Supplement to the

Fidelity Advisor

®

Stock Selector All Cap Fund

Class A (FMAMX), Class T (FSJHX), Class B (FHRLX), Class C (FLACX), and Institutional Class (FBRNX)

Classes of shares of Fidelity

®

Stock Selector All Cap Fund

A Fund of Fidelity Capital Trust

STATEMENT OF ADDITIONAL INFORMATION

August 1, 2012

As Revised October 22, 2012

The following information replaces similar information found in the "Buying, Selling, and Exchanging Information" section on page

23.

Class A:

Shares of Class A may be exchanged for Class Z or Institutional Class shares of the same fund.

Class T:

Shares of Class T may be exchanged for Class A (on a load-waived basis), Class Z, or Institutional Class shares of the same fund.

Class B:

Shares of Class B may be exchanged for Class A, Class T, Class Z, or Institutional Class shares of the same fund.

Class C:

Shares of Class C may be exchanged for Class A, Class T, Class Z, or Institutional Class shares of the same fund.

Class Z:

Shares of Class Z may be exchanged for Class A or Institutional Class shares of the same fund if you are no longer eligible for

Class Z.

Institutional Class:

Shares of Institutional Class may be exchanged for Class A, if you are no longer eligible for Institutional Class, or

Class Z shares of the same fund.

The following information replaces similar information for John Dowd found in the "Management Contract" section beginning on

page 34.

John Dowd is co-manager of Fidelity Stock Selector All Cap Fund and does not receive compensation for his services to this fund.

Christopher Lee has replaced Benjamin Hesse as the co-manager of the fund.

The following information supplements similar information found in the "Management Contract" section beginning on page 34.

Christopher Lee is co-manager of Fidelity Stock Selector All Cap Fund. He receives compensation for his services as a research analyst and

as a portfolio manager under a single compensation plan, but he does not receive compensation for his services to this fund. Research analysts

who also manage sector funds, such as the equity sector Central Funds, are referred to as sector fund managers. As of May 31, 2013, the sector

fund manager's compensation generally consists of a fixed base salary determined periodically (typically annually), a bonus, in certain cases,

participation in several types of equity-based compensation plans, and, if applicable, relocation plan benefits. A portion of the sector fund

manager's compensation may be deferred based on criteria established by FMR or at the election of the sector fund manager.

The sector fund manager's base salary is determined primarily by level of experience and skills, and performance as a research analyst and

sector fund manager at FMR or its affiliates. A portion of the sector fund manager's bonus relates to his performance as a research analyst and is

based on the Director of Research's assessment of the research analyst's performance and may include factors such as portfolio manager survey-based assessments, which relate to analytical work and investment results within the relevant sector(s) and impact on other equity funds

and accounts as a research analyst, and the research analyst's contributions to the research groups and to FMR. Another component of the

bonus is based upon (i) the pre-tax investment performance of the sector fund manager's fund(s) and account(s) measured against a benchmark

index (which may be a customized industry benchmark index developed by FMR) and within a defined peer group, if applicable, assigned to

each fund or account, (ii) the pre-tax investment performance of the research analyst's recommendations measured against a benchmark index

corresponding to the research analyst's assignment universe and against a broadly diversified equity index, and (iii) the investment performance of other FMR equity funds and accounts within the sector fund manager's designated sector team. The pre-tax investment performance

of the sector fund manager's fund(s) and account(s) is weighted according to the sector fund manager's tenure on those fund(s) and account(s).

The component of the bonus relating to the Director of Research's assessment is calculated over a one-year period, and each other component

of the bonus is calculated over a measurement period that initially is contemporaneous with the sector fund manager's tenure, but that eventually encompasses rolling periods of up to five years for the comparison to a benchmark index and rolling periods of up to three years for the

comparison to a peer group, if applicable. The sector fund manager also is compensated under equity-based compensation plans linked to

increases or decreases in the net asset value of the stock of FMR LLC, FMR's parent company. FMR LLC is a diverse financial services company engaged in various activities that include fund management, brokerage, retirement, and employer administrative services. If requested to

relocate their primary residence, sector fund managers also may be eligible to receive benefits, such as home sale assistance and payment of

certain moving expenses, under relocation plans for most full-time employees of FMR LLC and its affiliates.

