|

PROSPECTUS

|

Filed pursuant to 424(b)(3)

Registration No. 333-192141

|

244,500,000 Shares of Common Stock

LIBERTY STAR URANIUM & METALS CORP.

This prospectus relates to the resale of up to 244,500,000

shares of common stock of Liberty Star Uranium & Metals Corp. (“we” or the

“Company”), par value $0.00001 per share, issuable to KVM pursuant to that

certain investment agreement. The investment agreement permits us to “put” up to

$8,000,000 in shares of our common stock to KVM over a period of up to

thirty-six (36) months. We will not receive any proceeds from the resale of

these shares of common stock. However, we will receive proceeds from the sale of

securities pursuant to our exercise of the put right offered by KVM. KVM is

deemed an underwriter for our common stock.

The selling stockholder may offer all or part of the shares for

resale from time to time through public or private transactions, at either

prevailing market prices or at privately negotiated prices. KVM is paying all of

the registration expenses incurred in connection with the registration of the

shares except for accounting fees and expenses and we will not pay any of the

selling commissions, brokerage fees and related expenses.

Our common stock is quoted on the OTCQB under the ticker symbol “LBSR.”

On January 14, 2014, the closing price of our common stock was $0.02 per share.

Investing in our common stock involves a high degree of

risk. See “Risk Factors” beginning on page 5 to read about factors you should

consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE

SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus Is: January 27, 2014

3

TABLE OF CONTENTS

4

PROSPECTUS SUMMARY

This summary highlights selected information contained

elsewhere in this Prospectus. This summary does not contain all the information

that you should consider before investing in the common stock of Liberty Star

Uranium & Metals Corp. (referred to herein as the “Company,” “Liberty Star,”

“we,” “our,” and “us”). You should carefully read the entire Prospectus,

including “Risk Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and the financial statements before making

an investment decision.

Business Overview

We were formerly Liberty Star Gold Corp. and formerly Titanium

Intelligence, Inc. (“Titanium”). Titanium was incorporated on August 20, 2001

under the laws of the State of Nevada. On February 5, 2004 we commenced

operations in the acquisition and exploration of mineral properties business.

Big Chunk Corp. (“Big Chunk”) is our wholly owned subsidiary and was

incorporated on December 14, 2003 in the State of Alaska. Big Chunk is engaged

in the acquisition and exploration of mineral properties business in the State

of Alaska. Redwall Drilling Inc. (“Redwall”) was our wholly owned subsidiary and

was incorporated on August 31, 2007 in the State of Arizona. Redwall performed

drilling services on the Company’s mineral properties. Redwall ceased drilling

activities in July 2008 and was dissolved on March 30, 2010. In April 2007, we

changed our name to Liberty Star Uranium & Metals Corp. to reflect our

current efforts on uranium, copper, gold, silver, lead, zinc and other mineral

and metal exploration. We are considered to be an exploration stage company, as

we have not generated any revenues from operations. A more detailed discussion

of this technology and its anticipated benefits is provided under the section

“Description of Business”.

Our common stock is traded over-the-counter on the OTCQB under

the ticker symbol “LBSR.”

Investment Agreement with KVM

On October 30, 2013, we entered into an investment agreement with KVM Capital Partners LLC, a New York limited liability company (“KVM”). Pursuant to the terms of the KVM Investment Agreement, KVM committed to purchase up to $8,000,000 of our common stock over a period of up to thirty-six (36) months. From time to time during the thirty-six (36) months period commencing from the effectiveness of the registration statement, we may deliver a put notice to KVM which states the dollar amount that we intend to sell to KVM on a date specified in the put notice. The maximum investment amount per notice shall be no more than two hundred and fifty percent (250%) of the average daily volume of the common stock up to $250,000 for the ten consecutive trading days immediately prior to date of the applicable put notice. The purchase price per share to be paid by KVM shall be calculated at a twenty percent (20%) discount to the lowest volume weighted average price of the common stock as reported by Bloomberg, L.P. during the five (5) consecutive trading days immediately prior to the receipt by KVM of the put notice. We initially reserved 244,500,000 shares of our common stock for issuance under the KVM Investment Agreement.

In connection with the KVM Investment Agreement, we also entered into a registration rights agreement with KVM, pursuant to which we are obligated to file a registration statement with the SEC covering 244,500,000 shares of our common stock underlying the KVM Investment Agreement within 21 days after the closing of the transaction. In addition, we are obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC and maintain the effectiveness of such registration statement until termination of the KVM Investment Agreement.

The 244,500,000 shares to be registered herein represent 29.40% of the shares issued and outstanding, assuming that the selling stockholder will sell all of the shares offered for sale. The 244,500,000 shares to be registered herein represent 33.2% of the shares issued and outstanding held by non-affiliates of the Company.

The KVM Investment Agreement is not transferable and any benefits attached thereto may not be assigned.

At an assumed purchase price of $0.016 (equal to 80% of the closing price of our common stock of $0.02 on

January 14, 2014), we will be able to receive up to $3,912,000 in gross proceeds, assuming the sale of the entire 244,500,000 shares being registered hereunder pursuant to the KVM Investment Agreement. We agreed to register 244,500,000 shares of our common stock to register the maximum amount of shares permitted under Rule 415. Accordingly, we would be required to register additional 255,500,000 shares to obtain the balance of $4,088,000 under the KVM Investment Agreement. We are currently authorized to issue 1,250,000,000 shares of our common stock. We may be required to increase our authorized shares in order to receive the entire purchase price. KVM has agreed to refrain from holding an amount of shares which would result in KVM owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

5

There are substantial risks to investors as a result of the

issuance of shares of our common stock under the KVM Investment Agreement. These

risks include dilution of stockholders’ percentage ownership, significant

decline in our stock price and our inability to draw sufficient funds when

needed.

KVM will periodically purchase our common stock under the KVM

Investment Agreement and will, in turn, sell such shares to investors in the

market at the market price. This may cause our stock price to decline, which

will require us to issue increasing numbers of common shares to KVM to raise the

same amount of funds, as our stock price declines.

The aggregate investment amount of $8 million was determined based on numerous factors, including the following: the Company is involved in the Hay Mountain Super Project for copper, molybdenum, gold and silver in South East Arizona. These monies will be

completely absorbed by technical activities, drilling and attendant environmental, archeological and permitting studies. The Company will need the full amount of $8 million funding under the KVM Investment Agreement to fund the preparation and initiation of diamond core drilling connected to the Hay Mountain Super Project Porphyry Copper-Gold-Molybdenum-Rare Earth Element Mining Target in the Tombstone Mining District of Cochise County, Arizona. We may have to increase the number of our authorized shares in order to issue the shares to KVM if we reach our current amount of authorized shares of common stock. Accordingly, because our ability to draw down any amounts under the KVM Investment Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the proceeds of $8,000,000 under the KVM Investment Agreement. We believe that it is likely that we will be able to drawn down on the full amount of the Agreement, however, prior to drawing down on the full amount, we may not be able to draw down on the full amount without filing an amendment to our Articles of Incorporation to increase the Company’s authorized shares of common stock. Pursuant to state law, the filing of the amendment to increase the authorized shares of common stock may require board and shareholder approval. As such, we cannot make any guarantee that we will be successful in accessing the full amount under the equity line.

