Innovative Food Holdings, Inc. Announces Third Quarter 2013 Results: Record Revenues and Record EBITDA

November 14 2013 - 4:58PM

Marketwired

Innovative Food Holdings, Inc. Announces Third Quarter 2013

Results: Record Revenues and Record EBITDA

Q3 2013 Net Sales Increased 17%

BONITA SPRINGS, FL--(Marketwired - Nov 14, 2013) - Innovative

Food Holdings (OTCQB: IVFH), a leading nationwide provider of

specialty foods, healthcare foods, gluten free foods, and direct

from source artisanal foods, to the professional foodservice

market, today announced financial results for the third quarter,

the period ended September 30, 2013.

Third Quarter 2013

Financial and Operational Highlights:

- Q3 2013 revenues of $6.0 million, up 17% compared to $5.1

million for Q3 2012

- Organic revenue growth of approximately 17% vs. Q3 2012

- September 2013 represented 50th consecutive month of increased

month-over-month revenue

- Operating income increased 13% to $395,796, compared to

$349,739 in Q3 2012. The year-ago period included $111,288 of

operating income due to equity related gains primarily associated

with liability accounting for derivatives. Excluding this non-cash

gain in the year-ago quarter, operating income would have been

$238,451 in Q3 2012 and the comparative gain in 2013 would have

been 66%

- Adjusted EPS (EPS without amortization and equity related

gains/losses) grew approximately 54% to $0.06 per share for Q3 2013

vs. $0.04 per share in Q3 of 2012

- Cash EBITDA (EBITDA without equity related gains/losses) grew

approximately 64% to more than $481,000 for the third quarter of

2013 vs. approximately $293,000 in Q3 2012

- The Company moved into new facilities and expanded its

warehouse capabilities through the launch of a wholly-owned Florida

warehouse and distribution facility

- Improving balance sheet and cash position; the Company

generated more than $650,000 in operating cash flow in the third

quarter

Year-to-Date 2013

Highlights:

- Revenues for the first nine months of 2013 were $17.1 million

compared to $12.8 million for the first nine months of 2012

- Operating income in 2013 increased 141.7% to $1.0 million,

compared to $433,512 in the first nine months last year.

- Year-to-date Adjusted EPS grew 86% to $0.17 per share in 2013

vs. $0.09 per share for the same period in 2012

- Cash EBITDA grew approximately 97% to approximately $1.3

million year-to-date vs. approximately $656,000 for the same period

last year 2012

Sam Klepfish, CEO of Innovative Food Holdings, commented, "The

strong third quarter results, including sales growth and strong

bottom line performance, demonstrate our positive momentum and

strong positioning in the fast-growing specialty food space. We

delivered across the board organic growth by continuing to gain

market share, bringing on new customers, adding more chefs and

increasing sales to existing customers. Our unique low

infrastructure business model, which results in low sales-related

costs, enabled us to drive solid bottom-line improvements as well.

Turning to new growth catalysts, we expect that our continuing

focus on expanding market share in the nationwide specialty foods

market through existing and new partners, to make positive

contributions in the coming quarters."

Mr. Klepfish added, "We remain focused on the sales and bottom

line growth of our core businesses. In addition, we continue to see

many unique opportunities in the evolving specialty food space and

we are continuing to invest in additional specialty food

synergistic areas relating to all our subsidiaries, which we

believe will allow us to continue to be uniquely positioned within

a growing spectrum of the specialty food market. We strongly

believe that a laser-like focus on core sales and profitability,

combined with investments in synergistic opportunities, represent

key factors to building long-term value for Innovative Food's

shareholders."

Financial

Results

Third quarter 2013 revenue was $6.0 million, up 17% as compared

to the third quarter of 2012. Gross profit was approximately $1.7

million. Total operating expenses were $1.3 million in the third

quarter of 2013 compared with total operating expenses of $908,235

in the prior year period. The Company reported operating income of

$395,796 in the third quarter of 2013, compared to $349,739 in the

third quarter of 2012. The year-ago period included $111,288

related to SGA gains associated with options liability. Excluding

non-cash, non-operational adjustments related to equity

gains/losses, operating income increased 66% to $395,796 compared

to $238,451 in the year-ago period.

Third quarter adjusted EPS was $0.06 per share compared to $0.04

per share in the third quarter of 2012, an increase of

approximately 54%. Cash EBITDA, excluding the equity related

gains/losses increased approximately 64% to more than $481,000 for

the third quarter of 2013 compared to approximately $293,000 in the

third quarter last year.

Year-to-date revenue increased 34.2% to $17.1 million compared

to $12.8 million in the first nine months last year. The Company's

financial results for a portion of the first nine months of 2012

did not include sales and profits associated with the Company's

subsidiary, Artisan Specialty Foods, which was purchased by

Innovative Food Holdings in May 2012.

Year-to-date gross profit was $4.7 million compared with gross

profit of $3.1 million for the first nine months of 2012. Total

operating expenses were $3.7 million for the first nine months of

2013 compared with total operating expenses of $2.7 million for the

same period last year.

Year-to-date Adjusted EPS was $0.17 per share compared to $0.09

per share for the first nine months of 2012, an increase of 86%.

Cash EBITDA grew 97% to approximately $1.4 million year-to-date vs.

approximately $656,000 for the same period last year.

