues and earnings growth to continue

in 2014.

The Company's best estimate of effective income tax rate for

2014 as of today is around 21.0%. In estimating this tax rate, the

Company has considered relevant tax regulations and its internal

P&L forecast for the year. The Company has used 21% as the

effective tax rate for the first quarter.

Conference Call

Himax Technologies, Inc. will hold a conference call with

investors and analysts on February 13, 2014 at 8:00 a.m. US Eastern

Standard Time to discuss the Company's fourth quarter and full year

2013 financial results. Details of the call follow below.

| |

|

| DATE: |

Thursday, February 13, 2014 |

| TIME: |

U.S. 8:00 a.m. EST |

| |

TAIWAN 9:00 p.m. |

| DIAL IN: |

U.S. 1-877-407-4018 |

| |

INTERNATIONAL

1-201-689-8471 |

| CONFERENCE ID: |

13574978 |

| WEBCAST: |

http://public.viavid.com/index.php?id=107617 |

A replay of the call will be available beginning two hours after

the call through midnight February 20, 2014 (1 p.m. February 21,

Taiwan time) on www.himax.com.tw and by telephone at

+1-877-870-5176 (US Domestic) or +1-858-384-5517 (International).

The conference ID number is 13574978. This call is being webcast by

ViaVid Broadcasting and can be accessed by clicking on this

http://public.viavid.com/index.php?id=107617 or at ViaVid's

website at http://www.viavid.net, where the webcast can be accessed

through February 13, 2015.

About Himax Technologies, Inc.

Himax Technologies, Inc. (HIMX) is a fabless semiconductor

solution provider dedicated to display imaging processing

technologies. Himax is a worldwide market leader in display driver

ICs and timing controllers used in TVs, laptops, monitors, mobile

phones, tablets, digital cameras, car navigation, and many other

consumer electronics devices. Additionally, Himax designs and

provides controllers for touch sensor displays, LCOS micro-displays

used in palm-size projectors and head-mounted displays, LED driver

ICs, power management ICs, scaler products for monitors and

projectors, tailor-made video processing IC solutions and silicon

IPs. The company also offers digital camera solutions, including

CMOS image sensors and wafer level optics, which are used in a wide

variety of applications such as mobile phone, tablet, laptop, TV,

PC camera, automobile, security and medical devices. Founded in

2001 and headquartered in Tainan, Taiwan, Himax currently employs

over 1,600 people from three Taiwan-based offices in Tainan,

Hsinchu and Taipei and country offices in China, Korea, Japan and

the US. Himax has 2,207 patents granted and 1,008 patents pending

approval worldwide as of December 31, 2013. Himax has retained its

position as the leading display imaging processing semiconductor

solution provider to consumer electronics brands worldwide.

http://www.himax.com.tw

About Non-GAAP Financial Measures

To supplement the unaudited consolidated statement of income and

comprehensive income presented in accordance with GAAP, the Company

are also providing non-GAAP measures of income before income tax

expenses, net income, net income attributable to us and basic and

diluted earnings per share for the three months ended December 31,

2013 and 2012, which are adjusted from results based on GAAP to

exclude the non-cash transactions. The non-GAAP financial measures

are provided to enhance the investors' overall understanding of our

current performance in on-going core operations as the well as

prospects for the future. These measures should be considered in

addition to results prepared and presented in accordance with GAAP,

but should not be considered a substitute for or superior to GAAP

results. The Company uses both GAAP and non-GAAP information in

evaluating our operating business results internally and therefore

deems it important to provide all of this information to investors.

The non-GAAP adjustments include share based compensations,

acquisition related charges, bad debt collections and its tax

charges and tax credit write-offs.

Forward Looking Statements

Factors that could cause actual events or results to differ

materially include, but not limited to, general business and

economic conditions and the state of the semiconductor industry;

market acceptance and competitiveness of the driver and non-driver

products developed by the Company; demand for end-use applications

products; reliance on a small group of principal customers; the

uncertainty of continued success in technological innovations; our

ability to develop and protect our intellectual property; pricing

pressures including declines in average selling prices; changes in

customer order patterns; changes in estimated full-year effective

tax rate; shortages in supply of key components; changes in

environmental laws and regulations; exchange rate fluctuations;

regulatory approvals for further investments in our subsidiaries;

our ability to collect accounts receivable and manage inventory and

other risks described from time to time in the Company's SEC

filings, including those risks identified in the section entitled

"Risk Factors" in its Form 20-F for the year ended December 31,

2012 filed with the SEC, as may be amended.

