Focus Graphite Announces Updated Economic Results of Its 2012 Preliminary Economic Assessment

November 07 2013 - 3:30PM

Marketwired Canada

Focus Graphite Inc. ("Focus" or the "Company") (TSX

VENTURE:FMS)(OTCQX:FCSMF)(FRANKFURT:FKC) is pleased to announce the results of

an updated positive Preliminary Economic Assessment ("PEA") for its Lac Knife

Graphite Project ("Lac Knife" or "the Project"). The Lac Knife property is

located about 27 kilometers south west of Fermont, Quebec. This update is based

on improved metallurgical results of the recent Pilot Plant test campaign using

an optimized flotation and polishing circuit conducted at SGS Lakefield and

announced on August 21st, 2013.

The increase in concentrate grades and associated economic results were updated

in the project cash flow summary and were validated by RPA Inc. in consultation

with Soutex Inc. of Quebec City. Inputs updated in the financial model included:

final concentrate average grade increase from 92% Ct to 96.6% Ct within the new

flake size distribution categories, a reduction in operating cost by $367 per

tonne milled, due to the elimination of the need to purify the concentrate by a

third party and the associated $27,600,000 in working capital requirements.

Pricing is based on "run-of mine" prices, without the value added price used in

the original PEA financial model. The original report was filed on October 29th,

2012.

The Lac Knife project has a pre-tax internal rate of return ("IRR") of 36.4%

(28.6% after tax) and a pre-tax net present value of $ 316.9 million ($185.3

million after tax) in the base case using a weighted average price of US$1866

per tonne of run-of-mine concentrates. The cost of production is $458 per tonne

of concentrate.

Highlights are summarized below:

Pre Tax Value After Tax Value

($ millions) ($ millions)

----------------------------------------------------------------------------

Net Present Value

8% discount rate 316.9 185.3

10% discount rate 250.1 143.3

12% discount rate 198.4 110.6

Capital Expenditure including a 25%

contingency of $24m 125.95 125.95

Operating cost per tonne milled $67.61 $67.61

Operating cost per tonne ofconcentrate

produced $458.20 $458.20

Pre-Tax IRR 36.4% 28.6%

Pre Tax Payback Period 2.4 years 2.8 years

Exchange rate US$1.00 = C$1.00 US$1.00 = C$1.00

Strip Ratio 1.12 1.12

Don Baxter, P.Eng, President and Chief Operating Officer, stated: "The recent

Pilot Plant results are key to the potential economic viability of Lac Knife.

The results show that all flake concentrate above 200 mesh can be produced at

98% Ct thereby eliminating the need to use third party purification proposed in

our original PEA study. Within the graphite community, most operations produce

lower-grade fines that are difficult to sell. Lac Knife holds the potential to

open new markets to Focus for small flake technology-grade graphite products.

"The updated PEA indicates that Lac Knife shows positive economic potential

based on current run of mine prices for markets that are here today," Mr. Baxter

said.

Focus CEO Gary Economo said: "With the recent excellent metallurgical results

from the Lac Knife Pilot Plant and, with the key variables updated in this

announcement, our project has the potential to become one of the lowest-cost

producers of graphite in the world. The feasibility study we have just initiated

moves us closer to financing, securing off-take agreements, permitting and

construction."

In tandem to the feasibility level design for the Lac Knife development, Focus

continues its development of value-added products destined for technology

markets. These products will include spherical graphite used for Li-ion

batteries as well as expanded and micronized and purified graphite for use in

powder metallurgy and composite materials. These products for technology-grade

graphite applications can sell for prices averaging $10,000 per tonne. Focus'

work in this area is ongoing and is showing promising results. Value-added

products, their costs and their sale prices, were not included in the PEA update

average pricing.

Operational Highlights:

-- Open pit mine life is 20 years, at 300,000 tonnes per year.