AFSS-AFSSIB-13-03 August 13, 2013

1.960091.102

The sector fund manager's compensation plan may give rise to potential conflicts of interest. The sector fund manager's compensation is

linked to the pre-tax performance of the fund, rather than its after-tax performance. The sector fund manager's base pay and bonus opportunity

tend to increase with the sector fund manager's level of experience and skills relative to research and fund assignments. The management of

multiple funds and accounts (including proprietary accounts) may give rise to potential conflicts of interest if the funds and accounts have

different objectives, benchmarks, time horizons, and fees as the sector fund manager must allocate his time and investment ideas across multiple funds and accounts. In addition, the fund's trade allocation policies and procedures may give rise to conflicts of interest if the fund's orders

do not get fully executed due to being aggregated with those of other accounts managed by FMR. The sector fund manager may execute transactions for another fund or account that may adversely impact the value of securities held by the fund. Securities selected for other funds or

accounts may outperform the securities selected for the fund. Trading in personal accounts, which may give rise to potential conflicts of interest, is restricted by a fund's Code of Ethics. Furthermore, the potential exists that the sector fund manager's responsibilities as a portfolio

manager of a sector fund may not be entirely consistent with his responsibilities as a research analyst providing recommendations to other

Fidelity portfolio managers.

The following table provides information relating to other accounts managed by Mr. Lee as of May 31, 2013:

|

|

Registered

Investment

Companies

*

|

Other Pooled

Investment

Vehicles

|

Other

Accounts

|

|

Number of Accounts Managed

|

9

|

none

|

none

|

|

Number of Accounts Managed with Performance-Based Advisory Fees

|

2

|

none

|

none

|

|

Assets Managed (in millions)

|

$ 5,753

|

none

|

none

|

|

Assets Managed with Performance-Based Advisory Fees (in millions)

|

$ 2,353

|

none

|

none

|

* Includes Fidelity Stock Selector All Cap Fund ($561 (in millions) assets managed).

As of May 31, 2013, the dollar range of shares of Fidelity Stock Selector All Cap Fund beneficially owned by Mr. Lee was none.

Matthew Drukker has replaced Kristina Salen as the co-manager of the fund.

The following information supplements similar information found in the "Management Contract" section beginning on page 34.

Matthew Drukker is co-manager of Fidelity Stock Selector All Cap Fund. He receives compensation for his services as a research analyst

and as a portfolio manager under a single compensation plan, but he does not receive compensation for his services to this fund. Research

analysts who also manage sector funds, such as the equity sector Central Funds, are referred to as sector fund managers. As of January 31, 2013,

the sector fund manager's compensation generally consists of a fixed base salary determined periodically (typically annually), a bonus, in

certain cases, participation in several types of equity-based compensation plans, and, if applicable, relocation plan benefits. A portion of the

sector fund manager's compensation may be deferred based on criteria established by FMR or at the election of the sector fund manager.

The sector fund manager's base salary is determined primarily by level of experience and skills, and performance as a research analyst and

sector fund manager at FMR or its affiliates. A portion of the sector fund manager's bonus relates to his performance as a research analyst and is

based on the Director of Research's assessment of the research analyst's performance and may include factors such as portfolio manager survey-based assessments, which relate to analytical work and investment results within the relevant sector(s) and impact on other equity funds

and accounts as a research analyst, and the research analyst's contributions to the research groups and to FMR. Another component of the

bonus is based upon (i) the pre-tax investment performance of the sector fund manager's fund(s) and account(s) measured against a benchmark

index (which may be a customized industry benchmark index developed by FMR) assigned to each fund or account, (ii) the pre-tax investment

performance of the research analyst's recommendations measured against a benchmark index corresponding to the research analyst's assignment universe and against a broadly diversified equity index, and (iii) the investment performance of other FMR equity funds and accounts

within the sector fund manager's designated sector team. The pre-tax investment performance of the sector fund manager's fund(s) and account(s) is weighted according to the sector fund manager's tenure on those fund(s) and account(s). The component of the bonus relating to the

