B&G Foods, Inc. (NYSE:BGS) today announced financial results

for the fourth quarter and full-year 2013.

Highlights (vs. prior year quarter and full year where

applicable):

- Net sales increased 21.8% to $211.5

million for the quarter and 14.4% to $725.0 million for the

year

- Net income increased 96.6% to $18.8

million for the quarter due in part to a loss on extinguishment of

debt experienced in the prior year quarter

- Net income decreased 11.7% to $52.3

million for the year primarily due to 2013 loss on extinguishment

of debt and acquisition related transaction costs of $23.9 million,

net of tax

- Adjusted net income1 increased 21.8% to

$20.7 million for the quarter and 14.3% to $76.3 million for the

year

- Diluted earnings per share increased

94.4% to $0.35 for the quarter and decreased 18.3% to $0.98 for the

year

- Adjusted diluted earnings per share*

increased 21.9% to $0.39 for the quarter and 5.9% to $1.43 for the

year

- Adjusted EBITDA* increased 13.7% to

$50.0 million for the quarter and 8.9% to $184.0 million for the

year

- The Company expects to deliver 2014

adjusted EBITDA of $198.0 million to $203.0 million

David L. Wenner, President and Chief Executive Officer of

B&G Foods, stated, “2013 was an exciting and dynamic year for

our Company. We completed three strategic acquisitions during the

year and once again set Company records in net sales, adjusted net

income, adjusted diluted earnings per share and adjusted EBITDA.

Despite industry wide volume weakness, our base business remained

relatively stable, with net sales declining less than one percent

for the year, while acquisitions brought overall net sales growth

for the year to a 14.4% increase.”

________________________________

* Please see “About Non-GAAP Financial Measures and Items

Affecting Comparability” below for the definition of the terms

adjusted net income, adjusted diluted earnings per share, EBITDA

and adjusted EBITDA, as well as information concerning certain

items affecting comparability and reconciliations of the non-GAAP

terms adjusted net income, adjusted diluted earnings per share,

EBITDA and adjusted EBITDA to the most comparable GAAP financial

measures.

Financial Results for the Fourth Quarter of 2013

Net sales for the fourth quarter of 2013 increased 21.8% to

$211.5 million from $173.7 million for the fourth quarter of 2012.

Net sales of Pirate Brands, which B&G Foods acquired in July

2013, contributed $16.0 million to the overall increase, net sales

of the Rickland Orchards brand, acquired in October 2013,

contributed $12.9 million to the overall increase, net sales of the

TrueNorth brand, acquired in May 2013, contributed $4.5 million to

the overall increase and October 2013 net sales of the

New York Style and Old London brands, acquired at

the end of October 2012, contributed $2.9 million to the overall

increase. Net sales for B&G Foods’ base business increased $1.5

million, or 0.9%, attributable to a unit volume increase of $4.3

million offset by a net price decrease of $2.8 million.

Gross profit for the fourth quarter of 2013 increased 12.9% to

$67.1 million from $59.5 million in the fourth quarter of 2012.

Gross profit expressed as a percentage of net sales decreased 2.5

percentage points to 31.7% for the fourth quarter of 2013 from

34.2% in the fourth quarter of 2012, primarily attributable to a

net price decrease of $2.8 million, a sales mix shift to lower

margin products and an increase in distribution costs. Operating

income increased 6.7% to $39.9 million for the fourth quarter of

2013, from $37.4 million in the fourth quarter of 2012.

Selling, general and administrative expenses increased $3.9

million, or 19.7%, to $23.9 million for the fourth quarter of 2013

from $20.0 million for the fourth quarter of 2012. This increase

was primarily due to increases in consumer marketing of $1.5

million, selling expenses of $1.2 million (including increases of

$0.7 million for salesperson compensation and $0.4 million for

brokerage expenses), acquisition-related transaction costs of $1.8

million and warehousing expenses of $1.1 million, partially offset

by a $1.5 million gain relating to a legal settlement and a

decrease in all other expenses of $0.2 million.

