As filed with the Securities

and Exchange Commission on September 19, 2013

Registration No. [

]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

SANWIRE

CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

4899

|

94-3342064

|

|

(State or jurisdiction of incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

9710 E. 55

th

Pl.

Tulsa, OK 74146

(800) 243-1254

(Address and telephone number of principal executive offices and principal place of business)

President Stock Transfer

515 West Pender Street, Suite 217

Vancouver, BC, V6B 6H5

(604) 876-5526

(Name, address and telephone number of agent for service)

Copies to:

Mark C. Lee

GREENBERG TRAURIG, LLP

1201 K Street, Suite 1100

Sacramento, California 95814

Telephone: (916) 442-1111

Facsimile: (916) 448-1709

Approximate date of

proposed sale to the public:

From time to time after

the effective date of this registration statement.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. [ ]

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION

FEE

|

Title of each class of

securities to be registered

|

|

Amount of Shares

to be

Registered

|

|

|

Proposed

maximum

offering price

per share

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

5,761,000

|

(1)

|

$

|

0.30

|

(2)

|

$

|

1,728,300

|

|

$

|

235.74

|

|

|

Common Stock

|

|

1,890,000

|

(3)

|

$

|

0.30

|

(2)

|

$

|

567,000

|

|

$

|

77.34

|

|

|

Total

|

|

7,651,000

|

|

|

|

|

$

|

2,295,300

|

|

$

|

313.08

|

|

|

(1)

|

Represents shares issued and issuable pursuant to the Common Stock Purchase Agreement, between the Company and Hanover Holdings I, LLC, a New York limited liability company (“Hanover”), dated August 28, 2013 (the “Purchase Agreement”).

|

|

(2)

|

Calculated in accordance with Rule 457(c) of the Securities Act, based upon the average high and low prices reported on the OTCQB on September 16, 2013.

|

|

(3)

|

Represents 1,890,000 shares of the Company’s Common Stock issuable upon conversion of the Senior Convertible Note, issued by the Company in favor of Hanover, dated July 31, 2013 (the “Convertible Note”), in the principal amount of $405,000.

|

In the event of

stock splits, stock dividends, or similar transactions involving the Registrant’s common stock, the number of shares

registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be

offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities

Act”).

We hereby amend this

registration statement on such date or dates as may be necessary to delay its effective date until we shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

|

SUBJECT TO COMPLETION, DATED September 19, 2013

|

|

PROSPECTUS

|

|

7,651,000 SHARES OF COMMON STOCK

|

|

SANWIRE CORPORATION

|

This prospectus relates

to the resale of up to 7,651,000 shares of our common stock, which may be offered by the selling stockholder, Hanover Holdings

I, LLC, a New York limited liability company, or Hanover. The shares of common stock being offered by the selling stockholder are

issuable (i) upon conversion of a senior convertible note in the principal amount of $405,000, or the Convertible Note, that we

issued to Hanover on July 31, 2013 and (ii) pursuant to a common stock purchase agreement dated as of August 28, 2013 between us

and Hanover, or the Purchase Agreement.

We are not selling any

securities under this prospectus and will not receive any of the proceeds from the resale of shares of our common stock by the

selling stockholder under this prospectus, however, we have received gross proceeds of $300,000 from the sale of the Convertible

Note to Hanover and we may receive gross proceeds of up to $7,500,000 from sales of our common stock to Hanover under the Purchase

Agreement.

Hanover may offer all

or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or

at privately negotiated prices. We provide more information about how Hanover may sell its shares of common stock in the section

titled “Plan of Distribution” on page 38. We will pay the expenses incurred in connection with the offering described

in this prospectus, with the exception of brokerage expenses, fees, discounts and commissions, which will be paid by the selling

stockholder. In addition, we have agreed to issue 454,408 shares of our common stock to Hanover as an initial commitment fee for

entering into the Purchase Agreement and we may issue additional commitment shares to Hanover under certain circumstances described

in this Prospectus. With respect to the shares of common stock that have been and may be issued pursuant to the Purchase Agreement,

Hanover is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the

Securities Act, and with respect to any other shares of common stock, Hanover may be deemed to be an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act.

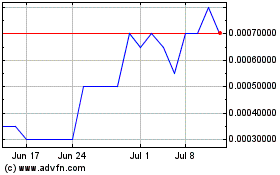

Our common stock is quoted

on the OTCQB Marketplace operated by OTC Markets Group Inc., or the OTCQB, under the symbol “SNWR”. The last reported

sale price of our common stock on the OTCQB on September 16, 2013 was $0.30 per share.

Investing in our common

stock involves a high degree of risk. Please see the sections entitled “Risk Factors” on page 17 of this prospectus

and “Part I—Item 1A Risk Factors” in Amendment No. 1 on Form 10-K/A to our Annual Report on Form 10-K for the

year ended December 31, 2012.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is September __, 2013.

|

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such state.

|

|

|

TABLE OF CONTENTS

|

PART I - INFORMATION REQUIRED IN PROSPECTUS

|

|

|

|

|

|

|

Page

|

|

PROSPECTUS SUMMARY

|

8

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

|

17

|

|

RISK FACTORS

|

17

|

|

USE OF PROCEEDS

|

27

|

|

DETERMINATION OF OFFERING PRICE

|

28

|

|

SELLING STOCKHOLDER

|

28

|

|

PLAN OF DISTRIBUTION

|

35

|

|

DESCRIPTION OF SECURITIES TO BE REGISTERED

|

55

|

|

INTERESTS OF NAMED EXPERTS AND COUNSEL

|

57

|

|

INFORMATION WITH RESPECT TO THE REGISTRANT

|

57

|

|

PROPERTIES

|

57

|

|

LEGAL PROCEEDINGS

|

57

|

|

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

|

58

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

59

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

65

|

|

EXECUTIVE COMPENSATION

|

67

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

72

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

72

|

|

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

74

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

75

|

|

FINANCIAL STATEMENTS

|

75

|

|

|

|

|

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

|

|

|

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

117

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

117

|

|

RECENT SALES OF UNREGISTERED SECURITIES

|

119

|

|

EXHIBIT INDEX

|

122

|

|

UNDERTAKINGS

|

123

|

|

SIGNATURES

|

126

|

Glossary of Terms

Backhaul:

The segment

of a Wi-Fi network which comprises the intermediate links between the head end of the network and access points.

CLEC (Competitive Local Exchange

Carrier):

The local or regional carrier in most rural communities.

Explosion Proof (XP) enclosure:

An enclosure that can withstand an explosion of gases within it and prevent the explosion of gases surrounding it due to sparks,

flashes or the explosion of the container itself, and maintain an external temperature which will not ignite the surrounding gases.

Head End:

The originating

point in a communications system to provide a telecommunication service, and access to a gateway.

Internet Protocol (IP):

A

communications protocol used to send and receive data across the Internet using Internet Protocol.

