Sequential Improvements Extend Progress Toward

2013 Adjusted EBITDA Goal

Air Transport Services Group, Inc. (Nasdaq: ATSG), a leading

provider of aircraft leasing, and air cargo transportation and

related services, today reported consolidated financial results for

the quarter ended September 30, 2013.

For the third quarter of 2013, compared with the third quarter

of 2012:

- Revenues decreased 8.4 percent to

$140.9 million. Revenues increased 1.4 percent from the second

quarter of 2013.

- Net earnings from continuing operations

decreased 32.5 percent to $7.8 million, or $0.12 per fully diluted

share, but were up 12.8 percent from this year's second quarter.

The Company is not a significant payer of federal income taxes and

does not expect to be until 2016.

- Adjusted EBITDA decreased 7.7 percent

from a year ago to $40.0 million. The sequential increase from the

second quarter was $4.1 million, or 11.3 percent. This non-GAAP

financial measure is defined and reconciled to comparable GAAP

results in a table at the end of this release.

Joe Hete, President and Chief Executive Officer of ATSG, said,

“Our third quarter results reflect progress versus the second

quarter in restoring the growth and profitability of our ACMI

Services segment, and keep us on pace toward our Adjusted EBITDA

goal for the year. Our cargo airline Air Transport International

(ATI) captured more revenue and improved its pre-tax results

compared with the second quarter, while adding two more Boeing 757

combi aircraft to its fleet. Curtailment of U.S. Federal Aviation

Administration operations during the government shutdown in October

did delay progress on our combi fleet upgrade, but we are now back

on track, and garnering the operating benefits of our 757

combis.”

Nine-month 2013 revenues decreased 6.6 percent to $423.1 million

compared with the same 2012 period. Pre-tax earnings for the nine

months decreased 22.4 percent to $37.2 million. Adjusted EBITDA,

which excludes gains or losses on derivative instruments, decreased

6.1 percent to $113.3 million from a year ago.

Segment Results

CAM (Aircraft Leasing)

CAM

Third Quarter Nine Months ($ in thousands)

2013 2012 2013

2012 Revenues $ 40,089 $ 39,155 $ 118,420 $ 115,073

Pre-Tax Earnings 15,893

17,334 49,980 50,819

Significant Developments:

- Higher revenues for the quarter stem

from more modern Boeing 767 and 757 aircraft in service, replacing

older legacy aircraft removed from service since the same quarter a

year ago.

- Reductions in pre-tax earnings reflect

fewer aircraft in service than a year ago, and also higher

depreciation on aircraft added since the third quarter of

2012.

- On September 30, 2013, ATSG owned 50

aircraft in serviceable condition - 20 leased to external customers

and 30 leased to ATSG affiliate airlines. A table reflecting

aircraft in service is included at the end of this release.

- The in-service fleet consisted of

forty-one Boeing 767 freighters, four Boeing 757 freighters, two

DC-8 combis (combined passenger and main-deck cargo aircraft) and

three 757 combis.

- Two 757 combi aircraft entered service

during the third quarter - one in July and another in

September.

- Two Boeing 767-300s were completing

passenger-to-freighter conversion as of September 30, 2013.

- A fourth 757 combi is expected to enter

service late this year or early in 2014. The two remaining DC-8

combis will be retired by year-end.

ACMI Services

ACMI Services

Third Quarter Nine Months ($ in thousands)

2013 2012

2013 2012 Revenues Airline services $ 93,116 $

102,072 $ 276,193 $ 299,434 Reimbursables 16,313 20,454

51,156 57,676 Total ACMI Services Revenues

109,429 122,526 327,349 357,110 Pre-Tax Loss

(7,113 ) (1,746 ) (21,610 )

(11,543 )

Significant Developments:

- Third-quarter airline services revenues

decreased $9.0 million primarily as a result of reduced

international ACMI operations, compared with the third quarter last

year. Pre-tax results, while improved versus second quarter, were

down versus a year ago, due primarily to lower revenues, and higher

costs associated with slower than expected regulatory approvals and

combi transition.

- ATI’s third-quarter operating loss,

while larger than a year ago, improved 31 percent from the second

quarter of 2013, and sequential improvements continued to be

realized into the fourth quarter. ATI served the U.S. Military

during most of the third quarter with two DC-8 and two 757 combi

aircraft. Operating expenses were reduced from the second quarter,

but still elevated due to continued DC-8 combi operations. A third

757 combi entered service in September.