Where You Can Find Us

Our principal office is located at 5610 E Sutler Lane, Tucson, Arizona 85712. Our telephone number is (520) 731-8786.

THE OFFERING

Common stock outstanding

before the

offering

|

832,747,859 shares of common stock as of January 15, 2014.

|

|

|

|

|

Common stock outstanding after

the offering

|

1,077,247,859 shares of common stock.

|

|

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares

by the selling stockholder. However, we will receive proceeds from the

sale of securities pursuant to the KVM Investment Agreement. The proceeds

received under the KVM Investment Agreement will be used for general

corporate and working capital purposes and acquisitions or assets,

businesses or operations or for other purposes that the Board of

Directors, in its good faith deem to be in the best interest of the

Company.

|

|

|

|

|

OTCQB Trading Symbol

|

LBSR

|

|

|

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of

risk and should not be purchased by investors who cannot afford the loss

of their entire investment. See “Risk Factors”.

|

RISK FACTORS

You should carefully consider the risks described below

together with all of the other information included in this Prospectus before

making an investment decision with regard to our securities. The statements

contained in or incorporated into this Prospectus that are not historic facts

are forward-looking statements that are subject to risks and uncertainties that

could cause actual results to differ materially from those set forth in or

implied by forward-looking statements. If any of the following risks actually

occurs, our business, financial condition or results of operations could be

harmed. In that case, the trading price of our common stock could decline, and

you may lose all or part of your investment.

6

Much of the information included in this annual report includes

or is based upon estimates, projections or other "forward-looking statements".

Such forward-looking statements include any projections or estimates made by us

and our management in connection with our business operations.

While these forward-looking statements, and any assumptions upon which they are

based, are made in good faith and reflect our current judgment regarding the

direction of our business, actual results will almost always vary, sometimes

materially, from any estimates, predictions, projections, assumptions or other

future performance suggested herein.

Such estimates, projections or other "forward-looking

statements" involve various risks and uncertainties as outlined below. We

caution the reader that important factors in some cases have affected and, in

the future, could materially affect actual results and cause actual results to

differ materially from the results expressed in any such estimates, projections

or other "forward-looking statements".

RISKS RELATED TO OUR BUSINESS

BECAUSE OF THE SPECULATIVE NATURE OF THE EXPLORATION OF

NATURAL RESOURCE PROPERTIES, THERE IS SUBSTANTIAL RISK THAT THIS BUSINESS WILL

FAIL.

There is no assurance that any of the claims we explore or

acquire will contain commercially exploitable reserves of minerals. Exploration

for natural resources is a speculative venture involving substantial risk.

Hazards such as unusual or unexpected geological formations and other conditions

often result in unsuccessful exploration efforts. We may also become subject to

significant liability for pollution or hazards, which we cannot insure or which

we may elect not to insure. There is substantial risk that our business will

fail.

IF WE CANNOT COMPETE SUCCESSFULLY FOR FINANCING AND FOR

QUALIFIED MANAGERIAL AND TECHNICAL EMPLOYEES, OUR EXPLORATION PROGRAM MAY

SUFFER.

Our competition in the mining industry includes large

established mining companies with substantial capabilities and with greater

financial and technical resources than we have. As a result of this competition,

we may be unable to acquire additional financing on terms we consider acceptable

because investors may choose to invest in our competitors instead of investing

in us. We also compete with other mining companies in the recruitment and

retention of qualified managerial and technical employees. Our success will be

largely dependent on our ability to hire and retain highly qualified personnel.

These individuals are in high demand and we may not be able to attract the

personnel we need. We may not be able to afford the high salaries and fees

demanded by qualified personnel, or may lose such employees after they are

hired. If we are unable to successfully compete for financing or for qualified

employees, our exploration program may be slowed down or suspended.

EXPLORATION AND EXPLOITATION ACTIVITIES ARE SUBJECT TO

COMPREHENSIVE REGULATION WHICH MAY CAUSE SUBSTANTIAL DELAYS OR REQUIRE CAPITAL

OUTLAYS IN EXCESS OF THOSE ANTICIPATED CAUSING AN ADVERSE EFFECT ON OUR COMPANY.

Exploration and exploitation activities are subject to federal,

state, and local laws, regulations and policies, including laws regulating the

removal of natural resources from the ground and the discharge of materials into

the environment. Exploration and exploitation activities are also subject to

federal, state, and local laws and regulations which seek to maintain health and

safety standards by regulating the design and use of drilling methods and

equipment.

Various permits from government bodies are required for

drilling operations to be conducted; no assurance can be given that such permits

will be received. Environmental and other legal standards imposed by federal,

state, or local authorities may be changed and any such changes may prevent us

from conducting planned activities or increase our costs of doing so, which

would have material adverse effects on our business. Moreover, compliance with

such laws may cause substantial delays or require capital outlays in excess of

those anticipated, thus causing an adverse effect on us. Additionally, we may be

subject to liability for pollution or other environmental damages which we may

not be able to or elect not to insure against due to prohibitive premium costs

and other reasons. Any laws, regulations or policies of any government body or

regulatory agency may be changed, applied or interpreted in a manner which will

alter and negatively affect our ability to carry on our business.

7

THERE ARE NO KNOWN RESERVES OF MINERALS ON OUR MINERAL

CLAIMS AND WE CANNOT GUARANTEE THAT WE WILL FIND ANY COMMERCIAL QUANTITIES OF

MINERALS.

We have not found any mineral reserves on our claims and there

can be no assurance that any of our mineral claims contain commercial quantities

of any minerals. Even if we identify commercial quantities of minerals in any of

our claims, there can be no assurance that we will be able to exploit the

reserves or, if we are able to exploit them, that we will do so on a profitable

basis.

BECAUSE THE PROBABILITY OF AN INDIVIDUAL PROSPECT EVER

HAVING RESERVES IS EXTREMELY REMOTE, ANY FUNDS SPENT ON EXPLORATION WILL

PROBABLY BE LOST.

The probability of an individual prospect ever having reserves

is extremely remote. In all probability our properties do not contain any

reserves. As such, any funds spent on exploration will probably be lost which

would most likely result in a loss of your investment.

RISKS RELATED TO OUR COMPANY

WE HAVE A LIMITED OPERATING HISTORY AND AS A RESULT THERE IS

NO ASSURANCE WE CAN OPERATE ON A PROFITABLE BASIS.