-- Life of mine production of 6.0 million tonnes (Mt) of mill feed at a

grade of 15.66% graphitic carbon (Cgr), based on the initial Mineral

Resource Estimate(i) disclosed on January 19, 2012

-- Processing includes crushing, grinding, flotation, magnetic separation,

thickening and drying of run of mine to produce 44,300 tonnes of

concentrate per annum (tpa), a reduction of 2,300 tonnes of concentrate

is essentially due to the higher concentrate grade.

-- Sustaining capital average is $996,300 per year

-- Life of mine project production of 880,877 tonnes of concentrate at

96.6% Ct

Sensitivity Analysis Update:

------------------------------------------------------------------------

Pre-Tax Sensitivity to Graphite Price

Product specifications $US/t conc NPV @10% NPV @8% IRR

-10% Downside scenario 1,679 $192,115 $247,502 30.9%

Updated Base Case 1,866 $250,112 $316,857 36.4%

+10% Upside scenario 2,053 $308,109 $386,213 41.7%

------------------------------------------------------------------------

After-Tax Sensitivity to Graphite Price

Product specifications $US/t conc NPV @10% NPV @8% IRR

-10% Downside scenario 1,679 $109,087 $144,646 24.5%

Updated Base Case 1,866 $143,266 $185,305 28.6%

+10% Upside scenario 2,053 $176,939 $225,431 32.4%

------------------------------------------------------------------------

A copy of the PEA report and the October 29th, 2012 PEA announcement are

available on Focus Graphite's website www.focusgraphite.com.

The updated PEA pre-tax cash flow model is based on a constant 2012 dollar

basis, with no provision for escalation. The prices used in the model do not

include any potential of value added products the Company is currently

developing.

(i) Note: This PEA is considered by RPA to meet the requirements of a

Preliminary Economic Assessment as defined in Canadian NI 43-101 regulations.

The economic analysis contained in the technical report is based, in part, on

Inferred Resources, and is preliminary in nature. Inferred Resources are

considered too geologically speculative to have mining and economic

considerations applied to them and to be categorized as Mineral Reserves. There

is no certainty that the reserves development, production, and economic

forecasts on which the PEA is based will be realized.

This news release has been reviewed by Don Baxter, P.Eng, President and COO of

the Company and a Qualified Person under National Instrument (NI) 43-101

guidelines.

About RPA:

RPA Inc. is a group of technical professionals who have provided advice to the

mining industry for nearly 30 years. During this time, RPA has grown into a

highly respected organization regarded as the specialty firm of choice for

resource and reserve work. RPA provides services to the mining industry at all

stages of project development from exploration and resource evaluation through

scoping, prefeasibility and feasibility studies, financing, permitting,

construction, operation, closure, and rehabilitation. Our portfolio of customers

includes clients in banking (both debt and equity) institutional investors,

government, major mining companies, exploration and development firms, law

firms, individual investors, and private equity ventures.

About SGS Metallurgical Services (Lakefield)

SGS Canada Inc. ("SGS") is recognized as a world leader in the development of

concentrator flowsheet design and pilot plant testing programs. SGS'

Metallurgical Services division was founded over half a century ago. Its

metallurgists, hydro-metallurgists and chemical engineers are experienced in all

the major physical and chemical separation processes utilized in the recovery of

metals and minerals contained in resource properties around the world.

The technical and economic information relating to the PEA contained in this

press release has been reviewed and approved by Marc Lavigne, M.Sc., ing.,

Senior Mining Engineer for RPA, Pierre Roy, M.Sc., P.Eng., ing., Senior

Metallurgist Specialist for Soutex, all independent qualified persons under NI

43-101.

The information pertaining to the metallurgical test program completed by SGS

that is presented in this news release has been reviewed and approved by Mr.

Oliver Peters, M.Sc., P.Eng, MBA, SGS Canada Inc. Consulting Metallurgist. Mr.

Peters has extensive experience in the development of metallurgical processes

and has managed the majority of the graphite testing programs conducted at SGS

in recent years.