Intrinsic Safety (IS):

A device

or an instrument which will not produce any spark or thermal effects under normal or abnormal conditions that will ignite a specified

gas mixture.

iPMine-M8 Model 810T

:

The

Company’s current handheld texting device.

iPMine-M8 Model 925V

:

The

Company’s future/planned handheld voice-over-IP/texting device.

iPMine-ZAP (Zone Access Point):

The Company’s wireless/wireline access point.

iPMine-VU:

The Company’s

enterprise management software that tracks, monitors, and displays the location of miners and/or equipment against a backdrop of

a mine’s map.

Last Mile:

The euphemism used

to describe the end of the wired signal capability.

Leaky Feeder:

An analog-based

communication system. A typical system consists of a coaxial cable, spliced in pre-determined locations/distances, that acts as

the medium to transport and “leaks” signals (radio waves).

LTE:

Long Term Evolution

Mesh Networking:

A type of networking

where each node (access point) must not only capture and disseminate its own data, but also serve as a

relay

for other nodes,

that is, it must collaborate to propagate the data in the network.

MINER Act:

The US Mine

Improvement and New Emergency Response Act of 2006.

Mine Safety and Health Administration

(MSHA):

A division of the US Department of Labor, MSHA is the US federal agency that approves electronic devices (explosion

proof or intrinsic safety approval) for use in underground coal mines.

MPLS:

An industry term that refers

to MultiProtocol Label Switching.

Node:

Also known as an

access point or a router. We refer to these nodes as iPMine-ZAPs.

Non-LOS (Line of Sight):

The

description often used to describe the ability of a wireless signal to transmit in an interrupted or non-interupted status do to

obstructions.

PPL09:

MSHA’s guidelines

to implement a wireless communication system in underground coal mines in the US per the MINER Act of 2006.

QoS (Quality of Service):

A level

of service often referred to as five 9’s of reliability.

RF (Radio Frequency):

The band

of transmission for an electronic signal.

RFiD Tags:

Radio Frequency

IDentification tags. A small radio that transmits a unique code associated with a device or a person (in this case a miner).

Saas:

An industry term that refers

to Software as a Service.

TVWS (TV White Space):

The TV

frequencies available for use today that do not have line of sight limitations.

Voice over Internet Protocol (VoIP):

A methodology and group of technologies for the delivery of voice communications and multimedia sessions over Internet Protocol

(IP) networks, such as the Internet. Other terms commonly associated with VoIP are IP telephony, Internet telephony, voice over

broadband (VoBB), broadband telephony, IP communications, and broadband phone service.

Wi-Fi:

A popular technology

that allows an electronic device to exchange data or connect to the internet wirelessly using radio waves.

Wireline Backhaul:

Wired

connection Backhaul network; typically fiber optic.

ZigBee:

A specification

for a suite of high level communication protocols used to create personal area networks built from small, low-power digital radios.

ZigBee is based on an IEEE 802.15 standard. Though low-powered, ZigBee devices often transmit data over longer distances by passing

data through intermediate devices to reach more distant ones, creating a mesh network; i.e., a network with no centralized control

or high-power transmitter/receiver able to reach all of the networked devices.

You should rely only on the information contained

in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these

securities in any state where the offer is not permitted.

PROSPECTUS SUMMARY

You should read the

following summary together with the more detailed information and the financial statements appearing elsewhere in this Prospectus.

This Prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially

from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Risk

Factors” and elsewhere in this Prospectus. Unless the context indicates or suggests otherwise, references to “we,”

“our,” “us,” the “Company,” or the “Registrant” refer to Sanwire Corporation, a

Nevada corporation.

Our Business

Corporate Information

Sanwire was incorporated

in the State of Nevada on February 10, 1997. The Company was formerly named Clear Water Mining, Inc. (February 10 1997 through

March 11, 1999), E-Casino Gaming Corporation (March 2, 1999 through June 21, 1999), E-Vegas.com Inc. (June 22, 1999 through July

20, 2000), 1st Genx.com Inc. (July 21, 2000 through October 18, 2001), Oasis Information Systems, Inc. (October 19, 2001 through

January 27, 2005), 777 Sports Entertainment, Corp. (January 28, 2005 through September 26, 2008) and NT Mining Corporation (September

28, 2008 through March 8, 2013). The Company operates from its offices at 9710 E. 55th Pl., Tulsa, OK

74146. Our telephone number is (800) 243-1254.

Sanwire aims to be a

global provider of wireless communication services and data solutions; delivering efficient and reliable communications to our

customers. Sanwire’s goal is to operate a number of vertically integrated portfolio of wireless subsidiaries that are synergistic,

diverse, and operate independently with their own revenue stream and customer base. We strive, however, to have our subsidiaries

to cross sell to each other with respect to products and services, and share customer base. Sanwire plans to grow organically and

through complementary acquisitions in the wireless sectors. Currently, Sanwire owns and operates two vertically integrated wholly-owned

subsidiaries:

|

|

·

|

iPTerra Technologies, Inc., a Nevada corporation, designs and develops

wireless and/or wireline communication solutions for hazardous environments including underground mines. iPTerra’s flagship

product, the iPMine system, is a real-time 2-way wireless/fiber mine-safety system for the global mining industry. iPMine tracks,

monitors, and communicates with miners and equipment underground and above ground. Our strategy is to acquire customers in the

U.S. underground coal mining industry and evaluate opportunities in other international mine-safety markets.

|

|

|

·

|

Aeronetworks LLC, an Oklahoma limited liability company, provides

advanced telecommunications and broadband services to rural communities and Native American tribes with focus on public safety,

education and healthcare sectors. Aero delivers 4G/LTE, TV White Space, and advanced wireless technologies.

|

The Company changed its

business focus during 2007 and in 2008 and completed the changeover to mining exploration and development, which was the concept

utilized when the Company was incorporated. In order to complete the transformation, the Company completed a reverse stock split

during 2008, settled the majority of its liabilities through a share exchange for debt and acquired a privately held Canadian mining

corporation with a single mining asset, former Gold Producer "The Bullmoose Mine", located in the Northwest Territory

of Canada. In 2009 and 2010, the company completed a limited program on the mining properties in Canada, sufficient to maintain

the lease and mineral claims in good standing.

In 2011, the

Company settled litigation it had initiated to assert its interest in the Bullmoose Mine (“Bullmoose”). Under the

settlement, the Company’s acquisition of Bullmoose will be rescinded. More particularly, the 120,000 shares issued by

the company as consideration for the acquisition will be cancelled and $75,000 of the $85,000 paid as part consideration for

the acquisition, will be returned to the Company. The closing date was set for June 30, 2012. Until that date and afterwards,

if the settlement does not close, the Company continues to retain title to Bullmoose.