Net interest expense for the fourth quarter of 2013 decreased

$0.9 million or 7.6% to $10.9 million from $11.8 million for the

fourth quarter of 2012. The decrease in net interest expense in the

fourth quarter of 2013 was primarily attributable to the

refinancing of the Company’s long-term debt during the second

quarter of 2013, including the issuance of 4.625% senior notes, the

repurchase of 7.625% senior notes, and the repayment of tranche B

term loans.

The Company’s reported net income under U.S. generally accepted

accounting principles (GAAP) was $18.8 million, or $0.35 per

diluted share, for the fourth quarter of 2013, as compared to

reported net income of $9.6 million, or $0.18 per diluted share,

for the fourth quarter of 2012. The Company’s adjusted net income

for the fourth quarter of 2013, which excludes the after tax impact

of acquisition-related transaction costs, was $20.7 million, or

$0.39 per adjusted diluted share. The Company’s adjusted net income

for the fourth quarter of 2012, which excludes the after tax impact

of loss on extinguishment of debt and acquisition-related

transaction costs, was $17.0 million, or $0.32 per adjusted diluted

share.

For the fourth quarter of 2013, adjusted EBITDA, which excludes

the impact of acquisition-related transaction costs, increased

13.7% to $50.0 million from $44.0 million for the fourth quarter of

2012.

Financial Results for Full-Year 2013

Net sales for fiscal 2013 increased 14.4% to $725.0 million from

$633.8 million for fiscal 2012. An additional ten months of net

sales of the New York Style and Old London brands contributed $36.5

million to the overall increase, net sales of Pirate Brands,

contributed $32.6 million to the overall increase, net sales of the

TrueNorth brand contributed $13.0 million to the overall increase

and net sales of the Rickland Orchards brand contributed $12.9

million to the overall increase. Net sales for the Company’s base

business decreased $3.8 million, or 0.6%, attributable to a net

price decrease of $6.7 million partially offset by a unit volume

increase of $2.9 million.

Gross profit for fiscal 2013 increased 8.8% to $242.9 million

from $223.3 million in fiscal 2012. Gross profit expressed as a

percentage of net sales decreased 1.7 percentage points to 33.5%

for fiscal 2013 from 35.2% in fiscal 2012. The decrease in gross

profit expressed as a percentage of net sales was primarily

attributable to a net price decrease of $6.7 million, a sales mix

shift to lower margin products and an increase in distribution

costs. Operating income increased 3.3% to $154.0 million for fiscal

2013, from $149.0 million in fiscal 2012.

Selling, general and administrative expenses increased $12.8

million, or 19.4%, to $79.0 million in fiscal 2013 from $66.2

million in fiscal 2012. The increase is primarily due to increases

in consumer marketing of $4.3 million, selling expenses of $3.5

million (including increases of $1.9 million for salesperson

compensation and $1.2 million for brokerage expenses),

acquisition-related transaction costs of $4.8 million and

warehousing expenses of $1.9 million, partially offset by a $1.5

million gain relating to a legal settlement and a decrease in all

other expenses of $0.2 million.

Net interest expense for fiscal 2013 decreased $5.9 million or

12.3% to $41.8 million from $47.7 million in fiscal 2012. The

decrease in net interest expense in fiscal 2013 was primarily

attributable to the refinancing of the Company’s long-term debt

during the second quarter of 2013.

After taking into account $23.9 million of after tax charges

relating to loss on extinguishment of debt and acquisition-related

transaction costs, the Company’s reported net income under U.S.

GAAP was $52.3 million, or $0.98 per diluted share, for fiscal

2013, as compared to reported net income of $59.3 million, or $1.20

per diluted share, for fiscal 2012. The Company’s adjusted net

income for fiscal 2013, which excludes the after tax impact of loss

on extinguishment of debt and acquisition-related transaction

costs, was $76.3 million, and adjusted diluted earnings per share

was $1.43. The Company’s adjusted net income for fiscal 2012, which

excludes the after tax impact of loss on extinguishment of debt and

acquisition-related transaction costs, was $66.7 million, and

adjusted diluted earnings per share was $1.35.

Adjusted EBITDA, which excludes acquisition-related transaction

costs, increased 8.9% to $184.0 million in fiscal 2013 from $169.0

million for fiscal 2012.