-- FINANCIAL TABLES --

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (These interim

financials do not fully comply with US GAAP because they omit all

interim disclosure required by US GAAP) |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

Three Months

Ended December

31, |

Three Months Ended

September

30, |

| |

2013 |

2012 |

2013 |

| Revenues |

|

|

|

| Revenues from third parties, net |

$ 195,232 |

$ 129,973 |

$ 192,814 |

| Revenues from related parties, net |

-- |

60,666 |

-- |

| |

195,232 |

190,639 |

192,814 |

| |

|

|

|

| Costs and expenses: |

|

|

|

| Cost of revenues |

146,205 |

146,216 |

144,092 |

| Research and development |

19,078 |

17,003 |

23,549 |

| General and administrative |

4,938 |

4,328 |

5,027 |

| Sales and marketing |

5,605 |

3,863 |

5,701 |

| Total costs and

expenses |

175,826 |

171,410 |

178,369 |

| |

|

|

|

| Operating income |

19,406 |

19,229 |

14,445 |

| |

|

|

|

| Non operating income

(loss): |

|

|

|

| Interest income |

153 |

74 |

104 |

| Equity in income (losses) of equity method

investees |

(32) |

(14) |

101 |

| Foreign exchange gains (losses), net |

258 |

(233) |

(30) |

| Interest expense |

(129) |

(79) |

(110) |

| Other income (loss), net |

347 |

(1,253) |

17 |

| |

597 |

(1,505) |

82 |

| Earnings before

income taxes |

20,003 |

17,724 |

14,527 |

| Income tax expense |

5,627 |

3,708 |

3,631 |

| Net income |

14,376 |

14,016 |

10,896 |

| Net loss attributable to

noncontrolling interests |

1,448 |

751 |

1,374 |

| Net income

attributable to Himax stockholders |

$ 15,824 |

$ 14,767 |

$ 12,270 |

| |

|

|

|

| Basic earnings per ADS attributable

to Himax stockholders |

$ 0.093 |

$ 0.087 |

$ 0.072 |

| Diluted earnings per ADS attributable

to Himax stockholders |

$ 0.092 |

$ 0.086 |

$ 0.072 |

| |

|

|

|

| Basic Weighted Average

Outstanding ADS |

170,920 |

170,057 |

169,980 |

| Diluted Weighted Average

Outstanding ADS |

172,148 |

170,868 |

171,591 |

| |

|

|

|

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

| |

|

|

Twelve Months

Ended December

31, |

| |

|

|

2013 |

|

2012 |

| Revenues |

|

|

|

|

|

| Revenues from third parties, net |

|

|

$ 684,184 |

|

$ 485,281 |

| Revenues from related parties, net |

|

|

86,555 |

|

251,974 |

| |

|

|

770,739 |

|

737,255 |

| |

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

| Cost of revenues |

|

|

578,886 |

|

566,700 |

| Research and development |

|

|

80,368 |

|

70,913 |

| General and administrative |

|

|

18,147 |

|

17,139 |

| Sales and marketing |

|

|

18,995 |

|

15,443 |

| Total costs and

expenses |

|

|

696,396 |

|

670,195 |

| |

|

|

|

|

|

| Operating income |

|

|

74,343 |

|

67,060 |

| |

|

|

|

|

|

| Non operating income

(loss): |

|

|

|

|

|

| Interest income |

|

|

527 |

|

317 |

| Equity in losses of equity method

investees |

|

|

(122) |

|

(128) |

| Foreign exchange gains (losses), net |

|

|

643 |

|

(452) |

| Interest expense |

|

|

(401) |

|

(352) |

| Other income (loss), net |

|

|

410 |

|

(559) |

| |

|

|

1,057 |

|

(1,174) |

| Earnings before

income taxes |

|

|

75,400 |

|

65,886 |

| Income tax

expense |

|

|

19,476 |

|

15,748 |

| Net income |

|

|

55,924 |

|

50,138 |

| Net loss attributable to

noncontrolling interests |

|

|

5,552 |

|

1,458 |

| Net income

attributable to Himax stockholders |

|

|

$ 61,476 |

|

$ 51,596 |

