Mutual Fund Summary Prospectus (497k)

October 31 2013 - 5:03PM

Edgar (US Regulatory)

|

|

|

|

|

SPDR

®

Barclays Aggregate Bond ETF

|

|

LAG

|

(NYSE Ticker)

SUMMARY PROSPECTUS - OCTOBER 31, 2013

Before you invest in the SPDR Barclays

Aggregate Bond ETF (the “Fund”), you may want to review the Fund’s prospectus and statement of additional information, which contain more information about the Fund and the risks of investing in the Fund. The Fund’s prospectus

and statement of additional information dated October 31, 2013, are incorporated by reference into this summary prospectus. You can find the Fund’s prospectus and statement of additional information, as well as other information about the Fund,

online at https://www.spdrs.com/product/fund.seam?ticker=LAG. You may also obtain this information at no charge by calling (866) 787-2257 or by sending an e-mail request to Fund_inquiry@ssga.com.

|

|

|

INVESTMENT OBJECTIVE

|

|

The SPDR Barclays Aggregate Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond

generally to the price and yield performance of an index that tracks the U.S. dollar denominated investment grade bond market.

|

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund (“Shares”). This table and the example below do not reflect brokerage commissions you may

pay on purchases and sales of the Fund’s Shares.

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your

investment):

|

|

MANAGEMENT FEES

|

|

0.1845%

|

|

|

|

DISTRIBUTION AND SERVICE (12b-1) FEES (1)

|

|

0.0000%

|

|

|

|

OTHER EXPENSES

|

|

0.0000%

|

|

|

|

ACQUIRED FUND FEES AND EXPENSES (2)

|

|

0.0300%

|

|

|

|

TOTAL ANNUAL FUND OPERATING EXPENSES

|

|

0.2145%

|

|

|

|

LESS CONTRACTUAL FEE WAIVER (3)

|

|

(0.0500)%

|

|

|

|

NET ANNUAL FUND OPERATING EXPENSES (3)

|

|

0.1645%

|

|

|

|

(1)

|

The Fund has adopted a Distribution and Service (12b-1) Plan pursuant to which payments of up to 0.25% of average daily net assets may be made, however, the Board

has determined that no such payments will be made through at least October 31, 2014.

|

|

(2)

|

The Fund is required to disclose “Acquired Fund Fees and Expenses” in the table above. Acquired Fund Fees and Expenses reflect the Fund’s

pro rata share of the fees and expenses incurred by investing in other investment companies, including affiliated investment companies. Since “Total Annual Fund Operating Expenses” for purposes of the table above includes Acquired

Fund Fees and Expenses, it does not correlate to the “Ratio of Expenses to Average Net Assets” in the

Financial Highlights

section of the Prospectus.

|

|

(3)

|

The Adviser has contractually agreed to waive its advisory fee and reimburse certain expenses, until October 31, 2014, so that the Net Annual Fund Operating

Expenses of the Fund will be limited to 0.1345% of the Fund’s average daily net assets before application of any extraordinary expenses or acquired fund fees and expenses. The contractual fee waiver does not provide for the recoupment by the

Adviser of any fees the Adviser previously waived. The Adviser may continue the waiver from year to year, but there is no guarantee that the Adviser will do so and after October 31, 2014, the waiver may be cancelled or modified at any time.

|

EXAMPLE:

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time

periods indicated, and then sell all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be

higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

YEAR 1

|

|

YEAR 3

|

|

YEAR 5

|

|

YEAR 10

|

|

$17

|

|

$64

|

|

$116

|

|

$269

|

|

|

|

|

|

|

|

Precise in a world that isn’t.

SM

|

|

1 of 4

|

|

|

PORTFOLIO TURNOVER:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A

higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the

Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 165% of the average value of its portfolio.

THE FUND’S PRINCIPAL INVESTMENT STRATEGY

In seeking to track the

performance of the Barclays U.S. Aggregate Index (the “Index”), the Fund employs a sampling strategy, which means that the Fund is not required to purchase all of the securities represented in the Index. Instead, the Fund may purchase

a subset of the securities in the Index in an effort to hold a portfolio of securities with generally the same risk and return characteristics of the Index. The quantity of holdings in the Fund will be based on a number of factors, including asset

size of the Fund. Based on its analysis of these factors, SSgA Funds Management, Inc. (“SSgA FM” or the “Adviser”), the investment adviser to the Fund, may invest the Fund’s assets in a subset of securities in the Index or

may invest the Fund’s assets in substantially all of the securities represented in the Index in approximately the same proportions as the Index.

Under normal market conditions, the Fund generally invests substantially all, but at least 80%, of its total assets in the securities comprising the Index or in securities that the Adviser

determines have economic characteristics that are substantially identical to the economic characteristics of the securities that comprise the Index. TBA transactions (as defined below) are included within the above-noted investment policy. The Fund

will provide shareholders with at least 60 days’ notice prior to any material change in this 80% investment policy. In addition, the Fund may invest in debt securities that are not included in the Index, cash and cash equivalents or money

market instruments, such as repurchase agreements and money market funds (including money market funds advised by the Adviser).

