Lundin Mining Corporation(TSX:LUN)(OMX:LUMI) ("Lundin Mining" or the "Company"),

provides the following production guidance for the three-year period of 2014

through 2016. Key highlights are as follows:

-- Commissioning and production at Eagle is expected to add significantly

to total nickel and copper production, starting in late 2014.

-- 2014 to 2016 annual attributable copper production is expected to

increase more than 20% from the Company's wholly owned operations.

-- Zinc production is expected to increase by 10% between 2014 to 2016, as

Neves-Corvo zinc production continues to ramp-up owing to higher

throughput levels and zinc grades from Lombador Phase I.

-- Nickel production is expected to increase significantly as Eagle reaches

full production levels in 2015. Additionally, mining at Aguablanca is

now expected to continue until 2018 as the underground project has been

approved for development owing to the favourable economics of the

project.

"For 2014, we anticipate continuing our strong execution at the current

operations and completing construction of the Eagle Mine on target. Our assets

continue to offer attractive, low risk, near-term production growth with

relatively modest levels of capital requirements, which ideally positions us to

continue to add significant shareholder value over the next several years," said

Mr. Paul Conibear, President & CEO.

Production Outlook 2014 - 2016(1):

2014 2015 2016

----------------------------------------------------------------------------

Copper: Tonnes Tonnes Tonnes

Neves-Corvo 50,000 - 55,000 50,000 - 55,000 50,000 - 55,000

Zinkgruvan 3,000 - 4,000 2,000 - 3,000 2,000 - 3,000

Aguablanca 5,000 - 6,000 3,000 - 4,000 4,000 - 5,000

Eagle 2,000 - 3,000 17,000 - 22,000 17,000 - 22,000

----------------------------------------------------------------------------

Copper wholly-owned

operations 60,000 - 68,000 72,000 - 84,000 73,000 - 85,000

Tenke(2) (24%) approx. 50,000 approx. 50,000 approx. 50,000

----------------------------------------------------------------------------

Total Attributable

Copper 110,000 - 118,000 122,000 - 134,000 123,000 - 135,000

----------------------------------------------------------------------------

Zinc:

Neves-Corvo 60,000 - 65,000 75,000 - 80,000 75,000 - 80,000

Zinkgruvan 75,000 - 80,000 80,000 - 85,000 75,000 - 80,000

----------------------------------------------------------------------------

Total Zinc 135,000 - 145,000 155,000 - 165,000 150,000 - 160,000

----------------------------------------------------------------------------

Lead:

Neves-Corvo 2,000 - 2,500 2,000 - 2,500 2,000 - 2,500

Zinkgruvan 27,000 - 30,000 30,000 - 34,000 30,000 - 34,000

----------------------------------------------------------------------------

Total Lead 29,000 - 32,500 32,000 - 36,500 32,000 - 36,500

----------------------------------------------------------------------------

Nickel:

Aguablanca 6,000 - 7,000 4,000 - 5,000 4,000 - 5,000

Eagle 2,000 - 3,000 20,000 - 25,000 20,000 - 25,000

----------------------------------------------------------------------------

Total Nickel 8,000 - 10,000 24,000 - 30,000 24,000 - 30,000

----------------------------------------------------------------------------

-- Neves-Corvo: Copper production is expected to be maintained above 50,000

tonnes per annum with an increasing zinc by-product credit. The zinc

plant operated at full capacity in 2013, processing approximately 1.0

million tonnes per annum ("Mtpa") of ore and is expected to reach 125%

of nameplate capacity in 2015 with minor investments in plant

debottlenecking, taking advantage of higher grade Lombador feed and

expected improvements in zinc price. The production forecasts assume

that the zinc plant will be used exclusively to process zinc ore over

the next three years, though the plant has already proven to have the

flexibility to process either zinc or copper ores.

-- Zinkgruvan: Zinc production over the outlook period is expected to

remain relatively steady, as plans to increase throughput by investment

in an ore dressing plant have been deferred indefinitely. In 2015,

production is expected to increase modestly due to higher zinc grades as

per the mine plan. Thereafter production is expected to remain

relatively steady between 75,000 - 80,000 tonnes of zinc.