| |

|

|

|

|

|

| Basic earnings per ADS attributable

to Himax stockholders |

|

|

$ 0.361 |

|

$ 0.303 |

| Diluted earnings per ADS attributable

to Himax stockholders |

|

|

$ 0.358 |

|

$ 0.302 |

| |

|

|

|

|

|

| Basic Weighted Average

Outstanding ADS |

|

|

170,211 |

|

170,528 |

| Diluted Weighted Average

Outstanding ADS |

|

|

171,809 |

|

170,762 |

| |

|

|

|

|

|

| |

|

|

|

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

|

| The amount of share-based

compensation included in applicable statements of

income categories is summarized as

follows: |

Three Months

Ended December

31, |

Three Months Ended

September

30, |

| |

2013 |

2012 |

2013 |

| Share-based compensation |

|

|

|

| Cost of revenues |

$ 15 |

$ 15 |

$ 190 |

| Research and development |

234 |

316 |

5,854 |

| General and administrative |

50 |

58 |

1,145 |

| Sales and marketing |

57 |

73 |

1,222 |

| Income tax benefit |

(84) |

(76) |

(1,872) |

| Total |

$ 272 |

$ 386 |

$ 6,539 |

| |

|

|

|

| The amount of

acquisition-related charges included in

applicable statements of income

categories is summarized as follows: |

|

|

|

| |

|

|

|

| Acquisition-related charges |

|

|

|

| Research and development |

$ 436 |

$ 559 |

$ 435 |

| Sales and marketing |

289 |

289 |

290 |

| Income tax benefit |

(208) |

(289) |

(208) |

| Total |

$ 517 |

$ 559 |

$ 517 |

| |

|

|

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

| The amount of share-based

compensation included in applicable statements of

income categories is summarized as

follows: |

Twelve

Months Ended December

31, |

| |

2013 |

2012 |

| Share-based compensation |

|

|

| Cost of revenues |

$ 235 |

$ 176 |

| Research and development |

6,705 |

5,625 |

| General and administrative |

1,308 |

1,191 |

| Sales and marketing |

1,425 |

1,230 |

| Income tax benefit |

(2,170) |

(1,367) |

| Total |

$ 7,503 |

$ 6,855 |

| |

|

|

| The amount of

acquisition-related charges included in

applicable statements of income

categories is summarized as follows: |

|

|

| |

|

|

| Acquisition-related charges |

|

|

| Research and development |

$ 1,746 |

$ 1,345 |

| Sales and marketing |

1,157 |

1,157 |

| Income tax benefit |

(835) |

(664) |

| Total |

$ 2,068 |

$ 1,838 |

| |

|

|

| |

|

|

|

| Himax Technologies,

Inc. |

| GAAP Unaudited

Condensed Consolidated Balance

Sheets |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

December

31,

2013 |

September

30,

2013 |

December

31,

2012 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ 127,320 |

$ 133,090 |

$ 138,737 |

| Restricted cash and cash equivalents |

108,399 |

115,000 |

74,100 |

| Investments in marketable securities

available-for-sale |

788 |

789 |

172 |

| Accounts receivable, less allowance for

doubtful accounts, sales returns and discounts |

200,725 |

202,201 |

135,747 |

| Accounts receivable from related parties,

less allowance for sales returns and discounts |

------ |

------ |

73,258 |

| Inventories |

177,399 |

159,615 |

116,671 |

| Deferred income taxes |

9,974 |

11,142 |

15,374 |

| Prepaid expenses and other current

assets |

15,052 |

14,428 |

13,029 |

|

Total current assets |

$ 639,657 |

$ 636,265 |

$ 567,088 |

| Investment securities |

$ 21,877 |

$ 17,877 |

$ 12,688 |

| Equity method

investments |

190 |

190 |

283 |

| Property,

plant and equipment, net |

60,588 |

59,332 |

52,609 |

| Deferred income taxes |