- Block hours decreased 14 percent during

the third quarter compared to the prior-year period, but increased

2 percent from the second quarter. The decrease versus a year ago

stemmed primarily from fewer long-haul international ACMI

operations at ABX Air and ATI. The improvement versus second

quarter was driven by a 12 percent increase in combi hours for the

U.S. Military.

Other Activities

Other Activities

Third Quarter Nine Months ($ in thousands)

2013 2012

2013 2012 Revenues $ 30,037 $ 26,773 $ 83,242

$ 81,876 Pre-Tax Earnings 4,400

3,373 9,188 8,602

- Revenue and earnings improvement

reflects good growth in aircraft maintenance operations, along with

continued solid results from our management of U.S. Postal Service

sorting facilities, compared with a year ago.

OutlookATSG reiterates its guidance for 2013 Adjusted

EBITDA to be within a range of $155 to $160 million.

Hete said, “The curtailment of operations of the U.S. Federal

Aviation Administration due to the government shutdown delayed

final approval of ETOPS certification for our 757 combis from

mid-September until earlier this week. However, with contributions

from our seasonal fourth-quarter ad-hoc ACMI and charter

operations, we still expect to achieve our 2013 Adjusted EBITDA

goal.

“We also are beginning to see positive shifts in various air

cargo networks that are creating new opportunities for us to deploy

our aircraft assets and expertise. In addition to these new

potential opportunities, with the regulatory and transition delays

largely behind us, improving free cash flow due to minimal capital

expenditure commitments, and expected positive pension

developments, we will have the flexibility to opportunistically

deploy capital at optimal, risk-adjusted returns heading into

2014.”

Conference CallATSG will host a conference call on

Thursday, November 7, 2013, at 10:00 a.m. Eastern time to review

its financial results for the third quarter of 2013. Participants

should dial (888) 895-5479 and international participants should

dial 847-619-6250 ten minutes before the scheduled start of the

call and ask for conference pass code 35929294. The call

will also be webcast live (listen-only mode) via www.atsginc.com and www.earnings.com for individual investors, and via

www.streetevents.com for institutional

investors.

A replay of the conference call will be available by phone on

Thursday, November 7, 2013, beginning at 2:00 p.m. and continuing

through Thursday, November 14, 2013, at (888) 843-7419

(international callers 630-652-3042); use pass code

35929294#. The webcast replay will remain available via

www.atsginc.com and www.earnings.com for 30 days.

About ATSGATSG is a leading provider of aircraft leasing

and air cargo transportation and related services to domestic and

foreign air carriers and other companies that outsource their air

cargo lift requirements. ATSG, through its leasing and airline

subsidiaries, is the world's largest owner and operator of

converted Boeing 767 freighter aircraft. Through its principal

subsidiaries, including two airlines with separate and distinct

U.S. FAA Part 121 Air Carrier certificates, ATSG provides aircraft

leasing, air cargo lift, aircraft maintenance services and airport

ground services. ATSG's subsidiaries include ABX Air, Inc.;

Airborne Global Solutions, Inc.; Air Transport International, Inc.;

Cargo Aircraft Management, Inc.; and Airborne Maintenance and

Engineering Services, Inc. For more information, please see

www.atsginc.com.

Except for historical information contained herein, the matters

discussed in this release contain forward-looking statements that

involve risks and uncertainties. There are a number of important

factors that could cause Air Transport Services Group's ("ATSG's")

actual results to differ materially from those indicated by such

forward-looking statements. These factors include, but are not

limited to, changes in market demand for our assets and services,

the costs and timing associated with the modification and

certification testing of Boeing 757 aircraft, the timing associated

with the deployment of aircraft to customers, achievement of the

benefits we anticipated from the merger of two of our airline

businesses, our operating airlines' ability to maintain on-time

service and control costs, and other factors that are contained

from time to time in ATSG's filings with the U.S. Securities and

Exchange Commission, including its Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Readers should carefully review

this release and should not place undue reliance on ATSG's

forward-looking statements. These forward-looking statements were

based on information, plans and estimates as of the date of this

release. ATSG undertakes no obligation to update any

forward-looking statements to reflect changes in underlying

assumptions or factors, new information, future events or other

changes.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

(In thousands, except per share data)

