Owens & Minor, Inc. (NYSE-OMI) today reported financial

results for the fourth quarter and full-year ended December 31,

2013, including the following highlights:

- Consolidated annual revenue growth and

adjusted EPS met targeted guidance for 2013

- Adjusted consolidated net income was

$1.90 per diluted share for 2013 and $0.52 for the quarter

- 4Q 2013 adjusted consolidated operating

earnings (non-GAAP) improved by more than $11 million

- The Domestic segment achieved revenue

growth for the second consecutive quarter

- The International segment reported

positive fourth quarter operating earnings

For the quarter ended December 31, 2013, the company reported

consolidated quarterly revenues of $2.32 billion, an increase of

1.1% when compared to the fourth quarter of 2012. For the fourth

quarter of 2013, net income increased 12% to $27.9 million, or

$0.44 per diluted share, when compared to the same period last

year. For the fourth quarter, adjusted net income (non-GAAP), which

excludes after-tax charges of $5.0 million for acquisition-related

and exit and realignment activities, was $33.0 million, or $0.52

per diluted share, an increase of 26% when compared to the fourth

quarter of 2012.

Consolidated operating earnings for the fourth quarter of 2013,

were $50.9 million, improved by $5.9 million, or 13.1%, when

compared to operating earnings for the same period last year.

Adjusted consolidated operating earnings (non-GAAP) for the fourth

quarter of 2013 were $58.0 million, or 2.50% of revenues, increased

$11.2 million, in comparison to last year’s fourth quarter results.

Since the fourth quarter of 2012, quarterly adjusted operating

earnings (non-GAAP) have improved sequentially in each of the four

consecutive quarters.

“During 2013, our teams in the U.S., Europe and Asia

collaborated to achieve a successful outcome for the year,” said

Craig R. Smith, chairman & chief executive officer of Owens

& Minor. “Our teammates are creating a faster, more flexible

Owens & Minor that is well-equipped to pursue emerging

opportunities. Looking ahead, we intend to capitalize on the

investments we have made in the company to capture new market

opportunities, operate more efficiently and provide our healthcare

customers with the best logistics’ solutions in healthcare.”

In completing a year-end review of customer contracts in the

International segment, the company has revised the presentation of

a portion of its International segment revenues from a gross to a

net basis, after determining that this presentation is more

representative of the customer arrangement. This change resulted in

reductions of gross revenues of approximately $30 million to $35

million per quarter for the fourth quarter of 2012 and each of the

first three quarters of 2013. As a result of this revised

classification, International segment revenues were $105 million

for the fourth quarter of 2013 compared to $96.3 million for the

same period last year, and were $384 million for 2013 compared to

$137 million for 2012. This change did not affect gross margin,

operating earnings or net income, and had an immaterial impact

on consolidated revenues reported for 2012 and the first three

quarters of 2013. The International segment consists of Movianto, a

leading European healthcare logistics provider, which was acquired

by Owens & Minor on August 31, 2012.

2013 Annual Results

For the year ended December 31, 2013, consolidated revenues were

$9.07 billion, an increase of $203 million, or 2.3%, when compared

to 2012 revenues. The International segment contributed $384

million in revenues for 2013 and $137 million for 2012, which

represented four months of revenue contributions. Net income for

2013 improved 1.7% to $111 million, or $1.76 per diluted share, in

comparison to net income of $109 million, or $1.72 per diluted

share, in the same period last year. For the year, adjusted net

income (non-GAAP), which excludes after-tax charges of $8.9 million

for acquisition-related and exit and realignment activities, was

$120 million, or $1.90 per diluted share, an increase of 2.2% in

comparison to last year’s results.

Consolidated operating earnings for 2013 improved slightly to

$198 million, or 2.18% of revenues, compared to operating earnings

of $197 million, or 2.22% of revenues, for the same period of 2012.

Adjusted operating earnings (non-GAAP) for 2013 were $211 million,

or 2.32 % of revenues, increased 1.7% when compared to adjusted

operating earnings of $207 million, or 2.33% of revenues, for the

same period last year.

Asset Management

The balance of cash and cash equivalents was $102 million at

December 31, 2013. For the year, the company reported cash provided

by operating activities of $141 million compared to $219 million in

the same period last year. Asset management metrics for the quarter

were positive with consolidated days sales outstanding (DSO) of

22.1, as of December 31, 2013, compared to DSO of 20.8 days for the

same period last year. Consolidated inventory turns were 10.4 for

2013 versus inventory turns of 10.1 for 2012.