2,135 |

4,479 |

4,303 |

| Goodwill |

28,138 |

28,138 |

28,138 |

| Other intangible

assets, net |

5,234 |

5,960 |

8,143 |

| Other assets |

1,508 |

4,498 |

1,346 |

| |

119,670 |

120,474 |

107,510 |

| Total

assets |

$ 759,327 |

$ 756,739 |

$ 674,598 |

| Liabilities and

Equity |

|

|

|

| Current liabilities: |

|

|

|

| Short-term debts |

$ 105,500 |

$ 115,000 |

$ 73,000 |

| Accounts payable |

151,290 |

162,522 |

135,546 |

| Income taxes payable |

16,932 |

15,671 |

9,766 |

| Other accrued expenses and other current

liabilities |

30,111 |

25,310 |

23,805 |

| Total current

liabilities |

$ 303,833 |

$ 318,503 |

$ 242,117 |

| Other liabilities |

3,279 |

2,846 |

4,323 |

| Total

liabilities |

$ 307,112 |

$ 321,349 |

$ 246,440 |

| |

|

|

|

| Redeemable noncontrolling

interests |

$ 3,656 |

------ |

------ |

| Equity |

|

|

|

| Himax stockholders'

equity: |

|

|

|

| Ordinary shares, US$0.3 par value,

1,000,000,000 shares authorized; 356,699,482 shares issued and

341,049,418 shares, 341,049,418 shares, 339,149,508 shares

outstanding at December 31, 2013, September 30, 2013, and December

31, 2012, respectively |

$ 107,010 |

$ 107,010 |

$ 107,010 |

| Additional paid-in capital |

106,636 |

105,312 |

104,911 |

| Treasury shares, at cost, 15,650,064

shares, 15,650,064 shares and 17,549,974 shares at December 31,

2013, September 30, 2013, and December 31, 2012, respectively |

(11,120) |

(11,120) |

(12,469) |

| Accumulated other comprehensive loss |

(412) |

(69) |

(137) |

| Unappropriated retained earnings |

247,710 |

231,886 |

228,628 |

| Himax

stockholders' equity |

$ 449,824 |

$ 433,019 |

$ 427,943 |

| Noncontrolling

interests |

(1,265) |

2,371 |

215 |

| Total

equity |

$ 448,559 |

$ 435,390 |

$ 428,158 |

| Total liabilities

and equity |

$ 759,327 |

$ 756,739 |

$ 674,598 |

| |

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.

Dollars) |

| |

|

|

|

| |

Three Months

Ended December

31, |

Three Months Ended

September

30, |

| |

2013 |

2012 |

2013 |

| Cash flows from operating

activities: |

|

|

|

| Net income |

$ 14,376 |

$ 14,016 |

$ 10,896 |

| Adjustments to reconcile net income to net

cash provided by (used in) operating activities: |

|

|

|

| Depreciation and amortization |

3,843 |

3,669 |

3,757 |

| Share-based compensation expenses |

356 |

458 |

578 |

| Loss on disposal of property and

equipment |

--- |

6 |

1 |

| Gain on disposal of equity method

investment |

(54) |

--- |

--- |

| Loss (gain) on disposal of marketable

securities, net |

13 |

(17) |

(4) |

| Valuation gain on financial

liabilities |

(160) |

--- |

--- |

| Impairment loss on investment |

--- |

1,299 |

--- |

| Equity in losses (income) of equity

method investees |

32 |

14 |

(101) |

| Deferred income tax expense |

3,722 |

1,913 |

870 |

| Inventories write downs |

3,179 |

2,445 |

2,862 |

| Changes in operating assets and

liabilities: |

|

|

|

| Accounts receivable |

1,503 |

537 |

17,060 |

| Accounts receivable from related

parties |

--- |

8,782 |

--- |

| Inventories |

(20,964) |

9,222 |

(19,554) |

| Prepaid expenses and other current

assets |

(587) |

1,987 |

1,907 |

| Accounts payable |

(11,232) |

5,586 |

7,102 |

| Income taxes payable |

832 |

1,669 |

2,970 |

| Other accrued expenses and other current

liabilities |

3,028 |

857 |

(861) |

| Other liabilities |

333 |

1 |

(49) |

| Net cash

provided by (used in)