Director of Research's assessment is calculated over a one-year period, and each other component of the bonus is calculated over a measurement period that initially is contemporaneous with the sector fund manager's tenure, but that eventually encompasses rolling periods of up to

five years. The sector fund manager also is compensated under equity-based compensation plans linked to increases or decreases in the net

asset value of the stock of FMR LLC, FMR's parent company. FMR LLC is a diverse financial services company engaged in various activities

that include fund management, brokerage, retirement, and employer administrative services. If requested to relocate their primary residence,

sector fund managers also may be eligible to receive benefits, such as home sale assistance and payment of certain moving expenses, under

relocation plans for most full-time employees of FMR LLC and its affiliates.

The sector fund manager's compensation plan may give rise to potential conflicts of interest. Although investors in the fund may invest

through either tax-deferred accounts or taxable accounts, the sector fund manager's compensation is linked to the pre-tax performance of the

fund, rather than its after-tax performance. The sector fund manager's base pay and bonus opportunity tend to increase with the sector fund

manager's level of experience and skills relative to research and fund assignments. The management of multiple funds and accounts (including

proprietary accounts) may give rise to potential conflicts of interest if the funds and accounts have different objectives, benchmarks, time

horizons, and fees as the sector fund manager must allocate his time and investment ideas across multiple funds and accounts. In addition, the

fund's trade allocation policies and procedures may give rise to conflicts of interest if the fund's orders do not get fully executed due to being

aggregated with those of other accounts managed by FMR. The sector fund manager may execute transactions for another fund or account that

may adversely impact the value of securities held by the fund. Securities selected for other funds or accounts may outperform the securities

selected for the fund. Trading in personal accounts, which may give rise to potential conflicts of interest, is restricted by a fund's Code of Ethics.

Furthermore, the potential exists that the sector fund manager's responsibilities as a portfolio manager of a sector fund may not be entirely

consistent with his responsibilities as a research analyst providing recommendations to other Fidelity portfolio managers.

The following table provides information relating to other accounts managed by Mr. Drukker as of January 31, 2013:

|

|

Registered

Investment

Companies

*

|

Other Pooled

Investment

Vehicles

|

Other

Accounts

|

|

Number of Accounts Managed

|

6

|

none

|

none

|

|

Number of Accounts Managed with Performance-Based Advisory Fees

|

1

|

none

|

none

|

|

Assets Managed (in millions)

|

$ 918

|

none

|

none

|

|

Assets Managed with Performance-Based Advisory Fees (in millions)

|

$ 100

|

none

|

none

|

* Includes Fidelity Stock Selector All Cap Fund ($100 (in millions) assets managed with performance-based advisory fees).

As of January 31, 2013, the dollar range of shares of Fidelity Stock Selector All Cap Fund beneficially owned by Mr. Drukker was none.

Supplement to the

Fidelity

®

Stock Selector All Cap Fund (FDSSX)

A Class of shares of Fidelity Stock Selector All Cap Fund

A Fund of Fidelity Capital Trust

STATEMENT OF ADDITIONAL INFORMATION

November 29, 2012

The following information replaces similar information for John Dowd found in the "Management Contract" section beginning on

page 35.

John Dowd is co-manager of Fidelity Stock Selector All Cap Fund and does not receive compensation for his services to this fund.

Christopher Lee has replaced Benjamin Hesse as the co-manager of the fund.

The following information supplements similar information found in the "Management Contract" section beginning on page 35.

