UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT

INVESTMENT COMPANY

Investment Company Act file number: 811-02575

Morgan Stanley Liquid Asset Fund Inc.

(Exact name of registrant as specified in charter)

522 Fifth Avenue, New York,

New York 10036

(Address of principal executive

offices) (Zip code)

Kevin Klingert

522 Fifth Avenue, New York, New York 10036

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 201-830-8894

Date of fiscal year end: August 31, 2013

Date of reporting period: May 31, 2013

Item 1. Schedule of Investments.

The Fund’s schedule of investments as of the

close of the reporting period prepared pursuant to Rule 12-12 of Regulation S-X is as follows:

Morgan Stanley Liquid Asset Fund Inc.

Portfolio of Investments

¡

May 31, 2013 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT

(000)

|

|

|

|

|

ANNUALIZED

YIELD

ON DATE OF

PURCHASE

|

|

|

|

|

|

MATURITY

DATE

|

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase Agreements (35.6%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 175,000

|

|

|

ABN Amro Securities LLC, (dated 05/31/13; proceeds $175,001,313; fully collateralized by U.S. Government Agencies; Federal Home

Loan Mortgage Corporation 1.00% - 5.00% due 07/28/17 - 05/01/41; Federal National Mortgage Association 0.88% - 5.50% due 08/28/17 - 05/01/42; valued at $180,097,543)

|

|

|

0.09

|

|

|

|

%

|

|

|

|

06/03/13

|

|

|

$

|

175,000,000

|

|

|

|

50,500

|

|

|

Bank of Montreal, (dated 05/31/13; proceeds $50,500,687; fully collateralized by U.S. Government Agencies; Federal Home Loan Bank

0.65% - 0.90% due 08/22/16 - 10/23/17; Federal Home Loan Mortgage Corporation 2.35% due 01/11/23; valued at $51,484,970)

|

|

|

0.07

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

50,500,000

|

|

|

|

49,500

|

|

|

Bank of Montreal, (dated 05/13/13; proceeds $49,504,950; fully collateralized by U.S. Government Agencies; Federal Home Loan

Mortgage Corporation 4.00% - 6.50% due 04/01/23 - 04/01/41; Federal National Mortgage Association 2.50% - 6.10% due 08/01/22 - 08/01/42; valued at $50,985,000) (Demand 06/07/13)

|

|

|

0.12

|

|

|

|

(a

|

)

|

|

|

06/12/13

|

|

|

|

49,500,000

|

|

|

|

180,000

|

|

|

Bank of Nova Scotia, (dated 05/31/13; proceeds $180,001,350; fully collateralized by U.S. Government Agencies; Federal National

Mortgage Association 3.50% - 6.00% due 05/01/41 - 12/01/42; Government National Mortgage Association 5.00% due 04/20/41; valued at $185,694,860)

|

|

|

0.09

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

180,000,000

|

|

|

|

130,000

|

|

|

Bank of Nova Scotia, (dated 01/07/13; proceeds $130,247,000; fully collateralized by U.S. Government Agencies; Federal Home Loan

Mortgage Corporation 2.50% - 4.50% due 08/01/26 - 01/01/43; Federal National Mortgage Association 2.50% - 4.50% due 04/01/26 - 05/01/43; valued at $133,861,467) (Demand 06/07/13)

|

|

|

0.19

|

|

|

|

(a

|

)

|

|

|

01/02/14

|

|

|

|

130,000,000

|

|

|

|

35,000

|

|

|

Bank of Nova Scotia, (dated 03/06/13; proceeds $35,070,583; fully collateralized by U.S. Government Agencies; Federal Home Loan

Mortgage Corporation 2.50% - 3.50% due 07/01/27 - 09/01/42; Federal National Mortgage Association 2.50% - 5.00% due 09/01/27 - 05/01/43; valued at $36,170,362) (Demand 06/07/13)

|

|

|

0.20

|

|

|

|

(a

|

)

|

|

|

03/04/14

|

|

|

|

35,000,000

|

|

|

|

105,000

|

|

|

Bank of Nova Scotia, (dated 03/15/13; proceeds $105,210,000; fully collateralized by U.S. Government Agencies; Federal Home Loan

