Cornerstone Sustainable Energy Announces Second Quarter Results

September 04 2013 - 11:34AM

Receivable Acquisition & Management Corporation (OTCBB:RCVA)

d/b/a/Cornerstone Sustainable Energy ("CSE"), has just announced

financial results for the quarter ended June 30, 2013.

Tom Telegades, Chief Executive Officer of CSE, commented, "Our

results for Q2 2013 show promise for the new direction the Company

has embarked upon. We have experienced substantial growth in our

energy infrastructure advisory, oversight and management business,

and we believe the Company is poised to take full advantage of its

exclusive license in the green energy arena."

Q2 2013 RESULTS

Second quarter 2013 revenue increased 67.6% to $235.6 thousand

from $140.5 thousand in Q2 2012. The higher revenue was

attributable to growth in business, as CSE acquired Columbia

University as a client in late 2012.

Net income in second quarter 2013 was $8.9 thousand, or 3.8% of

revenue, as compared to $36.9 thousand, or 26.2% of revenue, in Q2

2012. Net income for Q2 2013 included growth in expenses

associated with its advisory, oversight and management activities

as the Company adjusted to its increased business, as well as

substantial expenses relating to the recent merger, effective May

15, 2013.

Total assets increased to $699.7 thousand by the end of the

second quarter 2013, an increase of 68.1% over total assets of

$416.2 thousand at the end of Q2 2012. A substantial part of

this increase is attributable to the value of an exclusive license

for a green energy engine technology which converts heat to other

forms of energy, a technology with wide application in geothermal

and other areas where available heat levels are only moderate.

About Cornerstone Sustainable Energy

Cornerstone Sustainable Energy ("CSE") is focused on energy

infrastructure development projects and delivering alternative

energy solutions to a wide range of commercial and not-for-profit

customers.

CSE's Forward-Looking Statement Safe Harbor

Statements under the Private Securities Litigation Reform Act,

as amended: with the exception of the historical information

contained in this release, the matters described herein contain

forward-looking statements that involve risks and uncertainties

that may individually or mutually impact the matters herein

described for a variety of reasons that are outside the control of

the Company, including, but not limited to, its ability to raise

sufficient financing to implement its growth strategy, and its

ability to successfully develop and commercialize its proprietary

products. Readers are cautioned not to place undue reliance on

these forward-looking statements as actual results could differ

materially from the forward-looking statements contained herein.

Readers are urged to read the risk factors set forth in the

Company's most recent report on Forms 10-Q, 8-K and other filings

made with the SEC. Copies of these reports are available from the

SEC's website or without charge from the Company.

CONTACT: Cornerstone Sustainable Energy

Thomas Telegades, info@cseindustries.com

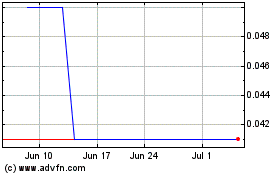

PwrCor (PK) (USOTC:PWCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

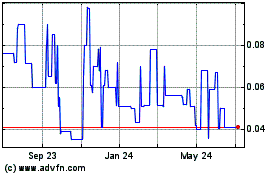

PwrCor (PK) (USOTC:PWCO)

Historical Stock Chart

From Apr 2023 to Apr 2024