-- Aguablanca: The Company's Board of Directors has approved the

development of the underground project which is expected to result in

production continuing until 2018. Total capital expenditures for the

project are expected to be approximately $30 million spread over the

period 2014 - 2017. Economics of the underground project are expected to

be very attractive with a rapid payback period, even at current

depressed nickel prices.

-- Eagle: The project remains on schedule and budget. Shipment of the first

saleable concentrates of copper and nickel are expected to occur prior

to the end of 2014. Following an initial ramp up period, ore is expected

to be processed at a rate of 2,000 tonnes/day by mid-2015. The Company

is also pleased to announce that Mr. Michael Welch has joined Lundin

Mining as General Manager Eagle Mine effective in early January, 2014.

Mr. Welch has more than 20 years of combined operations and project

management experience, and holds a Bachelor of Science Honors Degree in

Geology as well as a Master of Science Degree in Geology. Mr. Welch was

most recently responsible for Glencore Xstrata's Raglan nickel

operations in Quebec, and previously served as project director on the

successful construction and start up of the Nickel Rim South project in

Sudbury, Ontario.

-- Tenke Fungurume: 2014 production guidance has not yet been provided by

Freeport, the mine's operator. Lundin Mining anticipates production from

Tenke in 2014 to be largely consistent with that of 2013. The three year

outlook for Tenke does not reflect potential increases in copper

production that could occur from Phase III expansion initiatives which

could entail further plant debottlenecking and heap leach investment to

fully utilize the 270,000 tpa copper electro-winning capacity that has

been installed as part of the Phase II project. The Lundin Mining

estimate and comments do not represent the official guidance for the

mine which will ultimately be provided by Freeport.

2014 Cash Costs(3)

-- At Neves-Corvo, estimated C1 cash costs for 2014 are expected to

approximate $1.90/lb Cu after zinc by-product credits. Improvement on

this estimated unit cost could occur if zinc prices are higher than

internal assumptions.

-- At Zinkgruvan, estimated C1 cash costs are expected to approximate

$0.35/lb Zn after copper and lead by-product credits. Zinkgruvan is

expected to remain one of the lower cost zinc producers for the

foreseeable future.

-- At Aguablanca, estimated C1 cash costs for 2014 are expected to

approximate $4.50/lb Ni after by-product credits.

-- For Tenke, cash cost guidance will be provided by Freeport in due

course.

2014 Capital Expenditure Guidance

Capital expenditures for 2014 are expected to be $460 million including Eagle

and excluding Tenke (compared to an estimated $255 million in 2013, on the same

basis) which includes:

-- Sustaining capital in European operations: $100 million (vs. $100

million in 2013), consisting of approximately $55 million for Neves-

Corvo, $40 million for Zinkgruvan and $5 million across other sites.

-- New investment capital expenditures in European operations: $60 million

(vs. $45 million in 2013), consisting of approximately $50 million for

Neves-Corvo (including $38 million for Lombador Phase I, $6 million for

Lombador Phase II and underground drilling, and $5 million for zinc

plant expansion and shaft upgrade project studies), and $10 million in

support of the underground mining project at Aguablanca.

-- Eagle: $300 million to complete construction of the Humboldt mill and

Eagle mine.

-- Tenke: All of the capital expenditures are expected to be self-funded by

cash flow from Tenke operations. If current metal prices and operating

conditions prevail and construction of future phases of expansion are

not commenced in 2014, the Company believes it is reasonable to expect

Lundin's attributable cash distributions to range between $130 to $150

million in 2014.

2014 Exploration Investment

Exploration expenditures are expected to be in the range of $40 million in 2014

(2013 - estimated at $33 million). These expenditures are expected to be

directed primarily towards Neves-Corvo, Zinkgruvan and Eagle, where drilling

programs will advance exploration on various in and near mine targets. A portion

of 2014 exploration budgets are allocated to South American and Eastern European

exploration work.