Christopher Lee is co-manager of Fidelity Stock Selector All Cap Fund. He receives compensation for his services as a research analyst and

as a portfolio manager under a single compensation plan, but he does not receive compensation for his services to this fund. Research analysts

who also manage sector funds, such as the equity sector Central Funds, are referred to as sector fund managers. As of May 31, 2013, the sector

fund manager's compensation generally consists of a fixed base salary determined periodically (typically annually), a bonus, in certain cases,

participation in several types of equity-based compensation plans, and, if applicable, relocation plan benefits. A portion of the sector fund

manager's compensation may be deferred based on criteria established by FMR or at the election of the sector fund manager.

The sector fund manager's base salary is determined primarily by level of experience and skills, and performance as a research analyst and

sector fund manager at FMR or its affiliates. A portion of the sector fund manager's bonus relates to his performance as a research analyst and is

based on the Director of Research's assessment of the research analyst's performance and may include factors such as portfolio manager survey-based assessments, which relate to analytical work and investment results within the relevant sector(s) and impact on other equity funds and

accounts as a research analyst, and the research analyst's contributions to the research groups and to FMR. Another component of the bonus is

based upon (i) the pre-tax investment performance of the sector fund manager's fund(s) and account(s) measured against a benchmark index

(which may be a customized industry benchmark index developed by FMR) and within a defined peer group, if applicable, assigned to each fund

or account, (ii) the pre-tax investment performance of the research analyst's recommendations measured against a benchmark index corresponding to the research analyst's assignment universe and against a broadly diversified equity index, and (iii) the investment performance of other

FMR equity funds and accounts within the sector fund manager's designated sector team. The pre-tax investment performance of the sector fund

manager's fund(s) and account(s) is weighted according to the sector fund manager's tenure on those fund(s) and account(s). The component of

the bonus relating to the Director of Research's assessment is calculated over a one-year period, and each other component of the bonus is calculated over a measurement period that initially is contemporaneous with the sector fund manager's tenure, but that eventually encompasses rolling

periods of up to five years for the comparison to a benchmark index and rolling periods of up to three years for the comparison to a peer group, if

applicable. The sector fund manager also is compensated under equity-based compensation plans linked to increases or decreases in the net asset

value of the stock of FMR LLC, FMR's parent company. FMR LLC is a diverse financial services company engaged in various activities that

include fund management, brokerage, retirement, and employer administrative services. If requested to relocate their primary residence, sector

fund managers also may be eligible to receive benefits, such as home sale assistance and payment of certain moving expenses, under relocation

plans for most full-time employees of FMR LLC and its affiliates.

The sector fund manager's compensation plan may give rise to potential conflicts of interest. The sector fund manager's compensation is

linked to the pre-tax performance of the fund, rather than its after-tax performance. The sector fund manager's base pay and bonus opportunity

tend to increase with the sector fund manager's level of experience and skills relative to research and fund assignments. The management of

multiple funds and accounts (including proprietary accounts) may give rise to potential conflicts of interest if the funds and accounts have

different objectives, benchmarks, time horizons, and fees as the sector fund manager must allocate his time and investment ideas across multiple funds and accounts. In addition, the fund's trade allocation policies and procedures may give rise to conflicts of interest if the fund's orders

do not get fully executed due to being aggregated with those of other accounts managed by FMR. The sector fund manager may execute transactions for another fund or account that may adversely impact the value of securities held by the fund. Securities selected for other funds or

accounts may outperform the securities selected for the fund. Trading in personal accounts, which may give rise to potential conflicts of interest, is restricted by a fund's Code of Ethics. Furthermore, the potential exists that the sector fund manager's responsibilities as a portfolio

manager of a sector fund may not be entirely consistent with his responsibilities as a research analyst providing recommendations to other

Fidelity portfolio managers.