Guidance

Adjusted EBITDA for fiscal 2014 is expected to be approximately

$198.0 million to $203.0 million. Capital expenditures for fiscal

2014 are expected to increase to approximately $20.0 million as the

result of the planned installation of additional production lines

in the Company’s Yadkinville, North Carolina facility to improve

efficiency and manufacturing capacity. Cash interest expense for

fiscal 2014 is expected to be approximately $38.5 million.

Conference Call

B&G Foods will hold a conference call at 4:30 p.m. ET today,

February 12, 2014. The call will be webcast live from B&G

Foods’ website at www.bgfoods.com under “Investor Relations—Company

Overview.” The call can also be accessed live over the phone by

dialing (888) 471-3840 for U.S. callers or (719) 325-2161 for

international callers.

A replay of the call will be available one hour after the call

and can be accessed by dialing (877) 870-5176 or

(858) 384-5517 for international callers; the password is

7113672. The replay will be available from February 12, 2014

through February 26, 2014. Investors may also access a web-based

replay of the call at the Investor Relations section of B&G

Foods’ website, www.bgfoods.com.

About Non-GAAP Financial Measures and Items Affecting

Comparability

“Adjusted net income,” “adjusted diluted earnings per share,”

“EBITDA” (net income before net interest expense, income taxes,

depreciation and amortization and loss on extinguishment of debt)

and “adjusted EBITDA” (EBITDA as adjusted for acquisition-related

transaction costs, which include outside fees and expenses,

contingent consideration expense and restructuring and

consolidation costs of acquisitions) are “non-GAAP financial

measures.” A non-GAAP financial measure is a numerical measure of

financial performance that excludes or includes amounts so as to be

different than the most directly comparable measure calculated and

presented in accordance with GAAP in B&G Foods’ consolidated

balance sheets and related consolidated statements of operations,

comprehensive income, changes in stockholders’ equity and cash

flows. Non-GAAP financial measures should not be considered in

isolation or as a substitute for the most directly comparable GAAP

measures. The Company’s non-GAAP financial measures may be

different from non-GAAP financial measures used by other

companies.

The Company uses “adjusted net income” and “adjusted diluted

earnings per share,” which are calculated as reported net income

and reported diluted earnings per share adjusted for certain items

that affect comparability. These non-GAAP financial measures

reflect adjustments to reported net income and diluted earnings per

share to eliminate the items identified below. This information is

provided in order to allow investors to make meaningful comparisons

of the Company’s operating performance between periods and to view

the Company’s business from the same perspective as the Company’s

management. Because the Company cannot predict the timing and

amount of acquisition-related transaction costs and gains or losses

on extinguishment of debt, management does not consider these costs

when evaluating the Company’s performance or when making decisions

regarding allocation of resources.

Additional information regarding EBITDA and adjusted EBITDA, and

a reconciliation of EBITDA and adjusted EBITDA to net income and to

net cash provided by operating activities is included below for the

fourth quarter and full year of fiscal 2013 and 2012, along with

the components of EBITDA and adjusted EBITDA. Also included below

are reconciliations of the non-GAAP terms adjusted net income and

adjusted diluted earnings per share to reported net income and

reported diluted earnings per share.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and

distribute a diversified portfolio of high-quality, branded

shelf-stable foods across the United States, Canada and Puerto

Rico. Based in Parsippany, New Jersey, B&G Foods’

products are marketed under many recognized brands, including

Ac’cent, B&G, B&M, Baker’s Joy, Brer Rabbit, Cream of

Rice, Cream of Wheat, Devonsheer, Don Pepino, Emeril’s,

Grandma’s Molasses, JJ Flats, Joan of Arc, Las Palmas,

Maple Grove Farms, Molly McButter, Mrs. Dash, New York

Style, Old London, Original Tings, Ortega, Pirate’s Booty,

Polaner, Red Devil, Regina, Rickland Orchards, Sa-són, Sclafani,

Smart Puffs, Sugar Twin, Trappey’s, TrueNorth, Underwood,

Vermont Maid and Wright’s. B&G Foods also sells and

distributes two branded household products, Static Guard and

Kleen Guard.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements.”