About Lundin Mining

Lundin Mining Corporation is a diversified Canadian base metals mining company

with operations in Portugal, Sweden, Spain and the US, producing copper, zinc,

lead and nickel. In addition, Lundin Mining holds a 24% equity stake in the

world-class Tenke Fungurume copper/cobalt mine in the Democratic Republic of

Congo and in the Freeport Cobalt Oy business, which includes a cobalt refinery

in Kokkola, Finland.

On Behalf of the Board,

Paul Conibear, President and CEO

Forward Looking Statements

Certain of the statements made and information contained herein is

"forward-looking information" within the meaning of the Ontario Securities Act.

This release includes, but is not limited to, forward looking statements with

respect to the Company's estimated annual metal production, C1 cash costs and

capital expenditures. These estimates and other forward-looking statements are

based on a number of assumptions and are subject to a variety of risks and

uncertainties which could cause actual events or results to differ from those

reflected in the forward-looking statements, including, without limitation,

risks and uncertainties relating to estimated operating and cash costs, timing

and quantities of production from the Eagle Project, cost estimates for the

Eagle Project, foreign currency fluctuations; risks inherent in mining including

environmental hazards, industrial accidents, unusual or unexpected geological

formations, ground control problems and flooding; risks associated with the

estimation of mineral resources and reserves and the geology, grade and

continuity of mineral deposits; the possibility that future exploration,

development or mining results will not be consistent with the Company's

expectations; the potential for and effects of labour disputes or other

unanticipated difficulties with or shortages of labour or interruptions in

production; actual ore mined varying from estimates of grade, tonnage, dilution

and metallurgical and other characteristics; the inherent uncertainty of

production and cost estimates and the potential for unexpected costs and

expenses, commodity price fluctuations; uncertain political and economic

environments; changes in laws or policies, foreign taxation, delays or the

inability to obtain necessary governmental permits; and other risks and

uncertainties, including those described under Risk Factors Relating to the

Company's Business in the Company's Annual Information Form and in each

management discussion and analysis. Forward-looking information is in addition

based on various assumptions including, without limitation, the expectations and

beliefs of management, the assumed long term price of copper, nickel, lead and

zinc; that the Company can access financing, appropriate equipment and

sufficient labour and that the political environment where the Company operates

will continue to support the development and operation of mining projects.

Should one or more of these risks and uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary materially from

those described in forward-looking statements. Accordingly, readers are advised

not to place undue reliance on forward-looking statements.

(1) Production guidance is based on certain estimates and assumptions, including

but not limited to; mineral resources and reserves, geological formations, grade

and continuity of deposits and metallurgical characteristics.

(2) Tenke guidance has not yet been provided by operator, Freeport McMoRan

Copper and Gold Inc. ("Freeport"). Lundin Mining anticipates production from

Tenke in 2014 to be comparable to expected 2013 production.

(3) Cash Costs and C1 cash costs are based on various assumptions and estimates,

including, but not limited to; production volumes, as noted above, commodity

prices (2014 - Cu: $3.15, Zn: $0.87, Pb: $1.00, Ni: $6.50) foreign currency

exchange rates (2014 - EUR/USD:1.30, USD/SEK:6.50) and operating costs.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lundin Mining Corporation

Sophia Shane

Investor Relations North America

+1-604-689-7842

Lundin Mining Corporation

John Miniotis

Senior Business Analyst

+1-416-342-5565

Lundin Mining Corporation

Robert Eriksson

Investor Relations Sweden

+46 8 545 015 50

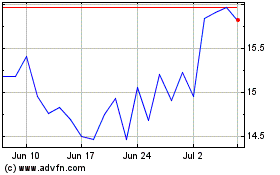

Lundin Mining (TSX:LUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

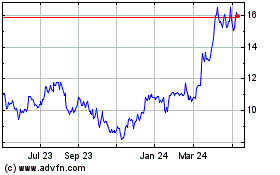

Lundin Mining (TSX:LUN)

Historical Stock Chart

From Apr 2023 to Apr 2024