operating activities |

(1,780) |

52,444 |

27,434 |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

| Purchase of property and equipment |

(3,925) |

(2,199) |

(3,752) |

| Proceeds from disposal of property and

equipment |

--- |

1 |

--- |

| Purchase of available-for-sale marketable

securities |

(6,354) |

(4,485) |

(4,970) |

| Disposal of available-for-sale marketable

securities |

6,344 |

5,290 |

4,361 |

| Purchase of investment securities |

(4,000) |

--- |

--- |

| Cash decrease resulting from change in

consolidated entity |

(4) |

--- |

--- |

| Release (pledge) of restricted cash

equivalents and marketable securities |

24 |

(2) |

1,090 |

| Increase in other assets |

(270) |

(535) |

(32) |

| Net cash

used in investing activities |

(8,185) |

(1,930) |

(3,303) |

| |

|

|

|

| |

|

|

|

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.

Dollars) |

| |

|

|

|

| |

Three Months

Ended December

31, |

Three Months Ended

September

30, |

| |

2013 |

2012 |

2013 |

| Cash flows from financing

activities: |

|

|

|

| Distribution of cash dividends |

--- |

--- |

(42,394) |

| Proceeds from issuance of new shares by

subsidiaries |

5,071 |

--- |

4,391 |

| Payments to repurchase ordinary

shares |

--- |

(664) |

--- |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Imaging, Inc. |

--- |

25 |

(14) |

| Purchase of subsidiary shares from

noncontrolling interests |

(896) |

(1) |

--- |

| Release (pledge) of restricted cash

equivalents (for borrowing of short-term debt) |

9,500 |

--- |

(42,000) |

| Proceeds from borrowing of short-term

debts |

19,000 |

--- |

115,000 |

| Repayment of short-term debts |

(28,500) |

--- |

(73,000) |

| Net cash

provided by (used

in) financing

activities |

4,175 |

(640) |

(38,017) |

| Effect of foreign

currency exchange rate changes on

cash and cash equivalents |

20 |

41 |

26 |

| Net increase

(decrease) in

cash and cash equivalents |

(5,770) |

49,915 |

(13,860) |

| Cash and cash equivalents at

beginning of period |

133,090 |

88,822 |

146,950 |

| Cash and cash equivalents at end of

period |

$ 127,320 |

$ 138,737 |

$ 133,090 |

| |

|

|

|

| Supplemental disclosures of cash flow

information: |

|

|

|

| Cash paid during the period

for: |

|

|

|

|

Interest expense |

$ 118 |

$ 79 |

$ 110 |

| Income

taxes |

$ 377 |

$ 96 |

$ 435 |

| |

|

|

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.