On January 2, 2013, the

Company signed an exclusive licensing and distribution agreement (the “Licensing Agreement”) to sell and market the

iPMine communication and mine-safety system for underground mines for the European continent. The terms of the agreement includes

exclusivity for the European market for a 5-year term renewable with an additional 5-year term and first right of refusal option

to acquire 100% of the iPMine intellectual property. The Company issued 300,000 common shares of the Company at a fair value of

$300 to the licensor.

On January 14, 2013,

the Company signed a purchase agreement to acquire 100% ownership in newly created iPTerra Technologies, Inc. for cash consideration

of $5,500, which shall be paid to a seller within a 12-month period from a closing date. The iPMine system will operate under iPTerra

Technologies, Inc.

On March 22, 2013, the

Company exercised its option under the recently executed Licensing Agreement to acquire 100% ownership of the iPMine communication

and mine-safety system. The iPMine system will operate under the Company’s wholly owned subsidiary, iPTerra Technologies,

Inc. The Company acquired 100% of the iPMine intellectual property for a total consideration of $10,000,000 comprised of 20,000,000

common shares with a fair value of $0.001 per share for total of $20,000 and the assumption of $9,980,000 in debt (the “Debt”)

in favor to two companies controlled by Naiel Kanno (the “Debt Holders”). On May 10, 2013, the Company and the Debt

Holders entered into an agreement to convert the Debt into a non-interest bearing convertible promissory note repayable in eighteen

months with the conversion price of $1.00 per common share at the option of the Debt Holders.

On May 29, 2013, the

Company completed the acquisition of Aeronetworks LLC (“Aero”), a company based in Tulsa, Oklahoma. In consideration

for the acquisition, the Company (i) issued Two Million and Four Hundred Thousand (2,400,000) shares of its common stock, (ii)

issued Three Million (3,000,000) warrants to purchase its common stock in three blocks consisting of One Million (1,000,000) warrants

each, expiring in 2014, 2015, and 2017 at an exercise price of $0.50, $0.75, and $1.00 respectively, (iii) granted future earn-out

performance bonus shares based on revenue growth, and (iv) granted a three-year extension to the management agreement for Aero’s

management team. Aero provides advanced telecommunications and broadband services to rural communities and Native American tribes

with a focus on public safety, education and healthcare sectors.

Recent Developments

Senior Convertible

Note Financing with Hanover Holdings I, LLC

Note Purchase Agreement

and Convertible Note

On July 31, 2013, we entered into a note purchase agreement with Hanover, which we refer to as the Note

Purchase Agreement. The Note Purchase Agreement provides that, upon the terms and subject to the conditions set forth

in the Note Purchase Agreement, Hanover will purchase from us the Convertible Note with an initial principal amount of $405,000

for a purchase price of $300,000, representing an approximately 25.93% original issue discount. We issued the Convertible Note

to Hanover on July 31, 2013.

$75,000 of the outstanding principal amount of the Convertible Note (together with any accrued and unpaid

interest with respect to such portion of the principal amount) will be automatically extinguished (without any cash payment

by us) if (i) the registration statement of which this prospectus is a part is declared effective by the SEC on or prior to

the earlier of (A) the 75

th

calendar day after July 31, 2013 and (B) the fifth business day after the date we

are notified by the Securities and Exchange Commission, or the Commission, that the registration statement will not be

reviewed or will not be subject to further review, and this prospectus is available for use by Hanover for the resale by

Hanover of all of the shares of our common stock issued or issuable upon conversion of the Convertible Note and (ii) no event

of default under the Convertible Note or an event that with the passage of time or giving of notice would constitute an event

of default under the Convertible Note has occurred on or prior to such date.

The Convertible Note

matures on January 27, 2014 and, in addition to the approximately 25.93% original issue discount, accrues interest at the rate

of 8.0% per year. The Convertible Note is convertible at any time, in whole or in part, at Hanover’s option into shares of

our common stock at a fixed conversion price of $0.2325 per share, subject to adjustment pursuant to the “full ratchet”

and standard anti-dilution provisions contained in the Convertible Note. This conversion price represents a discount of 25% from

the closing price of our common stock of $0.31 on July 24, 2013, which was the lowest closing price of our common stock during

the five-trading-day period immediately prior to the date we issued the Convertible Note to Hanover. At no time will Hanover be

entitled to convert any portion of the Convertible Note to the extent that after such conversion, Hanover (together with its affiliates)

would beneficially own more than 4.99% of our common stock (as calculated pursuant to Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, and the rules and regulations thereunder).

The

Convertible Note includes customary event of default provisions, and provides for a default interest rate of 18%. Upon the occurrence

of an event of default, Hanover may require us to pay in cash the “Event of Default Redemption Price” which is defined

in the Convertible Note to mean the greater of (i) the product of (A) the amount to be redeemed multiplied by (B) 125% (or 100%

if an insolvency related event of default) and (ii) the product of (X) the conversion price in effect at that time multiplied by

(Y) the product of (1) 125% (or 100% if an insolvency related event of default) multiplied by (2) the greatest closing sale price

of our common stock on any trading day during the period commencing on the date immediately preceding such event of default and

ending on the date we make the entire payment required to be made under this provision.

We have the right at

any time to redeem all, but not less than all, of the total outstanding amount then remaining under the Convertible Note in cash

at a price equal to 120% of the total amount of the Convertible Note then outstanding.

The Note Purchase Agreement

contains customary representations, warranties and covenants by, among and for the benefit of the parties. We also agreed to pay

up to $10,000 of reasonable attorneys' fees and expenses incurred by Hanover in connection with the transaction. The Note Purchase

Agreement also provides for indemnification of Hanover and its affiliates in the event that Hanover incurs losses, liabilities,

obligations, claims, contingencies, damages, costs and expenses related to a breach by us of any of our representations, warranties

or covenants under the Note Purchase Agreement.

The issuance of the Convertible

Note to Hanover under the Note Purchase Agreement was exempt from the registration requirements of the Securities Act pursuant

to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and

Rule 506 of Regulation D promulgated under the Securities Act.

Note Registration

Rights Agreement

In

connection with the execution of the Note Purchase Agreement, on July 31, 2013, Hanover and we also entered into a registration

rights agreement, which we refer to as the Note Registration Rights Agreement. Pursuant to the Note Registration Rights Agreement,

we agreed to file the registration statement of which this prospectus is a part with the Commission to register for resale 1,890,000

shares of our common stock into which the Convertible Note may be converted, on or prior to September 3, 2013, and have it declared

effective at the earlier of (i) the 75

th

calendar day after July 31, 2013 and (ii) the fifth business day after

the date we are notified by the Commission that the registration statement will not be reviewed or will not be subject to further

review. Prior to September 3, 2013, we and Hanover agreed to extend the filing deadline to September 20, 2013.

We have agreed to file

with the Commission one or more additional registration statements to cover all of the securities required to be registered under

the Note Registration Rights Agreement that are not covered by this prospectus, in each case, as soon as practicable, but in no

event later than the applicable filing deadline for such additional registration statements as provided in the Note Registration

Rights Agreement.

