UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 11, 2014

PEREGRINE

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

0-17085 |

|

95-3698422 |

(State of other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

| 14282 Franklin Avenue, Tustin, California 92780 |

| (Address of Principal Executive Offices) |

| |

|

|

|

|

| Registrant’s telephone number, including area code: (714) 508-6000 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

o

Soliciting material pursuant to Rule 14A-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive

Agreement.

On February 11, 2014,

Peregrine Pharmaceuticals, Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”)

with MLV & Co. LLC (“MLV”), as representative for the underwriters identified therein (collectively, the “Underwriters”),

providing for the offer and sale to the Underwriters in a firm commitment underwritten public offering of 700,000 shares (the “Initial

Shares”) of the Company’s 10.50% Series E Convertible Preferred Stock, par value $0.001 per share (the “Series

E Preferred Stock”), at a price of $25.00 per share (the “Offering”). Pursuant to the Underwriting Agreement,

the Company has also granted the Underwriters a 30-day option to purchase up to an additional 105,000 shares of its Series E Preferred

Stock under this Offering at the public offering price less the underwriting discount to cover overallotments, if any. The net

proceeds to the Company from the Offering are expected to be approximately $16.2 million, after deducting underwriting discounts

and commissions and estimated expenses payable by the Company, assuming no exercise by the Underwriters of their option to purchase

additional shares of Series E Preferred Stock. The Company expects to close the sale of the Initial Shares on February 19, 2014,

subject to the satisfaction of customary closing conditions as set forth in the Underwriting Agreement.

The Offering is being

made pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-193113), which became effective on

January 16, 2014, as supplemented by a preliminary prospectus supplement and final prospectus supplement filed with the Securities

and Exchange Commission (the “SEC”) pursuant to Rule 424(b) of the Securities Act of 1933, as amended (the “Securities

Act”)

The Underwriting Agreement

contains customary representations and warranties of the parties and indemnification and contribution provisions under which the

Company, on the one hand, and the Underwriters, on the other hand, have agreed to indemnify each other against certain liabilities,

including liabilities under the Securities Act.

The foregoing description

of the Underwriting Agreement is a summary only and is qualified in its entirety by reference to the Underwriting Agreement, a

copy of which is attached as Exhibit 1.1 to this Current Report on Form 8-K and incorporated in this Item 1.01 by reference. The

Underwriting Agreement has been included to provide investors and security holders with information regarding its terms. It is

not intended to provide any other factual information about the Company. The representations, warranties and covenants contained

in the Underwriting Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit

of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties, including being qualified

by confidential disclosures exchanged between the parties in connection with the execution of the Underwriting Agreement. The representations

and warranties may have been made for the purposes of allocating contractual risk between the parties to the agreement instead

of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that

differ from those applicable to investors.

The legal opinion

of K&L Gates LLP relating to the shares of Series E Preferred Stock included in the Offering is filed as Exhibit 5.1 to this

Current Report on Form 8-K. The legal opinion of K&L Gates LLP relating to tax matters in the Offering is filed as Exhibit

8.1 to this Current Report on Form 8-K.

Item 3.03 Material

Modification to Rights of Security Holders.

On February 12, 2014,

we filed with the Secretary of State of the State of Delaware a Certificate of Designations of Rights and Preferences (the “Certificate

of Designations”) to designate a new series of preferred stock, designated as the 10.50% Series E Convertible Preferred Stock

(as described below in Item 5.03) (the “Series E Preferred Stock”). The Series E Preferred Stock has a senior liquidation

preference to our common stock.

Item 5.03 Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The Certificate of

Designations designates 2,000,000 shares of Series E Preferred Stock. The rights and preferences of the Series E Preferred Stock

include:

(i) The holders are entitled to receive

a 10.50% per annum cumulative quarterly dividend, payable in cash, on or about the 1st day of each of January, April,

July, and October, provided that if any dividend payment date is not a business day, then the dividend which would have been payable

on that dividend payment date will be paid on the next succeeding business day;

(ii) The dividend may increase to a penalty

rate of 12.50%: (A) if the Company fails to pay dividends for any four consecutive or nonconsecutive quarterly dividend periods,

or (B) once the Series E Preferred Stock becomes initially eligible for listing on a national securities exchange, if the Company

fails, for 180 or more consecutive days, to maintain such listing;

(iii) Following a change of control of the

Company (as defined in the Certificate of Designations) by a person or entity, the Company (or the acquiring entity) may, at our

option, redeem the Series E Preferred Stock, in whole but not in part, within 120 days after the date on which the change of control

has occurred for cash, at the redemption price;