Mortgage Corporation 4.00% due 08/01/26; Federal National Mortgage Association 2.50% - 4.50% due 02/01/28 - 05/01/43; valued at $108,258,890) (Demand 06/07/13)

|

|

|

0.20

|

|

|

|

(a

|

)

|

|

|

03/10/14

|

|

|

|

105,000,000

|

|

1

Morgan Stanley Liquid Asset Fund Inc.

Portfolio of Investments

¡

May 31, 2013 (unaudited)

continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 110,000

|

|

|

BMO Capital Markets Corp., (dated 05/31/13; proceeds $110,000,917; fully collateralized by U.S. Government Agencies; Federal

National Mortgage Association 3.00% - 5.50% due 09/01/25 - 11/01/42; and by a U.S. Government Obligation; U.S. Treasury Bill Zero Coupon due 11/14/13; valued at $113,232,009)

|

|

0.10

|

|

|

|

|

|

|

%

|

|

|

|

06/03/13

|

|

|

$

|

110,000,000

|

|

|

|

109,032

|

|

|

BNP Paribas Securities Corp., (dated 05/31/13; proceeds $109,032,818; fully collateralized by U.S. Government Agencies;

Government National Mortgage Association 2.00% - 7.00% due 02/20/26 - 02/15/55; valued at $112,302,960)

|

|

0.09

|

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

109,032,000

|

|

|

|

75,000

|

|

|

BNP Paribas Securities Corp., (dated 02/20/13; proceeds $75,052,771; fully collateralized by U.S. Government Agencies; Federal

Home Loan Mortgage Corporation 2.63% - 7.00% due 02/01/16 - 01/01/43; Federal National Mortgage Association 2.50% - 6.50% due 06/01/15 - 04/01/43; Government National Mortgage Association 3.00% - 3.50% due 01/20/41 - 07/20/42; valued at $77,250,000)

(Demand 06/07/13)

|

|

0.17

|

|

|

(a

|

)

|

|

|

|

|

|

|

07/19/13

|

|

|

|

75,000,000

|

|

|

|

100,000

|

|

|

BNP Paribas Securities Corp., (dated 01/08/13; proceeds $100,090,500; fully collateralized by U.S. Government Agencies; Federal

Home Loan Mortgage Corporation 2.12% - 6.50% due 01/01/20 - 05/01/43; Federal National Mortgage Association 2.05% - 7.00% due 05/01/19 - 04/01/43; Government National Mortgage Association 1.63% - 4.00% due 12/20/33 - 05/20/41; valued at

$103,000,000) (Demand 06/07/13)

|

|

0.18

|

|

|

(a

|

)

|

|

|

|

|

|

|

07/08/13

|

|

|

|

100,000,000

|

|

|

|

35,000

|

|

|

BNP Paribas Securities Corp., (dated 12/06/12; proceeds $35,035,194; fully collateralized by U.S. Government Agencies; Government

National Mortgage Association 1.63% - 4.50% due 08/20/21 - 02/20/43; valued at $36,050,000)

|

|

0.20

|

|

|

|

|

|

|

|

|

|

|

06/05/13

|

|

|

|

35,000,000

|

|

|

|

40,000

|

|

|

BNP Paribas Securities Corp., (dated 12/04/12; proceeds $40,041,228; fully collateralized by U.S. Government Agencies; Government

National Mortgage Association 1.63% - 4.50% due 01/20/22 - 09/20/42; valued at $41,200,001)

|

|

0.21

|

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

40,000,000

|

|

|

|

230,000

|

|

|

Credit Agricole Corp., (dated 05/31/13; proceeds $230,001,725; fully collateralized by U.S. Government Agencies; Federal National

