UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

September 18, 2013

SEARCHLIGHT

MINERALS CORP.

(Exact Name of Registrant as Specified in

Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation)

| 000-30995 |

|

98-0232244 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

| 2360 W. Horizon Ridge Pkwy, Suite #100, Henderson, Nevada |

|

89052 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| (702) 939-5247 |

| (Registrant's Telephone Number, Including Area Code) |

| |

#120 - 2441 West Horizon Ridge Pkwy

Henderson, Nevada 89052 |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (SEE General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Item 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

Item 3.03 MATERIAL MODIFICATION TO RIGHTS OF SECURITY HOLDERS

Closing of $4 Million Offering of Secured Convertible

Notes

On September 18, 2013, Searchlight Minerals

Corp., a Nevada corporation (the “Company,” “we” “our” or “us”) completed a private

placement (the “Offering”) of secured convertible notes (the “Notes”) to certain investors

(collectively, the “Purchasers”), resulting in aggregate gross proceeds to us of $4,000,000.We intend to use

the proceeds from the Offering for general working capital purposes. We did not pay any commissions or brokers fees in connection

with the Offering.

In connection with the Offering, we entered

into certain agreements, including a Secured Convertible Note Purchase Agreement (the “Purchase Agreement”),

a Registration Rights Agreement (the “Registration Rights Agreement”) and a Pledge and Security Agreement (the

“Security Agreement”), each dated September 18, 2013, with the Purchasers (the Purchase Agreement, Registration

Rights Agreement and Security Agreement, together with all exhibits, schedules and other documents attached thereto, are collectively

referred to herein as the “Transaction Documents”). Our two wholly-owned subsidiaries, Clarkdale Metals Corp.

and Clarkdale Minerals, LLC, agreed to guarantee the obligations underlying the Notes. We and our subsidiaries granted a first

priority lien in all of our assets pursuant to the terms of the Security Agreement. The Bank of Utah has agreed to act as the collateral

agent under the Security Agreement. The following descriptions of the terms, conditions and restrictions of the Offering and the

Transaction Documents do not purport and are not intended to be complete and are qualified in their entirety by the complete text

of Exhibits 10.1 through 10.5 attached to this Current Report on Form 8-K.

Luxor Capital Group, LP and certain of its

associates and affiliates (collectively, “Luxor”) purchased $2,600,000 of the Notes in the Offering. Luxor and

certain other funds managed by Luxor are principal stockholders of the Company. Michael Conboy, one of our directors, currently

serves as Luxor’s Director of Research. In addition, Martin Oring, one of our directors, and our Chief Executive Officer

and President, and certain affiliates of Mr. Oring, purchased $235,000 of Notes. The Notes were issued in reliance on exemptions

from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”)

and Rule 506 of Regulation D thereunder.

The Notes contain the following terms and

conditions:

| · | the Notes are due five (5) years from the date of issuance. However, the Note holders have a put option with respect to the

Notes, on the second anniversary of the issuance date and every six (6) months thereafter, at par plus accrued and unpaid interest.

The Notes may not be prepaid without the consent of the holder s of the majority-in-interest of the Notes. The Notes have customary

provisions relating to events of default. |

| · | interest on the Notes accrues at a rate of 7% per annum, which will be payable in cash semi-annually. |

| · | following and during the continuance of an event of default, the Notes will bear interest at a rate per annum equal to the

rate otherwise applicable thereto, plus an additional 2% per annum. |

| · | each Note is convertible at any time while the Note is outstanding, at the option of the holder, into shares of our common

stock, at $0.40 per share. The Notes have customary anti-dilution provisions, including, without limitation, provisions for the

adjustment to the exercise price based on certain stock dividends and stock splits. In addition, the conversion price of the Notes

may require adjustment upon the issuance of equity securities (including the issuance of debt convertible into equity) by the Company

at prices below the then existing conversion price, subject to certain exempt issuances which will not result in an adjustment

to the exercise price. |

| · | the Notes are secured by a first priority lien on all assets of the Company and our two subsidiaries in favor of the Purchasers.