Three Months Ended Nine Months Ended

September 30, September 30, 2013

2012 2013 2012 REVENUES $ 140,877 $

153,826 $ 423,060 $ 452,886 OPERATING EXPENSES Salaries,

wages and benefits 41,498 44,153 126,771 135,827 Fuel 11,356 12,038

38,157 39,962 Maintenance, materials and repairs 24,644 26,751

71,783 75,135 Depreciation and amortization 23,392 21,057 66,077

62,871 Rent 6,958 6,745 20,528 18,719 Travel 4,409 5,618 13,908

17,162 Landing and ramp 2,227 3,877 8,264 11,823 Insurance 1,559

1,944 4,466 5,780 Other operating expenses 8,224 9,348

25,914 27,908 124,267 131,531 375,868 395,187

OPERATING INCOME 16,610 22,295 47,192

57,699 OTHER INCOME (EXPENSE) Interest income 17 38 56 104 Interest

expense (3,814 ) (3,668 ) (10,500 ) (10,886 ) Net gain (loss) on

derivative instruments (317 ) 294 425 956

(4,114 ) (3,336 ) (10,019 ) (9,826 )

EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES 12,496

18,959 37,173 47,873 INCOME TAX EXPENSE (4,697 ) (7,403 ) (13,958 )

(18,436 ) EARNINGS FROM CONTINUING

OPERATIONS 7,799 11,556 23,215 29,437 LOSS FROM DISCONTINUED

OPERATIONS, NET OF TAX — (186 ) (2 ) (576 ) NET EARNINGS $

7,799 $ 11,370 $ 23,213 $ 28,861

EARNINGS PER SHARE - Basic Continuing operations $ 0.12 $

0.18 $ 0.36 $ 0.46 Discontinued operations —

— — (0.01 ) NET EARNINGS PER SHARE $ 0.12

$ 0.18 $ 0.36 $ 0.45 EARNINGS

PER SHARE - Diluted Continuing operations $ 0.12 $ 0.18

$ 0.36 $ 0.46 Discontinued operations —

— — (0.01 ) NET EARNINGS PER SHARE $ 0.12 $

0.18 $ 0.36 $ 0.45 WEIGHTED AVERAGE

SHARES Basic 64,052 63,456 63,972 63,439

Diluted 65,036 64,667 64,807 64,478

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

September 30, December 31, 2013

2012 ASSETS CURRENT ASSETS: Cash and cash equivalents

$ 16,864 $ 15,442 Accounts receivable, net of allowance of $543 in

2013 and $749 in 2012 45,680 47,858 Inventory 8,952 9,430 Prepaid

supplies and other 11,075 8,855 Deferred income taxes 19,154 19,154

Aircraft and engines held for sale 2,491 3,360 TOTAL

CURRENT ASSETS 104,216 104,099 Property and equipment, net

848,550 818,924 Other assets 21,427 20,462 Intangibles 4,958 5,146

Goodwill 86,980 86,980

TOTAL ASSETS $

1,066,131 $ 1,035,611

LIABILITIES AND STOCKHOLDERS’ EQUITY CURRENT LIABILITIES:

Accounts payable $ 32,988 $ 36,521 Accrued salaries, wages and

benefits 22,936 22,917 Accrued expenses 8,258 8,502 Current portion

of debt obligations 23,572 21,265 Unearned revenue 9,771

10,311 TOTAL CURRENT LIABILITIES 97,525 99,516 Long

term debt obligations 368,331 343,216 Post-retirement liabilities

149,326 185,097 Other liabilities 61,592 62,104 Deferred income

taxes 62,066 46,422 STOCKHOLDERS’ EQUITY: Preferred stock,

20,000,000 shares authorized, including 75,000 Series A Junior

Participating Preferred Stock — — Common stock, par value $0.01 per

share; 75,000,000 shares authorized; 64,672,632 and 64,130,056

shares issued and outstanding in 2013 and 2012, respectively 647

641 Additional paid-in capital 524,554 523,087 Accumulated deficit

(83,972 ) (107,185 ) Accumulated other comprehensive loss (113,938

) (117,287 ) TOTAL STOCKHOLDERS’ EQUITY 327,291 299,256

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $

1,066,131 $ 1,035,611

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

PRE-TAX EARNINGS AND ADJUSTED PRE-TAX

EARNINGS SUMMARY

FROM CONTINUING OPERATIONS

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended

Nine Months Ended September 30, September 30,

2013 2012 2013 2012

Revenues CAM $ 40,089 $ 39,155 $ 118,420 $ 115,073

ACMI Services Airline services 93,116 102,072 276,193

299,434 Reimbursables 16,313 20,454 51,156

57,676

Total ACMI Services 109,429 122,526 327,349

357,110

Other Activities 30,037 26,773 83,242

81,876

Total Revenues 179,555 188,454 529,011

554,059 Eliminate internal revenues (38,678 ) (34,628 ) (105,951 )