Mortgage Association 2.50% - 5.00% due 04/01/28 - 04/01/43; valued at $236,859,466)

|

|

0.09

|

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

230,000,000

|

|

|

|

50,000

|

|

|

Deutsche Bank Securities, Inc., (dated 05/30/13; proceeds $50,000,583; fully collateralized by U.S. Government Agencies;

Government National Mortgage Association 3.50% due 01/20/43 - 05/20/43; valued at $51,442,276)

|

|

0.06

|

|

|

|

|

|

|

|

|

|

|

06/06/13

|

|

|

|

50,000,000

|

|

|

|

75,000

|

|

|

ING Financial Markets LLC, (dated 05/31/13; proceeds $75,000,563; fully collateralized by U.S. Government Agencies; Federal

National Mortgage Association 2.31% - 5.00% due 11/01/27 - 01/01/43; valued at $77,252,106)

|

|

0.09

|

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

75,000,000

|

|

2

Morgan Stanley Liquid Asset Fund Inc.

Portfolio of Investments

¡

May 31, 2013 (unaudited)

continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 150,000

|

|

|

Merrill Lynch Pierce Fenner & Smith, (dated 04/10/13; proceeds $150,045,500; fully collateralized by U.S. Government

Obligations; U.S. Treasury Notes 0.75% - 1.38% due 02/28/18 - 12/31/18; valued at $153,174,515) (Demand 06/07/13)

|

|

|

0.12

|

|

|

|

(a

|

)

|

|

%

|

|

|

07/10/13

|

|

|

$

|

150,000,000

|

|

|

|

62,000

|

|

|

Merrill Lynch Pierce Fenner & Smith, (dated 04/10/13; proceeds $62,034,169; fully collateralized by a U.S. Government

Obligation; U.S. Treasury Bond 6.00% due 02/15/26; valued at $63,282,343) (Demand 06/07/13)

|

|

|

0.16

|

|

|

|

(a

|

)

|

|

|

|

|

08/12/13

|

|

|

|

62,000,000

|

|

|

|

180,000

|

|

|

Merrill Lynch Pierce Fenner & Smith, (dated 03/01/13; proceeds $180,186,000; fully collateralized by U.S. Government

Agencies; Federal Farm Credit Bank Zero Coupon - 2.17% due 02/05/14 - 05/02/22; Federal Home Loan Bank

0.15% -

5.38% due 01/23/14 - 08/15/24; Federal Home Loan Mortgage Corporation 0.10% - 5.50% due

08/01/13 - 02/25/28; Federal Home Loan Mortgage Corporation Strip Zero Coupon due 09/15/29; Federal National Mortgage Association Zero Coupon - 6.63% due 07/28/15 - 07/15/37; Federal National Mortgage Association Discount Note Zero Coupon due

06/03/13 - 09/03/13; Federal National Mortgage Association Strip Zero Coupon due 07/15/21 - 07/15/37; valued at $183,600,292) (Demand 06/07/13)

|

|

|

0.20

|

|

|

|

(a

|

)

|

|

|

|

|

09/03/13

|

|

|

|

180,000,000

|

|

|

|

125,000

|

|

|

Mizuho Securities USA, Inc., (dated 05/29/13; proceeds $125,002,188; fully collateralized by U.S. Government Agencies; Federal

Home Loan Mortgage Corporation 2.50% - 3.50% due 11/01/27 - 12/01/27; Federal National Mortgage Association 2.50% - 3.50% due 10/01/27 - 12/01/27; Government National Mortgage Association 4.50% - 5.00% due 08/15/39; and by a U.S. Government

Obligation; U.S. Treasury Note 2.25% due 05/31/14; valued at $128,822,921)

|

|

|

0.09

|

|

|

|

|

|

|

|

|

|

06/05/13

|

|

|

|

125,000,000

|

|

|

|

230,000

|

|

|

Mizuho Securities USA, Inc., (dated 05/31/13; proceeds $230,002,300; fully collateralized by U.S. Government Agencies; Federal