FSSB-13-03 August 13, 2013

1.946353.104

The following table provides information relating to other accounts managed by Mr. Lee as of May 31, 2013:

|

|

Registered

Investment

Companies

*

|

Other Pooled

Investment

Vehicles

|

Other

Accounts

|

|

Number of Accounts Managed

|

9

|

none

|

none

|

|

Number of Accounts Managed with Performance-Based Advisory Fees

|

2

|

none

|

none

|

|

Assets Managed (in millions)

|

$ 5,753

|

none

|

none

|

|

Assets Managed with Performance-Based Advisory Fees (in millions)

|

$ 2,353

|

none

|

none

|

* Includes Fidelity Stock Selector All Cap Fund ($561 (in millions) assets managed).

As of May 31, 2013, the dollar range of shares of Fidelity Stock Selector All Cap Fund beneficially owned by Mr. Lee was none.

Matthew Drukker has replaced Kristina Salen as the co-manager of the fund.

The following information supplements similar information found in the "Management Contract" section beginning on page 35.

Matthew Drukker is co-manager of Fidelity Stock Selector All Cap Fund. He receives compensation for his services as a research analyst

and as a portfolio manager under a single compensation plan, but he does not receive compensation for his services to this fund. Research

analysts who also manage sector funds, such as the equity sector Central Funds, are referred to as sector fund managers. As of January 31, 2013,

the sector fund manager's compensation generally consists of a fixed base salary determined periodically (typically annually), a bonus, in

certain cases, participation in several types of equity-based compensation plans, and, if applicable, relocation plan benefits. A portion of the

sector fund manager's compensation may be deferred based on criteria established by FMR or at the election of the sector fund manager.

The sector fund manager's base salary is determined primarily by level of experience and skills, and performance as a research analyst and

sector fund manager at FMR or its affiliates. A portion of the sector fund manager's bonus relates to his performance as a research analyst and is

based on the Director of Research's assessment of the research analyst's performance and may include factors such as portfolio manager survey-based assessments, which relate to analytical work and investment results within the relevant sector(s) and impact on other equity funds and

accounts as a research analyst, and the research analyst's contributions to the research groups and to FMR. Another component of the bonus is

based upon (i) the pre-tax investment performance of the sector fund manager's fund(s) and account(s) measured against a benchmark index

(which may be a customized industry benchmark index developed by FMR) assigned to each fund or account, (ii) the pre-tax investment performance of the research analyst's recommendations measured against a benchmark index corresponding to the research analyst's assignment universe and against a broadly diversified equity index, and (iii) the investment performance of other FMR equity funds and accounts within the

sector fund manager's designated sector team. The pre-tax investment performance of the sector fund manager's fund(s) and account(s) is

weighted according to the sector fund manager's tenure on those fund(s) and account(s). The component of the bonus relating to the Director of

Research's assessment is calculated over a one-year period, and each other component of the bonus is calculated over a measurement period that

initially is contemporaneous with the sector fund manager's tenure, but that eventually encompasses rolling periods of up to five years. The sector

fund manager also is compensated under equity-based compensation plans linked to increases or decreases in the net asset value of the stock of

FMR LLC, FMR's parent company. FMR LLC is a diverse financial services company engaged in various activities that include fund management, brokerage, retirement, and employer administrative services. If requested to relocate their primary residence, sector fund managers also

may be eligible to receive benefits, such as home sale assistance and payment of certain moving expenses, under relocation plans for most full-time employees of FMR LLC and its affiliates.

The sector fund manager's compensation plan may give rise to potential conflicts of interest. Although investors in the fund may invest

through either tax-deferred accounts or taxable accounts, the sector fund manager's compensation is linked to the pre-tax performance of the

fund, rather than its after-tax performance. The sector fund manager's base pay and bonus opportunity tend to increase with the sector fund

manager's level of experience and skills relative to research and fund assignments. The management of multiple funds and accounts (including

proprietary accounts) may give rise to potential conflicts of interest if the funds and accounts have different objectives, benchmarks, time

horizons, and fees as the sector fund manager must allocate his time and investment ideas across multiple funds and accounts. In addition, the

fund's trade allocation policies and procedures may give rise to conflicts of interest if the fund's orders do not get fully executed due to being

aggregated with those of other accounts managed by FMR. The sector fund manager may execute transactions for another fund or account that

may adversely impact the value of securities held by the fund. Securities selected for other funds or accounts may outperform the securities

selected for the fund. Trading in personal accounts, which may give rise to potential conflicts of interest, is restricted by a fund's Code of Ethics.