We also agreed, among

other things, to indemnify Hanover from certain liabilities and fees and expenses of Hanover incident to our obligations under

the Note Registration Rights Agreement, including certain liabilities under the Securities Act. Hanover has agreed to indemnify

and hold harmless us and each of our directors, officers and persons who control us against certain liabilities that may be based

upon written information furnished by Hanover to us for inclusion in the registration statement of which this prospectus is a part,

including certain liabilities under the Securities Act.

Equity Enhancement

Program with Hanover Holdings I, LLC

Common Stock Purchase

Agreement

On August 28, 2013, which

we refer to as the Closing Date, we entered into the Purchase Agreement with Hanover. The Purchase Agreement provides

that, upon the terms and subject to the conditions set forth therein, Hanover is committed to purchase up to $7,500,000, which

we refer to as the Total Commitment, worth of our common stock, which we refer to as the Shares, over the 36-month term of the

Purchase Agreement.

From time to time over

the term of the Purchase Agreement, commencing on the trading day immediately following the date on which the registration statement

of which this prospectus is a part is declared effective by the Commission, we may, in our sole discretion, provide Hanover with

either “regular” draw down notices or, if certain conditions are satisfied, “fixed” draw down notices,

each referred to as a Draw Down Notice, in each case to purchase a specified dollar amount of Shares, which we refer to as the

Draw Down Amount, with each draw down subject to the limitations discussed below. The maximum amount of Shares requested to be

purchased pursuant to any single “regular” Draw Down Notice, each a Regular Draw Down Notice, cannot exceed 300% of

the average daily trading volume of the Company’s common stock for the 20 trading days immediately preceding the date of

the Regular Draw Down Notice, which we refer to as the Maximum Regular Draw Down Amount. The maximum amount of Shares requested

to be purchased pursuant to any single “fixed” Draw Down Notice, each a Fixed Draw Down Notice, cannot exceed 200%

of the average daily trading volume of the Company’s common stock for the 20 trading days immediately preceding the date

of the Fixed Draw Down Notice, which we refer to as the Maximum Fixed Draw Down Amount. Each purchase pursuant to a draw down will

reduce, on a dollar-for-dollar basis, the Total Commitment under the Purchase Agreement.

We

may, in our sole discretion, provide Hanover with Regular Draw Down Notices to purchase a specified Draw Down Amount, up to the

Maximum Regular Draw Down Amount, over a 10 consecutive trading day period commencing on the trading day specified in the applicable

Regular Draw Down Notice, which we refer to as the Pricing Period. Once presented with a Regular Draw Down Notice, Hanover is required

to purchase a pro rata portion of the applicable Draw Down Amount on each trading day during the applicable Pricing Period on which

the daily volume weighted average price for our common stock, or VWAP, equals or exceeds an applicable floor price, or Floor Price,

equal to the product of (i) 0.70 and (ii) the VWAP over the 10 trading days immediately preceding the date the Regular Draw Down

Notice is delivered, subject to adjustment for any stock splits, stock combinations, stock dividends, recapitalizations and other

similar transactions. If the VWAP falls below the applicable Floor Price on any trading day during the applicable Pricing Period,

the Purchase Agreement provides that Hanover will not purchase the pro rata portion of the applicable Draw Down Amount allocated

to that trading day. The per share purchase price for the Shares subject to a Regular Draw Down Notice will be equal to 90%

of the arithmetic average of the three lowest daily VWAPs that equal or exceed the applicable Floor Price during the applicable

Pricing Period, except that if the VWAP does not equal or exceed the applicable Floor Price for at least three trading days during

the applicable Pricing Period, then the per share purchase price will be equal to 90% of the arithmetic average of all VWAPs that

equal or exceed the applicable Floor Price during such Pricing Period.

We may, in our sole discretion,

on any trading day on which both of the equity conditions described below are satisfied, provide Hanover with a Fixed Draw Down

Notice to purchase a specified Draw Down Amount, up to the Maximum Fixed Draw Down Amount, on the applicable settlement date, which

will occur within one trading day following the date the Fixed Draw Down Notice is delivered. The per share purchase price for

the Shares subject to a Fixed Draw Down Notice, or the Fixed Purchase Price, will be equal to 75% of the lower of (i) the lowest

trade price of a share of our common stock on the date the Fixed Draw Down Notice is delivered, which we refer to as the Draw Down

Exercise Date, and (ii) the arithmetic average of the three lowest daily VWAPs during the 10 consecutive trading days ending on

the trading day immediately preceding the applicable Draw Down Exercise Date. We may deliver a Fixed Draw Down Notice only if both

of the following equity conditions have been satisfied as of the applicable Draw Down Exercise Date:

|

|

·

|

on each trading day during the period beginning 30 trading days prior

to the applicable Draw Down Exercise Date and ending on and including the applicable Draw Down Exercise Date, the lowest trade

price of a share of our common stock must be greater than $0.20, subject to adjustment for any stock splits, stock combinations,

stock dividends, recapitalizations and other similar transactions, which we refer to as the Fixed Floor Price; and

|

|

|

·

|

on each trading day during the period beginning 30 trading days prior

to the applicable Draw Down Exercise Date and ending on and including the applicable Draw Down Exercise Date, the trade price of

a share of our common stock must not have declined more than 20% from an intraday high to an intraday low during such trading day.

|

We are prohibited

from issuing a Draw Down Notice if (i) the amount requested in such Draw Down Notice exceeds the Maximum Regular Draw Down Amount,

in the case of a Regular Draw Down Notice, or exceeds the Maximum Fixed Draw Down Amount, in the case of a Fixed Draw Down Notice,

(ii) the sale of Shares pursuant to such Draw Down Notice would cause us to issue or sell or Hanover to acquire or purchase an

aggregate dollar value of Shares that would exceed the Total Commitment, or (iii) the sale of Shares pursuant to the Draw Down

Notice would cause us to sell or Hanover to purchase an aggregate number of shares of our common stock which would result in beneficial

ownership by Hanover of more than 4.99% of our common stock (as calculated pursuant to Section 13(d) of the Exchange Act, and

the rules and regulations thereunder). With respect to a draw down pursuant to a Regular Draw Down Notice, we cannot make

more than one draw down (whether pursuant to a Fixed Draw Down Notice or a Regular Draw Down Notice) in any Pricing Period and

must allow 24 hours to elapse between the completion of the settlement of any one draw down pursuant to a Regular Draw Down Notice

and the delivery of any Fixed Draw Down Notice or Regular Draw Down Notice for any other draw down. With respect to a draw down

pursuant to a Fixed Draw Down Notice, we must allow 15 trading days to elapse between the completion of the settlement of any

one draw down pursuant to a Fixed Draw Down Notice and the delivery of any Fixed Draw Down Notice or Regular Draw Down Notice

for any other draw down.