We have a limited operating history and must be considered in

the exploration stage. Our operations will be subject to all the risks inherent

in the establishment of an exploration stage enterprise and the uncertainties

arising from the absence of a significant operating history. Potential investors

should be aware of the difficulties normally encountered by mineral exploration

companies and the high rate of failure of such enterprises, especially those

with a limited operating history. The likelihood of success must be considered

in light of the problems, expenses, difficulties, complications and delays

encountered in connection with the exploration of the mineral properties that we

plan to undertake. These potential problems include, but are not limited to,

unanticipated problems relating to exploration, and additional costs and

expenses that may exceed current estimates. The expenditures to be made by us in

the exploration of the mineral claim may not result in the discovery of mineral

deposits. Problems such as unusual or unexpected formations of rock or land and

other conditions are involved in mineral exploration and often result in

unsuccessful exploration efforts. If the results of our exploration do not

reveal viable commercial mineralization, we may decide to abandon our claim and

acquire new claims for new exploration or cease operations. The acquisition of

additional claims will be dependent upon us possessing capital resources at the

time in order to purchase such claims. If no funding is available, we may be

forced to abandon our operations. No assurance can be given that we will ever

operate on a profitable basis.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL

FAIL AND OUR INVESTORS COULD LOSE THEIR INVESTMENT.

We had cash in the amount of $90,966 and negative working capital of $(5,770,168) as of

October 31, 2013. We currently do not generate revenues from our operations. Our business plan calls for substantial investment and cost in connection with the acquisition and exploration of our mineral properties currently under lease and option. Any direct acquisition of any of the claims under lease or option is subject to our ability to obtain the financing necessary for us to fund and carry out exploration programs on the subject properties. The requirements are substantial. There is no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on their investment in our common stock. Further, we may continue to be unprofitable. Obtaining additional financing would be subject to a number of factors, including market prices for minerals, investor acceptance of our properties, contractual restrictions on our ability to enter into further financing arrangements, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us and our business could fail.

BECAUSE THERE IS NO ASSURANCE THAT WE WILL GENERATE

REVENUES, WE FACE A HIGH RISK OF BUSINESS FAILURE.

8

We have not earned any revenues as of the date of this filing and have never been profitable. We do not have an interest in any revenue generating properties. We were incorporated on August 20, 2001 and took over our current business on February 5, 2004. To date we have been involved primarily in organizational and exploration activities. We will incur substantial operating and exploration expenditures without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We have limited operating history upon which an evaluation of our future success or failure can be made. Our net loss from inception to

October 31, 2013 is $(65,874,190). We recognize that if we are unable to generate significant revenues from our activities, we will not be able to earn profits or continue operations. Based upon current plans, we also expect to incur significant operating losses in the future. We cannot guarantee that we will be successful in raising capital to fund these operating losses or generate revenues in the future. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail and our investors could lose their investment.

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM'S REPORT

STATES THAT THERE IS A SUBSTANTIAL DOUBT THAT WE WILL BE ABLE TO CONTINUE AS A

GOING CONCERN.

Our independent registered public accounting firm, Malone

Bailey LLP, state in their audit report attached to our audited financial

statements for the fiscal year ended January 31, 2013 that since we are an

exploration stage company, have no established source of revenue and are

dependent on our ability to raise capital from shareholders or other sources to

sustain operations, there is a substantial doubt that we will be able to

continue as a going concern

.

THE EXISTENCE OF OUR MINING CLAIMS DEPENDS ON OUR ABILITY TO

FUND EXPLORATORY ACTIVITY OR TO PAY FEES.

Our mining claims, which are the central part of our business,

require that we either pay fees, or incur certain minimum development costs

annually, or the claims will be forfeited. Due to our current financial

situation we may not be able to meet these obligations and we could therefore

lose our claims. This would impair our ability to raise capital and would

negatively impact the value of the Company.

RISKS RELATED TO OUR COMMON STOCK

BECAUSE WE WILL LIKELY ISSUE ADDITIONAL SHARES OF OUR COMMON

STOCK, INVESTMENT IN OUR COMPANY COULD BE SUBJECT TO SUBSTANTIAL DILUTION.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share when we issue additional shares. Our formation documents previously authorized the issuance of up to 200,000,000 shares of common stock with a par value of $0.001. At our shareholder meeting held on May 27, 2009 the shareholders voted to increase the number of authorized shares to 10,000,000,000 shares of common stock with a par value of $0.001. We filed a certificate of amendment on June 4, 2009 to increase the number of authorized shares to 5,000,000,000 shares of common stock with a par value of $0.001. On September 1, 2009 we completed a one for four reverse stock split of our authorized and outstanding common stock resulting in a decrease in authorized shares to 1,250,000,000 with a par value of $0.00001. As of

January 15, 2014, there were 832,747,859 of our common shares issued and outstanding. We anticipate that all or at least some of our future funding, if any, will be in the form of equity financing from the sale of our common stock. If we do sell more common stock, investors' investment in our company will likely be diluted. Dilution is the difference between what you pay for your stock and the net tangible book value per share immediately after the additional shares are sold by us. If dilution occurs, any investment in our company's common stock could seriously decline in value.

THE SALE OF OUR STOCK UNDER THE CONVERTIBLE NOTES AND THE

COMMON SHARE PURCHASE WARRANTS COULD ENCOURAGE SHORT SALES BY THIRD PARTIES,

WHICH COULD CONTRIBUTE TO THE FUTURE DECLINE OF OUR STOCK PRICE.

9

In many circumstances, the provision of financing based on the distribution of equity for companies that are traded on the OTC Bulletin Board has the potential to cause a significant downward pressure on the price of common stock. This is especially

the case if the shares being placed into the market exceed the market's ability to take up the increased stock or if we have not performed in such a manner to show that the equity funds raised will be used to grow our business. Such an event could

place further downward pressure on the price of our common stock. Regardless of our activities, the opportunity exists for short sellers and others to contribute to the future decline of our stock price. If there are significant short sales of our

common stock, the price decline that would result from this activity will cause the share price to decline more, which may cause other shareholders of the stock to sell their shares, thereby contributing to sales of common stock in the market. If

there are many more shares of our common stock on the market for sale than the market will absorb, the price of our common shares will likely decline.

TRADING IN OUR COMMON STOCK ON THE OTCQB IS LIMITED AND SPORADIC MAKING IT DIFFICULT FOR OUR SHAREHOLDERS TO SELL THEIR SHARES OR LIQUIDATE THEIR INVESTMENTS.

Our common stock is currently listed for public trading on the OTCQB. The trading price of our common stock has been subject to wide fluctuations. Trading prices of our common stock may fluctuate in response to a number of factors, many of which

will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can

be no assurance that trading prices and price earnings ratios previously experienced by our common stock will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common stock, regardless of

our operating performance. In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs

for us and a diversion of management's attention and resources.

OUR BY-LAWS CONTAIN PROVISIONS INDEMNIFYING OUR OFFICERS AND DIRECTORS AGAINST ALL COSTS, CHARGES AND EXPENSES INCURRED BY THEM.

Our By-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him,

including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

OUR BY-LAWS DO NOT CONTAIN ANTI-TAKEOVER PROVISIONS WHICH COULD RESULT IN A CHANGE OF OUR MANAGEMENT AND DIRECTORS IF THERE IS A TAKE-OVER OF OUR COMPANY.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and

directors. This could result in a disruption to the activities of our company, which could have a material adverse effect on our operations.