(iv) The Company may not redeem the Series

E Preferred Stock prior to February 11, 2017 (except following a change of control) and, on and after February 11, 2017, the Company

may redeem the Series E Preferred Stock for cash at its option, from time to time, in whole or in part, at the redemption price;

(v) The redemption price is $25.00 per share,

plus any accrued and unpaid dividends (whether or not earned or declared) to, but excluding, the redemption date;

(vi) The liquidation preference is $25.00

per share, plus any accrued and unpaid dividends (whether or not earned or declared);

(vii) The Series E Preferred Stock has no

stated maturity date or mandatory redemption and is senior to all of the Company’s other securities;

(viii) There is a general conversion right

with respect to the Series E Preferred Stock with an initial conversion price of $3.00, a special conversion right upon a change

of control, and a market trigger conversion at our option in the event of Market Trigger (as defined in the Certificate of Designations);

and

(ix) The holders of the Series E Preferred

Stock have no voting rights, except:

1. with respect to any proposal to (A) authorize,

reclassify or create, or increase the authorized amount of, any shares of any class or series of Stock ranking senior to the Series

E Preferred Stock with respect to the payment of dividends or the distribution of assets on liquidation, dissolution or winding

up or (B) amend, alter or repeal any provision or our certificate of incorporation, as amended, so as to materially and adversely

affect the rights, preferences or voting power of the Series E Preferred Stock; and

2. so long as Series E Preferred Stock has

at least an aggregate of $10,000,000 in liquidation amount outstanding, to approve the incurrence of additional Indebtedness (as

defined in the Certificate of Designations) in an amount greater than the lesser of (a) $10,000,000 or (b) four and one-half (4.5)

multiplied by our TTM EBITDA (as defined in the Certificate of Designations), as calculated as of the end of the month prior to

the incurrence of any Indebtedness.

The foregoing description

does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designations which is filed

as Exhibit 3.11 to the Company’s Form 8-A filed on February 12, 2014 and is incorporated herein by reference.

Item 8.01 Other Events.

On February 11, 2014,

the Company issued a press release announcing the pricing of the Offering, a copy of which is filed hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following material is

filed as an exhibit to this Current Report on Form 8-K:

Exhibit

Number

| 1.1 | Underwriting Agreement dated February 11, 2014 by and between

Peregrine Pharmaceuticals, Inc. and MLV & Co. LLC, as representative for the underwriters identified therein. |

| 3.1 | Certificate of Designations of Rights and Preferences of

10.50% Series E Convertible Preferred Stock (incorporated by reference to Exhibit 3.11 of the Company’s Form 8-A Registration

Statement filed with the Securities and Exchange Commission on February 12, 2014). |

| 5.1 | Opinion of K&L Gates LLP. |

| 8.1 | Opinion of K&L Gates LLP relating to tax matters. |

| 23.1 | Consent of K&L Gates LLP (included in the opinion filed

as Exhibit 5.1). |

| 23.2 | Consent of K&L Gates LLP (included in the opinion filed

as Exhibit 8.1). |

| 99.1 | Press Release issued February 11, 2014. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

PEREGRINE PHARMACEUTICALS, INC. |

| |

|

| Date: February 12, 2014 |

By: |

/s/ Paul J. Lytle |

| |

|

Paul J. Lytle

Chief Financial Officer |

EXHIBIT INDEX

| Exhibit |

|

| Number |

Description |

| 1.1 |

Underwriting Agreement dated February 11, 2014 by and between Peregrine Pharmaceuticals, Inc. and MLV & Co. LLC, as representative for the underwriters identified therein. |

| 3.1 |

Certificate of Designations of Rights and Preferences of 10.50% Series E Convertible Preferred Stock (incorporated by reference to Exhibit 3.11 of the Company’s Form 8-A Registration Statement filed with the Securities and Exchange Commission on February 12, 2014). |

| 5.1 |

Opinion of K&L Gates LLP. |

| 8.1 |

Opinion of K&L Gates LLP relating to tax matters. |

| 23.1 |

Consent of K&L Gates LLP (included in the opinion filed as Exhibit 5.1). |

| 23.2 |

Consent of K&L Gates LLP (included in the opinion filed as Exhibit 8.1). |

| 99.1 |

Press Release issued February 11, 2014. |

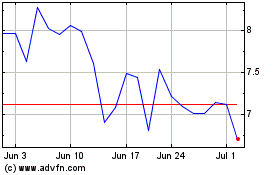

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

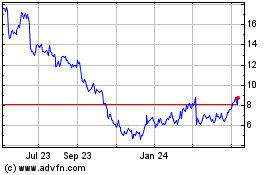

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Apr 2023 to Apr 2024