The Purchase Agreement

contains customary representations, warranties and covenants by, among and for the benefit of the parties. The Purchase Agreement

may be terminated at any time by the mutual written consent of the parties. Unless earlier terminated, the Purchase Agreement

will terminate automatically on the earliest to occur of (i) the first day of the month next following the 36-month anniversary

of the date on which the registration statement of which this prospectus is a part is declared effective by the Commission, (ii)

the date on which Hanover purchases the Total Commitment worth of common stock under the Purchase Agreement and (iii) the date

on which our common stock ceases to be listed or quoted on an eligible trading market under the Purchase Agreement. Under certain

circumstances set forth in the Purchase Agreement, we and Hanover each may terminate the Purchase Agreement on one trading day’s

prior written notice to the other, without fee, penalty or cost.

We have agreed to pay to Hanover a commitment fee for entering

into the Purchase Agreement equal to $150,000 (or 2.0% of the Total Commitment under the Purchase Agreement) in the form

of 454,408 shares of our common stock, which we refer to as the Initial Commitment Shares, calculated using a per share price

of $0.3301, representing the lowest daily volume weighted average price of a share of our common stock during the three-trading

day period immediately preceding the Closing Date. In addition, as soon as practicable following the effective date of the

registration statement of which this prospectus is a part, we are required to issue to Hanover additional shares of our common

stock, which we refer to as the Additional Commitment Shares, equal to the greater of (i) zero and (ii) the difference of

(a) the quotient of (x) $150,000 divided by (y) the greater of (1) the lowest trade price of a share of our common stock during

the period beginning two trading days immediately preceding the effective date of the registration statement of which this prospectus

is a part and ending on such effective date and (2) $0.15, less (ii) 454,408, provided that in no event will we issue more than

an aggregate of 545,592 shares of our common stock, subject to adjustment for any stock splits, stock combinations, stock dividends,

recapitalizations and other similar transactions, as Additional Commitment Shares. The Initial Commitment Shares, together with

545,592 Additional Commitment Shares, are being registered for resale in the registration statement of which this prospectus is

a part. We sometimes in this prospectus refer to the Initial Commitment Shares and the Additional Commitment Shares, collectively,

as the Commitment Shares.

We also agreed to

pay up to $20,000 of reasonable attorneys' fees and expenses (exclusive of disbursements and out-of-pocket expenses) incurred

by Hanover in connection with the preparation, negotiation, execution and delivery of the Purchase Agreement and related

transaction documentation. Further, if we issue a Draw Down Notice and fail to deliver the shares to Hanover on the

applicable settlement date, we agreed to pay Hanover, in addition to all

other remedies available to Hanover under the Purchase Agreement, an amount in cash equal to 2.0% of the purchase price of

such shares for each 30-day period the shares are not delivered, plus accrued interest.

The Purchase Agreement

also provides for indemnification of Hanover and its affiliates in the event that Hanover incurs losses, liabilities, obligations,

claims, contingencies, damages, costs and expenses related to a breach by us of any of our representations and warranties under

the Purchase Agreement or the other related transaction documents or any action instituted against Hanover or its affiliates due

to the transactions contemplated by the Purchase Agreement or other transaction documents, subject to certain limitations.

Registration

Rights Agreement

In

connection with the execution of the Purchase Agreement, on the Closing Date, we and Hanover also entered into a registration

rights agreement dated as of the Closing Date, which we refer to as the Registration Rights Agreement. Pursuant to the Registration

Rights Agreement, we agreed to file the registration statement of which this prospectus is a part with the Commission to register

for resale 7,651,000 shares of our common stock, which includes the 454,408 Initial Commitment Shares and 545,592 Additional Commitment

Shares, on or prior to September 3, 2013, which we refer to as the Filing Deadline, and have it declared effective at the earlier

of (A) the 75

th

calendar day after the earlier of (1) the Filing Deadline and (2) the date on which the registration

statement of which this prospectus is a part is filed with the Commission and (B) the fifth business day after the date the Company

is notified by the Commission that the registration statement will not be reviewed or will not be subject to further review, which

we refer to as the Effectiveness Deadline. Prior to September 3, 2013, we and Hanover agreed to extend the Filing Deadline

to September 20, 2013. The effectiveness of the registration statement of which this prospectus is a part is a condition precedent

to our ability to sell common stock to Hanover under the Purchase Agreement.

We have agreed to file

with the Commission one or more additional registration statements to cover all of the securities required to be registered under

the Registration Rights Agreement that are not covered by this prospectus, in each case, as soon as practicable, but in no event

later than the applicable filing deadline for such additional registration statements as provided in the Registration Rights Agreement.

We also agreed, among

other things, to indemnify Hanover from certain liabilities and fees and expenses of Hanover incident to our obligations under

the Registration Rights Agreement, including certain liabilities under the Securities Act. Hanover has agreed to indemnify and

hold harmless us and each of our directors, officers and persons who control us against certain liabilities that may be based upon

written information furnished by Hanover to us for inclusion in the registration statement of which this prospectus is a part,

including certain liabilities under the Securities Act.

Recent Issuances

The table below sets forth shares of

our common stock that have been recently issued in exchange for certain services or rights.

|

Date

|

|

Issuance of Shares

|

|

January 3, 2013

|

|

The Company issued 300,000 shares of common stock with a fair value of $300 pursuant to the License Agreement.

|

|

March 22, 2013

|

|

The Company exercised its option under the License Agreement to acquire 100% ownership of the iPMine communication and mine safety system. As consideration, the Company issued 20,000,000 shares of common stock with a fair value of $20,000.

|

|

March 27, 2013

|

|

The Company issued 20,000,000 shares of common stock with a fair value of $20,000 to settle debt of $20,000. The shares were issued to Senso Investments (15,000,00 shares for $15,000 fair value) and, Northwest Management Anstalt (5,000,00 shares for $5,000 fair value).

|

|

May 17, 2013

|

|

The Company

issued 200,000 shares of common stock with a fair value of $58,000 to J R Vetter Consulting, Inc., a company controlled

by J R Roland Vetter, the Chief Financial Officer of the Company as compensation under this consultant

agreement

|

|

May 17, 2013

|

|

The Company issued 200,000 shares of common stock with a fair value of $58,000 to Biarritz Productions, of which $7,150 was expensed as consulting fees for the pro-rate portion of services rendered to June 30, 2013.

|

|

May 17, 2013

|

|

The Company issued 275,000 shares of common stock with a fair value of $79,750 to Lloyd Donner, of which $9,832 was expensed as consulting fees for the pro-rate portion of services rendered to June 30, 2013

|

|

May 29, 2013

|

|

The Company issued 2,400,000 shares of common stock with a fair value of $600,000 to acquire Aero.