WE DO NOT INTEND TO PAY DIVIDENDS ON ANY INVESTMENT IN THE SHARES OF STOCK OF OUR COMPANY AND ANY GAIN ON AN INVESTMENT IN OUR COMPANY WILL NEED TO COME THROUGH AN INCREASE IN OUR STOCK'S PRICE, WHICH MAY NEVER HAPPEN.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit

the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in the stock's price. This may never happen and investors may lose all of their investment in

our company.

10

BECAUSE OUR SECURITIES ARE SUBJECT TO PENNY STOCK RULES, YOU MAY HAVE DIFFICULTY RESELLING YOUR SHARES.

Our shares as penny stocks, are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell our company's securities including the delivery of a standardized

disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. These rules apply to companies whose shares are not traded on a national stock

exchange or on the Nasdaq system, trade at less than $5.00 per share, or who do not meet certain other financial requirements specified by the Securities and Exchange Commission. These rules require brokers who sell "penny stocks" to persons

other than established customers and "accredited investors" to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning the risks of trading in such penny stocks. These rules

may discourage or restrict the ability of brokers to sell our shares of common stock and may affect the secondary market for our shares of common stock. These rules could also hamper our ability to raise funds in the primary market for our shares of

common stock.

FINRA SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT A STOCKHOLDER'S ABILITY TO BUY AND SELL OUR STOCK.

In addition to the "penny stock" rules described above, the Financial Industry Regulatory Authority (known as "FINRA") has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for

believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's

financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers.

FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

KVM WILL PAY LESS THAN THE THEN-PREVAILING MARKET PRICE FOR OUR COMMON STOCK.

The Common Stock to be issued to KVM pursuant to the KVM Investment Agreement will be purchased at a 20% discount to the lowest trading price of our Common Stock during the five (5) consecutive trading days immediately before KVM receives our notice

of sale. KVM has a financial incentive to sell our Common Stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If KVM sells the shares, the price of our Common

Stock could decrease. If our stock price decreases, KVM may have a further incentive to sell the shares of our Common Stock that it holds. These sales may have a further impact on our stock price.

YOUR OWNERSHIP INTEREST MAY BE DILUTED AND THE VALUE OF OUR COMMON STOCK MAY DECLINE BY EXERCISING THE PUT RIGHT PURSUANT TO THE KVM INVESTMENT AGREEMENT.

Pursuant to the KVM Investment Agreement, when we deem it necessary, we may raise capital through the private sale of our Common Stock to KVM at a price equal to a discount to the lowest volume weighted average price of the common stock for the five

(5) consecutive trading days before KVM receives our notice of sale. Because the put price is lower than the prevailing market price of our Common Stock, to the extent that the put right is exercised, your ownership interest may be diluted.

WE ARE REGISTERING AN AGGREGATE OF 244,500,000 SHARES OF COMMON STOCK TO BE ISSUED UNDER THE KVM INVESTMENT AGREEMENT. THE SALES OF SUCH SHARES COULD DEPRESS THE MARKET PRICE OF OUR COMMON STOCK.

We are registering an aggregate of 244,500,000 shares of Common Stock under the registration statement of which this prospectus is a part, pursuant to the KVM Investment Agreement. Notwithstanding KVM’s ownership limitation, the 244,500,000 shares would represent approximately 22.70% of our shares of Common Stock outstanding immediately after our exercise of the put right under the Investment Agreement. The sale of these shares into the public market by KVM could depress the market price of our Common Stock.

11

WE MAY NOT HAVE ACCESS TO THE FULL AMOUNT AVAILABLE UNDER

THE

KVM INVESTMENT AGREEMENT.

Our ability to draw down funds and sell shares under the KVM Investment Agreement requires that this resale registration statement be declared effective and continue to be effective. This registration statement registers the resale of 244,500,000 shares issuable under the KVM Investment Agreement, and our ability to sell any remaining shares issuable under the KVM Investment Agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured. The effectiveness of these registration statements is a condition precedent to our ability to sell all of the shares of Common Stock to KVM under the KVM Investment Agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the KVM Investment Agreement to be declared effective by the SEC in a timely manner, we may not be able to sell the shares unless certain other conditions are met. For example, we might have to increase the number of our authorized shares in order to issue the shares to KVM. Accordingly, because our ability to draw down any amounts under the KVM Investment Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the proceeds of $8,000,000 under the KVM Investment Agreement. We believe that it is likely that we will be able to drawn down on the full amount of the Agreement, however, prior to drawing down on the full amount, we may not be able to draw down on the full amount without filing an amendment to our Articles of Incorporation to increase the Company’s authorized shares of common stock. Pursuant to state law, the filing of the amendment to increase the authorized shares of common stock may require board and shareholder approval. As such, we cannot make any guarantee that we will be successful in accessing the full amount under the KVM Investment Agreement.

CERTAIN RESTRICTIONS ON THE EXTENT OF PUTS AND THE DELIVERY OF ADVANCE NOTICES MAY HAVE LITTLE, IF ANY, EFFECT ON THE ADVERSE IMPACT OF OUR ISSUANCE OF SHARES IN CONNECTION WITH THE KVM INVESTMENT AGREEMENT, AND AS SUCH, KVM MAY SELL A LARGE NUMBER OF SHARES, RESULTING IN SUBSTANTIAL DILUTION TO THE VALUE OF SHARES HELD BY EXISTING SHAREHOLDERS.

KVM has agreed, subject to certain exceptions listed in the KVM

Investment Agreement, to refrain from holding an amount of shares which would

result in KVM or its affiliates owning more than 4.99% of the then-outstanding

shares of our Common Stock at any one time. These restrictions, however, do not

prevent KVM from selling shares of Common Stock received in connection with a

put, and then receiving additional shares of Common Stock in connection with a

subsequent put. In this way, KVM could sell more than 4.99% of the outstanding

Common Stock in a relatively short time frame while never holding more than

4.99% at one time.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains certain forward-looking statements.

When used in this Prospectus or in any other presentation, statements which are

not historical in nature, including the words “anticipate,” “estimate,”

“should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,”

and similar expressions are intended to identify forward-looking statements.

They also include statements containing a projection of revenues, earnings or

losses, capital expenditures, dividends, capital structure or other financial

terms.

The forward-looking statements in this Prospectus are based

upon our management’s beliefs, assumptions and expectations of our future

operations and economic performance, taking into account the information

currently available to them. These statements are not statements of historical

fact. Forward-looking statements involve risks and uncertainties, some of which

are not currently known to us that may cause our actual results, performance or

financial condition to be materially different from the expectations of future

results, performance or financial condition we express or imply in any

forward-looking statements. These forward-looking statements are based on our

current plans and expectations and are subject to a number of uncertainties and

risks that could significantly affect current plans and expectations and our

future financial condition and results.

We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise. In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this Prospectus might not occur. We qualify

any and all of our forward-looking statements entirely by these cautionary

factors. As a consequence, current plans, anticipated actions and future

financial conditions and results may differ from those expressed in any

forward-looking statements made by or on our behalf. You are cautioned not to

unduly rely on such forward-looking statements when evaluating the information

presented herein.