Home Loan Mortgage Corporation 4.50% due 09/01/41; Federal National Mortgage Association 3.50% due 01/01/43; Government National Mortgage Association 2.48% - 5.00% due 06/20/27 - 03/15/54; valued at $237,372,392)

|

|

|

0.12

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

230,000,000

|

|

|

|

225,000

|

|

|

RBC Capital Markets LLC, (dated 05/31/13; proceeds $225,001,688; fully collateralized by U.S. Government Agencies; Federal Home

Loan Mortgage Corporation 3.50% due 10/01/42; Federal National Mortgage Association 4.00% due 12/01/41; valued at $231,426,320)

|

|

|

0.09

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

225,000,000

|

|

|

|

285,000

|

|

|

RBC Capital Markets LLC, (dated 04/01/13; proceeds $285,202,825; fully collateralized by U.S. Government Agencies; Federal Home

Loan Mortgage Corporation 3.00% due 04/01/27 - 10/01/42; Federal National Mortgage Association 2.50% - 4.00% due 08/01/26 - 05/01/43; valued at $293,607,419) (Demand 06/07/13)

|

|

|

0.14

|

|

|

|

(a

|

)

|

|

|

|

|

10/01/13

|

|

|

|

285,000,000

|

|

|

|

300,000

|

|

|

Wells Fargo Securities LLC, (dated 05/31/13; proceeds $300,002,500; fully collateralized by U.S. Government Agencies; Federal

Home Loan Bank Discount Note Zero Coupon due 08/28/13 - 10/16/13; Federal Home Loan Mortgage Corporation 2.50% due 04/01/28; and by a U.S. Government Obligation; U.S. Treasury Note 1.00% due 01/15/14; valued at $305,839,248)

|

|

|

0.10

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

300,000,000

|

|

|

|

125,000

|

|

|

Wells Fargo Securities LLC, (dated 05/31/13; proceeds $125,001,042; fully collateralized by a U.S. Government Obligation; U.S. Treasury Note 0.25% due 11/30/14; valued at

$128,000,000)

|

|

|

0.10

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

125,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Repurchase Agreements

(Cost $3,231,032,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,231,032,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

Morgan Stanley Liquid Asset Fund Inc.

Portfolio of Investments

¡

May 31, 2013 (unaudited)

continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUPON

RATE (a)

|

|

|

|

|

|

DEMAND

DATE (b)

|

|

|

|

|

|

|

|

|

|

|

|

|

Floating Rate Notes (27.4%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Banks (3.9%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 220,000

|

|

|

JP Morgan Chase Bank NA

|

|

|

0.36

|

|

|

|

%

|

|

|

|

06/07/13

|

|

|

|

06/06/14

|

|

|

$

|

220,000,000

|

|

|

|

138,000

|

|

|

Wells Fargo Bank NA

|

|

|

0.34

|

|

|

|

|

|

|

|

06/20/13

|

|

|

|

06/20/14

|

|

|

|

138,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

358,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Banks (23.5%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69,000

|

|

|

ASB Finance Ltd. (c)

|

|

|

0.30

|

|

|

|

|

|

|

|

07/03/13

|

|

|

|

01/03/14

|

|

|

|

69,000,000

|

|

|

|

220,000

|

|

|

Bank of Nova Scotia

|

|

|

0.33 - 0.34

|

|

|

|

|

|

|

|

07/02/13 - 07/30/13

|

|

|

|

07/02/13 - 06/27/14

|

|

|

|

220,000,000

|

|

|

|

34,100

|

|

|

BNZ International Funding Ltd.

