GUIDESTONE FUNDS

Supplement dated September 13, 2013

to

Prospectus dated May 1,

2013, as amended July 1, 2013

This supplement provides new information beyond that contained in the Prospectus.

It should be retained and read in conjunction with the Prospectus, as supplemented.

I. SUB-ADVISER TERMINATION FOR THE

INTERNATIONAL EQUITY FUND

McKinley Capital Management, LLC (“McKinley Capital”) has been terminated as a sub-adviser to the

International Equity Fund. All references herein to McKinley Capital are deleted in their entirety.

II. SUB-ADVISER CORPORATE

REORGANIZATION FOR THE

EXTENDED-DURATION BOND FUND

All references to STW Fixed Income Management LLC, 6185 Carpinteria Avenue, Carpinteria, California 93013 are deleted in their

entirety and replaced with Schroder Investment Management North America Inc., 875 Third Avenue, 22

nd

Floor, New York, New York 10022. There are no other changes to the disclosure.

III. CHANGES FOR THE FLEXIBLE INCOME FUND

In the section disclosing “Sub-Advisers and Portfolio Managers” for the Flexible Income Fund on page 85, the

disclosure entitled “Shenkman Capital Management, Inc.” is deleted in its entirety and replaced with the following:

|

|

|

|

|

|

|

Shenkman Capital Management, Inc.

|

|

|

Mark R.

Shenkman

President and

Chief Investment Officer

|

|

|

Since July 2013

|

|

|

David H.

Lerner

Senior Vice President and

Portfolio Manager

|

|

|

Since September 2013

|

|

|

Jonathan

Savas

Senior Vice President and

Portfolio Manager

|

|

|

Since July 2013

|

|

Under the heading “Sub-Advisers” the disclosure for the Flexible Income Fund

beginning on page 138, is deleted in its entirety and replaced with the following:

Shenkman Capital Management, Inc.

(“Shenkman”) is located at 461 Fifth Avenue, 22

nd

Floor, New York, New York 10017:

Shenkman is an independently owned, registered investment adviser founded in 1985. Since

inception, the firm has been dedicated to providing investment management services to institutional and individual investors. Shenkman is a pioneer firm in the high yield market and seeks to be the world leading specialist in credit

analysis of leveraged companies. As of June 30, 2013, the firm

i

had assets under management of approximately $23.6 billion. Shenkman employs a team approach to portfolio management. Mark R. Shenkman is the Chief Investment Officer of the firm and has

responsibility for setting strategy and direction with respect to the firm’s investment operations. Portfolio management responsibilities for the Flexible Income Fund are shared by David H. Lerner, Senior Vice President and Portfolio Manager,

and Jonathan Savas, Senior Vice President and Portfolio Manager. Mr. Shenkman founded the firm in 1985. Prior to joining Shenkman in 2013, Mr. Lerner was a Managing Director and Portfolio Manager with Credit Suisse, where he had served

since 2000. Mr. Savas has been a portfolio manager at Shenkman for more than five years.

IV. CHANGES FOR THE REAL ESTATE

SECURITIES FUND

Under the section disclosing, “Principal Investment Strategies” for the Real Estate

Securities Fund on page 99, the following information is added after the second bullet point:

|

|

•

|

|

The Fund may invest in equity securities of REITs and other real estate related companies located throughout the world and in countries having

economies and markets generally considered to be developed, but may also invest in equity securities of REITs and other real estate related companies located in emerging markets.

|

Under the section disclosing, “Principal Investment Risks” for the Real Estate Securities Fund on page 99, the

following information is added after the seventh bullet point:

|

|

•

|

|

Securities of foreign issuers may be negatively affected by political events, economic conditions or inefficient, illiquid or unregulated markets

in foreign countries. Foreign issuers may be subject to inadequate regulatory or accounting standards, which may increase investment risk.

|

|

|

•

|

|

Changes in currency exchange rates relative to the U.S. dollar may negatively affect the values of foreign investments held by the Fund.