12

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares by the

selling stockholder. However, we will receive proceeds from the sale of

securities pursuant to the KVM Investment Agreement. The proceeds received from

any “Puts” tendered to KVM under the KVM Investment Agreement will be used for

general corporate and working capital purposes and acquisitions or assets,

businesses or operations or for other purposes that the Board of Directors, in

its good faith deem to be in the best interest of the Company.

DILUTION

The sale of our common stock to KVM in accordance with the KVM

Investment Agreement will have a dilutive impact on our shareholders. As a

result, our net loss per share could increase in future periods and the market

price of our common stock could decline. In addition, the lower our stock price

is at the time we exercise our put option, the more shares of our common stock

we will have to issue to KVM in order to drawdown pursuant to the KVM Investment

Agreement. If our stock price decreases during the Pricing Period, then our

existing shareholders would experience greater dilution.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Public Market for Common Stock

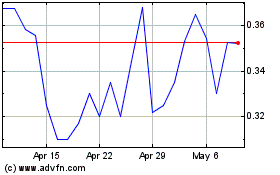

The following table summarizes the high and low historical

closing prices reported by the OTCQB Historical Data Service for the periods

indicated. OTCQB quotations reflect inter-dealer prices, without retail mark-up,

mark down or commissions, so those quotes may not represent actual transactions.

|

Quarter Ended

|

High

|

Low

|

|

October 31, 2013

|

$0.041

|

$0.018

|

|

July 31, 2013

|

$0.0237

|

$0.0083

|

|

April 30, 2013

|

$0.0169

|

$0.0096

|

|

January 31, 2013

|

$0.024

|

$0.0109

|

|

October 31, 2012

|

$0.0345

|

$0.022

|

|

July 31, 2012

|

$0.0405

|

$0.017

|

|

April 30, 2012

|

$0.0387

|

$0.0202

|

|

January 31, 2012

|

$0.00

|

$0.00

|

|

October 31, 2011

|

$0.00

|

$0.00

|

|

July 31, 2011

|

$0.00

|

$0.00

|

|

April 30, 2011

|

$0.042

|

$0.00

|

Holders

On January 15, 2014, the shareholders' list for our common stock showed 832,747,859 shares issued and outstanding with 96 registered stockholders and approximately 8,500 stockholders whose names and contact information we have and an unknown number of unregistered stockholders whose shares are held in their brokerage accounts.

Dividends

13

There are no restrictions in our articles of incorporation or

bylaws that restrict us from declaring dividends. The Nevada Revised Statutes,

however, do prohibit us from declaring dividends where, after giving effect to

the distribution of the dividend:

|

|

1.

|

we would not be able to pay our debts as they become due

in the usual course of business; or

|

|

|

|

|

|

|

2.

|

our total assets would be less than the sum of our total

liabilities, plus the amount that would be needed to satisfy the rights of

shareholders who have preferential rights superior to those receiving the

distribution.

|

We have not declared any dividends. We do not plan to declare

any dividends in the foreseeable future.

Equity Compensation Plans

Other than the shares of common stock to be issued to Mr.

Ferris under his Employment Agreement, as described more fully in “Executive

Compensation” below, we have no equity compensation program, including no stock

option plan, and none are planned for the foreseeable future.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Our discussion includes forward-looking statements based

upon current expectations that involve risks and uncertainties, such as our

plans, objectives, expectations and intentions. Actual results and the timing of

events could differ materially from those anticipated in these forward-looking

statements as a result of a number of factors, including those set forth under

the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and

Business sections in this Prospectus. We use words such as “anticipate,”

“estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,”

“intend,” “may,” “will,” “should,” “could,” and similar expressions to identify

forward-looking statements.

Our Business

Liberty Star Uranium & Metals Corp. was formerly Liberty

Star Gold Corp. and formerly Titanium Intelligence, Inc. We were incorporated on

August 20, 2001 under the laws of the State of Nevada. Big Chunk is our wholly

owned subsidiary and was incorporated on December 14, 2003 in the State of

Alaska. Big Chunk is engaged in the acquisition and exploration of mineral

properties business in the State of Alaska. We are an exploration stage company,

as we have not generated revenues from operations. We use the term “Super

Project” to indicate a project in which numerous mineral targets have been

identified, any one or more of which could potentially contain commercially

viable quantities of minerals. Our significant projects are:

North Pipes Super Project (“NPSP”):

Located in Northern

Arizona on the Arizona Strip, we plan to ascertain whether the North Pipes Super

Project claims possess commercially viable deposits of uranium and associated

co-product metals. We have not identified any ore reserves to date.

Big Chunk Super Project (“Big Chunk”):

Located in the

Iliamna region of Southwestern Alaska, we plan to ascertain whether the Big

Chunk claims possess commercially viable deposits of copper, gold, molybdenum,

silver, palladium rhenium and zinc. We have not identified any ore reserves to

date.

Tombstone Super Project (“Tombstone”)(formerly referred to

as Tombstone Porphyry Precious Metals Project):

Tombstone is located in

Cochise County, Arizona. We plan to ascertain whether the land holding at the

Hay Mountain Project within the Tombstone Super Project area possess

commercially viable deposits of copper, molybdenum, gold, silver, lead, zinc,

manganese and other metals. While exploring for the afore said metals, we found

in addition to a very large porphyry copper style geochemical anomaly containing

those metals, we also found a very spatially large anomaly of Rare Earth

Elements (REE’s). This anomaly covers approximately seven to nine square miles.

It is still under evaluation but at this time, its symmetry , draped around the

east end of the porphyry anomaly, suggests they are related at least in space

and possibility genetically. Study is ongoing. Prior to this discovery there were no significant nor potentially minable anomalies of REEs, in Arizona. Because we have not drilled, we have not identified any ore reserves to date.

14

East Silver Bell Porphyry Copper Project (“East Silver Bell”):

Located northwest of Tucson, Arizona, we plan to ascertain whether the East Silver Bell claims possess commercially viable deposits of copper. We have not identified

any ore reserves to date.

The mineral resource business generally consists of three stages: exploration, development and production. Mineral resource companies that are in the exploration stage have not yet found mineral resources in commercially exploitable quantities, and

are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those

engaged in the extraction of a known mineral resource are in the production stage. We are in the exploration stage – as we have not found any mineral resources in commercially exploitable quantities.

There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically feasible to develop or

exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know

whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit). Please refer to the section entitled "Risk Factors" in this Form 10-Q and in our Form 10-K for the year ended January 31, 2013 for

additional information about the risks of mineral exploration.

To date, we have not generated any revenues and we remain in the exploration stage. Our ability to pursue our business plan and generate revenues is subject to our ability to obtain additional financing, and we cannot give any assurance that we will

be able to do so.