Dollars) |

| |

Twelve Months Ended

December 31, |

| |

2013 |

2012 |

| Cash flows from operating

activities: |

|

|

| Net income |

$ 55,924 |

$ 50,138 |

| Adjustments to reconcile net income to net

cash provided by operating activities: |

|

|

| Depreciation and amortization |

14,309 |

13,299 |

| Provision for allowance for doubtful

accounts |

173 |

--- |

| Share-based compensation expenses |

1,840 |

1,936 |

| Loss (gain) on disposal of marketable

securities, net |

8 |

(648) |

| Loss on disposal of property and

equity |

88 |

36 |

| Gain on disposal of equity method

investment |

(54) |

--- |

| Valuation gain on financial

liabilities |

(160) |

--- |

| Unrealized gain on conversion option |

--- |

(28) |

| Interest income from amortization of

discount on investment in corporate bonds |

--- |

(101) |

| Issuance of new shares by subsidiary for

royalties |

49 |

--- |

| Impairment loss on investment |

--- |

1,299 |

| Equity in losses of equity method

investees |

122 |

128 |

| Deferred income tax expense |

7,409 |

8,851 |

| Inventories write downs |

10,759 |

12,418 |

| Changes in operating assets and

liabilities: |

|

|

| Accounts receivable |

(65,106) |

(34,467) |

| Accounts receivable from related

parties |

73,267 |

6,591 |

| Inventories |

(71,488) |

(16,104) |

| Prepaid expenses and other current

assets |

(1,857) |

1,421 |

| Accounts payable |

15,744 |

1,192 |

| Income taxes payable |

8,326 |

6,711 |

| Other accrued expenses and other current

liabilities |

2,812 |

(172) |

| Other liabilities |

229 |

(333) |

| Net cash

provided by operating

activities |

52,394 |

52,167 |

| |

|

|

| Cash flows from investing

activities: |

|

|

| Purchase of property and equipment |

(18,412) |

(6,560) |

| Proceed from disposal of property and

equipment |

--- |

1 |

| Purchase of available-for-sale marketable

securities |

(22,410) |

(19,609) |

| Disposal of available-for-sale marketable

securities |

21,792 |

25,043 |

| Purchase of investment securities |

(9,189) |

(3) |

| Cash increase (decrease) resulting from

change in consolidated entity |

(4) |

546 |

| Pledge of restricted cash equivalents and

marketable securities |

(1,761) |

(7) |

| Increase in other assets |

(541) |

(106) |

| Net cash

used in investing activities |

(30,525) |

(695) |

| |

|

|

| |

|

|

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.

Dollars) |

| |

|

|

| |

Twelve

Months Ended December

31, |

| |

2013 |

2012 |

| Cash flows from financing

activities: |

|

|

| Distribution of cash dividends |

(42,394) |

(10,680) |

| Proceeds from issuance of new shares by

subsidiaries |

9,852 |

116 |

| Payments to repurchase ordinary

shares |

--- |

(8,886) |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Technologies

Limited |

--- |

97 |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Imaging, Inc. |

64 |

436 |

| Purchase of subsidiary shares from

noncontrolling interests |

(896) |

(14) |

| Release (pledge) of restricted cash

equivalents (for borrowing of short-term debt) |

(32,500) |

11,200 |

| Proceeds from borrowing of short-term

debts |

352,320 |

304,000 |

| Repayment of short-term debts |

(319,820) |

(315,200) |

| Net cash

used in financing activities |

(33,374) |

(18,931) |

| Effect of foreign

currency exchange rate changes on

cash and cash equivalents |

88 |

32 |

| Net increase

(decrease) in

cash and cash equivalents |

(11,417) |

32,573 |

| Cash and cash equivalents at

beginning of period |

138,737 |

106,164 |

| Cash and cash equivalents at end of

period |

$ 127,320 |

$ 138,737 |

| |

|

|

| Supplemental disclosures of cash flow

information: |

|

|

| Cash paid during the period

for: |

|

|

|

Interest expense |

$ 390 |

$ 352 |

| Income

taxes |

$ 3,591 |

$ 456 |

| Supplemental disclosures of

non--cash investing

activities: |

|

|

| Fair

value of ordinary shares issued by Himax Display, Inc. in the

acquisition of Spatial Photonics, Inc. |

$ --- |

$ 270 |

| |

|

|

|

| Himax Technologies,

Inc. |

| Non-GAAP Unaudited

Supplemental Data – Reconciliation Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