Segment Results

Domestic segment revenues for the fourth quarter of 2013 were

$2.21 billion, improved modestly from revenue of $2.20 billion. For

2013, Domestic segment revenue experienced a slight decline to

$8.69 billion, when compared to the prior year. Domestic revenue

growth was impeded by ongoing market trends, including lower rates

of healthcare utilization and reduced government spending, as well

as the company’s continued rationalization of smaller, less

profitable healthcare provider customers and suppliers. Despite

these market challenges, the Domestic segment achieved

year-over-year and sequential revenue growth for both the third and

fourth quarters of 2013.

For the fourth quarter of 2013, Domestic segment operating

earnings were $56.6 million, an increase of $5.0 million when

compared to same period of 2012. Quarterly operating earnings, when

compared to the prior year, benefitted from certain strategic

initiatives, including growth in fee-for-service business. In

addition, $2.0 million in legal expenses and loss contingencies

associated with California-specific litigation and compensation and

benefits requirements in 2012 did not recur in 2013. During the

quarter, certain exit and realignment activities designed to

optimize the company’s Domestic operations were accelerated; these

activities were associated with closing certain U.S.-based

distribution and logistics centers, and offsite warehouses. For the

full year, Domestic segment operating earnings were $212 million

for 2013 and 2012, representing 2.44% and 2.43% of segment revenues

respectively for each year. In addition to factors affecting fourth

quarter results, annual operating earnings benefitted from certain

California municipal sales tax incentives and supplier price

changes in the first half of the year, offset by increases in

healthcare costs, workers’ compensation and other administrative

expenses.

For the International segment, quarterly revenues increased 8.6%

to $105 million and were $384 million for the first full year as

part of Owens & Minor. For the fourth quarter of 2013, the

International segment had operating earnings of $1.4 million,

representing a $6.2 million increase over fourth quarter of 2012.

For the full-year 2013, the International segment narrowed its

operating losses by $4.0 million to $1.4 million. The comparative

improvement for 2013 resulted from increased utilization of network

capacity, continued growth, and diminishing reliance on transition

services from the former parent company. During the second half of

2013, the International segment also benefitted from seasonally

stronger customer activity.

2014 Outlook

The company reiterated the following financial guidance for

2014, which was originally issued at its December 2013 Investor

Day:

For 2014, the company is targeting revenue growth of up to 2%

and adjusted net income per diluted share of $1.95 to $2.05 for the

year, which excludes exit and realignment and transaction-related

costs.

Upcoming Investor Relations

Events

Owens & Minor will participate in the following investor

conferences in the first quarter of 2014; webcasts of executive

presentations will be available on www.owens-minor.com

- Leerink Swann Global Healthcare

Conference 2014; February 12; New York

- Citi 2014 Global Healthcare Conference;

February 26; New York

- Barclays Capital 2014 Global Healthcare

Conference; March 13; Miami

Investors Conference Call &

Supplemental Material

Conference Call: Owens & Minor’s management team will

conduct a conference call for investors on Tuesday, February 11,

2014, at 8:30 a.m. Eastern. The access code for the conference

call, international dial-in and replay is #40287606. Participants

may access the call at 866-393-1604. The international dial-in

number is 224-357-2191. Replay: A replay of the call will be

available for one week by dialing 855-859-2056. Webcast: A

listen-only webcast of the call, along with supplemental

information, will be available on www.owens-minor.com under “Investor

Relations.”

Owens & Minor uses its Web site, www.owens-minor.com, as a

channel of distribution for material company information, including

news releases, investor presentations and financial information.

This information is routinely posted and accessible under the

Investor Relations section.

Included with the press release financial tables are

reconciliations of the differences between the non-GAAP financial

measures presented in this news release, which exclude

acquisition-related and exit and realignment charges, and their

most directly comparable GAAP financial measures.

Safe Harbor Statement

Except for historical information, the matters discussed in this

press release may constitute forward-looking statements that

involve risks and uncertainties that could cause actual results to

differ materially from those projected. These risk factors are

discussed in reports filed by the company with the Securities &

Exchange Commission. All of this information is available at

www.owens-minor.com. The company assumes no obligation, and

expressly disclaims any such obligation, to update or alter

information, whether as a result of new information, future events,

or otherwise.