About Focus Graphite

Focus Graphite Inc. is an emerging mid-tier junior mining development company, a

technology solutions supplier and a business innovator. Focus is the owner of

the Lac Knife graphite deposit located in the Cote-Nord region of northeastern

Quebec. The Lac Knife project hosts a NI 43-101 compliant Indicated Mineral

Resource Estimate(i) of 4.9 million tons grading 15.8% graphitic carbon (Cgr) as

crystalline graphite with an additional Inferred Mineral Resource Estimate(i) of

3.0 million tons grading 15.6% Cgr of crystalline graphite. Focus' goal is to

assume an industry leadership position by becoming a low-cost producer of

technology-grade graphite. On October 29th, 2012 the Company released the

results of a Preliminary Economic Assessment ("PEA") of the Lac Knife Project

which indicated that the project has a very good potential to become a graphite

producer. As a technology-oriented enterprise with a view to building long-term,

sustainable shareholder value, Focus also invests in the development of graphene

applications and patents through Grafoid Inc.

Forward Looking Statements - Disclaimer

This news release contains forward looking information within the meaning of

Canadian securities legislation. All information contained herein that is not

clearly historical in nature may constitute forward-looking information.

Generally, such forward-looking information can be identified by the use of

forward-looking terminology such as "plans", "expects", or "does not expect",

"is expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "does not anticipate", or "believes", or variations of such

words or phrases or state that certain actions, events or results "may",

"could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially different from those

expressed or implied by such forward-looking Information, including but not

limited to: (i) volatile stock price; (ii) the general global markets and

economic conditions; (iii) the possibility of write-downs and impairments; (iv)

the risk associated with exploration, development and operations of mineral

deposits; (v) the risk associated with establishing title to mineral properties

and assets; (vi) the risks associated with entering into joint ventures; (vii)

fluctuations in commodity prices; (viii) the risks associated with uninsurable

risks arising during the course of exploration, development and production; (ix)

competition faced by the resulting issuer in securing experienced personnel and

financing; (x) access to adequate infrastructure to support mining, processing,

development and exploration activities; (xi) the risks associated with changes

in the mining regulatory regime governing the resulting issuer; (xii) the risks

associated with the various environmental regulations the resulting issuer is

subject to; (xiii) risks related to regulatory and permitting delays; (xiv)

risks related to potential conflicts of interest; (xv) the reliance on key

personnel; (xvi) liquidity risks; (xvii) the risk of potential dilution through

the issue of common shares; (xviii) the Company does not anticipate declaring

dividends in the near term; (xix) the risk of litigation; and (xx) risk

management.

Forward-looking information is based on assumptions management believes to be

reasonable at the time such statements are made, including but not limited to,

continued exploration activities, no material adverse change in metal prices,

exploration and development plans proceeding in accordance with plans and such

plans achieving their expected outcomes, receipt of required regulatory

approvals, and such other assumptions and factors as set out herein. Although

the Company has attempted to identify important factors that could cause actual

results to differ materially from those contained in the forward-looking

information, there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that such

forward-looking information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such

forward-looking information. Such forward-looking information has been provided

for the purpose of assisting investors in understanding the Company's business,

operations and exploration plans and may not be appropriate for other purposes.

Accordingly, readers should not place undue reliance upon forward-looking

information. Forward-looking information is made as of the date of this news

release, and the Company does not undertake to update such forward-looking

information except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Focus Graphite Inc.

Mr. Don Baxter, P.Eng.

President and Chief Operating Officer

705-789-9706

dbaxter@focusgraphite.com

www.focusgraphite.com

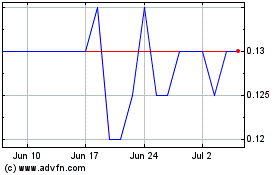

Focus Graphite (TSXV:FMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

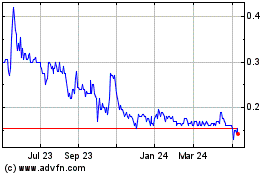

Focus Graphite (TSXV:FMS)

Historical Stock Chart

From Apr 2023 to Apr 2024