The forward-looking statements contained in this press release

include, without limitation, statements related to B&G Foods’

adjusted EBITDA, capital expenditures and cash interest expense

expectations for fiscal 2014. Such forward-looking statements

involve known and unknown risks, uncertainties and other unknown

factors that could cause the actual results of B&G Foods to be

materially different from the historical results or from any future

results expressed or implied by such forward-looking statements. In

addition to statements that explicitly describe such risks and

uncertainties readers are urged to consider statements labeled with

the terms “believes,” “belief,” “expects,” “projects,” “intends,”

“anticipates” or “plans” to be uncertain and forward-looking. The

forward-looking statements contained herein are also subject

generally to other risks and uncertainties that are described from

time to time in B&G Foods’ filings with the Securities and

Exchange Commission, including under Item 1A, “Risk Factors” in the

Company’s most recent Annual Report on Form 10-K and in its

subsequent reports on Forms 10-Q and 8-K. Investors are cautioned

not to place undue reliance on any such forward looking statements,

which speak only as of the date they are made. B&G Foods

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

B&G Foods, Inc. and

Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per

share data)

(Unaudited)

December 28, 2013 December 29, 2012

Assets Current assets: Cash and cash equivalents $ 4,107 $

19,219 Trade accounts receivable, less allowance for doubtful

accounts and discounts of $1,081 and $831 in 2013 and 2012,

respectively 62,763 43,357 Inventories 101,251 89,757 Prepaid

expenses and other current assets 8,079 5,326 Income tax receivable

3,422 4,262 Deferred income taxes 2,115 2,175

Total current assets 181,737 164,096 Property, plant

and equipment, net 110,374 104,746 Goodwill 319,292 267,940 Other

intangibles, net 844,141 637,196 Other assets 28,799

17,990 Total assets $ 1,484,343 $ 1,191,968

Liabilities and Stockholders’ Equity

Current liabilities: Trade accounts payable $ 42,638 $ 25,050

Accrued expenses 19,189 23,610 Current portion of long-term debt

26,250 40,375 Dividends payable 17,637 15,243

Total current liabilities 105,714 104,278 Long-term

debt 844,635 597,314 Other liabilities 8,692 8,038 Deferred income

taxes 146,939 121,163 Total liabilities

1,105,980 830,793 Commitments and contingencies

Stockholders’ equity: Preferred stock, $0.01 par value per share.

Authorized 1,000,000 shares; no shares issued or outstanding — —

Common stock, $0.01 par value per share. Authorized 125,000,000

shares; 53,445,910 and 52,560,765 issued and outstanding as of

December 28, 2013 and December 29, 2012, respectively 534 526

Additional paid-in capital 183,113 226,900 Accumulated other

comprehensive loss (2,471 ) (11,095 ) Retained earnings

197,187 144,844 Total stockholders’ equity

378,363 361,175 Total liabilities and

stockholders’ equity $ 1,484,343 $ 1,191,968

B&G Foods, Inc. and

Subsidiaries

Consolidated Statements of

Operations

(In thousands, except per share

data)

(Unaudited)

Fourth Quarter Ended Year Ended December

28, December 29, December 28,

December 29, 2013 2012

2013 2012 Net sales $ 211,547 $ 173,706 $

724,973 $ 633,812 Cost of goods sold 144,399 114,223

482,050 410,469 Gross profit 67,148 59,483 242,923

223,343 Operating expenses: Selling, general and

administrative expenses 23,946 20,006 79,043 66,212 Amortization

expense 3,276 2,059 9,884 8,126

Operating income 39,926 37,418 153,996 149,005 Other

expenses: Interest expense, net 10,913 11,815 41,813 47,660 Loss on

extinguishment of debt — 10,431 31,291

10,431 Income before income tax expense 29,013 15,172 80,892 90,914

Income tax expense 10,221 5,613 28,549

31,654 Net income $ 18,792 $ 9,559 $ 52,343 $ 59,260

Weighted average shares outstanding: Basic 53,398 52,154 52,998

49,239 Diluted 53,660 52,602 53,182 49,557 Earnings per

share: Basic $ 0.35 $ 0.18 $ 0.99 $ 1.20 Diluted $ 0.35 $ 0.18 $

0.98 $ 1.20 Cash dividends declared per share $ 0.33 $ 0.29

$ 1.23 $ 1.10

B&G Foods, Inc. and

Subsidiaries

Reconciliation of EBITDA and Adjusted

EBITDA to Net Income and to Net Cash Provided by

Operating Activities

(In thousands)