Agreement with Northern Dynasty Minerals Ltd

On July 15, 2010, we issued a secured convertible promissory note (the "2010 Convertible Note") to Northern Dynasty Minerals Ltd ("Northern Dynasty"). The original advanced amount is $4,000,000 and bears interest at a rate of 10% per annum

compounded monthly (the "Loan"). On August 17, 2010, we transferred 95 of our Alaska State mineral claims from the Big Chunk Super Project to Northern Dynasty for consideration of $1,000,000 of the original advanced amount under the Convertible

Note, leaving $3,000,000 of the Loan amount outstanding. No interest accrued on the $1,000,000 of the original advanced amount. Effective September 1, 2011, the agreement with Northern Dynasty was amended to increase the 2010 Convertible

Note by $561,816 to reimburse Northern Dynasty for assessment work, rental fees, cash in lieu of assessment work and filing fees on the mineral claims that was paid in fiscal 2011 and fiscal 2012 because we could not come to an agreement on an

earn-in option and joint venture agreement with Northern Dynasty. On February 29, 2012, with effect from November 30, 2011, we executed an additional convertible promissory note (the "2011 Convertible Note" and together with the 2010 Convertible

Note, the "Convertible Notes") in the amount of $168,358 in reimbursement to Northern Dynasty of assessment work, rental fees and filing fees on our mineral claims. The principal balance of the Convertible Notes at April 30, 2013 was

$3,730,174 with accrued interest on the Convertible Notes at April 30, 2013 at $1,088,222.

As part of the transactions noted above, we entered into a letter agreement with Northern Dynasty whereby, subject to negotiating and signing a definitive earn-in option and joint venture agreement, Northern Dynasty can earn a 60% interest in our

Big Chunk project in Alaska (the "Joint Venture Claims") by spending $10,000,000 on those properties over six years. Details of this agreement may be found in Liberty Star news releases and in the public record.

To date, no joint venture agreement has been agreed upon. Northern Dynasty has demanded payment of the funds due under the Convertible Notes. On November 14 2012 the Parties (NDM-U-5 Resources) and Liberty Star negotiated a settlement where in Liberty Star transferred a certain number of non critical mineral lands to NDM-U-5 Resources in satisfaction of the debt.

15

On November 14, 2012, we signed a loan settlement agreement with Northern Dynasty which would have discharged the $3,730,174 principal balance and $1,088,222 of accrued interest for the 2010 Convertible Note and would have terminated

Northern Dynasty’s earn-in rights. In exchange for the settlement, we initiated the transfer of 199 Alaska mining claims to Northern Dynasty’s subsidiary, U5 Resources. However, since a third party filed liens against the claims before

the transfer could be completed, we have not recorded the settlement transaction as of April 30, 2013, pending resolution of the lien claims. “We are unable to complete the settlement with Northern Dynasty while the lien claims are

outstanding. We are vigorously disputing the lien claims and working to have them vacated.

Financing Agreement with Deer Valley Capital Offshore Ltd.

On January 19, 2012, we entered into a financing agreement (the “Deer Valley Agreement”) with Deer Valley Capital Offshore Ltd. (“Deer Valley Capital”), whereby Deer Valley Capital will provide for a non-brokered financing

arrangement of up to $10,000,000. The financing allows but does not require us to issue and sell up to the number of shares of common stock having an aggregate purchase price of $10,000,000 to Deer Valley Capital. On May 1, 2012, we entered

into an amendment to the Investment Agreement (the “Amendment”). Pursuant to the Amendment, the Investment Agreement will only expire upon any of the following events: (i) when the Investor has purchased an aggregate of Ten Million

dollars ($10,000,000) in the shares of our common stock pursuant to the Investment Agreement; or (ii) on the date which is thirty-six (36) months after the effective date of the Investment Agreement; or (iii) at such time that the Registration

Statement registering the shares of common stock contemplated by the Investment Agreement is no longer in effect. In addition, we may terminate the Investment Agreement upon thirty (30) days written notice. Subject to the terms and conditions of the

Deer Valley Agreement and a registration rights agreement entered into concurrently (the “Registration Rights Agreement”), we may, in our sole discretion, deliver a notice to Deer Valley Capital which states the dollar amount which we

intend to sell to Deer Valley Capital on a certain date. The amount that we shall be entitled to sell to Deer Valley Capital shall be equal to two hundred percent (200%) of the average daily volume (U.S. market only) of our shares of common stock

for the ten (10) trading days prior to the applicable notice date. Such shares of our common stock will be valued at a 27.5% discount from the weighted average trading price of our stock for the five (5) trading days before Deer Valley Capital

receives our notice of sale. The shares of common stock that we sell to Deer Valley Capital must be registered stock, among other conditions of investment.

Pursuant to the Registration Rights Agreement, we agreed to file a registration statement on Form S-1 with the Securities and Exchange Commission within twenty-one (21) days of the date of the Registration Rights Agreement and to have a registration

statement declared effective by the Securities and Exchange Commission within one hundred and twenty (120) calendar days from January 19, 2012. The registration statement was filed on March 13, 2012 and has been declared effective. In August 2013,

we decided to terminate the Deer Valley Agreement due to their violation of the payment terms pursuant to the agreement. No further shares issuances to Deer Valley Management, LLC are expected to occur. On August 7, 2013, we filed a Post-Effective

Amendment to the registration statement, which de-registered the shares that were not sold under the registration statement. The amendment was declared effective on August 16, 2013.

Changes in Officers and Directors

On August 28, 2013, Larry Liang, resigned as the president and a director of our

company. On the same date, we appointed James Briscoe as president of our

company until a replacement is named.

Recent Development

s

KVM Investment Agreement

On October 30, 2013, we entered into an investment agreement with KVM Capital Partners LLC, a New York limited liability company (“KVM”). Pursuant to the terms of the KVM Investment Agreement, KVM committed to purchase up to $8,000,000 of our common stock over a period of up to thirty-six (36) months. From time to time during the thirty-six (36) months period commencing from the effectiveness of the registration statement, we may deliver a put notice to KVM which states the dollar amount that we intend to sell to KVM on a date specified in the put notice. The maximum investment amount per notice shall be no more than two hundred and fifty percent (250%) of the average daily volume of the common stock up to $250,000 for the ten consecutive trading days immediately prior to date of the applicable put notice. The purchase price per share to be paid by KVM shall be calculated at a twenty percent (20%) discount to the lowest volume weighted average price of the common stock as reported by Bloomberg, L.P. during the five (5) consecutive trading days immediately prior to the receipt by KVM of the put notice. We initially reserved 244,500,000 shares of our common stock for issuance under the KVM Investment Agreement.

16

In connection with the KVM Investment Agreement, we also entered into a registration rights agreement with KVM, pursuant to which we are obligated to file a registration statement with the SEC covering 244,500,000 shares of our common stock underlying the KVM Investment Agreement within 21 days after the closing of the transaction. In addition, we are obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC and maintain the effectiveness of such registration statement until termination of the KVM Investment Agreement.

The KVM Investment Agreement may not be transferred and the benefits attached thereto may not be assigned.

We plan to use the proceeds from the sale of the common stock under the KVM Investment Agreement for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of

Directors, in its good faith deem to be in the best interest of the Company.

