Current Report Filing (8-k)

October 07 2013 - 4:51PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 1, 2013

3DIcon

Corporation

(Exact name of registrant as specified in

charter)

| Oklahoma |

|

000-54697 |

|

73-1479206 |

| (State or other jurisdiction of incorporation) |

|

(Commission |

|

(IRS Employer |

| |

|

File Number) |

|

Identification No.) |

| 6804 South Canton Avenue, Suite 150 |

74136 |

| Tulsa, OK |

(Zip Code) |

| (Address of principal executive offices) |

|

Registrant’s telephone number, including

area code: (918) 494-0505

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01 |

Entry Into A Material Definitive Agreement |

| Item 2.03 |

Creation of a Direct Financial Obligation |

| Item 3.02 |

Unregistered Sales of Equity Securities |

On October 1,

2013 (the “Date of Issuance”), 3DIcon Corporation (the “Company”) issued and sold to an accredited investor

a Senior Convertible Note (the “Note”) in the principal amount of $205,000 and a warrant to purchase 300,000 shares

of the Company’s common stock (“Common Stock”) at an exercise price equal to 110% of the closing bid price on

September 30, 2013 (the “Warrant”). The Note included a $30,750 original issue discount. Accordingly, the Company received

$174,250 gross proceeds from which the Company paid legal and documentation fees of $22,500 and placement agent fees of $15,682.

The Note matures

on July 1, 2014 and does not carry interest. However, in the event the Note is not paid on maturity, all past due amounts will

accrue interest at 15% per annum. At any time subsequent to six months following the Date of Issuance, the Note holder may elect

to convert all or any portion of the outstanding principal amount of the Note into shares of Common Stock at a conversion price

equal to the lesser of 100% of the Volume Weighted Average Price (VWAP), as reported for the 5 trading days prior to the Date of

Issuance or 80% of the average VWAP during the 5 days prior to the date the holder delivers a conversion notice to the Company.

The Warrant is

exercisable at any time on or after March 31, 2014 and on or prior to the close of business on March 31, 2019. At the election

of the Warrant holder, the Warrant may be exercised using a cashless exercise method.

The Note and Warrant

were offered and sold to an accredited investor in a private placement transaction made in reliance upon exemptions from

registration pursuant to Section 4(2) under the Securities Act of 1933.

The foregoing

information is a summary of each of the agreements involved in the transactions described above, is not complete, and is qualified

in its entirety by reference to the full text of those agreements, each of which is attached as an exhibit to this Current Report

on Form 8-K. Readers should review those agreements for a complete understanding of the terms and conditions associated

with this transaction.

| Item 9.01 |

Financial Statements and Exhibits |

| Exhibit No . |

|

Description |

| |

|

|

| 4.1 |

|

Senior Convertible Note |

| 10.1 |

|

Securities Purchase Agreement |

| 10.2 |

|

Warrant |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 7, 2013

| |

3DICON CORPORATION |

| |

|

|

| |

By: |

/s/ Mark Willner |

| |

Name: |

Mark Willner |

| |

Position: |

Chief Executive Officer |

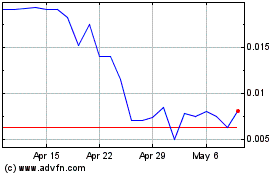

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024