|

|

May 29, 2013

|

|

The Company issued 300,000 shares of common stock with a fair value of $75,000 to the management team of Aero, which consists of Richard Bjorklund, James Bradley and Samuel Sibala.

|

|

June 1, 2013

|

|

The Company issued 50,000 shares of common stock with a fair value of $12,500 to Les Matthews, a consultant.

|

|

June 3, 2013

|

|

The Company issued 50,000 shares of common stock with a fair value of $13,500 to George Naylor and John Sisk, both of whom are members of IpTerra’s advisory board.

|

|

June 12, 2013

|

|

The Company issued 500,000 of common stock with a fair value of $170,000 to C Dillow & Co., of which $18,580 was expensed as consulting fees for the pro-rate portion of services rendered to June 30, 2013

|

|

June 12, 2013

|

|

The Company issued 250,000 shares of common stock with a fair value of $92,500 to Core Consulting, of which $9,604 was expensed as consulting fees for the pro-rate portion of services rendered to June 30, 2013.

|

|

June 27, 2013

|

|

The Company issued 500,000 shares of common stock with a fair value of $170,000 to Rovert Consulting, of which $3,716 was expensed as consulting fees for the pro-rate portion of services rendered to June 30, 2013.

|

|

June 28, 2013

|

|

The Company issued 96,000 shares of common stock with a fair value of $45,120 to Gross Capital which was recorded as deferred compensation which will be expensed on the vesting date of July 1, 2013.

|

|

June 1, 2013

|

|

The Company issued 250,000 share purchase warrants at an exercise price of $0.50 per share expiring on May 31, 2014 to Les Matthews, a consultant.

|

|

|

|

|

Transfer Agent

Our transfer agent is

President Stock Transfer, and is located at 515 West Pender Street, Suite 217, Vancouver, BC, V6B 6H5. The agent’s telephone

number is (604) 876-5526.

The Offering

As of September 2, 2013, there were 46,553,147 shares of

our common stock outstanding, of which 22,953,147 shares were held by non-affiliates. Although the Purchase Agreement provides

that we may sell up to $7,500,000 of our common stock to Hanover, only 7,651,000 shares of our common stock are being offered under

this prospectus, which represents (i) 1,890,000 shares of common stock that may be issued to Hanover upon conversion of the Convertible

Note, (ii) 454,408 shares of common stock that we agreed to issue to Hanover as Initial Commitment Shares, (iii) a maximum of

545,592

shares of common stock that we may be required to issue to Hanover as Additional Commitment Shares and (iv) 4,761,000 shares

of common stock that we may issue to Hanover as Shares pursuant to draw downs under the Purchase Agreement. If all of the 7,651,000

shares offered under this prospectus were issued and outstanding as of September 2, 2013, such shares would represent approximately

14.1% of the total number of shares of our common stock outstanding and 25.0% of the total number of outstanding shares of our

common stock held by non-affiliates, in each case as of September 2, 2013.

At an assumed purchase price of

$0.30 (equal to the closing price of our common stock of $0.30 on September 16, 2013), and assuming the sale by us to Hanover

of all of the 4,761,000 Shares, or approximately 10.2% of our issued and outstanding common stock, being registered hereunder

pursuant to draw downs under the Purchase Agreement, we would receive only approximately $1,428,300 in gross proceeds.

Furthermore, we may receive substantially less than $1,428,300 in gross proceeds from the financing due to our share price,

discount to market and other factors relating to our common stock. If we elect to issue and sell more than the 4,761,000

Shares offered under this prospectus to Hanover, which we have the right, but not the obligation, to do, we must first

register for resale under the Securities Act any such additional Shares, which could cause additional substantial dilution to

our stockholders. Based on the above assumptions, we would be required to register an additional approximately 20,239,000

shares of our common stock to obtain the balance of $6,071,700 of the Total Commitment that would be available to us under

the Purchase Agreement. We currently have authorized and available for issuance 750,000,000 shares of our common stock

pursuant to our charter. The number of shares of our common stock ultimately offered for resale by Hanover is dependent upon

a number of factors, including the extent to which Hanover converts the Convertible Note into shares of our common stock and

the number of Shares we ultimately issue and sell to Hanover under the Purchase Agreement.

The Total Commitment of $7,500,000 was determined based on

numerous factors, including our estimated operating expenses for the next three years. While it is difficult to estimate the likelihood

that we will need the full Total Commitment, we presently believe that we may need the full Total Commitment under the Purchase

Agreement.

|

Common stock offered by Selling Stockholder

|

7,651,000 shares of common stock, consisting

of:

·

1,890,000 shares of common stock that we may issue to Hanover upon conversion of the Convertible

Note;

·

454,408 shares of common stock that we issued to Hanover as Initial Commitment Shares;

·

a maximum of 545,592 shares of common stock that we may be required to issue to Hanover as

Additional Commitment Shares; and

·

4,761,000 shares of common stock that we may issue to Hanover as Shares pursuant to draw downs

under the Purchase Agreement.

|

|

|

|

|

Common stock outstanding before the offering

|

46,553,147 shares of common stock.

|

|

|

|

|

Common stock outstanding after the offering

|

54,204,147 shares of common stock.

|

|

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares by the selling stockholder. However, we have received gross proceeds of $300,000 from the sale of the Convertible Note to Hanover and we may receive gross proceeds of up to $7,500,000 from the sale of Shares to Hanover pursuant to the Purchase Agreement. The net proceeds received from the sale of the Convertible Note to Hanover and from the sale of Shares pursuant to the Purchase Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that our Board of Directors, in its good faith deem to be in the best interest of the company and its stockholders.

|

|

|

|

|

OTCQB Trading Symbol

|

SNWR

|

|

|

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”.

|

SUMMARY OF FINANCIAL

INFORMATION

The

following selected financial information is derived from the Company’s Consolidated Financial Statements appearing

elsewhere in this Prospectus and should be read in conjunction with the Company’s Consolidated Financial Statements,

including the notes thereto, appearing elsewhere in this Prospectus.

Summary of Statements of Operations

|

|

Year Ended December 31, 2012

|

Six Months Ended June 30, 2013 (unaudited)

|

|

Total Revenue

|

$0

|

$117,800

|

|

Net loss

|

$(464,429)

|

$(10,619,869)

|

|

Net loss per common share (basic and diluted)

|

$(0.46)

|

$(0.44)

|

|

Weighted average common shares

|

1,004,540

|

24,028,385

|

Statement

of Financial Position

|

|

As At

December 31, 2012

|

As At

June 30, 2013

(unaudited)

|

|

Cash

|

$1,094

|

$2,413

|

|

Total current assets

|

$1,094

|

$113,833

|

|

Total assets

|

$1,094

|

$1,497,175

|

|

Total current liabilities

|

$1,373,129

|

$1,719,661

|

|

Stockholders’ deficit

|

$(1,372,035)

|

$(8,011,131)

|

|

Total liabilities and stockholders’ deficit

|

$1,094

|

$1,497,175

|

DISCLOSURE REGARDING

FORWARD-LOOKING STATEMENTS

Except for statements

of historical facts, this Prospectus contains forward-looking statements involving risks and uncertainties. The words “anticipate,”

“believe,” “estimate,” “expect,” “future,” “intend,” “plan”

or the negative of these terms and similar expressions or variations thereof are intended to forward looking statements. Such statements

reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and

other factors (including the risks contained in the section of this registration statement on Form S-1 entitled “Risk Factors”)

relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that

may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions

prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant

believes that the expectations reflected in the forward looking statements are reasonable, the Registrant cannot guarantee future

results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of

the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to

actual results. The following discussion should be read in conjunction with the Registrant’s financial statements and the

related notes included in this registration statement on Form S-1.