Convertible Note Financing

On November 18, 2013, we entered into a securities purchase agreement, whereby

we agreed to issue a convertible note (the "Note") to one lender in the

principal amount of $250,000. The Note is payable in full on November 18, 2014

and bears no interest except in an event of default. Default interest and past

due amounts will accrue interest at the rate of 15% per annum or, if less, the

maximum rate permitted by applicable law, and will be payable on demand. The

Note was issued at a discount to the face value of $25,000, and closing costs

and fees were $10,000, so net proceeds to our company was $215,000, before

broker-dealer costs.

The lender may, at its option, convert the principal amount or any portion of

such principal amount of the Note into shares of common stock of our company at

the price equal to the lesser of (a) 100% of the volume weighted average price

(the "VWAP"), as reported on the closing date (November 18, 2013), and (b) 70%

of the average of the 5 day VWAP immediately prior to the day of conversion.

Results of Operations

Material Changes in Financial Condition for the Nine Month Period Ended

October 31, 2013

We had cash and cash equivalents in the amount of $90,996 as of October 31,

2013 compared to $117,716 as of January 31, 2013. We had negative working

capital of $5,770,168 as of October 31, 2013 compared to $(5,025,086) as of

January 31, 2013. We received $898,271 net cash inflows from financing

activities during the nine months ended October 31, 2013 which was utilized for

working capital. We also utilized our cash funds to continue exploration

activities at our Hay Mountain mineral lands by working on geochemical soil,

rock chip and vegetation sampling. We purchased $1,418 in new equipment during

the nine months ended October 31, 2013. We have been raising capital from

selling equity by way of private placements. We intend to continue to raise

capital from such sources. In addition, we previously entered into the

Investment Agreement with Deer Valley whereby we were permitted, but not

required, to issue and sell up to the number of shares of our common stock

having an aggregate purchase price of $10,000,000 to Deer Valley. In addition to

seeking sources of funding through the sale of equity, we may seek to enter into

joint venture agreements, or other types of agreements with other companies to

finance our projects for the long term. In addition, we may choose to sell a

portion of our assets to finance our projects. Should our properties prove to be

commercially viable, we may be in a position to seek debt financing to help

build infrastructure, and finally, we eventually hope to obtain revenues from

commercial mining of our properties.

Material Changes in Results of Operations for the Three and Nine Month Periods

Ended October 31, 2013 and October 31, 2012

We had a net loss of $770,426 and $1,798,142 for the three and nine months

ended October 31, 2013, respectively, compared to a net loss of $1,002,895 and

$2,010,349 for the three and nine months ended October 31, 2012, respectively.

During the three and nine months ended October 31, 2013 we incurred a decrease

of approximately $407,190 and $534,489, respectively, in geological and

geophysical costs compared to the three and nine months ended October 31, 2012

due to reduced geochemical sampling and mapping being performed on our Hay

Mountain project. We incurred an increase in legal expense of approximately

$25,333 and $83,951 during the three and nine months ended October 31, 2013,

respectively, as compared to the three and nine months ended October 31, 2012,

due to the costs associated with defending a lien claim by a former associate.

We incurred an increase in interest expense of approximately $11,389 and $34,363

during the three and nine months ended October 31, 2013, respectively, as

compared to the three and nine months ended October, 31, 2012 due to the

compounding effect this year compared to last year. We incurred an increase in

investor relation expenses of approximately $54,332 and $53,590 during the three

and nine months ended October 31, 2013, respectively, as compared to the three

and nine months ended October 31, 2012 due to our efforts to increase market

awareness and search for additional funding sources.

17

Results of Operations for the year ended January 31, 2013

We had a net loss of $(2,644,787) for the twelve-month period ended January 31, 2013 compared to a net loss of $(2,461,459) for the twelve-month period ended January 31, 2012. The two periods were comparable, and there were no significant

changes in the level of expenditures by category.

Liquidity and Capital Resources

In August, 2013, we entered into a promissory note (the "August 2013 Note") for

a principal sum of $555,000 plus accrued and unpaid interest and any other fees.

The consideration is up to $500,000, which would produce an original issue

discount of $55,000 if all the consideration is received. The lender paid

$150,000 upon closing pursuant to the terms of the August 2013 Note. The August

2013 Note has a maturity of one year from the delivery of each payment. The

August 2013 Note may be convertible into shares of common stock of our company

at any time from 180 days after the date of each payment of consideration. We

may repay the August 2013 Note at any time on or before 90 days from the

effective date of the August 2013 Note with an interest rate of 0%. If we elect

not to repay the August 2013 Note on or before 90 days from the effective date

of the August 2013 Note, a one-time interest charge of 12% will be applied to

the principal sum. On December 9, 2013, we received additional consideration of

$75,000 pursuant to the terms of the August 2013 Note.

On November 18, 2013, we entered into a securities purchase agreement, whereby

we agreed to issue a convertible note to one lender in the principal amount of

$250,000. The Note is payable in full on November 18, 2014 and bears no interest

except in an event of default.

Critical Accounting Policies

The condensed consolidated financial statements of Liberty Star have been prepared in conformity with accounting principles generally accepted in the United States of America. Our significant accounting policies are described in Note 2 to the

consolidated financial statements included in Item 8 in our Form 10-K for the year ended January 31, 2013. The critical accounting policies adopted by our company are as follows:

Going Concern

Since we have not generated any revenue, we have negative cash flows from operations, and negative working capital we have included a reference to the substantial doubt about our ability to continue as a going concern in connection with our

consolidated financial statements for the period ended October 31, 2013. Our total stockholders’ equity (deficit) at

October 31, 2013 was $(5,720,422).

These condensed consolidated financial statements have been prepared on the going concern basis, which assumes that adequate sources of financing will be obtained as required and that our assets will be realized, and liabilities settled in the

ordinary course of business. Accordingly, these condensed consolidated financial statements do not include any adjustments related to the recoverability of assets and classification of assets and liabilities that might be necessary should we be

unable to continue as a going concern.

Mineral claims

We account for costs incurred to acquire, maintain and explore mineral properties as charged to expense in the period incurred until the time that an ore body is established at which point development of the mineral property would be capitalized.

Currently, we do not have any proven mineral resources on any of our mineral properties.

Convertible promissory notes

We reviewed the convertible promissory notes and the related subscription agreements to determine the appropriate reporting within the financial statements. We report convertible promissory notes as liabilities at their carrying value less

unamortized discounts in accordance with the applicable accounting guidance. We bifurcate conversion options and detachable common stock purchase warrants, and report them as liabilities at fair value at each reporting period when required in

accordance with the applicable accounting guidance. No gain or loss is reported when the notes are converted into shares of our common stock in accordance with the note’s terms.

Common stock purchase warrants

We report common stock purchase warrants as equity unless a condition exists which requires reporting as a derivative liability at fair market value. For common stock purchase warrants reported as a derivative liability, as well as new and modified

warrants reported as equity, we utilize the Black-Scholes valuation method in order to determine fair value.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures

or capital resources that are material to stockholders.