|

|

|

| |

Three Months

Ended December

31, |

Three Months Ended

September

30, |

| |

2013 |

2012 |

2013 |

| Revenues |

$195,232 |

$ 190,639 |

$ 192,814 |

| |

|

|

|

| Gross profit |

49,027 |

44,423 |

48,722 |

| Add: Share-based compensation – Cost of

revenues |

15 |

15 |

190 |

| Gross profit excluding share-based

compensation |

49,042 |

44,438 |

48,912 |

| Gross margin excluding share-based

compensation |

25.1% |

23.3% |

25.4% |

| |

|

|

|

| Operating income |

19,406 |

19,229 |

14,445 |

| Add: Share-based compensation |

356 |

462 |

8,411 |

| Operating income excluding share-based

compensation |

19,762 |

19,691 |

22,856 |

| Add: Acquisition-related charges –Intangible

assets amortization |

725 |

848 |

725 |

| Operating income excluding share-based

compensation and acquisition-related charges |

20,487 |

20,539 |

23,581 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

10.5% |

10.8% |

12.2% |

| Net income attributable to Himax

stockholders |

15,824 |

14,767 |

12,270 |

| Add: Share-based compensation, net of

tax |

272 |

386 |

6,539 |

| Add: Acquisition-related charges, net of

tax |

517 |

559 |

517 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

16,613 |

15,712 |

19,326 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

8.5% |

8.2% |

10.0% |

| |

|

|

|

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| |

|

|

| Himax Technologies,

Inc. |

| Non-GAAP Unaudited

Supplemental Data – Reconciliation Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

Twelve

Months Ended December

31, |

| |

2013 |

2012 |

| Revenues |

$ 770,739 |

$ 737,255 |

| |

|

|

| Gross profit |

191,853 |

170,555 |

| Add: Share-based compensation – Cost of

revenues |

235 |

176 |

| Gross profit excluding share-based

compensation |

192,088 |

170,731 |

| Gross margin excluding share-based

compensation |

24.9% |

23.2% |

| |

|

|

| Operating income |

74,343 |

67,060 |

| Add: Share-based compensation |

9,673 |

8,222 |

| Operating income excluding share-based

compensation |

84,016 |

75,282 |

| Add: Acquisition-related charges –Intangible

assets amortization |

2,903 |

2,502 |

| Operating income excluding share-based

compensation and acquisition-related charges |

86,919 |

77,784 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

11.3% |

10.6% |

| Net income attributable to Himax

stockholders |

61,476 |

51,596 |

| Add: Share-based compensation, net of

tax |

7,503 |

6,855 |

| Add: Acquisition-related charges, net of

tax |

2,068 |

1,838 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

71,047 |

60,289 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

9.2% |

8.2% |

| |

|

|

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| |

|

|

| Diluted Earnings Per ADS

Attributable to Himax stockholders Excluding Share-based

Compensation and Acquisition-Related Charges: |

| |

|

|

| |

Three Months Ended December

31, |

Twelve Months Ended December

31, |

| |

2013 |

2013 |

| Diluted GAAP earning per ADS attributable to

Himax stockholders |

$0.092 |

$0.358 |

| Add: Share-based compensation per ADS |

$0.002 |

$0.044 |

| Add: Acquisition-related charges per ADS |

$0.003 |

$0.012 |

| |

|

|

| Diluted non-GAAP earning per ADS attributable

to Himax stockholders excluding share-based compensation and

acquisition-related charges |

$0.097 |

$0.414 |

| |

|

|

| Numbers do not add up due to rounding |

|

|

CONTACT: Company Contacts

Jackie Chang, CFO

Himax Technologies, Inc.

Tel: +886-2-2370-3999 Ext.22300

Or

US Tel: +1-949-585-9838 Ext.252

Fax: +886-2-2314-0877

Email: jackie_chang@himax.com.tw

www.himax.com.tw.

Penny Lin, Investor Relations

Himax Technologies, Inc.

Tel: +886-2-2370-3999 Ext.22320

Fax: +886-2-2314-0877

Email: penny_lin@himax.com.tw

www.himax.com.tw

Stephanie Kuo, Investor Relations

Himax Technologies, Inc.

Tel: +1-949-585-9838 Ext.221

Fax: +1-949-585-9598

Email: stephanie_kuo@himax.com.tw

www.himax.com.tw

Investor Relations - US Representative

MZ North America

John Mattio, SVP

Tel: +1-212-301-7130

Email: john.mattio@mzgroup.us

www.mzgroup.us

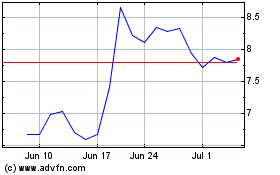

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

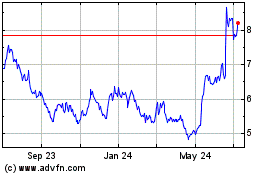

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Apr 2023 to Apr 2024