Wialan Technologies Agrees to Repurchase ACYD Stock

September 20 2013 - 8:30AM

Business Wire

Wialan Technologies (OTC Pink: ACYD), a next generation

telecommunications provider, today announced that the board of

directors have approved an aggressive strategy to tighten up its

share structure and decrease the float up to one hundred million

shares.

The plan, starting October 1, 2013, calls for the repurchase

from the open market or in privately negotiated transactions. The

repurchase of stock will continue until the value has increased by

300 percent as of closing yesterday.

“The repurchase plan shows our confidence in the long-term

potential for Wialan Technologies and our commitment to increasing

shareholder value. We believe that the ACYD share value is greatly

undervalued by the market, and it is our goal to raise our stock

price by 300 percent by the end of this year, with substantial

share value increases in 2014,” commented Timothy Peabody, Chief

Executive Officer.

About Wialan Technologies

Wialan, a next generation Wireless telecommunications provider,

is poised for exponential growth from their five years of

successful R&D, sales and installations of their impressive

WiFi solutions spanning 10 countries. They have established a track

record of successful installations in airports, municipalities,

apartment buildings, parks, marinas and other locations that

require a superior and more robust communication footprint than

conventional WiFi providers. Among the outstanding features

available with Wialan’s wireless 802.11n 300 Mbps solutions is the

capability of real-time live color video streaming for many

simultaneous end-users, which can help companies with video on

demand services, like Netflix, to deliver their services wireless

without using the Internet.

Safe Harbor Statement

Except for historical information contained herein, the

statements in this press release are forward-looking statements

that are made pursuant to the safe harbor provisions of the Private

Securities Reform Act of 1995. Forward-looking statements involve

known and unknown risks and uncertainties, which may cause the

company's actual results in future periods to differ materially

from forecasted results. These risks and uncertainties include,

among other things, product price volatility, product demand,

market competition, risk inherent in the company's domestic and

international operations, imprecision in estimating product

reserves and the company's ability to replace and expand its

holdings.

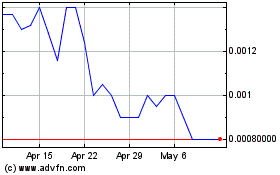

Wialan Technologies (PK) (USOTC:WLAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

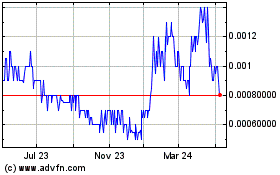

Wialan Technologies (PK) (USOTC:WLAN)

Historical Stock Chart

From Apr 2023 to Apr 2024