Furthermore, the potential exists that the sector fund manager's responsibilities as a portfolio manager of a sector fund may not be entirely

consistent with his responsibilities as a research analyst providing recommendations to other Fidelity portfolio managers.

The following table provides information relating to other accounts managed by Mr. Drukker as of January 31, 2013:

|

|

Registered

Investment

Companies

*

|

Other Pooled

Investment

Vehicles

|

Other

Accounts

|

|

Number of Accounts Managed

|

6

|

none

|

none

|

|

Number of Accounts Managed with Performance-Based Advisory Fees

|

1

|

none

|

none

|

|

Assets Managed (in millions)

|

$ 918

|

none

|

none

|

|

Assets Managed with Performance-Based Advisory Fees (in millions)

|

$ 100

|

none

|

none

|

* Includes Fidelity Stock Selector All Cap Fund ($100 (in millions) assets managed with performance-based advisory fees).

As of January 31, 2013, the dollar range of shares of Fidelity Stock Selector All Cap Fund beneficially owned by Mr. Drukker was none.

Supplement to the

Fidelity

®

Stock Selector All Cap Fund

Class K (FSSKX)

A Fund of Fidelity Capital Trust

STATEMENT OF ADDITIONAL INFORMATION

November 29, 2012

The following information replaces similar information for John Dowd found in the "Management Contract" section beginning on

page 35.

John Dowd is co-manager of Fidelity Stock Selector All Cap Fund and does not receive compensation for his services to this fund.

Christopher Lee has replaced Benjamin Hesse as the co-manager of the fund.

The following information supplements similar information found in the "Management Contract" section beginning on page 35.

Christopher Lee is co-manager of Fidelity Stock Selector All Cap Fund. He receives compensation for his services as a research analyst and

as a portfolio manager under a single compensation plan, but he does not receive compensation for his services to this fund. Research analysts

who also manage sector funds, such as the equity sector Central Funds, are referred to as sector fund managers. As of May 31, 2013, the sector

fund manager's compensation generally consists of a fixed base salary determined periodically (typically annually), a bonus, in certain cases,

participation in several types of equity-based compensation plans, and, if applicable, relocation plan benefits. A portion of the sector fund

manager's compensation may be deferred based on criteria established by FMR or at the election of the sector fund manager.

The sector fund manager's base salary is determined primarily by level of experience and skills, and performance as a research analyst and

sector fund manager at FMR or its affiliates. A portion of the sector fund manager's bonus relates to his performance as a research analyst and is

based on the Director of Research's assessment of the research analyst's performance and may include factors such as portfolio manager survey-based assessments, which relate to analytical work and investment results within the relevant sector(s) and impact on other equity funds and

accounts as a research analyst, and the research analyst's contributions to the research groups and to FMR. Another component of the bonus is

based upon (i) the pre-tax investment performance of the sector fund manager's fund(s) and account(s) measured against a benchmark index

(which may be a customized industry benchmark index developed by FMR) and within a defined peer group, if applicable, assigned to each fund

or account, (ii) the pre-tax investment performance of the research analyst's recommendations measured against a benchmark index corresponding to the research analyst's assignment universe and against a broadly diversified equity index, and (iii) the investment performance of other

FMR equity funds and accounts within the sector fund manager's designated sector team. The pre-tax investment performance of the sector fund

manager's fund(s) and account(s) is weighted according to the sector fund manager's tenure on those fund(s) and account(s). The component of

the bonus relating to the Director of Research's assessment is calculated over a one-year period, and each other component of the bonus is calculated over a measurement period that initially is contemporaneous with the sector fund manager's tenure, but that eventually encompasses rolling

periods of up to five years for the comparison to a benchmark index and rolling periods of up to three years for the comparison to a peer group, if

applicable. The sector fund manager also is compensated under equity-based compensation plans linked to increases or decreases in the net asset

value of the stock of FMR LLC, FMR's parent company. FMR LLC is a diverse financial services company engaged in various activities that

include fund management, brokerage, retirement, and employer administrative services. If requested to relocate their primary residence, sector

fund managers also may be eligible to receive benefits, such as home sale assistance and payment of certain moving expenses, under relocation

plans for most full-time employees of FMR LLC and its affiliates.