Sub-Advisers may make currency investment decisions independent of their underlying stock selections.

|

|

|

•

|

|

Investing in emerging markets involves even greater risks than investing in more developed foreign markets because, among other things, emerging

markets often have more political and economic stability.

|

In the section disclosing

“Sub-Advisers and Portfolio Managers” for the Real Estate Securities Fund on page 100, the disclosure entitled “RREEF America L.L.C.” is deleted in its entirety and replaced with the following:

|

|

|

|

|

|

|

Heitman Real

Estate Securities, LLC,

Heitman International Real Estate Securities HK Limited and

Heitman International Real Estate Securities GmbH

|

|

|

Timothy Pire, CFA

Managing Director and

Portfolio

Manager – North America

|

|

|

Since September 2013

|

|

|

Mark Abramsom

Managing Director and

Portfolio

Manager – Europe

|

|

|

Since September 2013

|

|

|

John White

Managing Director and

Portfolio

Manager – Asia-Pacific

|

|

|

Since September 2013

|

|

ii

|

|

|

|

|

|

|

RREEF America,

L.L.C.,

Deutsche Investments Australia Limited and

Deutsche Alternative Asset Management (Global) Limited

|

|

|

Daniel Ekins

Managing Director

|

|

|

Since September 2013

|

|

|

John Hammond

Managing Director

|

|

|

Since September 2013

|

|

|

Joseph D. Fisher, CFA

Director

|

|

|

Since August 2013

|

|

|

Chris Robinson

Director

|

|

|

Since September 2013

|

|

|

David W. Zonavetch, CPA

Director

|

|

|

Since August 2013

|

|

Under the heading “Sub-Advisers” the disclosure for the Real Estate Securities

Fund beginning on page 140, is deleted in its entirety and replaced with the following:

Heitman Real Estate Securities, LLC

(“HRES”), Heitman International Real Estate Securities HK Limited (“HIRES HK”) and Heitman International Real Estate Securities GmbH (“HIRES GmbH”) (together, “Heitman”) are located at 191 North Wacker Drive,

Suite 2500, Chicago, IL 60606, at 15/F LHT Tower, 31 Queen’s Road, Central, Hong Kong and at Maximillianstrasse 35A, 80539, Munich, Germany, respectively.

HRES, HIRES HK and HIRES GmbH are affiliated companies under common control jointly

managing an assigned portion of the Real Estate Securities Fund, with HRES primarily responsible for the portfolio account and HIRES HK and HIRES GmbH responsible for providing advice regarding management of foreign real estate securities

investments. Heitman was founded in 1966 in Chicago and as of June 30, 2013, had approximately $27.1 billion in assets under management. Heitman’s real estate securities team consists of over 20 investment professionals situated in offices

around the globe. The team is led by three portfolio managers: Tim Pire, CFA, Managing Director and Portfolio Manager – North America; Mark Abramsom, Managing Director and Portfolio Manager – Europe; and John White, Managing Director and

Portfolio Manager – Asia-Pacific. These three portfolio managers work to carry out the firm’s highly specialized investment process and are responsible for defining the global investment themes and risk management. Messrs. Pire, Abramsom

and White have been working together since 2006. Messrs. Pire and Abramsom have been with the firm for more than five years, and Mr. White joined Heitman in 2010. Prior to 2010, Mr. White served for five years as a Portfolio Manager at

Challenger Financial Services Group, which had a relationship with Heitman providing real estate securities coverage in Asia-Pacific.

RREEF America L.L.C. (“RREEF”), Deutsche Investments Australia Limited (“DIAL”) and Deutsche Alternative Asset

Management (Global) Limited (“DeAAM Global”) (together, “RREEF”) are located at Deutsche Asset & Wealth Management, 222 South Riverside Plaza, Floor 24, Chicago, Illinois 60606, at Deutsche Bank Place, Level 16, CNR

Hunter and Phillip Streets, Sydney, NSW 2000, Australia, and at Winchester House, 1 Great Winchester Street, London, EC2N 2DB, United Kingdom, respectively.

Founded in 1975, RREEF had approximately $47.7 billion in total assets under management

as of June 30, 2013. The Global Real Estate Securities strategy is managed on a team basis under the leadership of John F. Robertson, CFA, Global Head of RREEF Real Estate Securities, and John Vojticek, Chief Investment Officer and Global

Portfolio Manager. The team is led by regional portfolio managers: Joseph D. Fisher, CFA, Director, and David W. Zonavetch, CPA, Director, who are co-lead portfolio managers for the Americas Real Estate Securities business; Daniel Ekins, Managing

Director, and Chris Robinson, Director, who are co-lead portfolio managers for the Asia Pacific Real Estate Securities business; and John Hammond, Managing Director, lead portfolio manager for the European Real Estate Securities business. Messrs.