(Unaudited)

Fourth Quarter Ended Year Ended December

28, December 29, December 28,

December 29, 2013 2012

2013 2012 Net income $ 18,792 $ 9,559 $ 52,343

$ 59,260 Income tax expense 10,221 5,613 28,549 31,654 Interest

expense, net 10,913 11,815 41,813 47,660 Depreciation and

amortization 7,075 5,410 24,077 18,853 Loss on extinguishment of

debt (1) — 10,431 31,291

10,431 EBITDA (2) 47,001 42,828 178,073 167,858

Acquisition-related transaction costs 2,999

1,159 5,932 1,159 Adjusted

EBITDA (2) 50,000 43,987 184,005 169,017 Income tax expense (10,221

) (5,613 ) (28,549 ) (31,654 ) Interest expense, net (10,913 )

(11,815 ) (41,813 ) (47,660 ) Deferred income taxes 8,737 4,328

20,800 15,295 Amortization of deferred financing costs and bond

discount 1,082 1,257 4,400 5,028 Acquisition-related transaction

costs (2,999 ) (1,159 ) (5,932 ) (1,159 ) Share-based compensation

expense 666 877 3,935 3,777 Excess tax benefits from share-based

compensation — — (4,192 ) (8,031 ) Acquisition-related contingent

consideration expense, including interest accretion 208 — 208 —

Changes in assets and liabilities, net of effects of business

combinations 9,457 15,170

(17,952 ) (4,085 ) Net cash provided by operating activities

$ 46,017 $ 47,032 $ 114,910 $ 100,528

(1)

Fiscal 2013 loss on extinguishment of debt

includes costs relating to our repurchase of $248.5 million

aggregate principal amount of 7.625% senior notes and our repayment

of $222.2 million aggregate principal amount of tranche B term

loans, including the repurchase premium and other expenses of $20.2

million, the write-off of deferred debt financing costs of $8.3

million and the write-off of unamortized discount of $2.8 million.

Fourth quarter and full year fiscal 2012 loss on extinguishment of

debt includes costs relating to our partial redemption of $101.5

million aggregate principal amount of 7.625% senior notes,

including the repurchase premium and other expenses of $7.7

million, the write-off of deferred debt financing costs of $1.5

million and the write-off of unamortized discount of $0.5 million.

Loss on extinguishment during the fourth quarter and full year

fiscal 2012 also includes costs related to the amendment and

restatement of our credit agreement, including the write-off of

deferred debt financing costs of $0.4 million, unamortized discount

of $0.1 million and other expenses of $0.2 million.

(2)