The sector fund manager's compensation plan may give rise to potential conflicts of interest. The sector fund manager's compensation is

linked to the pre-tax performance of the fund, rather than its after-tax performance. The sector fund manager's base pay and bonus opportunity

tend to increase with the sector fund manager's level of experience and skills relative to research and fund assignments. The management of

multiple funds and accounts (including proprietary accounts) may give rise to potential conflicts of interest if the funds and accounts have

different objectives, benchmarks, time horizons, and fees as the sector fund manager must allocate his time and investment ideas across multiple funds and accounts. In addition, the fund's trade allocation policies and procedures may give rise to conflicts of interest if the fund's orders

do not get fully executed due to being aggregated with those of other accounts managed by FMR. The sector fund manager may execute transactions for another fund or account that may adversely impact the value of securities held by the fund. Securities selected for other funds or

accounts may outperform the securities selected for the fund. Trading in personal accounts, which may give rise to potential conflicts of interest, is restricted by a fund's Code of Ethics. Furthermore, the potential exists that the sector fund manager's responsibilities as a portfolio

manager of a sector fund may not be entirely consistent with his responsibilities as a research analyst providing recommendations to other

Fidelity portfolio managers.

FSS-KB-13-03 August 13, 2013

1.946354.104

The following table provides information relating to other accounts managed by Mr. Lee as of May 31, 2013:

|

|

Registered

Investment

Companies

*

|

Other Pooled

Investment

Vehicles

|

Other

Accounts

|

|

Number of Accounts Managed

|

9

|

none

|

none

|

|

Number of Accounts Managed with Performance-Based Advisory Fees

|

2

|

none

|

none

|

|

Assets Managed (in millions)

|

$ 5,753

|

none

|

none

|

|

Assets Managed with Performance-Based Advisory Fees (in millions)

|

$ 2,353

|

none

|

none

|

* Includes Fidelity Stock Selector All Cap Fund ($561 (in millions) assets managed).

As of May 31, 2013, the dollar range of shares of Fidelity Stock Selector All Cap Fund beneficially owned by Mr. Lee was none.

Matthew Drukker has replaced Kristina Salen as the co-manager of the fund.

The following information supplements similar information found in the "Management Contract" section beginning on page 35.

Matthew Drukker is co-manager of Fidelity Stock Selector All Cap Fund. He receives compensation for his services as a research analyst

and as a portfolio manager under a single compensation plan, but he does not receive compensation for his services to this fund. Research

analysts who also manage sector funds, such as the equity sector Central Funds, are referred to as sector fund managers. As of January 31, 2013,

the sector fund manager's compensation generally consists of a fixed base salary determined periodically (typically annually), a bonus, in

certain cases, participation in several types of equity-based compensation plans, and, if applicable, relocation plan benefits. A portion of the

sector fund manager's compensation may be deferred based on criteria established by FMR or at the election of the sector fund manager.