|

|

|

0.30

|

|

|

|

|

|

|

|

06/06/13

|

|

|

|

12/06/13

|

|

|

|

34,100,000

|

|

|

|

34,600

|

|

|

BNZ International Funding Ltd. (c)

|

|

|

0.30

|

|

|

|

|

|

|

|

06/09/13

|

|

|

|

12/09/13

|

|

|

|

34,600,000

|

|

|

|

140,000

|

|

|

Credit Suisse NY

|

|

|

0.25

|

|

|

|

|

|

|

|

06/24/13

|

|

|

|

08/29/13

|

|

|

|

140,000,000

|

|

|

|

388,400

|

|

|

National Australia Bank

|

|

|

0.27 - 0.28

|

|

|

|

|

|

|

|

07/11/13 - 08/09/13

|

|

|

|

08/09/13 - 10/11/13

|

|

|

|

388,400,000

|

|

|

|

215,000

|

|

|

Rabobank Nederland NY

|

|

|

0.33

|

|

|

|

|

|

|

|

09/24/13

|

|

|

|

03/24/14

|

|

|

|

215,000,000

|

|

|

|

334,000

|

|

|

Royal Bank of Canada

|

|

|

0.33 - 0.37

|

|

|

|

|

|

|

|

07/01/13 - 07/26/13

|

|

|

|

07/11/13 - 05/30/14

|

|

|

|

333,987,981

|

|

|

|

130,000

|

|

|

Svenska Handelsbanken AB (c)

|

|

|

0.29

|

|

|

|

|

|

|

|

06/17/13

|

|

|

|

11/15/13

|

|

|

|

130,000,000

|

|

|

|

332,500

|

|

|

Toronto Dominion Bank

|

|

|

0.28

|

|

|

|

|

|

|

|

06/13/13 - 07/26/13

|

|

|

|

07/26/13 - 10/21/13

|

|

|

|

332,500,000

|

|

|

|

141,000

|

|

|

Westpac Banking Corp. (c)

|

|

|

0.27

|

|

|

|

|

|

|

|

08/27/13

|

|

|

|

08/27/13

|

|

|

|

140,998,402

|

|

|

|

75,000

|

|

|

Westpac Banking Corp.

|

|

|

0.28

|

|

|

|

|

|

|

|

07/09/13

|

|

|

|

10/09/13

|

|

|

|

75,000,000

|

|

|

|

17,500

|

|

|

Westpac Securities NZ Ltd. (c)

|

|

|

0.25

|

|

|

|

|

|

|

|

06/18/13

|

|

|

|

07/18/13

|

|

|

|

17,499,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,131,085,483

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Floating Rate Notes

(Cost $2,489,085,483)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,489,085,483

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUALIZED

YIELD

ON DATE OF

PURCHASE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Paper (19.5%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobile (0.1%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,000

|

|

|

Toyota Credit Canada, Inc.

|

|

|

0.06

|

|

|

|

%

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

9,999,900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Banks (19.4%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

123,300

|

|

|

KFW International Finance, Inc. (c)

|

|

|

0.20

|

|

|

|

|

|

|

|

|

|

|

|

07/08/13 - 07/10/13

|

|

|

|

123,273,785

|

|

|

|

282,000

|

|

|

Mizuho Funding LLC (c)

|

|

|

0.24 - 0.25

|

|

|

|

|

|

|

|

|

|

|

|

07/12/13 - 07/19/13

|

|

|

|

281,920,099

|

|

|

|

123,336

|

|

|

Nordea North America, Inc.

|

|

|

0.30 - 0.31

|

|

|

|

|

|

|

|

|

|

|

|

06/05/13 - 06/12/13

|

|

|

|

123,331,033

|

|

|

|

375,000

|

|

|

NRW Bank

|

|

|

0.12

|

|

|

|

|

|

|

|

|

|

|

|

06/04/13 - 06/05/13

|

|

|

|

374,995,528

|

|

4

Morgan Stanley Liquid Asset Fund Inc.