Owens & Minor, Inc.,

(NYSE: OMI) a FORTUNE 500 company headquartered in Richmond,

Virginia, is a leading national provider of distribution and

logistics services to the healthcare industry and a leading

European provider of logistics services to pharmaceutical,

life-science, and medical-device manufacturers. With a diverse

product and service offering and facilities throughout the United

States and Europe, the company serves hospitals, integrated

healthcare systems, alternate site locations, group purchasing

organizations, healthcare manufacturers, and the federal

government. Owens & Minor also provides technology and

consulting programs that improve inventory management and

streamline logistics across the entire medical supply chain. For

news releases, or for more information about Owens & Minor,

visit the company website at www.owens-minor.com.

Owens & Minor, Inc.

Consolidated Statements of Income

(unaudited)

(in thousands, except per share data)

Three Months Ended December 31, 2013

2012 Net revenue

$ 2,318,524 $

2,294,208 Cost of goods sold

2,027,261 2,023,434

Gross margin

291,263 270,774 Selling, general and

administrative expenses

222,043 211,415 Acquisition-related

and exit and realignment charges

7,049 1,717 Depreciation

and amortization

13,239 12,420 Other operating expense

(income), net

(2,002 ) 181 Operating earnings

50,934 45,041 Interest expense, net

3,263

3,422 Income before income taxes

47,671 41,619 Income

tax provision

19,729 16,685

Net income

$ 27,942 $ 24,934

Net income

per common share: Basic $ 0.44 $ 0.40

Diluted $ 0.44 $ 0.39

Twelve

Months Ended December 31, 2013 2012 Net revenue

$ 9,071,532 $ 8,868,324 Cost of goods sold

7,954,457 7,943,670 Gross margin

1,117,075 924,654 Selling, general and administrative

expenses

863,656 682,595 Acquisition-related and exit and

realignment charges

12,444 10,164 Depreciation and

amortization

50,586 39,604 Other operating expense (income),

net

(7,694 ) (4,462 ) Operating earnings

198,083 196,753 Interest expense, net

13,098

13,397 Income before income taxes

184,985 183,356

Income tax provision

74,103 74,353

Net

income $ 110,882 $ 109,003

Net income per common share: Basic $

1.76 $ 1.72

Diluted $ 1.76 $ 1.72

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands)

December 31, December 31,

2013 2012

Assets Current assets

Cash and cash equivalents

$ 101,905 $ 97,888 Accounts

and notes receivable, net

572,854 537,335 Merchandise

inventories

771,663 763,756 Other current assets

279,510 231,264

Total current assets

1,725,932 1,630,243 Property and equipment, net

191,961 191,841 Goodwill, net

275,439 274,884

Intangible assets, net

40,406 42,313 Other assets, net

90,304 75,117

Total assets

$ 2,324,042 $ 2,214,398

Liabilities and equity Current liabilities Accounts

payable

$ 643,872 $ 603,137 Accrued payroll and

related liabilities

23,296 25,468 Deferred income taxes

41,613 42,107 Other current liabilities

280,398 254,924

Total current

liabilities 989,179 925,636 Long-term debt, excluding

current portion

213,815 215,383 Deferred income taxes

43,727 36,269 Other liabilities

52,278

63,454

Total liabilities 1,298,999 1,240,742

Total equity 1,025,043 973,656

Total liabilities and equity $

2,324,042 $ 2,214,398

Owens & Minor, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

Twelve Months Ended 2013

2012 Operating activities: Net

income

$ 110,882 $ 109,003 Adjustments to reconcile

net income to cash provided by operating activities: Depreciation

and amortization

50,586 39,604 Share-based compensation

expense

6,381 5,697 Deferred income tax expense

3,713

1,060 Provision for losses on accounts and notes receivable

787 1,004 Changes in operating assets and liabilities:

Accounts and notes receivable

(38,645 ) 27,161

Merchandise inventories

(7,064 ) 58,734 Accounts

payable

47,374 (18,694 ) Net change in other assets and

liabilities

(32,337 ) (4,490 ) Other, net

(1,123 ) (573 )

Cash provided by operating

activities 140,554 218,506

Investing activities: Acquisition, net of cash

acquired

— (155,210 ) Additions to computer software and

intangible assets

(32,010 ) (29,131 ) Additions to

property and equipment

(28,119 ) (9,832 ) Proceeds

from the sale of property and equipment

3,051

3,298

Cash used for investing activities

(57,078 ) (190,875 )