However, we have the right to cause defeasance of the liens and to reduce the interest rate on the Notes to 4% per annum, if, at

any time, we deposit additional collateral and other agreements, satisfactory to the holders of the majority-in-interest of the

Notes, with the collateral agent. |

| · | we have agreed to not incur any (a) additional secured indebtedness, or (b) indebtedness of any kind (unsecured or secured)

with a maturity of less than 5 years from the issuance date of the Notes, in each case, without the written consent of the holders

of the majority-in-interest of the Notes, except for purposes of defeasance or trade payables in the ordinary course of business. |

| · | in the event of a change of control of the Company, the Note holders will be entitled to require us to redeem their Notes for

120% of the outstanding principal amount of Notes, plus accrued and unpaid interest. |

| · | the holders have the right to purchase pro rata up to $600,000 of additional separate Notes, on or before the first

anniversary of the issuance date, on the same general terms and conditions as the terms as the original Notes issued at the closing

of the Offering(the “Additional Notes”). |

Pursuant to the Registration Rights Agreement,

we have agreed to file a registration statement covering the resale of the shares of common stock issuable upon conversion of the

Notes and Additional Notes. Pursuant to the Registration Rights Agreement, we have agreed to file a registration statement with

the Securities and Exchange Commission within 60 calendar days upon demand by a majority-in-interest of the Purchasers, and to

use our best efforts to cause such registration statement to become effective within 120 calendar days after the filing date of

such registration statement, or we will be subject to certain liquidated damages provisions. We also have agreed to file and keep

continuously effective such additional registration statements until all of the shares of common stock registered thereunder have

been sold or may be sold without volume restrictions pursuant to Rule 144 of the Securities Act. The Purchasers will also be granted

piggyback registration rights with respect to such shares.

If, among other things, (i) we fail to file

the initial registration statement within the prescribed period or (ii) any registration statement that we file is not declared

effective within 120 calendar days of the required filing date, we have agreed to pay each Purchaser, as partial liquidated damages,

an amount of cash equal to 1% of the aggregate purchase price paid by each such Purchaser for any shares of common stock underlying

the Notes and Additional Notes that have not been registered for every monthly period following any required filing date and, on

a pro rata basis, for every monthly period following the 120 day period within which any registration statement was to be declared

effective. The maximum aggregate liquidated damages payable to a Purchaser will not exceed 3% of the aggregate purchase price paid

by such Purchaser.

In connection with the Offering, our board

of directors agreed to waive certain provisions of our Rights Agreement, dated August 24, 2009 (the “Rights Agreement”),

with respect to accounts managed by Luxor. In connection with the Rights Agreement, the Board of Directors previously declared

a dividend of one common share purchase right for each outstanding share of our common stock. The rights become exercisable, under

certain circumstances, in the event that a person or group of affiliated or associated persons has acquired beneficial ownership

of 15% or more of the outstanding shares of our common stock (an “acquiring person”). On June 7, 2012, we previously

had agreed to waive the 15% limitations currently in the Rights Agreements with respect to Luxor, and to allow Luxor to become

the beneficial owners of up to 17.5% of the shares of our common stock, without being deemed to be an “acquiring person”

under the Rights Agreement. In connection with the Offering, we have agreed to waive the 17.5% limitations currently in the Rights

Agreement with respect to Luxor, and allow Luxor to become the beneficial owners of up to 22% of the shares of our common stock,

without being deemed to be an “acquiring person” under the Rights Agreement. Following the Offering, Luxor is the beneficial

owner of approximately 21% of our common stock (including giving effect to derivative securities or other rights to purchase or

acquire shares of our common stock).

The foregoing description of the terms,

conditions and restrictions of the Rights Agreement do not purport and are not intended to be complete and are qualified in their

entirety by the complete text of the Rights Agreement, which is filed as Exhibit 4.1 of the Company’s registration statement

on Form 8-A filed on August 25, 2009, and as amended on Form 8-A12G/A on September 24, 2009. A summary of the Rights Agreement

is set forth in such registration statement.