EBITDA and adjusted EBITDA are non-GAAP

financial measures used by management to measure operating

performance. A non-GAAP financial measure is defined as a numerical

measure of our financial performance that excludes or includes

amounts so as to be different than the most directly comparable

measure calculated and presented in accordance with GAAP in our

consolidated balance sheets and related consolidated statements of

operations, comprehensive income, changes in stockholders’ equity

and cash flows. We define EBITDA as net income before net interest

expense, income taxes, depreciation and amortization and loss on

extinguishment of debt. We define adjusted EBITDA as EBITDA

adjusted for acquisition-related transaction costs, which include

outside fees and expenses, contingent consideration expense and

restructuring and consolidation costs of acquisitions. Management

believes that it is useful to eliminate net interest expense,

income taxes, depreciation and amortization, loss on extinguishment

of debt and acquisition-related transaction costs because it allows

management to focus on what it deems to be a more reliable

indicator of ongoing operating performance and our ability to

generate cash flow from operations. We use EBITDA and adjusted

EBITDA in our business operations to, among other things, evaluate

our operating performance, develop budgets and measure our

performance against those budgets, determine employee bonuses and

evaluate our cash flows in terms of cash needs. We also present

EBITDA and adjusted EBITDA because we believe they are useful

indicators of our historical debt capacity and ability to service

debt and because covenants in our credit agreement and our senior

notes indenture contain ratios based on these measures. As a

result, internal management reports used during monthly operating

reviews feature the EBITDA and adjusted EBITDA metrics. However,

management uses these metrics in conjunction with traditional GAAP

operating performance and liquidity measures as part of its overall

assessment of company performance and liquidity and therefore does

not place undue reliance on these measures as its only measures of

operating performance and liquidity.

EBITDA and adjusted EBITDA are not recognized terms under

GAAP and do not purport to be an alternative to operating income or

net income as an indicator of operating performance or any other

GAAP measure. EBITDA and adjusted EBITDA are not complete net cash

flow measures because EBITDA and adjusted EBITDA are measures of

liquidity that do not include reductions for cash payments for an

entity’s obligation to service its debt, fund its working capital,

capital expenditures and acquisitions and pay its income taxes and

dividends. Rather, EBITDA and adjusted EBITDA are two potential

indicators of an entity’s ability to fund these cash requirements.

EBITDA and adjusted EBITDA are not complete measures of an entity’s

profitability because they do not include costs and expenses for

depreciation and amortization, interest and related expenses, loss

on extinguishment of debt, acquisition-related transaction costs

and income taxes. Because not all companies use identical

calculations, this presentation of EBITDA and adjusted EBITDA may

not be comparable to other similarly titled measures of other

companies. However, EBITDA and adjusted EBITDA can still be useful

in evaluating our performance against our peer companies because

management believes these measures provide users with valuable

insight into key components of GAAP amounts.

B&G Foods, Inc. and

Subsidiaries

Items Affecting Comparability —

Reconciliation of Adjusted Information to GAAP Information

(In thousands, except per share

data)

(Unaudited)

Fourth Quarter Ended Year Ended December

28, December 29, December 28,

December 29, 2013 2012

2013 2012 Reported net income $ 18,792 $ 9,559 $

52,343 $ 59,260 Loss on extinguishment of debt, net of tax(1) —

6,707 20,120 6,707 Acquisition-related transaction costs, net of

tax 1,928 745 3,814 745 Adjusted net

income $ 20,720 $ 17,011 $ 76,277 $ 66,712 Adjusted diluted

earnings per share $ 0.39 $ 0.32 $ 1.43 $ 1.35

_____________________

(1)

Loss on extinguishment of debt for the

full-year 2013 includes costs relating to our repurchase of $248.5

million aggregate principal amount of 7.625% senior notes and our

repayment of $222.2 million aggregate principal amount of tranche B

term loans, including the repurchase premium and other expenses of

$20.2 million, the write-off of deferred debt financing costs of

$8.3 million and the write-off of unamortized discount of $2.8

million. Loss on extinguishment of debt for the fourth quarter and

full-year fiscal 2012 includes costs relating to our partial

redemption of $101.5 million aggregate principal amount of our

7.625% senior notes, including the repurchase premium and other

expenses of $7.7 million, the write-off of deferred debt financing

costs of $1.5 million and the write-off of unamortized discount of

$0.5 million. Loss on extinguishment during fiscal 2012 also

includes costs related to the amendment and restatement of our

credit agreement, including the write-off of deferred debt

financing costs of $0.4 million, unamortized discount of $0.1

million and other expenses of $0.2 million.

ICR, Inc.Investor Relations:Don Duffy, 866-211-8151orMedia

Relations:Matt Lindberg, 203-682-8214

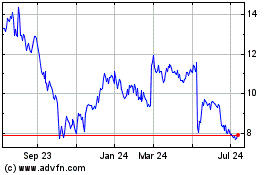

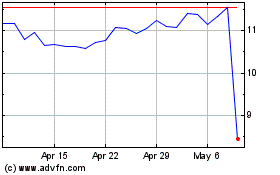

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024