Short the Euro with These Inverse Currency ETFs - ETF News And Commentary

November 13 2013 - 10:01AM

Zacks

While the Eurozone appears to be back on track after a two-year

debt crisis, the recent rate cut by the European Central Bank (ECB)

has led to questions about the common currency.

Thanks to the steep decline in CPI inflation that hit as low as

0.7% in October and the rising worries about the region’s banking

sector’s liquidity, the ECB has apparently resorted to such a move.

Notably, the ECB follows a directive to maintain inflation rates

close to 2%.

The ECB slashed its benchmark interest rate 25 basis points to a

record low of 0.25% that strained the euro against the greenback.

Following the announcement, the euro currency slumped against the

dollar by about 1%. Added to this, a better-than-expected U.S.

economic data again stirred up the possibilities of the Fed’s

tapering which is likely to push up the dollar further.

ETF Impact

Following the news,

CurrencyShares Euro Trust

(FXE) – designed to track the performance of the euro against the

dollar – lost 0.7%. We are maintaining our strong sell

recommendation on this Euro ETF. As a result, investors who are

bearish on the euro right now, definitely for a valid reason, may

consider a near-term short on the space.

Fortunately, ETFs offer several options to investors to accomplish

this task. Below, we highlight a few of the options in the inverse

ETF space. These ETFs make a profit when the euro declines and are

suitable for hedging purposes against the fall in the currency

(Read: Guide to the 10 Most Popular Leveraged Inverse ETFs).

ProShares Ultra Short Euro ETF (EUO)

This leveraged ETF was launched in November 2008 and looks to

provide twice the inverse exposure to the performance of euro

versus the U.S. dollar on a daily basis.

The product has amassed over $436.6 million in AUM while it trades

at a volume of 700,000 shares daily. However, given its active

management style, the ETF charges a hefty annual expense ratio of

95 basis points.

Following the rate cut announcement, EUO crept up 1.47% (as on

November 7) although the product suffered a loss of 5.42% on a

year-to-date basis thanks to the strength of the euro earlier in

the year (read: Is Rising Euro hurting Euro-zone?).

Investors could book more profits off this fund, should the euro

continue to struggle.

Market Vectors Double Short Euro ETN (DRR)

This is an exchange-traded note issued by Morgan Stanley. The

product seeks to track the performance of the Double Short Euro

Index. For every 1% weakening of the euro relative to the

greenback, the Index normally gains 2%. The choice is an overlooked

one with just $80.9 million in AUM. The product charges an expense

ratio of 0.65% a year.

While on a year-to-date basis, the product shed 5.35% (as on

November 7, 2013), it rose 1.37% following the announcement.

Bottom Line

Although after prolonged weakness, the euro zone returned to growth

in the second quarter of this year, the growth rate was soft

at 0.3%. It is quite clear that the region is far from being stable

and still needs time and stimulus.

Further, with nearly four-year lows of inflation and a record-high

unemployment report in September, the European Union lowered its

euro-zone GDP growth forecast for next year and raised its

unemployment estimate. Thus, pressure on euro could remain in the

coming days.

In such a scenario, the ECB will certainly leave no stone unturned

to trigger growth. A strengthening euro is likely to hurt the

company’s export profile, which is why the ECB tries to keep a

check on further euro appreciation.

Given this, investors can ignore the euro at the current level or

book profit out of some inverse products. However, these products

should only be considered for very short-term trading purposes, but

they could be interesting over the next few days if we see some

more euro weakness.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT-VEC DB S EU (DRR): ETF Research Reports

PRO-ULS EURO (EUO): ETF Research Reports

CRYSHS-EURO TR (FXE): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

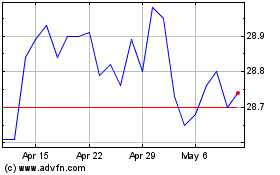

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

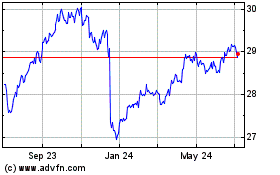

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Apr 2023 to Apr 2024