Further, in connection with the Offering,

we amended a Voting Agreement and Irrevocably Proxy Coupled with Interest (the “Voting Agreement”) we previously

entered into with Luxor on June 7, 2012. Pursuant to the Voting Agreement, Luxor retained the right to vote, in the aggregate,

up to that number of issued and outstanding shares of Company common stock which are equal to or less than 15% of the issued and

outstanding shares of our common stock, and were required to vote all issued and outstanding shares of common stock in excess of

15% as instructed by our Board of Directors (the “Voting Threshold”). On September 18, 2013, the Company and

Luxor amended the Voting Agreement to raise the Voting Threshold from 15% to 19.5%. All of the other terms, conditions and provisions

of the Voting Agreement remain in full force and effect. The provisions of the Voting Agreement, as amended, extend to any account

managed by Luxor, which becomes an owner of any shares of our common stock. However, if any shares of common stock or warrants

(or other rights to acquire shares of common stock) are transferred, so that Luxor and its affiliates are no longer the beneficial

owners, the Voting Agreement will terminate as to such securities (unless beneficial ownership is reacquired by Luxor, in which

case, such reacquired shares will become subject to the Voting Agreement).

The foregoing description of the terms,

conditions and restrictions of the Voting Agreement do not purport and are not intended to be complete and are qualified in their

entirety by the complete text of the Voting Agreement, which is filed as Exhibit 10.3 of the Company’s Current Report on

Form 8-K filed on June 11, 2012, and the amendment to the Voting Agreement, which is attached hereto as Exhibit 10.5.

Warrant Adjustments in Connection with Offering

On November 12, 2009, we completed a private

placement of the Company’s securities to certain investors, including Luxor. In connection with the November 2009 private

placement, we issued 12,078,596 shares of common stock and warrants to purchase up to 6,341,263 additional shares of common stock

(the “Warrants”).

The Warrants, as amended, have an expiration

date of November 12, 2013. The Warrants originally had an exercise price of $1.85 per share. However, the Warrants have customary

anti-dilution provisions which may affect the amount and exercise price of Warrants based on issuances of equity securities (including

the issuance of debt convertible into equity, such as in the Offering) by the Company, subject to certain exempt issuances which

will not result in an adjustment to the exercise price.

As adjusted, immediately prior to

the closing of the Offering, there were 6,785,825 Warrants issued and outstanding. Of those Warrants, 3,996,890 were held

by Luxor and had an adjusted exercise price of $1.74, 255,993 were held by another Warrant holder, and

had an adjusted exercise price of $1.74, and 2,532,942 were held by other Warrant holders and had an adjusted exercise price

of $1.710. Luxor previously waived the application of certain adjustments to its Warrants, so the exercise price of

Warrants held by it is different from the exercise price of Warrants held by non-Luxor investors.

As the per share conversion price

for the Notes in the Offering was $0.40, the amount of Warrants and the exercise price of the Warrants were adjusted at

the closing of the Offering, and immediately following the closing of the Offering upon the purchase of the Notes, Luxor

held 4,214,920 Warrants with an exercise price of $1.65, another Warrant holder held 269,957 Warrants

with an exercise price of $1.65, and other Warrant holders investors held 2,673,671 Warrants with an exercise price of

$1.62.

Office Sublease

On September 1, 2013, we entered into a

Sublease Agreement with Ireland, Inc. (“Ireland”), pursuant to which Ireland subleased to us two office suites

located at 2360 W. Horizon Ridge Parkway, Suite 100, Henderson, Nevada 89052. The term of the sublease is two years. We have agreed

to pay to Ireland monthly rent of $2,819.00 through August 31, 2014. However, commencing on September 1, 2014, the monthly rent

will decrease to $1,667.00. Our principal executive offices are now located at these newly subleased office suites. Ireland is

an affiliate of Nanominerals Corp., a privately owned Nevada corporation (and one of our current principal stockholders), and an

affiliate of Carl S. Ager, one of our directors and our current Vice President, Secretary and Treasurer.

ITEM 5.03 AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS;

CHANGE IN FISCAL YEAR

In connection with and prior to the closing

of the Offering, our Board of Directors voted to approve an amendment (the “Amendment”) to Article III, Section

13(c) of our Bylaws (the “Bylaws”). The Amendment became effective on September 18, 2013 immediately prior to

the closing of the Offering.