Fisher, Zonavetch, Ekins, Robinson and Hammond have each been with the firm for over five years and are primarily responsible for the day-to-day operations, as well as final decisions on stock selection and property sector allocation (where

appropriate), for an assigned portion of the Real Estate Securities Fund.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE.

iii

GUIDESTONE FUNDS

Supplement dated September 13, 2013

to

Statement of Additional

Information (“SAI”) dated May 1, 2013, as amended July 1, 2013

This supplement provides new

information beyond that contained in the SAI. It should be retained and read in conjunction with the SAI, as supplemented.

I.

CHANGES TO MANAGEMENT OF THE FUNDS

The SAI is hereby amended to delete all references to William T. Patterson as an

Independent Trustee of the Board of Trustees of GuideStone Funds.

II. SUB-ADVISER TERMINATION FOR THE INTERNATIONAL EQUITY FUND

McKinley Capital Management, LLC (“McKinley Capital”) has been terminated as a sub-adviser to the

International Equity Fund. All references herein to McKinley Capital are deleted in their entirety.

III. SUB-ADVISER CORPORATE

REORGANIZATION FOR THE

EXTENDED-DURATION BOND FUND

All references to STW Fixed Income Management LLC, 6185 Carpinteria Avenue, Carpinteria, California 93013 are deleted in their entirety and

replaced with Schroder Investment Management North America Inc., 875 Third Avenue, 22

nd

Floor, New York, New York 10022. There are no other changes to the disclosure.

IV. CHANGES FOR THE REAL ESTATE SECURITIES FUND

In the section entitled “Control Persons of Sub-Advisers” under the sub-heading for the Real Estate Securities

Fund, on page 53, the following paragraphs are added:

Deutsche Investments Australia Limited (“DIAL”), Deutsche Bank

Place, Level 16, CNR Hunter and Phillip Streets, Sydney, NSW 2000, Australia:

DIAL is a wholly-owned subsidiary of Deutsche Australia Limited which is a wholly-owned subsidiary of Deutsche Bank. DIAL performs investment advisory services for its

U.S. affiliated clients, which includes RREEF. DIAL is an affiliated company of RREEF.

Deutsche Alternative Asset Management

(Global) Limited (“DeAAM Global”), Winchester House, 1 Great Winchester Street, London, EC2N 2DB, United Kingdom:

DeAAM Global is an indirect wholly-owned subsidiary of Deutsche Bank. DeAAM Global is part of the global real estate and

infrastructure asset management operation known as RREEF. DeAAM Global is an affiliated company of RREEF.

Heitman Real Estate

Securities, LLC (“HRES”), 191 North Wacker Drive, Suite 2500, Chicago, IL 60606:

HRES is an SEC-registered investment adviser that has been in business since 1989. The firm is 50% owned indirectly by certain of the firm’s senior

officers through KE I LLC, and 50% owned indirectly by Old Mutual Plc, a global financial services company listed on the London and Stockholm Stock Exchanges.

i

Heitman International Real Estate Securities HK Limited (“HIRES HK”), 15/F LHT

Tower, 31 Queen’s Road, Central, Hong Kong:

HIRES HK is an SEC-registered investment adviser that has been in business since 2012. The firm is 50% owned indirectly by certain of the firm’s senior officers through KE I LLC, and 50%

owned indirectly by Old Mutual Plc, a global financial services company listed on the London and Stockholm Stock Exchanges. HIRES HK is an affiliated company of HRES.

Heitman International Real Estate Securities GmbH (“HIRES GmbH”), Maximillianstrasse 35A, 80539, Munich, Germany:

HRES is an

SEC-registered investment adviser that has been in business since 2007. The firm is 50% owned indirectly by certain of the firm’s senior officers through KE I LLC, and 50% owned indirectly by Old Mutual Plc, a global financial services company

listed on the London and Stockholm Stock Exchanges. HIRES GmbH is an affiliated company of HRES.

ii

The “Other Accounts Managed” chart, beginning on page 57, is amended

to include information for Heitman Real Estate Securities, LLC, Heitman International Real Estate Securities HK Limited and Heitman International Real Estate Securities GmbH. The information for RREEF America L.L.C. is deleted in its entirety and

replaced with the information below for RREEF America L.L.C., Deutsche Investments Australia Limited and Deutsche Alternative Asset Management (Global) Limited. This information for Shenkman Capital Management, Inc. has been amended to add David H.