Portfolio of Investments

¡

May 31, 2013 (unaudited)

continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 197,600

|

|

|

Oversea Chinese Banking Corporation

|

|

|

0.22 - 0.27

|

|

|

|

%

|

|

|

|

|

|

|

|

07/22/13 - 10/04/13

|

|

|

$

|

197,459,148

|

|

|

|

201,300

|

|

|

Skandin Ens Banken AB (c)

|

|

|

0.30

|

|

|

|

|

|

|

|

|

|

|

|

11/01/13

|

|

|

|

201,043,342

|

|

|

|

165,500

|

|

|

Sumitomo Mitsui Banking Corp.

|

|

|

0.24

|

|

|

|

|

|

|

|

|

|

|

|

08/27/13

|

|

|

|

165,404,010

|

|

|

|

224,200

|

|

|

Svenska Handelsbanken AB (c)

|

|

|

0.25 - 0.26

|

|

|

|

|

|

|

|

|

|

|

|

06/28/13 - 07/12/13

|

|

|

|

224,147,117

|

|

|

|

66,000

|

|

|

UOB Funding LLC

|

|

|

0.22

|

|

|

|

|

|

|

|

|

|

|

|

07/10/13 - 07/16/13

|

|

|

|

65,983,323

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,757,557,385

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Commercial Paper

(Cost $1,767,557,285)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,767,557,285

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of Deposit

(12.2%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Banks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

75,000

|

|

|

Bank of Montreal

|

|

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

06/06/13

|

|

|

|

75,000,000

|

|

|

|

95,000

|

|

|

Credit Suisse NY

|

|

|

0.25

|

|

|

|

|

|

|

|

|

|

|

|

07/31/13

|

|

|

|

95,000,000

|

|

|

|

231,200

|

|

|

Deutsche Bank AG

|

|

|

0.35 - 0.37

|

|

|

|

|

|

|

|

|

|

|

|

10/30/13 - 11/26/13

|

|

|

|

231,200,000

|

|

|

|

445,000

|

|

|

Lloyds TSB Bank PLC

|

|

|

0.10

|

|

|

|

|

|

|

|

|

|

|

|

06/04/13 - 06/06/13

|

|

|

|

445,000,000

|

|

|

|

94,000

|

|

|

Skandin Ens Banken AB

|

|

|

0.30

|

|

|

|

|

|

|

|

|

|

|

|

11/07/13

|

|

|

|

93,997,927

|

|

|

|

96,000

|

|

|

Svenska Handelsbanken AB

|

|

|

0.31

|

|

|

|

|

|

|

|

|

|

|

|

06/05/13

|

|

|

|

96,000,053

|

|

|

|

70,000

|

|

|

Swedbank AB

|

|

|

0.09

|

|

|

|

|

|

|

|

|

|

|

|

06/04/13

|

|

|

|

70,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Certificates of Deposit

(Cost $1,106,197,980)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,106,197,980

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUPON

RATE (a)

|

|

|

|

|

|

DEMAND

DATE (b)

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-Exempt Instruments (4.2%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weekly Variable Rate Bonds (2.6%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,000

|

|

|

California Statewide Communities Development Authority, Kaiser Permanente Ser 2009 C-2

|

|

|

0.10

|

|

|

|

%

|

|

|

|

06/07/13

|

|

|

|

04/01/46

|

|

|

|

22,000,000

|

|

|

|

24,875

|

|

|

Eastern Municipal Water District, CA, Water & Sewer Ser 2008 A COPs

|

|

|

0.10

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

07/01/30

|

|

|

|

24,875,000

|

|

|

|

9,805

|

|

|

Fremont, CA, Ser 2008 COPs

|

|

|

0.11

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

08/01/38

|

|

|

|

9,805,000

|

|

|

|

10,000

|

|

|

Indiana Finance Authority, Parkview Health System Ser 2009 B

|

|

|

0.13

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

11/01/39

|

|

|

|

10,000,000

|

|

|

|

40,800

|

|

|

Los Angeles Department of Water & Power, CA, Water System 2001 Ser B Subser B-1

|

|

|

0.09

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

07/01/35

|

|

|

|

40,800,000

|

|

|

|

18,700

|

|

|

Miami-Dade County, FL, Professional Sports Franchise Facilities Tax Ser 2009 E

|

|

|

0.13

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

10/01/48

|

|

|

|

18,700,000

|

|

|

|

11,700

|

|

|

Nassau County Interim Finance Authority, NY, Sales Tax Ser 2008 A

|

|

|

0.11

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

11/15/25

|

|

|

|

11,700,000

|

|

|

|

|

|

|

New York State Housing Finance Agency,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,000