The

Index is designed to measure the performance of the U.S. dollar denominated investment grade bond market, which includes investment grade (must be Baa3/BBB- or higher using the middle rating of Moody’s Investors Service, Inc.,

Standard & Poor’s, and Fitch Inc.) government bonds, investment grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities and asset backed securities that are publicly for sale in the United States.

The securities in the Index must have at least 1 year remaining to maturity and must have $250 million or more of outstanding face value. Asset backed securities must have a minimum deal size of $500 million and a minimum tranche size

of $25 million. For commercial mortgage backed securities, the original aggregate transaction must have a minimum deal size of $500 million, and a minimum tranche size of $25 million; the aggregate outstanding transaction sizes must

be at least $300 million to remain in the Index. In addition, the securities must be U.S. dollar denominated, fixed rate, non-convertible, and taxable. Certain types of securities, such as flower bonds, targeted investor notes, and state

and local government series bonds are excluded from the Index. Also excluded from the Index are structured notes with embedded swaps or other special features, private placements, floating rate securities and Eurobonds. The Index is market

capitalization weighted and the securities in the Index are updated on the last business day of each month. As of September 30, 2013, there were approximately 8,518 securities in the Index and the modified adjusted duration of securities in the

Index was approximately 5.41 years.

As of September 30, 2013, approximately 29.45% of the bonds represented in the Index are

U.S. agency mortgage pass-through securities. U.S. agency mortgage pass-through securities are securities issued by entities such as Government National Mortgage Association (“GNMA”) and Federal National Mortgage Association

(“FNMA”) that are backed by pools of mortgages. Most transactions in mortgage pass-through securities occur through standardized contracts for future delivery in which the exact mortgage pools to be delivered are not specified until a few

days prior to settlement, referred to as a “to-be-announced transaction” or “TBA Transaction.” In a TBA Transaction, the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount and price.

The actual pools delivered generally are determined two days prior to the settlement date; however, it is not anticipated that the Fund will receive pools, but instead will participate in rolling TBA Transactions. The Fund expects to enter into such

contracts on a regular basis. The Fund, pending settlement of such contracts, will invest its assets in high-quality, liquid short term instruments, including shares of affiliated money market funds.

The Index is sponsored by Barclays, Inc. (the “Index Provider”) which is not affiliated with the Fund or the Adviser. The Index Provider

determines the composition of the Index, relative weightings of the securities in the Index and publishes information regarding the market value of the Index.

|

|

|

|

|

|

|

Precise in a world that isn’t.

SM

|

|

2 of 4

|

|

|

PRINCIPAL RISKS OF INVESTING IN

THE FUND

As with all investments, there are certain risks of investing in the Fund, and you could lose money on an investment in the

Fund.

PASSIVE STRATEGY/INDEX RISK:

The Fund is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities. This differs from an actively managed fund, which

typically seeks to outperform a benchmark index. As a result, the Fund may hold constituent securities of the Index regardless of the current or projected performance of a specific security or a particular industry or market sector. Maintaining

investments in securities regardless of market conditions or the performance of individual securities could cause the Fund’s return to be lower than if the Fund employed an active strategy.

INDEX TRACKING RISK:

While the Adviser seeks to track the performance of the Index as closely as possible (

i.e.,

achieve a high degree of correlation with the Index), the Fund’s return may not

match or achieve a high degree of correlation with the return of the Index due to operating expenses, transaction costs, cash flows, regulatory requirements and operational inefficiencies. For example, the Adviser anticipates that it may take

several business days for additions and deletions to the Index to be reflected in the portfolio composition of the Fund.

DEBT SECURITIES INVESTING RISK:

The value of the debt securities may increase or decrease as a result of the following: market fluctuations, increases in interest rates, inability of issuers to repay principal and

interest or illiquidity in debt securities markets; the risk of low rates of return due to reinvestment of securities during periods of falling interest rates or repayment by issuers with higher coupon or interest rates; and/or the risk of low

income due to falling interest rates. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply. This may result in a

reduction in income from debt securities income.

U.S.

GOVERNMENT AGENCY SECURITIES RISK:

Treasury securities are backed by the full faith and credit of the U.S. government as to the timely payment of principal and interest.

Securities issued by U.S. government agencies or government-sponsored entities may not be guaranteed by the U.S. Treasury. If a government-sponsored entity is unable to meet its obligations, the performance of the Fund will be adversely

impacted.

PREPAYMENT RISK:

The Fund may invest in mortgage-related securities, which may be paid off early if the borrower on the underlying mortgage prepays the mortgage or refinances the mortgage prior to the

maturity date. If interest rates are falling, the Fund may have to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the Fund’s income.

MORTGAGE-BACKED SECURITIES RISK:

Mortgage-backed securities, other than GNMA mortgage-backed securities, are not backed by the full faith and credit of the U.S. government, and there can be no assurance that the

U.S. government would provide financial support to its agencies or instrumentalities where it is not obligated to do so. Mortgage-backed securities tend to increase in value less than other debt securities when interest rates decline, but are

subject to similar risk of decline in market value during periods of rising interest rates. Because of prepayment and extension risk, mortgage-backed securities react differently to changes in interest rates than other bonds. Small movements in

interest rates (both increases and decreases) may quickly and significantly affect the value of certain mortgage-backed securities.