RISK FACTORS

You should carefully

consider the risks described below together with all of the other information included in our public filings before making an investment

decision with regard to our securities. The statements contained in or incorporated into this registration statement on Form S-1

that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual

results to differ materially from those set forth in or implied by forward-looking statements. While the risks described below

are the ones we believe are most important for you to consider, these risks are not the only ones that we face. If any of the following

events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed.

In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to our

Business and Industry

We have a history

of losses which may continue, which may negatively impact our ability to achieve our business objectives.

We cannot be assured

that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks

and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be

profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

If we are unable

to obtain additional funding our business operations will be harmed and if we do obtain additional financing our then existing

shareholders may suffer substantial dilution.

We will require additional

funds to expand our business activities, and to take advantage of any available business opportunities. Historically, we have financed

our expenditures primarily with proceeds from the sale of debt and equity securities. The proceeds from our operations are currently

insufficient to fully meet our obligations or enable us to carry out our business plan, so we will have to raise additional funds.

Obtaining additional financing will be subject to market conditions, industry trends, investor sentiment and investor acceptance

of our business plan and management. These factors may make the timing, amount, terms and conditions of additional financing unattractive

or unavailable to us. If we are not successful in achieving financing in the amount necessary to further our operations, implementation

of our business plan may fail or be delayed and any such failure or delay may have a material adverse effect on our company, stock

price and business.

Funding from our

Purchase Agreement with Hanover may be limited or insufficient to fund our operations or to implement our strategy.

Under our Purchase Agreement

with Hanover, upon effectiveness of the registration statement of which this prospectus is a part, and subject to other conditions,

we may direct Hanover to purchase up to $7,500,000 of our shares of common stock over a 36-month period. Although the Purchase

Agreement provides that we may sell up to $7,500,000 of our common stock to Hanover, only 7,651,000 shares of our common stock

are being offered under this prospectus, which represents (i) 1,890,000 shares of common stock that may be issued to Hanover upon

conversion of the Convertible Note, (ii) 454,408 shares of common stock that we have agreed to issue to Hanover as Initial Commitment

Shares, (iii) a maximum of 545,592 shares of common stock that we may be required to issue to Hanover as Additional Commitment

Shares and (iv) 4,761,000 shares of common stock that we may issue to Hanover as Shares pursuant to draw downs under the Purchase

Agreement.

At an assumed purchase

price of $0.30 (equal to the closing price of our common stock of $0.30 on September 16, 2013), and assuming the sale by us to

Hanover of all of the 4,761,000 Shares, or approximately 10.2% of our issued and outstanding common stock, being registered hereunder

pursuant to draw downs under the Purchase Agreement, we would receive only approximately $1,428,300 in gross proceeds. Furthermore,

we may receive substantially less than $1,428,300 in gross proceeds from the financing due to our share price, discount to market

and other factors relating to our common stock. If we elect to issue and sell more than the 4,761,000 Shares offered under this

prospectus to Hanover, which we have the right, but not the obligation, to do, we must first register for resale under the Securities

Act any such additional Shares, which could cause additional substantial dilution to our stockholders. Based on the above assumptions,

we would be required to register an additional approximately 20,239,000 shares of our common stock to obtain the balance of $6,071,700

of the Total Commitment that would be available to us under the Purchase Agreement. We currently have authorized and available

for issuance 750,000,000 shares of our common stock pursuant to our charter. Depending on the price at which Shares are ultimately

sold, we may have to increase the number of our authorized shares in order to issue Shares to Hanover.

There can be no assurance

that we will be able to receive all or any of the Total Commitment from Hanover because the Purchase Agreement contains certain

limitations, restrictions, requirements, conditions and other provisions that could limit our ability to cause Hanover to buy common

stock from us. For instance, we are prohibited from issuing a Draw Down Notice if the amount requested in such Draw Down Notice

exceeds the Maximum Regular Draw Down Amount, in the case of a Regular Draw Down Notice, or exceeds the Maximum Fixed Draw Down

Amount, in the case of a Fixed Draw Down Notice, or the sale of Shares pursuant to the Draw Down Notice would cause us to sell

or Hanover to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership

by Hanover of more than 4.99% of our common stock (as calculated pursuant to Section 13(d) of the Exchange Act and the rules and

regulations thereunder). Since Hanover is the beneficial owner of 4.80% of our common stock as of September 2, 2013 (including

the Initial Commitment Shares and the shares of our common stock issuable upon conversion of the Convertible Note), Hanover may

not be able to issue a Draw Down Notice until Hanover’s beneficial ownership percentage is reduced, either through the sale

of the shares of common stock held by Hanover, or through a reduction of the principal under the Convertible Note. Hanover is not

obligated to reduce its beneficial ownership percentage through the sale of shares of our common stock.

Moreover, there are limitations

with respect to the frequency with which we may provide Draw Down Notices to Hanover under the Purchase Agreement. Also, as discussed

above, there must be an effective registration statement covering the resale of any Shares to be issued pursuant to any draw down

under the Purchase Agreement, and the registration statement of which this prospectus is a part covers the resale of only 4,761,000

Shares that may be issuable pursuant to draw downs under the Purchase Agreement. These registration statements may be subject to

review and comment by the staff of the Commission, and will require the consent of our independent registered public accounting

firm. Therefore, the timing of effectiveness of these registration statements cannot be assured.

The extent to which

we rely on Hanover as a source of funding will depend on a number of factors, including the amount of working capital needed,

the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources.

If obtaining sufficient funding from Hanover were to prove unavailable or prohibitively dilutive, we would need to secure another

source of funding. Even if we sell all $7,500,000 of common stock under the Purchase Agreement with Hanover, we will still need

additional capital to fully implement our current business, operating plans and development plans.

Our independent

auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain

future financing.

In their report dated

April 16, 2013, our independent auditors stated that our financial statements for the fiscal year ended December 31, 2012 were

prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as a

result of recurring losses from operations. We continue to experience net operating losses. Our ability to continue as a going

concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from

the sale of our securities. Our continued net operating losses increase the difficulty in meeting such goals and there can be no

assurances that such methods will prove successful.

