2 Ways to Short the Dollar with ETFs - ETF News And Commentary

September 25 2013 - 2:00PM

Zacks

The mood in the market has changed abruptly following the

conclusion of the FOMC meeting. Ben Bernanke surprised the market

with a no-taper decision, keeping the current bond-buying program

intact. Investors were looking for a reduction of at least $10

billion in the Fed’s $85 billion per month in purchases.

No Tapering

Though the delay in tapering sparked investors’ confidence across

the riskier assets sending the broad equity and bond markets

higher, it dampened the demand for safe haven currencies. As such,

the U.S. dollar (USD), the shining currency this year, tumbled the

most in seven months against a basket of major currencies in Asia

(read: 3 ETF Winners from the 'No Taper' Shocker).

The FOMC said that the cut down in the bond buying would not happen

until and unless the economy shows more evidence of solid growth.

Instead, the Fed lowered the GDP growth outlook to 2–2.3% from

2.3–2.6% for this year, citing concerns relating to tight fiscal

policy and higher mortgage rates.

Further, the Fed reiterated that the interest rates would stay near

zero level and not be increase until the unemployment rate falls

below 6.5% and inflation exceeds 2.5%.

Other Factors

The bearish trend in the greenback is expected to continue at least

in the near term given the lower economic growth outlook and the

improving global conditions.

China, as seen in nine of the past 10 quarters, is seemingly

bottoming out. The European economy is on the verge of recovery

thanks to upbeat data, less concerns on debt levels and a firmer

currency. Further, the emerging markets are showing an impressive

turnaround of late (read: Emerging Market ETFs Surge on Solid China

Data).

Given the change in the market fundamentals, investors could think

about shorting U.S. dollars to take advantage of the growing equity

markets and the broad commodities strength.

How to Play?

While futures or short-currency approach are possibilities, there

are a two lower-risk short USD ETF options which may make more

sense to many investors. That is because these short USD ETFs

prevent investors from losing more than their initial investment

and are also cheaper than direct shorting currency or utilization

of futures contracts.

So investors seeking to make a short play on USD could consider any

of the following ETFs given the bearish outlook for the currency

(see: all the Inverse Currency ETFs here):

PowerShares DB US Dollar Bearish Fund

(UDN)

This fund could be the prime beneficiary of the falling USD as it

offers exposure against a basket of world currencies. These include

the euro, Japanese yen, British pound, Canadian dollar, Swedish

krona and Swiss franc.

This is done by tracking the Deutsche Bank Short US Dollar Index

Futures Index Excess Return plus the interest income from the

fund’s holdings of U.S. Treasury securities.

In terms of holdings, UDN allocates nearly 58% in euros while 25%

collectively in Japanese yen and British pounds. All of these

currencies were on the rise over the past few weeks. The fund has

so far managed an asset base of $64.2 million while sees moderate

daily volume of 44,000 shares. It charges 75 bps in fees and

expenses.

This ETF added 1.16% following the announcement of not

withdrawing stimulus but is down 0.74% year-to-date. We believe

that this is just the beginning of the trend, and that more gains

could be ahead for this ETF in the future (read: Is the Dollar ETF

About to Surge?).

PowerShares DB 3x Short US Dollar Index Futures ETN

(UDNT)

This ETN seeks to provide three times (300%) inverse (opposite)

exposure to the monthly performance of the Deutsche Bank Long U.S.

Dollar Index Futures Index – Excess Return plus returns from U.S.

T-bills net of fees and expenses.

The ETN is unpopular and could have wider bid ask spreads with AUM

of only $1.7 million and average daily volume of just 6,000 shares.

The product charges 95 bps in fees per year from investors. The

note added nearly 3% buoyed by the negative sentiments for the

greenback on a no-taper decision while it is down 15.64% in the

year-to-date time frame.

Bottom Line

Investors should note that being extremely volatile, these products

are suitable only for short-term traders. Additionally, rebalancing

– when combined with leverage – may lead to returns that are not

close to the expected long-term performance figures (see more in

the Zacks ETF Center).

Still, for ETF investors who are bearish on the USD in the near

term, either of the above products could make an interesting

choice. Clearly, many are opting for riskier assets, so a near-term

short could be intriguing for those with high risk tolerance, and a

belief that the “trend is your friend” in this corner of the

investing world.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-DB US$ BE (UDN): ETF Research Reports

PWRSH-DB3X SUSD (UDNT): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

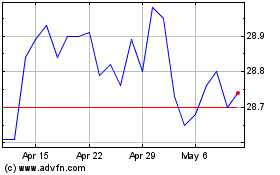

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

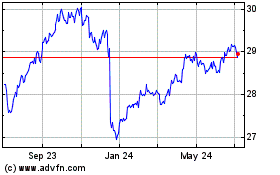

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Apr 2023 to Apr 2024