Financing activities: Cash dividends paid

(60,731

) (55,681 ) Repurchases of common stock

(18,876

) (15,000 ) Financing costs paid

— (1,303 ) Proceeds

from exercise of stock options

5,352 4,986 Excess tax

benefits related to share-based compensation

898 1,293

Other, net

(8,623 ) (2,710 )

Cash

used for financing activities (81,980 )

(68,415 )

Effect of exchange rate changes on cash and

cash equivalents 2,521 2,734

Net increase (decrease) in cash and cash equivalents

4,017 (38,050 )

Cash and cash equivalents at beginning of

period 97,888 135,938

Cash and cash equivalents at end of period $

101,905 $ 97,888

Owens & Minor, Inc.

Financial Statistics and GAAP/Non-GAAP

Reconciliations (unaudited)

Quarter Ended (in thousands, except

ratios and per share data)

12/31/2013

9/30/2013 6/30/2013 3/31/2013 12/31/2012

Consolidated operating results:

Domestic

$ 2,213,949 $ 2,175,663 $ 2,143,691 $

2,154,715 $ 2,197,932 International (1)

104,575

94,884 92,386 91,669

96,276 Net revenue

$

2,318,524 $ 2,270,547 $

2,236,077 $ 2,246,384 $ 2,294,208

Gross margin

$ 291,263 $ 273,329 $

273,431 $ 279,052 $ 270,774 Gross margin as a percent of revenue

12.56 % 12.04 % 12.23 %

12.42 % 11.80 % SG&A expenses

$

222,043 $ 211,344 $ 212,548 $ 217,721 $ 211,415 SG&A

expenses as a percent of revenue

9.58 %

9.31 % 9.51 % 9.69 % 9.22 % Operating

earnings, as reported (GAAP)

$ 50,934 $ 49,215 $

50,050 $ 47,884 $ 45,041 Acquisition-related and exit and

realignment charges

7,049 2,747

638 2,010 1,717 Operating

earnings, adjusted (Non-GAAP)

$ 57,983 $ 51,962 $

50,688 $ 49,894 $ 46,758 Operating earnings as a percent of

revenue, adjusted (Non-GAAP)

2.50 %

2.29 % 2.27 % 2.22 % 2.04 % Net income,

as reported (GAAP)

$ 27,942 $ 27,970 $ 28,872 $

26,098 $ 24,934 Acquisition-related and exit and realignment

charges, after-tax

5,024 1,899

412 1,521 1,237 Net income,

adjusted (Non-GAAP)

$ 32,966 $

29,869 $ 29,284 $ 27,619

$ 26,171 Net income per diluted common share, as

reported (GAAP)

$ 0.44 $ 0.44 $ 0.46 $ 0.41 $ 0.39

Acquisition-related and exit and realignment charges

0.08 0.03 —

0.03 0.02 Net income per diluted common

share, adjusted (Non-GAAP)

$ 0.52

$ 0.47 $ 0.46 $ 0.44

$ 0.41

Financing: Cash and cash

equivalents

$ 101,905 $ 153,789 $ 207,826 $ 218,563 $

97,888 Total interest-bearing debt

$ 216,243

$ 216,850 $ 216,994 $

216,414 $ 217,591

Stock

information: Cash dividends per common share

$

0.24 $ 0.24 $ 0.24

$ 0.24 $ 0.22 Stock price at quarter-end

$ 36.56 $ 34.59 $

33.83 $ 32.56 $ 28.51

(1) Revised to reflect net presentation of

revenues for certain customer contracts. Previously reported

revenues were $128,937, $122,996, $120,994 and $126,992 for the

prior four quarters from 9/30/2013 to 12/31/2012, respectively.

Use of Non-GAAP

Measures

This earnings release contains financial measures that are not

calculated in accordance with U.S. generally accepted accounting

principles ("GAAP"). In general, the measures exclude items and

charges that (i) management does not believe reflect Owens &

Minor, Inc.'s (the "Company") core business and relate more to

strategic, multi-year corporate activities; or (ii) relate to

activities or actions that may have occurred over multiple or in

prior periods without predictable trends. Management uses these

non-GAAP financial measures internally to evaluate the Company's

performance, evaluate the balance sheet, engage in financial and

operational planning and determine incentive compensation.

Management provides these non-GAAP financial measures to

investors as supplemental metrics to assist readers in assessing

the effects of items and events on its financial and operating

results and in comparing the Company's performance to that of its

competitors. However, the non-GAAP financial measures used by the

Company may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other

companies.