|

|

|

10 Barclay Street 2004 Ser A

|

|

|

0.11

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

11/15/37

|

|

|

|

15,000,000

|

|

|

|

20,000

|

|

|

Gotham West Housing Ser 2011 B (Taxable)

|

|

|

0.18

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

05/01/45

|

|

|

|

20,000,000

|

|

|

|

27,400

|

|

|

NGSP, Inc., Ser 2006

|

|

|

0.18

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

06/01/46

|

|

|

|

27,400,000

|

|

|

|

9,210

|

|

|

Pennsylvania Housing Finance Agency, Single Family Mortgage Ser 2004-82C (AMT)

|

|

|

0.12

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

10/01/34

|

|

|

|

9,210,000

|

|

|

|

10,000

|

|

|

Sacramento Transportation Authority, CA, Measure A Sales Tax Ser 2009 A

|

|

|

0.09

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

10/01/38

|

|

|

|

10,000,000

|

|

|

|

15,750

|

|

|

Wyoming Student Loan Corporation, Student Loan Senior Ser 2010 A-2

|

|

|

0.12

|

|

|

|

|

|

|

|

06/07/13

|

|

|

|

04/01/39

|

|

|

|

15,750,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Weekly Variable Rate Bonds

(Cost $235,240,000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

235,240,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

Morgan Stanley Liquid Asset Fund Inc.

Portfolio

of Investments

¡

May 31, 2013 (unaudited)

continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUPON

RATE

|

|

|

|

|

|

YIELD TO

MATURITY

ON DATE OF

PURCHASE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Municipal Bond (1.6%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$149,500

|

|

|

California, Ser 2012-13 A-2 RANs, dtd 08/23/12

(Cost $149,660,521)

|

|

|

2.50

|

|

|

|

%

|

|

|

|

0.43

|

|

|

|

%

|

|

|

|

06/20/13

|

|

|

$

|

149,660,521

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Tax-Exempt Instruments

(Cost $384,900,521)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

384,900,521

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUALIZED

YIELD ON

DATE OF

PURCHASE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Deposit (1.7%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Bank

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150,000

|

|

|

US Bank Cayman Islands

(Cost $150,000,000)

|

|

|

0.12

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

06/03/13

|

|

|

|

150,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments

(Cost $9,128,773,269)

(d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100.6

|

%

|

|

|

9,128,773,269

|

|

|

|

|

|

|

Liabilities in Excess of Other Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.6

|

)

|

|

|

(53,263,524

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100.0

|

%

|

|

$

|

9,075,509,745

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMT

|

Alternative Minimum Tax.

|

|

COPs

|

Certificates of Participation.

|

|

RANs

|

Revenue Anticipation Notes.

|

|

(a)

|

Rate shown is the rate in effect at May 31, 2013.

|

|

(b)

|

Date of next interest rate reset.

|

|

(c)

|

144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

|

|

(d)

|

Cost is the same for federal income tax purposes.

|

6

Morgan Stanley Liquid Asset Fund Inc.

Notes to Portfolio of Investments

¡

May 31, 2013 (unaudited)

Valuation of Investments

- Portfolio securities are valued at amortized cost, which approximates fair value, in accordance with Rule 2a-7 under the Investment Company Act of 1940.

Fair Valuation Measurements

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820,

Fair Value Measurements and Disclosures

(“ASC 820”), defines fair value as

the value that the Fund would receive to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market the most advantageous market for the

investment or liability. ASC 820 establishes a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in valuing an asset or liability developed based on market data obtained from

sources independent of the reporting entity (observable inputs); and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in valuing an asset or liability developed based on the

best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Fund’s investments. The inputs are

summarized in the three broad levels listed below.