The Nevada Revised Statutes contain provisions

governing the acquisition of a controlling interest in certain publicly held Nevada corporations. These laws provide generally

that any person that acquires 20% or more of the outstanding voting shares of certain publicly held Nevada corporations, such as

us, in the secondary public or private market, must follow certain formalities before such acquisition or they may be denied voting

rights, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or

in part. These laws provide that a person acquires a "controlling interest" whenever a person acquires shares of a subject

corporation that, but for the application of these provisions of the Nevada Revised Statutes, would enable that person to exercise

(1) one-fifth or more, but less than one-third, (2) one-third or more, but less than a majority or (3) a majority or more, of all

of the voting power of the corporation in the election of directors. The Control Share Acquisition Statute generally applies only

to Nevada corporations with at least 200 stockholders, including at least 100 stockholders of record who are Nevada residents,

and which conduct business directly or indirectly in Nevada. We currently do not have at least 200 stockholders, including at least

100 stockholders of record who are Nevada residents, and which conduct business directly or indirectly in Nevada, and therefore,

the provisions of the Control Share Acquisition Statute do not apply to us, except as provided in the Bylaws.

Prior to the Amendment, Article III, Section

13(c) of our Bylaws provided that the provisions of the Control Share Acquisition Statute would apply to the acquisition of a controlling

interest in us, irrespective of whether we have 200 or more stockholders of record, or whether at least 100 of our stockholders

have addresses in the State of Nevada appearing on our stock ledger.

Pursuant to the Amendment, the provisions

of Control Share Acquisition Statute will apply to the acquisition of a controlling interest in us irrespective of whether we have

200 or more stockholders of record, or whether at least 100 of our stockholders have addresses in the State of Nevada appearing

on our stock ledger, unless such acquisition has previously been approved by our Board of Directors.

Item 7.01 REGULATION FD DISCLOSURE

Press Release

On September 20, 2013, we issued a press

release, which is attached hereto as Exhibit 99.1.

The press release attached hereto is being

furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section, nor shall it be deemed incorporated

by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference

in such filing. By filing this report on Form 8-K and furnishing this information, the Company makes no admission as

to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| Exhibit |

Description |

| |

|

| 3.1 |

First Amendment to the Amended and Restated Bylaws of Searchlight Minerals Corp. |

| 10.1 |

Form of Secured Convertible Note Purchase Agreement, dated September 18, 2013, by and between Searchlight Minerals Corp. and the investors listed on Schedule I attached thereto |

| |

|

| 10.2 |

Form of Secured Convertible Promissory Note of Searchlight Minerals Corp. dated September 18, 2013 |

| |

|

| 10.3 |

Form of Registration Rights Agreement, dated September 18, 2013, between Searchlight Minerals Corp. and each of the several purchasers signatory thereto |

| |

|

| 10.4 |

Form of Pledge and Security Agreement, dated September 18, 2013, by and among Searchlight Minerals Corp., Clarkdale Minerals, LLC, and Clarkdale Metals Corp. in favor of the Collateral Agent on behalf of the Secured Parties listed on the signature pages thereto |

| |

|

| 10.5 |

First Amendment to Voting Agreement and Irrevocable Proxy Coupled with Interest, effective September 18, 2013, by and among Searchlight Minerals Corp. and each of the undersigned stockholders thereto |

| |

|

| 10.6 |

Sublease Agreement, dated September 1, 2013, by and between Ireland, Inc. and Searchlight Minerals Corp. |

| |

|

| 99.1 |

Press Release dated September 20, 2013, issued by Searchlight Minerals Corp. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Dated: September 24, 2013

| |

SEARCHLIGHT MINERALS CORP. |

| |

|

|

| |

By: |

/s/Martin B. Oring |

| |

|

Martin B. Oring |

| |

|

President |

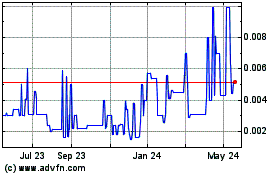

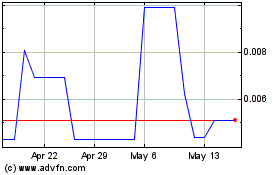

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Apr 2023 to Apr 2024