MORTGAGE PASS-THROUGH SECURITIES RISK:

Transactions

in mortgage pass through securities primarily occur through TBA Transactions, as described above. Default by or bankruptcy of a counterparty to a TBA Transaction would expose the Fund to possible losses because of an adverse market action, expenses

or delays in connection with the purchase or sale of the pools of mortgage pass-through securities specified in the TBA Transaction.

NON-DIVERSIFICATION RISK:

The Fund is

non-diversified and may invest a larger percentage of its assets in securities of a few issuers or a single issuer than that of a diversified fund. As a result, the Fund’s performance may be disproportionately impacted by the performance of

relatively few securities.

|

|

|

|

|

|

|

Precise in a world that isn’t.

SM

|

|

3 of 4

|

|

|

FUND PERFORMANCE

|

|

|

|

|

|

|

The following bar chart and table provide an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by

showing how the Fund’s average annual returns for certain time periods compare with the average annual returns of the Index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform

in the future. Updated performance information is available online at

http://www.spdrs.com

.

|

|

|

|

ANNUAL TOTAL RETURN

(years ended 12/31)*

Highest

Quarterly Return: 5.90% (Q4 2008)

Lowest Quarterly Return: -1.23% (Q2 2008)

* As of September 30,

2013, the Fund’s Calendar Year-To-Date return was -1.95%.

|

AVERAGE ANNUAL TOTAL RETURNS

(for periods ending 12/31/12)

The after-tax returns presented in the table below are calculated using highest historical individual federal marginal income tax rates and do not

reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold Shares of the Fund through

tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. The returns after taxes can exceed the return before taxes due to an assumed tax benefit for a shareholder from realizing a capital loss on a sale of Fund Shares.

|

|

|

|

|

|

|

|

|

|

|

ONE YEAR

|

|

FIVE YEARS

|

|

SINCE INCEPTION

(5/23/07)

|

|

RETURN BEFORE TAXES

|

|

3.94%

|

|

6.01%

|

|

6.34%

|

|

RETURN AFTER TAXES ON DISTRIBUTIONS

|

|

3.12%

|

|

4.57%

|

|

4.84%

|

|

RETURN AFTER TAXES ON DISTRIBUTIONS AND SALE OF FUND SHARES

|

|

2.59%

|

|

4.31%

|

|

4.56%

|

BARCLAYS U.S. AGGREGATE INDEX

(reflects no deductions for fees, expenses or taxes)

|

|

4.21%

|

|

5.94%

|

|

6.30%

|

PORTFOLIO MANAGEMENT

INVESTMENT ADVISER

SSgA FM serves as the investment adviser to the Fund.

PORTFOLIO MANAGERS

The professionals primarily responsible for the day-to-day management of the Fund are Peter R. Breault and Marc DiCosimo.

PETER R. BREAULT, CFA

is a Principal of SSgA FM and a Portfolio

Manager in the Fixed Income, Currency and Cash Investments Team. He joined the Adviser in 2012.

MARC DICOSIMO, CFA

is a Vice President of SSgA and a Senior Portfolio Manager in the Fixed Income, Currency and Cash investments team.

He joined SSgA in 2013.

PURCHASE AND SALE INFORMATION

The Fund will issue (or redeem) Shares to certain institutional investors (typically market makers or other broker-dealers) only in large blocks of 100,000 Shares known as “Creation

Units.” Creation Unit transactions are

typically conducted in exchange for the deposit or delivery of in-kind securities and/or cash constituting a substantial replication, or a representation, of the securities included in the

Fund’s benchmark Index.

Individual Shares of the Fund may only be purchased and sold on the NYSE Arca, Inc., other national

securities exchanges, electronic crossing networks and other alternative trading systems through your broker-dealer at market prices. Because Fund Shares trade at market prices rather than at net asset value (“NAV”), Shares may trade at a

price greater than NAV (premium) or less than NAV (discount).

TAX INFORMATION

The Fund’s distributions are expected to be taxed as ordinary income and/or capital gains, unless you are investing through a tax-deferred

arrangement, such as a 401(k) plan or individual retirement account.

|

|

|

|

|

|

|

Precise in a world that isn’t.

SM

|

|

4 of 4

|

|

|

LAGSUMPRO

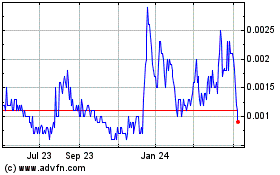

ProText Mobility (PK) (USOTC:TXTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

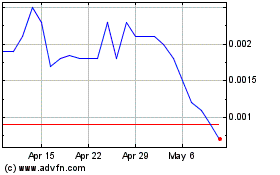

ProText Mobility (PK) (USOTC:TXTM)

Historical Stock Chart

From Apr 2023 to Apr 2024