18

DESCRIPTION OF BUSINESS

Business overview

Liberty Star Uranium & Metals Corp. was formerly Liberty

Star Gold Corp. and formerly Titanium Intelligence, Inc. (“Titanium”). Titanium

was incorporated on August 20, 2001 under the laws of the State of Nevada. On

February 5, 2004 we commenced operations in the acquisition and exploration of

mineral properties business. Big Chunk Corp. (“Big Chunk”) is our wholly owned

subsidiary and was incorporated on December 14, 2003 in the State of Alaska. Big

Chunk is engaged in the acquisition and exploration of mineral properties

business in the State of Alaska. Redwall Drilling Inc. (“Redwall”) was our

wholly owned subsidiary and was incorporated on August 31, 2007 in the State of

Arizona. Redwall performed drilling services on our mineral properties. Redwall

ceased drilling activities in July 2008 and was dissolved on March 30, 2010. In

April 2007, we changed our name to Liberty Star Uranium & Metals Corp. to

reflect our current general exploration for base and precious metals. We are

considered to be an exploration stage company, as we have not generated any

revenues from operations.

Our current business

We are an exploration stage company engaged in the acquisition

and exploration of mineral properties in the States of Arizona and Alaska.

Claims in the State of Alaska are held in the name of our wholly-owned

subsidiary, Big Chunk Corp. Claims in the State of Arizona are held in the name

of Liberty Star. We use the term “Super Project” to indicate a project in which

numerous mineral targets have been identified, any one or more of which could

potentially contain commercially viable quantities of minerals. Our significant

projects are described below.

North Pipes Super Project (“North Pipes” and “NPSP”):

Located in Northern Arizona on the Arizona Strip, we plan to ascertain

whether the NPSP claims possess commercially viable deposits of uranium and

associated co-product metals. We have not identified any ore reserves to date.

Big Chunk Super Project (“Big Chunk”):

Located in the

Iliamna region of Southwestern Alaska, we plan to ascertain whether the Big

Chunk claims possess commercially viable deposits of copper, gold, molybdenum,

silver, palladium rhenium and zinc. We have not identified any ore reserves to

date.

Bonanza Hills Project (“Bonanza Hills”):

Located in the

Iliamna region of Southwestern Alaska, our plans have been to ascertain whether

the Bonanza Hills claims possess commercially viable deposits of gold and

silver. We have not identified any ore reserves. Bonanza Hills is hampered by

its remote location. We have completely relinquished any rights we had to

Bonanza Hills.

Tombstone Super Project (“Tombstone”)(formerly referred to

as Tombstone Porphyry Precious Metals Project):

Tombstone is located in

Cochise County, Arizona and the Super Project covers the Tombstone caldera and

its environs. Within the Tombstone Caldera is the Hay Mountain target where we

are concentrating our work at this time. We plan to ascertain whether the

Tombstone, Hay Mountain claims possess commercially viable deposits of copper,

molybdenum, gold, silver, lead, zinc, manganese and other metals including Rare

Earth Elements (REE’s). We have not identified any ore reserves to date.

East Silver Bell Porphyry Copper Project (“East Silver

Bell”):

Located northwest of Tucson, Arizona, we plan to ascertain whether

the East Silver Bell claims possess commercially viable deposits of copper. We

have not identified any ore reserves to date.

Title to mineral claims involves certain inherent risks due to

difficulties of determining the validity of certain claims as well as potential

for problems arising from the frequently ambiguous conveyancing history

characteristic of many mineral properties. We have investigated title to all the

Company’s mineral properties and, to the best of its knowledge, title to all

properties are in good standing.

The mineral resource business generally consists of three

stages: exploration, development and production. Mineral resource companies that

are in the exploration stage have not yet found mineral resources in

commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the

development stage, while those engaged in the extraction of a known mineral resource are in the production stage. We are in the exploration stage – as we have not found any mineral resources in commercially exploitable quantities.

19

There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically feasible to develop or

exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know

whether that mineral deposit will constitute an ore reserve (an ore reserve is a commercially viable mineral deposit).

To date, we have not generated any revenues and we remain in the exploration stage. Our ability to pursue our business plan and generate revenues is subject to our ability to obtain additional financing, and we cannot give any assurance that we will

be able to do so.

Competition

We are a mineral resource exploration stage company engaged in the business of mineral exploration. We compete with other mineral resource exploration stage companies for financing from a limited number of investors that are prepared to make

investments in mineral resource exploration stage companies. The presence of competing mineral resource exploration stage companies may impact our ability to raise additional capital in order to fund our property acquisitions and exploration

programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We also compete for mineral properties of merit with other exploration stage companies. Competition could reduce the availability of properties of merit or increase the cost of acquiring additional mineral properties.

Many of the resource exploration stage companies with whom we compete may have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of properties of merit and on

exploration of their properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of resource properties. This competition could result in our competitors having resource properties of greater

quality and interest to prospective investors who may finance additional exploration and to senior exploration stage companies that may purchase resource properties or enter into joint venture agreements with junior exploration stage companies. This

competition could adversely impact our ability to finance property acquisitions and further exploration.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the States of Arizona and Alaska.

We are required to perform annual assessment work in order to maintain the Big Chunk Alaska State mining claims. If annual assessment work is not performed we must pay the assessment amount in cash in order to maintain the claims. Completion of

annual assessment work in the amount of $400 per 1/4 section (160 acre) claim or $100 per 1/16 section (40 acre) claim extends the claims for a one year period. Assessment work performed in excess of the required amount may be carried

forward for up to 4 years to reduce future obligations for assessment work. We estimate that the required annual assessments to maintain the claims will be approximately $238,200.

The annual state rentals for the Big Chunk Alaska State mining claims vary from $70 to $280 per mineral claim and escalate with the age of the mining claim. The rental period begins at noon September 1

st

through the following

September 1

st

and annual rental payments are due on November 30

th

of each year. Annual rent is due in full within 45 days of staking a new claim and covers the period from staking until the next September 1

st

. The

rentals of $113,120 to extend the Big Chunk claims through September 1, 2013 were paid in November 2012. The estimated state rentals due for the Big Chunk claims by November 30, 2013 for the period from September 1, 2013 through September 1, 2014 are

$113,120. Alaska State production royalty is three percent of net income. State law prescribes that after a 3.5 -year exemption from state taxes a metal mine is liable for a 15% state licensing tax on net income from the mine.

20

Our North Pipes claims are Federal lode mining claims located on U.S. Federal Lands and administered by the Department of Interior, Bureau of Land Management. The Bureau of Land Management (“BLM”) has prepared an environmental impact

statement (“EIS”) addressing potential for contamination of significant amounts of uranium leaking into the Colorado River. The EIS indicated the danger of such contamination insignificant. Regardless, the United States Secretary of the

Interior, Kenneth Salazar, through executive order has withdrawn Federal lands from locatable mineral exploration and mining North of the Grand Canyon along the Utah border in Arizona, the so-called “Arizona Strip”. Nearly 1 million

acres of land managed by the BLM and the Forest Service were segregated in July 2009 by the Secretary of Interior. The executive order has resulted in the withdrawal of an area of the Arizona Strip from mining in particular, and the moratorium now

is instated for the next 20 years. However, the moratorium permits existing claims and mines to continue as before, including our North Pipes lode mining claims.