Current Report Filing (8-k)

October 01 2013 - 3:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 30, 2013

| |

|

JBI, Inc.

|

|

|

| |

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

|

000-52444

|

|

90-0822950

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

20 Iroquois Street

Niagara Falls, NY

|

|

|

|

14303

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (716) 278-0015

N/A

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On September 30, 2013, JBI, Inc., a Nevada corporation (the “Company”), entered into a Subscription Agreement (the “Purchase Agreement”) with Mr. Richard Heddle, the Company’s Chief Executive Officer and a member of the Company board of directors (the “Purchaser”), pursuant to which, on September 30, 2013, the Company sold to the Purchaser in the second closing of the Company’s private placement (the “Note Financing”) a $2 million principal amount 12% Secured Promissory Note (the “Note”), together with a five-year warrant to purchase up to two million shares of the Company’s common stock at an exercise price of $0.54 per share (the “Warrant”). The gross proceeds to the Company were $2 million. As previously disclosed, on August 29, 2013, Mr. Heddle purchased a $1 million Note and received a Warrant for one million shares of common stock in the first closing of the Note Financing.

In connection with the second closing of the Note Financing, the Company and the Purchaser entered into transaction documents substantially identical to the transaction documents executed and delivered in the first closing of the Note Financing. The summaries of the transaction documents contained in the Company’s Current Report on Form 8-K dated August 29, 2013 are incorporated herein by reference (the “Prior 8-K”). Such summaries do not purport to be complete and are qualified in their entirety by reference to the actual transaction documents, copies of which are attached to the Prior 8-K as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively.

Section 2 - Financial Information

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosures contained in Item 1.01 of this Report are incorporated herein by reference.

Section 3 — Securities and Trading Markets

Item 3.02 Unregistered Sales of Equity Securities.

In connection with the Note Financing described in Item 1.01, the Company agreed to issue the Notes and Warrants described therein. Such issuances were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Act”), and Regulation D promulgated thereunder on the basis that the issuances did not involve a public offering and the Purchasers made certain representations to the Company in the Purchase Agreements, including without limitation, that the Purchasers were “accredited investors” as defined in Rule 501 under the Act.

Section 8 — Other Events

Item 8.01 Other Events.

On October 1, 2013, the Company issued a press release to announce the second closing of the Note Financing described in this Report. A copy of the press release is attached as Exhibit 99.1 hereto.

Section 9 — Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The exhibits required by this item are listed on the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

JBI, Inc.

|

| |

|

|

October 1, 2013

|

By:

|

/s/ Nicholas J. Terranova

|

| |

Name:

|

Nicholas J. Terranova

|

| |

Title:

|

Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

Press Release dated October 1, 2013.

|

4

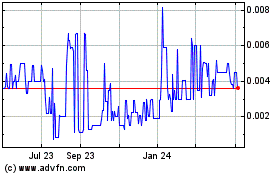

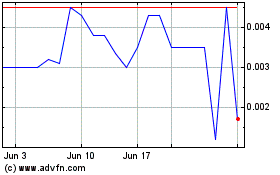

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Apr 2023 to Apr 2024