Balance

Sheet

As of September 30, 2013, Innovative Food Holdings had more than

$1.3 million in cash and cash equivalents. Stockholders' equity

increased 34.9% to $1.6 million compared to $1.2 million as of

December 31, 2012.

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

3 Months Ended Sept 30, |

|

|

9 Months Ended Sept 30, |

|

| |

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2012 |

|

| GAAP Income (Loss) |

|

$ |

(337,758 |

) |

|

$ |

1,600,903 |

|

|

$ |

(400,392 |

) |

|

$ |

6,644 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Depreciation & amortization of assets, taxes: |

|

|

85,372 |

|

|

|

54,729 |

|

|

|

213,058 |

|

|

|

69,313 |

|

| |

Interest expense: |

|

|

33,283 |

|

|

|

39,670 |

|

|

|

110,177 |

|

|

|

97,540 |

|

| |

Amortization of discounts on notes payable: |

|

|

700,271 |

|

|

|

23,322 |

|

|

|

1,337,934 |

|

|

|

68,493 |

|

| EBITDA |

|

$ |

481,168 |

|

|

$ |

1,718,624 |

|

|

$ |

1,260,777 |

|

|

$ |

241,990 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Non-cash SGA related to equity instruments: |

|

|

|

|

|

|

(111,288 |

) |

|

|

35,662 |

|

|

|

153,663 |

|

| |

Other non-cash expense (income) related to equity instruments: |

|

|

|

|

|

|

(1,314,156 |

) |

|

|

|

|

|

|

260,835 |

|

| Cash EBITDA |

|

$ |

481,168 |

|

|

$ |

293,180 |

|

|

$ |

1,296,439 |

|

|

$ |

656,488 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pro Forma EPS: |

|

|

3 Months Ended Sept 30, |

|

|

|

9 Months Ended Sept 30, |

|

| |

|

|

2013 |

|

|

|

2012 |

|

|

|

2013 |

|

|

|

2012 |

|

| GAAP Income (Loss) |

|

$ |

(337,758 |

) |

|

$ |

1,600,903 |

|

|

$ |

(400,392 |

) |

|

$ |

6,644 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Gain) Loss from change in fair value of derivative

liabilities: |

|

|

|

|

|

|

(1,429,734 |

) |

|

|

|

|

|

|

(621,202 |

) |

| |

Cost

of warrant extension: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

842,100 |

|

| |

Options issued to officers and directors: |

|

|

|

|

|

|

|

|

|

|

7,725 |

|

|

|

186,299 |

|

| |

Shares issued in settlement: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,302 |

|

| |

Restricted stock units issued to CEO: |

|

|

|

|

|

|

|

|

|

|

27,937 |

|

|

|

|

|

| Adjusted Income (Loss) |

|

$ |

(337,758 |

) |

|

$ |

171,169 |

|

|

$ |

(364,730 |

) |

|

$ |

421,143 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Amortization of discounts |

|

|

700,271 |

|

|

|

23,322 |

|

|

|

1,337,934 |

|

|

|

68,493 |

|

| |

Amortization of intangible assets |

|

|

45,970 |

|

|

|

36,000 |

|

|

|

137,911 |

|

|

|

36,000 |

|

| Pro forma income (loss) |

|

$ |

408,483 |

|

|

$ |

230,491 |

|

|

$ |

1,111,115 |

|

|

$ |

525,636 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding: |

|

|

6,479,385 |

|

|

|

5,673,844 |

|

|

|

6,405,756 |

|

|

|

5,673,844 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Adjusted EPS |

|

$ |

0.063 |

|

|

$ |

0.041 |

|

|

$ |

0.173 |

|

|

$ |

0.093 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Follow us on

Twitter: @IVFHcompany

ABOUT INNOVATIVE FOOD HOLDINGS, INC.

Innovative Food Holdings, is a leading nationwide provider of

specialty foods, healthcare foods, gluten free foods, and direct

from source artisanal foods, to the professional foodservice

market. IVFH also markets those products directly to the consumer,

through its website at www.forthegourmet.com. Many of Innovative

Food Holdings' 7,000+ products are used on a daily basis by

approximately 30,000 of some of the leading professional chefs

across the United States.

FORWARD-LOOKING

STATEMENTS

This release contains certain forward-looking statements and

information relating to Innovative Food Holdings, Inc. (IVFH) (the

"Company") that are based on the current beliefs of the Company's

management, as well as assumptions made by, and information

currently available to, the Company. Such statements reflect the

current views of the Company with respect to future events and are

subject to certain assumptions, including those described in this

release. Should one or more of these underlying assumptions prove

incorrect, actual results may vary materially from those described

herein as "should," "could," "anticipate," "believe," "intend,"

"plan," "might," "potentially" or "expect." The Company does not

intend to update these forward-looking

statements.

Management

Contact Sam Klepfish CEO (239) 449-3235

sklepfish@innovativefoodholdings.com Investor Relations Contact

James Carbonara Regional Vice President Hayden IR Office: (646)

755-7412 James@haydenir.com

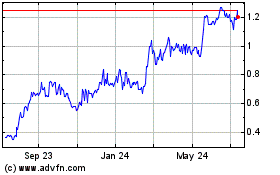

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

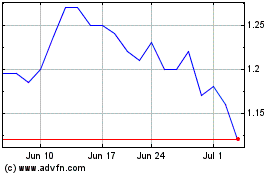

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Apr 2023 to Apr 2024