Current Report Filing (8-k)

February 11 2014 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): February 5, 2014

NEKTAR THERAPEUTICS

(Exact Name of Registrant as Specified

in Charter)

| Delaware |

|

0-24006 |

|

94-3134940 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

455 Mission Bay Boulevard South

San Francisco, California 94158

(Address of Principal Executive Offices

and Zip Code)

Registrant’s telephone number, including

area code: (415) 482-5300

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(e) On

February 5, 2014, the Organization and Compensation Committee of the Board of Directors (the “Committee”)

of the Nektar Therapeutics, a Delaware corporation (the “Company”) approved changes to the compensation

of the Company’s named executive officers.

Effective

February 1, 2014, the Committee approved increases in annual base salary for certain executive officers. For Howard W. Robin, President

and Chief Executive Officer, the Committee increased his annual base salary from $833,270 to $862,434. For John Nicholson, Senior

Vice President and Chief Financial Officer, the Committee increased his annual base salary from $525,500 to $544,000. For

Gil M. Labrucherie, Senior Vice President and General Counsel, the Committee increased his annual base salary from $505,500 to

$528,000. The Committee also approved the following cash bonuses for 2013: Mr. Robin - $656,200 (approximately 105% of his

2013 annual performance-based bonus compensation target); Mr. Nicholson - $276,000 (approximately 105% of his 2013 annual performance-based

bonus compensation target); Mr. Labrucherie - $278,000 (approximately 110% of his 2013 annual performance-based bonus compensation

target); and Robert A. Medve, Senior Vice President and Chief Medical Officer - $80,000 (approximately 35% of his 2013 annual performance-based

bonus compensation target).

The Committee

also approved target levels for each executive’s 2014 annual performance-based bonus compensation as follows (expressed in

each case as a percentage of the executive’s base salary): Mr. Robin - 75%; Mr. Nicholson - 50%; Mr. Labrucherie - 50%; and

Dr. Medve - 50%. The actual amount of each executive’s 2014 annual performance bonus will range from 0% to 200% of the target

annual bonus based on the Committee’s assessment of his achievement of a combination of corporate and personal objectives.

The corporate objectives for 2014 that have been approved by the Committee include specific goals related to drug development and

regulatory outcomes, research program advancement, manufacturing performance and financial objectives.

Item 7.01. Regulation FD

Disclosure

On February

5, 2014, Messrs. Robin, Nicholson, Medve, and Labrucherie were granted stock options to purchase 450,000, 175,000, 25,000, and

170,000 shares, respectively, of the Company’s common stock pursuant to the terms and conditions of the Company’s 2012

Performance Incentive Plan (the “Stock Plan”). The exercise price of each stock option is

$12.43, the closing price of the Company’s common stock on the NASDAQ Global Select Market on the grant date. Fifty percent

(50%) of the shares subject to each stock option grant will vest according to a four-year vesting schedule on a monthly pro rata

basis (“Time-Based Vesting”), and fifty percent (50%) of the shares subject to each stock option grant

will vest according to Time-Based Vesting and will only be exercisable upon the attainment of a performance goal (the “Performance-Based

Vesting”) within five years of the grant date (the “Performance Period”). The performance

goal that must be met before the end of the Performance Period in order to achieve the Performance-Based Vesting condition is the

filing by the Company or a collaboration partner of the Company of either (i) a new drug application (an “NDA”)

or biologics license application (a “BLA”) with the United States Food and Drug Administration or (ii)

a marketing authorization application (an “MAA”) with the European Medicines Agency for any Proprietary

Company Program. For these purposes, a “Proprietary Company Program” includes drug candidates for which

the Company acts as the sponsor of the NDA, BLA or MAA, as the case may be, or drug candidates licensed by the Company to a third

party (and in such case the third party is the sponsor of the NDA, BLA or MAA, as the case may be) in which the Company is entitled

to an average potential royalty on net sales of the drug candidate equal to or greater than 7.5%, including, without limitation,

any one of the following drug candidates: (1) etirinotecan pegol (a topoisomerase I inhibitor); (2) NKTR-061/Amikacin Inhale (a

drug-device combination for an inhaled solution of amikacin); (3) BAX-855 (a longer-acting (PEGylated) form of a full-length recombinant

factor VIII (rFVIII) protein); or (4) dry powder ciprofloxacin. The “average potential royalty on net sales” is determined

by the quotient of (x) the sum of the lowest and highest applicable royalty rates payable to the Company based on net sales of

the drug candidate, divided by (y) two.

The information

in this Item 7.01 is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall

such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities

Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

SIGNATURES

Pursuant to the requirement of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

| |

|

| By: |

|

/s/ Gil M. Labrucherie |

| |

|

Gil M. Labrucherie |

| |

|

General Counsel and Secretary |

| |

|

| Date: |

|

February 11, 2014

|

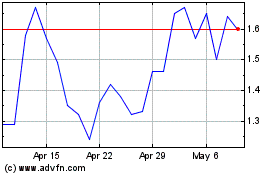

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Apr 2023 to Apr 2024