Because we have

a limited history of revenues from our operations, our business may fail and investors may lose all of their investment in our

Company.

We have a limited history

of positive earnings and there can be no assurance that we will continue to operate profitably. If our business plan is not successful

and we are not able to continue operating profitably, then our stock may become worthless and investors may lose all of their investment

in our company.

We recognize that if

we are unable to generate significant revenues from the sale of our products in the future, we will not be able to continue to

earn profits or continue operations. There is very little history upon which to base any assumption as to the likelihood that we

will prove successful in the long term, and we can provide no assurance that we will generate sufficient revenues or continue to

achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their

investment in our company.

We may be unable

to compete effectively with other companies in our market who offer, or may in the future offer, competing technologies.

We compete in a rapidly

evolving and highly competitive sector of the wireless communications industry. Our competitors have also identified the potential

market opportunity offered by us, and we therefore face intense competition in this portion of our market. We also face competition

from companies that offer partial or alternative solutions addressing limited aspects of the challenges facing broadband providers.

Our competitors may announce

new products, services or enhancements that better meet the needs of customers or changing industry requirements, or may offer

alternative methods to achieve customer objectives. New competitors have entered and may continue to enter the market. The entry

of new competitors into our market and acquisitions of our existing competitors by companies with significant resources and established

relationships with our potential customers could result in increased competition and harm to our business. Increased competition

may cause price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on

our business, financial condition or result of operations.

Industry consolidation

may lead to increased competition and may harm our operating results.

Our market may be subject

to industry consolidation, as companies attempt to maintain or strengthen their positions in an evolving industry, are unable to

continue their operations or are acquired. For example, some of our current and potential competitors have made, or have been reported

as considering making, acquisitions or have announced new strategic alliances designed to position them with the ability to provide

many of the same services that we provide, to both the service provider and enterprise markets. We believe that industry consolidation

may result in stronger competitors that are better able to compete as sole-source vendors for customers. This could lead to more

variability in our operating results and could have a material adverse effect on our financial condition or results of operations.

Our products may

not continue to comply with the regulations governing their sale, which may harm our business.

Some of our products

must comply with various regulations and standards defined by the [Federal Communications Commission (“FCC”), and the

U.S. Mine Safety and Health Administration (“MSHA”). Products sold internationally may be required to comply with local

regulations or standards established by communications authorities in various countries, as well as those of certain international

bodies. Although we believe our products are currently in compliance with domestic regulations such as MSHA, there can be no assurance

that we will be able to obtain international approvals in the future. Further, the cost of complying with the evolving standards

and regulations, or the failure to obtain timely domestic or foreign regulatory approvals or certification such that we may not

be able to sell our products where these standards or regulations apply, may adversely affect our results of operations and financial

condition.

If our products

do not interoperate with our customers’ networks, installations may be delayed or cancelled, which could harm our business.

Some of our products

must interface with existing networks, each of which may have different specifications, utilize multiple protocol standards and

incorporate products from other vendors. Many of our customers’ networks contain multiple generations of products that have

been added over time as these networks have grown and evolved. Our products may be required to interoperate with many or all of

the products within these networks as well as future products in order to meet our customers’ requirements. If we find errors

in the existing software or defects in the hardware used in our customers’ networks, we may have to modify our software or

hardware to fix or overcome these errors so that our products will interoperate with the existing software and hardware. Such issues

may affect our ability to obtain product acceptance from other customers. Implementation of product corrections involving interoperability

issues could increase our costs and adversely affect our results of operations.

We must continue

to update and improve our products and develop new products in order to compete and to keep pace with improvements in communications

technology.

The markets for our products

are characterized by rapidly changing technology, evolving industry standards, and continuing improvements in the communications

service offerings of common service providers. If technologies or standards applicable to our products, or common service provider

offerings based on our products, become obsolete or fail to gain widespread commercial acceptance, our existing products or products

under development may become obsolete or unmarketable. Moreover, the introduction of products embodying new technologies, the emergence

of new industry standards, or changes in common service provider offerings could adversely affect our ability to sell our products.

To meet the requirements of these new delivery systems and to maintain our market position, we may have to develop new products

or modify existing products.

Our ability to adapt

will be a significant factor in establishing a competitive position and our prospects for growth. We cannot assure that we will

be able to respond effectively to changes in technology, industry standards, common service provider offerings or new product announcements

by our competitors. We also cannot assure that we will be able to successfully develop and market new products or product enhancements,

or that these products or enhancements will achieve market acceptance. Any failure by us to continue to anticipate or respond in

a cost-effective and timely manner to changes in technology, industry standards, common service provider offerings, or new product

announcements by our competitors, or any significant delays in product development or introduction, could have a material adverse

effect on our ability to competitively market our products and on our revenues, results of operations and financial condition.

We need to increase

the functionality of our products and offer additional features and value-added services in order to maintain or increase our profitability.

The market in which we

operate is highly competitive and unless we continue to enhance the functionality of our products and add additional features,

our competitiveness may be harmed and the average sale prices for our products may decrease. Decreases in sale prices generally

result from the introduction by competitors of competing products. We may also need to reduce our per unit manufacturing costs

at a rate equal to or greater than the rate at which selling prices decline. If we are unable to reduce costs or offer increased

functionally and features, our profitability may be adversely affected.

We integrate various

third-party solutions into our products and may integrate or offer additional third-party solutions in the future. If we lose the

right to use such solutions, our sales could be disrupted and we would have to spend additional capital to replace such components.

We integrate various

third-party solutions into our products and may integrate or offer additional third-party solutions in the future. Sales of our

products could be disrupted if such third-party solutions were either no longer available to us or no longer offered to us on commercially

reasonable terms. In either case, we would be required to spend additional capital to either redesign our products to function

with alternate third-party solutions or develop substitute components ourselves. We might, as a result, be forced to

limit the features available in our current or future product offerings, which could have a material adverse effect on our business.

Our products are

highly technical and any undetected software or hardware errors in our products could have a material adverse effect on our operating

results.

Our products are complex

and are incorporated into broadband networks, which are a major source of revenue for service providers and support critical

applications for subscribers and enterprises. Due to the highly technical nature of our products and variations among customers’

network environments, we may not detect product defects until our products have been fully deployed in our customers’ networks.

Regardless of whether warranty coverage exists for a product, we may be required to dedicate significant technical resources to

repair any defects. If we encounter significant product problems, we could experience, among other things, loss of major customers,

cancellation of product orders, increased costs, delay in recognizing revenues and damage to our reputation. We could also face

claims for product liability, tort or breach of warranty. Defending a lawsuit, regardless of its merit, is costly and may divert

management’s attention. In addition, if our business liability insurance is inadequate or future coverage is unavailable

on acceptable terms or at all, our financial condition could be harmed.

We may expand our