(101,173 )

Customer Revenues $ 140,877

$ 153,826 $ 423,060

$ 452,886 Pre-tax Earnings (Loss)

from Continuing Operations CAM, inclusive of interest

expense 15,893 17,334 49,980 50,819

ACMI Services (7,113

) (1,746 ) (21,610 ) (11,543 )

Other Activities 4,400 3,373

9,188 8,602

Net, unallocated interest expense (367 ) (296 )

(810 ) (961 )

Net gain (loss) on derivative instruments (317

) 294 425 956

Total Pre-tax Earnings

$ 12,496 $ 18,959 $

37,173 $ 47,873 Adjustments to

Pre-tax Earnings Less net gain (loss) on derivative instruments

317 (294 ) (425 ) (956 )

Adjusted Pre-tax Earnings

$ 12,813 $ 18,665

$ 36,748 $ 46,917

Adjusted Pre-tax Earnings is defined as Earnings from Continuing

Operations Before Income Taxes less derivative gains and losses.

Management uses Adjusted Pre-tax Earnings from Continuing

Operations to assess the performance of its operating results among

periods. Adjusted Pre-tax earnings from Continuing Operations is a

non-GAAP financial measure and should not be considered an

alternative to Earnings from Continuing Operations Before Income

Taxes or any other performance measure derived in accordance with

GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

UNAUDITED ADJUSTED EARNINGS FROM

CONTINUING OPERATIONS BEFORE INTEREST, TAXES, DEPRECIATION AND

AMORTIZATION

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended

Nine Months Ended September 30, September 30,

2013 2012 2013 2012

Earnings from Continuing Operations Before Income

Taxes $ 12,496 $ 18,959 $ 37,173 $ 47,873 Interest Income (17 )

(38 ) (56 ) (104 ) Interest Expense 3,814 3,668 10,500 10,886

Depreciation and Amortization 23,392 21,057 66,077

62,871

EBITDA from Continuing Operations $

39,685 $ 43,646 $ 113,694 $ 121,526 Less net gain (loss) on

derivative instruments 317 (294 ) (425 ) (956 )

Adjusted EBITDA from Continuing Operations $

40,002 $ 43,352 $ 113,269 $ 120,570

EBITDA and Adjusted EBITDA from Continuing Operations are

non-GAAP financial measures and should not be considered as

alternatives to Earnings from Continuing Operations Before Income

Taxes or any other performance measure derived in accordance with

GAAP.

EBITDA from Continuing Operations is defined as Earnings from

Continuing Operations Before Income Taxes plus net interest

expense, depreciation, and amortization expense. Adjusted EBITDA

from Continuing Operations is defined as EBITDA from Continuing

Operations less derivative gains and losses.

Management uses EBITDA from Continuing Operations as an

indicator of the cash-generating performance of the operations of

the Company. Management uses Adjusted EBITDA and Adjusted Pre-tax

Earnings from Continuing Operations to assess the performance of

its operating results among periods. EBITDA and Adjusted EBITDA

from Continuing Operations, and Adjusted Pre-tax Earnings should

not be considered in isolation or as a substitute for analysis of

the Company's results as reported under GAAP, or as an alternative

measure of liquidity.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

IN-SERVICE AIRCRAFT FLEET

Aircraft Types

December 31, September 30,

December 31, 2012 2013 2013

Projected Operating Operating

Operating Total Owned Lease Total Owned Lease Total

Owned Lease B767-200 40 36 4 40 36 4 40 36 4 B767-300 7 5 2 7 5 2 9

7 2 B757-200 3 3 — 4 4 — 4 4 — B757 Combi — — — 3 3 — 4 4 — DC-8

Combi 4 4 — 2 2 — — — —

Total Aircraft In-Service 54

48 6 56 50 6 57 51

6 Owned Aircraft In Serviceable Condition

December 31, September 30, December 31,

2012 2013 2013 Projected ATSG airlines

28 30 30-31 External customers 20 20 20-21

48 50

ATSG, Inc.Quint O. Turner, 937-382-5591Chief Financial

Officer

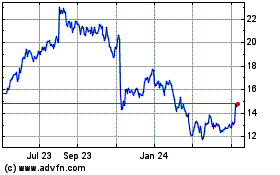

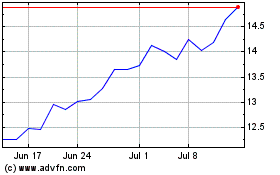

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Apr 2023 to Apr 2024