East West Petroleum to Conduct Normal Course Issuer Bid

January 31 2014 - 7:15AM

Marketwired Canada

East West Petroleum Corp. (the "Company") (TSX VENTURE:EW) wishes to announce

that, subject to regulatory approval, it will conduct a normal course issuer bid

(the "Bid"). The Bid will be for up to 8,882,872 shares of the Company over a

period of one year (the "Bid Period"), being 9.53% of Company's issued and

outstanding common shares, with up to 1,864,438 shares of the Company

purchasable over any 30-day period within the Bid Period, being 2% of Company's

issued and outstanding common shares. The Bid Period will commence on February

3, 2014 and will continue until the earlier of February 3, 2015 or the date by

which the Company has acquired the maximum 8,882,872 shares which may be

purchased under the bid.

Management believes that the market price of the Company's shares may not fully

reflect the value of its business and future prospects, and as such it believes

that purchasing its own shares for cancellation is an appropriate strategy for

increasing long-term shareholder value. With respect to the Company's previous

Bid, which expired on October 16, 2013, a total of 998,500 shares of the Company

were purchased under the Bid at an average price of $0.3085 per share. As per

the previous Bid, purchases will be made through the facilities of the TSX

Venture Exchange (the "Exchange"), and the price at which the Company will

purchase its shares will be the market price of the shares at the time of

acquisition. The Company has appointed Mackie Research Capital Corporation as

its broker to conduct normal course issuer bid transactions.

The Company has 93,211,165 common shares issued and outstanding. Common shares

purchased by the Company will be returned to treasury for cancellation.

About East West Petroleum Corp.

East West Petroleum (www.eastwestpetroleum.ca) is a TSX Venture Exchange listed

company established in 2010 to invest in international oil & gas opportunities.

East West has built a diverse platform of attractive exploration assets covering

a gross area of approximately 1.8 million acres. In New Zealand, East West holds

an interest in three exploration permits near to existing commercial production

in the Taranaki Basin with a nine well drilling campaign, operated by TAG Oil

Ltd. (TSX:TAO), is in progress. The Company also interests in four exploration

concessions covering 1,000,000 acres in the prolific Pannonian Basin of western

Romania with a subsidiary of Russia's GazpromNeft; a joint venture exploration

program covering 8,000 gross acres in the San Joaquin Basin of California; an

oil-prone exploration block of 100,000 acres in the Assam region of India with

the three largest exploration and production Indian firms ONGC, Oil India and

GAIL; and a 100% interest in a 500,000 acre exploration block onshore Morocco.

The Company has now entered operational phases in Romania, where it will be

fully carried by its partner Gazprom-controlled Naftna Industrija Srbije in a

seismic and 12-well drilling program which is underway.

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company's actual results, level of

activity, performance or achievements to be materially different from those

expressed or implied by such forward-looking information. Such factors include,

but are not limited to: the ability to raise sufficient capital to fund

exploration and development; the quantity of and future net revenues from the

Company's reserves; oil and natural gas production levels; commodity prices,

foreign currency exchange rates and interest rates; capital expenditure programs

and other expenditures; supply and demand for oil and natural gas; schedules and

timing of certain projects and the Company's strategy for growth; competitive

conditions; the Company's future operating and financial results; and treatment

under governmental and other regulatory regimes and tax, environmental and other

laws.

Prospective Resources are those quantities of petroleum estimated, as of a given

date, to be potentially recoverable from undiscovered accumulations by

application of future development projects. Prospective resources have both an

associated chance of discovery and a chance of development. Prospective

Resources are further subdivided in accordance with the level of certainty

associated with recoverable estimates assuming their discovery and development

and may be subclassified based on project maturity. Best estimate resources are

considered to be the best estimate of the quantity that will actually be

recovered from the accumulation. If probabilistic methods are used, this term is

a measure of central tendency of the uncertainty distribution (most likely/mode,

P50/median, or arithmetic average/mean). As estimates, there is no certainty

that any portion of the resources will be discovered. If discovered, there is no

certainty that it will be commercially viable to produce any portion of the

resources that the estimated reserves or resources will be recovered or

produced.

This list is not exhaustive of the factors that may affect our forward-looking

information. These and other factors should be considered carefully and readers

should not place undue reliance on such forward-looking information. The Company

disclaims any intention or obligation to update or revise forward-looking

information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

East West Petroleum Corp.

Chris Beltgens

Corporate Development Manager

+1 604 682 1558

+1 604 682 1568 (FAX)

www.eastwestpetroleum.ca

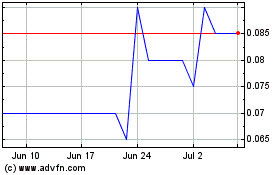

East West Petroleum (TSXV:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

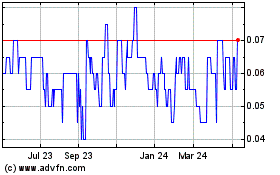

East West Petroleum (TSXV:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024