Lerner and delete Frank X. Whitley. This information is current as of June 30, 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Advisers

Portfolio Managers

|

|

Total number of other accounts managed by Portfolio Manager(s) within each

category below and the total assets in the accounts managed within each

category below.

|

|

For other accounts managed by Portfolio Manager(s) within each category

below, number of accounts and the total assets in the accounts with respect

to which the advisory fee is based on the performance of the

account.

|

|

|

Registered Investment

Companies

|

|

Other Pooled

Investment Vehicles

|

|

Other Accounts

|

|

Registered Investment

Companies

|

|

Other Pooled

Investment Vehicles

|

|

Other Accounts

|

|

|

Number

of

Accounts

|

|

Total

Assets

($mm)

|

|

Number

of

Accounts

|

|

Total

Assets

($mm)

|

|

Number

of

Accounts

|

|

Total

Assets

($mm)

|

|

Number

of

Accounts

|

|

Total

Assets

($mm)

|

|

Number

of

Accounts

|

|

Total

Assets

($mm)

|

|

Number

of

Accounts

|

|

Total

Assets

($mm)

|

|

Heitman Real Estate Securities, LLC,

Heitman International Real Estate Securities HK Limited and

Heitman International Real Estate Securities GmbH

|

|

Tim Pire, CFA

|

|

1

|

|

$51

|

|

N/A

|

|

N/A

|

|

21

|

|

$2,262

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

2

|

|

$133

|

|

Mark Abramson

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

21

|

|

$2,262

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

John White

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

21

|

|

$2,262

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

RREEF America L.L.C.,

Deutsche Investments Australia Limited and

Deutsche Alternative Asset Management (Global) Limited

|

|

Joseph D. Fisher, CFA

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

David W. Zonavetch, CPA

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

Daniel Elkins

|

|

3

|

|

$1,518

|

|

9

|

|

$1,132

|

|

7

|

|

$978

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

1

|

|

$72

|

|

Chris Robinson

|

|

3

|

|

$1,518

|

|

9

|

|

$1,132

|

|

7

|

|

$978

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

1

|

|

$72

|

|

John Hammond

|

|

2

|

|

$1,292

|

|

9

|

|

$1,132

|

|

6

|

|

$900

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

1

|

|

$72

|

|

Shenkman Capital Management, Inc.

|

|

David H. Lerner

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

|

N/A

|

iii

In the section entitled “Portfolio Manager Compensation”, beginning

on page 66, the following disclosure pertaining to Heitman Real Estate Securities, LLC, Heitman International Real Estate Securities HK Limited and Heitman International Real Estate Securities GmbH, which is current as of June 30, 2013, is

added:

Heitman Real Estate Securities LLC (“HRES”), Heitman International Real Estate Securities HK Limited (“HIRES

HK”) and Heitman International Real Estate Securities GmbH (“HIRES GmbH”) (together, “Heitman”).

Heitman’s compensation program is designed to accomplish several objectives, one of which is retention of the

firm’s team. Thirty-five senior employees hold a 50% equity interest in the business. Heitman believes that equity ownership provides a carrot for retention of key personnel and, equally important, that the structure creates alignment of

interest between Heitman’s partners and the firm’s clients. The total compensation of the firm’s equity owners is tied directly to the performance of the investments under their collective management and the degree to which client

objectives have been met. The incentive compensation is based on a combination of factors including company, business unit and individual performance. The portfolio managers associated with the Real Estate Securities Fund are all equity owners in

the firm.

In the section entitled “Portfolio Manager Compensation”, the introductory sentence referring to

RREEF America L.L.C., beginning on page 78, is deleted in its entirety and replaced with the following sentence. There are no other changes to this disclosure.

RREEF America L.L.C. (“RREEF”), Deutsche Investments Australia Limited (“DIAL”) and Deutsche Alternative Asset

Management (Global) Limited (“DeAAM Global”) (together, “RREEF”).

In Appendix B –

Description of Proxy Voting Procedures, the introductory sentence referring to RREEF America, L.L.C., is deleted in its entirety and replaced with the following sentence. There are no other changes to this disclosure.

RREEF America L.L.C. (“RREEF”), Deutsche Investments Australia Limited (“DIAL”) and Deutsche Alternative Asset

Management (Global) Limited (“DeAAM Global”) (together, “RREEF”).

In Appendix B –

Description of Proxy Voting Procedures, the following disclosure is added:

Heitman Real Estate Securities LLC

(“HRES”), Heitman International Real Estate Securities HK Limited (“HIRES HK”) and Heitman International Real Estate Securities GmbH(“HIRES GmbH”) (together, “Heitman”).