The sector fund manager's base salary is determined primarily by level of experience and skills, and performance as a research analyst and

sector fund manager at FMR or its affiliates. A portion of the sector fund manager's bonus relates to his performance as a research analyst and is

based on the Director of Research's assessment of the research analyst's performance and may include factors such as portfolio manager survey-based assessments, which relate to analytical work and investment results within the relevant sector(s) and impact on other equity funds and

accounts as a research analyst, and the research analyst's contributions to the research groups and to FMR. Another component of the bonus is

based upon (i) the pre-tax investment performance of the sector fund manager's fund(s) and account(s) measured against a benchmark index

(which may be a customized industry benchmark index developed by FMR) assigned to each fund or account, (ii) the pre-tax investment performance of the research analyst's recommendations measured against a benchmark index corresponding to the research analyst's assignment universe and against a broadly diversified equity index, and (iii) the investment performance of other FMR equity funds and accounts within the

sector fund manager's designated sector team. The pre-tax investment performance of the sector fund manager's fund(s) and account(s) is

weighted according to the sector fund manager's tenure on those fund(s) and account(s). The component of the bonus relating to the Director of

Research's assessment is calculated over a one-year period, and each other component of the bonus is calculated over a measurement period that

initially is contemporaneous with the sector fund manager's tenure, but that eventually encompasses rolling periods of up to five years. The sector

fund manager also is compensated under equity-based compensation plans linked to increases or decreases in the net asset value of the stock of

FMR LLC, FMR's parent company. FMR LLC is a diverse financial services company engaged in various activities that include fund management, brokerage, retirement, and employer administrative services. If requested to relocate their primary residence, sector fund managers also

may be eligible to receive benefits, such as home sale assistance and payment of certain moving expenses, under relocation plans for most full-time employees of FMR LLC and its affiliates.

The sector fund manager's compensation plan may give rise to potential conflicts of interest. Although investors in the fund may invest

through either tax-deferred accounts or taxable accounts, the sector fund manager's compensation is linked to the pre-tax performance of the

fund, rather than its after-tax performance. The sector fund manager's base pay and bonus opportunity tend to increase with the sector fund

manager's level of experience and skills relative to research and fund assignments. The management of multiple funds and accounts (including

proprietary accounts) may give rise to potential conflicts of interest if the funds and accounts have different objectives, benchmarks, time

horizons, and fees as the sector fund manager must allocate his time and investment ideas across multiple funds and accounts. In addition, the

fund's trade allocation policies and procedures may give rise to conflicts of interest if the fund's orders do not get fully executed due to being

aggregated with those of other accounts managed by FMR. The sector fund manager may execute transactions for another fund or account that

may adversely impact the value of securities held by the fund. Securities selected for other funds or accounts may outperform the securities

selected for the fund. Trading in personal accounts, which may give rise to potential conflicts of interest, is restricted by a fund's Code of Ethics.

Furthermore, the potential exists that the sector fund manager's responsibilities as a portfolio manager of a sector fund may not be entirely

consistent with his responsibilities as a research analyst providing recommendations to other Fidelity portfolio managers.

The following table provides information relating to other accounts managed by Mr. Drukker as of January 31, 2013:

|

|

Registered

Investment

Companies

*

|

Other Pooled

Investment

Vehicles

|

Other

Accounts

|

|

Number of Accounts Managed

|

6

|

none

|

none

|

|

Number of Accounts Managed with Performance-Based Advisory Fees

|

1

|

none

|

none

|

|

Assets Managed (in millions)

|

$ 918

|

none

|

none

|

|

Assets Managed with Performance-Based Advisory Fees (in millions)

|

$ 100

|

none

|

none

|

* Includes Fidelity Stock Selector All Cap Fund ($100 (in millions) assets managed with performance-based advisory fees).

As of January 31, 2013, the dollar range of shares of Fidelity Stock Selector All Cap Fund beneficially owned by Mr. Drukker was none.

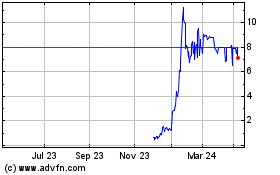

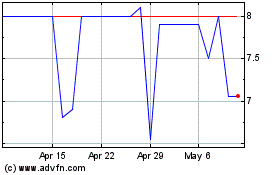

Zivo Bioscience (QB) (USOTC:ZIVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zivo Bioscience (QB) (USOTC:ZIVO)

Historical Stock Chart

From Apr 2023 to Apr 2024