The non-GAAP financial measures disclosed by the Company should

not be considered a substitute for, or superior to, financial

measures calculated in accordance with GAAP, and the financial

results calculated in accordance with GAAP and reconciliations to

those financial statements set forth above should be carefully

evaluated.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(in thousands)

Three Months Ended December 31, Twelve

Months Ended December 31, 2013 2012

2013 2012 % of % of % of % of

consolidated consolidated consolidated consolidated

Amount

net revenue Amount net revenue

Amount net revenue Amount net

revenue

Net revenue: Domestic

$ 2,213,949

95.49% $ 2,197,932 95.80%

$ 8,688,018

95.77% $ 8,731,484 98.46% International

104,575

4.51% 96,276 4.20%

383,514

4.23% 136,839 1.54% Consolidated net revenue

$

2,318,524 100.00% $ 2,294,208 100.00%

$ 9,071,532 100.00% $ 8,868,323

100.00% % of segmentnet revenue % of segmentnet

revenue % of segmentnet revenue % of segmentnet revenue

Operating earnings (loss): Domestic

$ 56,568

2.56% $ 51,546 2.35%

$ 211,932 2.44% $

212,335 2.43% International

1,415 1.35% (4,788 )

(4.97)%

(1,405 ) (0.37)% (5,418 ) (3.96)%

Acquisition-related and exit and realignment charges

(7,049

) N/A (1,717 ) N/A

(12,444 ) N/A

(10,164 ) N/A Consolidated operating earnings

$

50,934 2.20% $ 45,041 1.96%

$

198,083 2.18% $ 196,753 2.22%

Depreciation and amortization: Domestic

$

9,033 $ 9,121

$ 35,808 $ 35,016 International

4,206 3,299

14,778 4,588

Consolidated depreciation and amortization

$ 13,239

$ 12,420

$ 50,586 $ 39,604

Capital expenditures: (1) Domestic

$ 8,295 $ 7,364

$ 42,802 $ 34,450

International

6,328 3,775

17,327

4,513 Consolidated capital expenditures

$

14,623 $ 11,139

$ 60,129

$ 38,963

December 31,

2013

December 31,

2012

Total assets: Domestic

$ 1,747,572 $ 1,730,396

International

474,565 386,114 Segment assets

2,222,137 2,116,510 Cash and cash equivalents

101,905

97,888 Consolidated total assets

$

2,324,042 $ 2,214,398 (1) Represents

additions to property and equipment and additions to computer

software and separately acquired intangible assets.

Owens & Minor, Inc.

Net Income Per Common Share

(unaudited)

(in thousands, except per share data)

Three Months Ended December 31, Twelve

Months Ended December 31, 2013 2012

2013 2012 Numerator: Net income

$

27,942 $ 24,934

$ 110,882 $ 109,003 Less:

income allocated to unvested restricted shares

(193 )

(173 )

(738 ) (749 ) Net income attributable to

common shareholders - basic

27,749 24,761

110,144

108,254 Add: undistributed income attributable to unvested

restricted shares -basic

67 61

257 292 Less:

undistributed income attributable to unvested restricted shares

-diluted

(67 ) (61 )

(257 ) (292 )

Net income attributable to common shareholders - diluted

$ 27,749 $ 24,761

$

110,144 $ 108,254 Denominator: Weighted

average shares outstanding — basic

62,446 62,671

62,625 62,765 Dilutive shares - stock options

21

67

36 79

Weighted average

shares outstanding — diluted 62,467 62,738

62,661 62,844 Net income per

share attributable to common shareholders: Basic

$

0.44 $ 0.40

$ 1.76 $ 1.72 Diluted

$

0.44 $ 0.39

$ 1.76 $ 1.72

Owens & Minor, Inc.Truitt Allcott, Director, Investor &

Media Relations, 804-723-7555,

truitt.allcott@owens-minor.comorChuck Graves, Director, Finance

& Investor Relations,

804-723-7556,chuck.graves@owens-minor.com

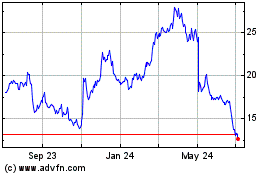

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

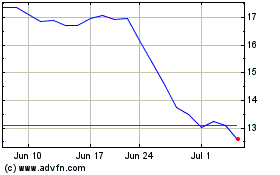

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Apr 2023 to Apr 2024