Heitman’s general policy

with respect to all clients in which Heitman has authority to vote proxies is that such proxies will always be voted, or not voted, in all cases in the best interest of such clients. Heitman utilizes the services of an independent unaffiliated proxy

firm, who is responsible for: notifying Heitman in advance of the shareholder meeting at which such proxies will be voted; providing the appropriate proxies to be voted; providing independent research on corporate governance, proxy and corporate

responsibility issues; recommending actions with respect to proxies which are always deemed by the proxy firm to be in the best interests of the shareholders; and maintaining records of proxy statements received and votes cast.

Heitman will consider each corporate proxy statement on a case-by-case basis and may vote a proxy in a manner different from that recommended

by the proxy firm when deemed appropriate. There may also be occasions when Heitman determines, contrary to the proxy voting firm voting’s recommendation for a particular proxy, that not voting such proxy may be more in the best interest of

clients. The firm will generally vote with the proxy firm recommendations unless a client agreement specifies differently or

iv

Heitman’s Proxy Policies and Procedures Oversight Committee (the “Proxy Committee”) overturns the recommendations.

Heitman has established the Proxy Committee, consisting of a senior portfolio manager, the chief compliance officer, special counsel of Heitman

LLC and chief investment officer of HRES. The Proxy Committee is responsible for (i) designing and reviewing from time to time the Proxy Voting Policies and Procedures (the “Policy”); and (ii) reviewing and addressing all

instances where a portfolio manager determines to respond to an issue in a proxy in a manner inconsistent with the Policy and/or identifies actual or perceived potential conflicts of interests in the context of voting proxies.

The firm has delegated the voting of proxies to the proxy voting clerk. As a general rule the proxy voting clerk votes all proxies to which

Heitman is entitled to vote. When a proxy is received, the proxy voting clerk will send a proxy analysis report to the portfolio manager within Heitman who is responsible for review of the company conducting the proxy. In reviewing the

recommendations to determine how to respond to the proxy in the best interest of clients, the Heitman portfolio manager may consider information from various sources, such as another Heitman portfolio manager or research analyst, management of the

company conducting the proxy and shareholder groups, as well as the possibility of any actual or perceived potential conflicts of interest between Heitman and its clients with respect to such proxy. The portfolio manager will return his or her

recommendation as to how to vote the proxy to the proxy voting clerk along with a description and explanation of any actual or perceived conflicts of interest. In instances where the portfolio manager recommends responding to a proxy contrary to the

general voting guidelines of the Policy or contrary to the proxy firm recommendation with respect to such proxy and/or perceives an actual or potential conflict of interest, an exception is noted. These exceptions are promptly forwarded to the Proxy

Committee to confirm or overturn any of the recommendations made by the portfolio manager.

Where potential conflicts of interest have

been highlighted, the Proxy Committee will evaluate whether an actual or potential material conflict of interest exists and, if so, how it should be addressed in voting or not voting the particular proxy. Although any three members of the Proxy

Committee constitute a quorum for the purposes of conducting the Proxy Committee’s business, the votes of not less than three members of the overall Proxy Committee are required to confirm any recommendations by a Heitman portfolio manager to

vote any proxy contrary to the proxy firm recommendation as to how to vote that issue. With respect to actual or potential conflicts of interest, the Proxy Committee may take one of the following courses of action: (i) independently determine

that no material conflict of interest exists or will likely potentially exist; (ii) respond to such proxy in strict accordance with the recommendations of the proxy firm; or (iii) take another course of action that, in the opinion of the

Proxy Committee, adequately addresses the issue.

In all other cases, the proxy voting clerk will respond to the proxy in accordance with

the recommendations of the proxy firm. The proxy voting clerk will prepare a proxy voting summary for the Proxy Committee on a periodic basis containing all the proxy firm proxy vote recommendations that were overridden during the period and also

highlighting any proxy issues that were identified as presenting actual and/or potential conflicts of interest and how they were addressed.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE.

v

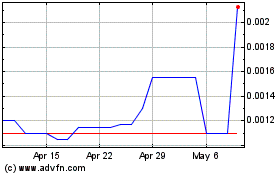

Movie Studio (PK) (USOTC:MVES)

Historical Stock Chart

From Mar 2024 to Apr 2024

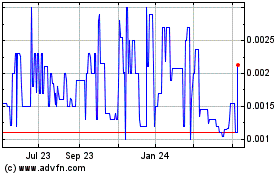

Movie Studio (PK) (USOTC:MVES)

Historical Stock Chart

From Apr 2023 to Apr 2024