• Level 1 – unadjusted quoted prices in active markets for

identical investments

• Level 2 – other significant observable inputs (including quoted prices for similar

investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs

including the Fund’s own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate

stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities and the

determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to each security.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Type

|

|

Level 1

Unadjusted

quoted

prices

|

|

|

Level 2

Other

significant

observable inputs

|

|

|

|

|

Level 3

Significant

unobservable

inputs

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase Agreements

|

|

$

|

—

|

|

|

$

|

3,231,032,000

|

|

|

|

|

$

|

—

|

|

|

$

|

3,231,032,000

|

|

|

Floating Rate Notes

|

|

|

—

|

|

|

|

2,489,085,483

|

|

|

|

|

|

—

|

|

|

|

2,489,085,483

|

|

|

Commercial Paper

|

|

|

—

|

|

|

|

1,767,557,285

|

|

|

|

|

|

—

|

|

|

|

1,767,557,285

|

|

|

Certificates of Deposit

|

|

|

—

|

|

|

|

1,106,197,980

|

|

|

|

|

|

—

|

|

|

|

1,106,197,980

|

|

|

Tax-Exempt Instruments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weekly Variable Rate Bonds

|

|

|

—

|

|

|

|

235,240,000

|

|

|

|

|

|

—

|

|

|

|

235,240,000

|

|

|

Municipal Bond

|

|

|

—

|

|

|

|

149,660,521

|

|

|

|

|

|

—

|

|

|

|

149,660,521

|

|

|

Total Tax-Exempt Instruments

|

|

|

—

|

|

|

|

384,900,521

|

|

|

|

|

|

—

|

|

|

|

384,900,521

|

|

|

Time Deposit

|

|

|

—

|

|

|

|

150,000,000

|

|

|

|

|

|

—

|

|

|

|

150,000,000

|

|

|

Total Asset

|

|

$

|

—

|

|

|

$

|

9,128,773,269

|

|

|

|

|

$

|

—

|

|

|

$

|

9,128,773,269

|

|

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an

investment’s valuation changes. The Fund recognizes transfers between the levels as of the end of the period. As of May 31, 2013, the Fund did not have any investments transfer between investment levels.

7

Item 2. Controls and Procedures.

(a) The Fund’s principal executive officer and principal financial officer have concluded that the Fund’s disclosure controls and procedures are sufficient to ensure that information required to

be disclosed by the Fund in this Form N-Q was recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, based upon such officers’ evaluation of these

controls and procedures as of a date within 90 days of the filing date of the report.

(b) There were no changes in the Fund’s internal

control over financial reporting that occurred during the registrant’s fiscal quarter that has materially affected, or is reasonably likely to materially affect, the Fund’s internal control over financial reporting.

Item 3. Exhibits.

(a) A separate

certification for each principal executive officer and principal financial officer of the registrant are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Morgan Stanley Liquid Asset Fund Inc.

/s/ Kevin Klingert

Kevin Klingert

Principal Executive Officer

July 23, 2013

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed

by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

/s/ Kevin Klingert

Kevin Klingert

Principal Executive Officer

July 23, 2013

/s/ Francis

Smith

Francis Smith

Principal

Financial Officer

July 23, 2013

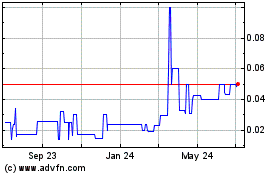

Wolverine Resources (PK) (USOTC:WOLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

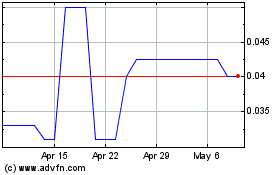

Wolverine Resources (PK) (USOTC:WOLV)

Historical Stock Chart

From Apr 2023 to Apr 2024