Statement of Ownership (sc 13g)

August 05 2013 - 5:30PM

Edgar (US Regulatory)

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13G

|

|

(Rule 13d-102)

|

|

|

|

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

|

|

TO RULES 13d-1(b), (c), AND (d) AND AMENDMENTS THERETO FILED

|

|

PURSUANT TO RULE 13d-2

|

|

|

|

|

|

|

|

3DICON CORPORATION

|

|

(Name of Issuer)

|

|

|

|

COMMON

|

|

(Title of Class of Securities)

|

|

|

|

88579F102

|

|

(CUSIP Number)

|

|

|

|

July 22, 2013

|

|

(Date of Event Which Requires Filing of the Statement)

|

Check the appropriate box to designate

the rule pursuant to which this Schedule is filed:

*The remainder of

this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover

page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however,

see

the

Notes

).

|

CUSIP NO. 88579F102

|

13G

|

Page 2 of 8 Pages

|

|

1.

|

NAME OF REPORTING PERSONS

IBC Funds LLC

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

¨

(b)

¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Nevada

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5.

|

SOLE VOTING POWER

(1)

|

|

6.

|

SHARED VOTING POWER

0

|

|

7.

|

SOLE DISPOSITIVE POWER

(1)

|

|

8.

|

SHARED DISPOSITIVE POWER

0

|

|

9.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

(1)

|

|

10.

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

x

(1)

|

|

11.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%

(1)

|

|

12.

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

(1)

|

Bryan Collins and Samuel Oshana are Managing Members of IBC Funds LLC

(“IBC”) and may be deemed to hold shared voting and dispositive power over shares held by IBC. On July 26, 2013, the

Circuit Court in the 12

th

Judicial Circuit in and for Sarasota County, Florida, entered an Order Granting Approval

of Settlement Agreement approving a Settlement Agreement between the Issuer and IBC whereby the Issuer, in lieu of cash payment,

agreed to issue 650,000 shares of the Issuer’s common stock (“Common Stock”) and, in one or more tranches, that

number of shares of Common Stock equal to $197,630.64 upon conversion into Common Stock at a conversion rate equal to 65%

of the lowest closing bid price of the Common Stock during the ten trading days prior to the date the conversion is requested by

IBC

minus

$0.002. However, pursuant to the Settlement Agreement, the Issuer may not issue shares of Common Stock

that would result in more than an aggregate 9.99% beneficial ownership of the Issuer’s issued and outstanding Common Stock

by IBC and its affiliates, including other entities managed by Mr. Collins and Mr. Oshana.

|

|

CUSIP NO. 88579F102

|

13G

|

Page 3 of 8 Pages

|

|

1.

|

NAME OF REPORTING PERSONS

Bryan Collins

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

¨

(b)

¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5.

|

SOLE VOTING POWER

0

|

|

6.

|

SHARED VOTING POWER

(1)(2)

|

|

7.

|

SOLE DISPOSITIVE POWER

0

|

|

8.

|

SHARED DISPOSITIVE POWER

(1)(2)

|

|

9.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

(1)(2)

|

|

10.

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

x

(1)(2)

|

|

11.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%

(1)(2)

|

|

12.

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

|

(1)

|

Bryan Collins is a Managing Member of IBC Funds LLC (“IBC”) and may be deemed to hold

shared voting and dispositive power over shares held by IBC. On July 26, 2013, the Circuit Court in the 12

th

Judicial

Circuit in and for Sarasota County, Florida, entered an Order Granting Approval of Settlement Agreement approving a Settlement

Agreement between the Issuer and IBC whereby the Issuer, in lieu of cash payment, agreed to issue 650,000 shares of the Issuer’s

common stock (“Common Stock”) and, in one or more tranches, that number of shares of Common Stock equal to $197,630.64

upon conversion into Common Stock at a conversion rate equal to 65% of the lowest closing bid price of the Common Stock during

the ten trading days prior to the date the conversion is requested by IBC

minus

$0.002. However, pursuant to the

Settlement Agreement, the Issuer may not issue shares of Common Stock that would result in more than an aggregate 9.99% beneficial

ownership of the Issuer’s issued and outstanding Common Stock by IBC and its affiliates, including other entities managed

by Mr. Collins.

|

|

|

(2)

|

Bryan Collins is a Managing Member of Red Creek Group LLC, which is a Managing Member of CP

US Income Group LLC (“CPUS”) and may be deemed to hold shared voting and dispositive power over shares held by

CPUS. On July 22, 2013, CPUS acquired a Convertible Bridge Note of the Issuer in principal amount of $325,000 (the

“Note”), which Note was amended by agreement between the Issuer and CPUS to provide for its conversion at a

conversion price equal to 60% of the lowest closing bid price, as reported by Bloomberg, L.P., for the 10 trading days prior

to the date CPUS requests conversion of all or part of the Note. However, pursuant to the Note, the Issuer may not issue

shares of Common Stock that would result in more than an aggregate 9.99% beneficial ownership of the Issuer’s issued

and outstanding Common Stock by CPUS and its affiliates, including other entities managed by Mr. Collins.

|

|

CUSIP NO. 88579F102

|

13G

|

Page 4 of 8 Pages

|

|

1.

|

NAME OF REPORTING PERSONS

Samuel Oshana

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

¨

(b)

¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5.

|

SOLE VOTING POWER

0

|

|

6.

|

SHARED VOTING POWER

(1)(2)

|

|

7.

|

SOLE DISPOSITIVE POWER

0

|

|

8.

|

SHARED DISPOSITIVE POWER

(1)(2)

|

|

9.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

(1)(2)

|

|

10.

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

x

(1)(2)

|

|

11.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%

(1)(2)

|

|

12.

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

|

(1)

|

Samuel Oshana is a Managing Member of IBC Funds LLC (“IBC”) and may be deemed to hold

shared voting and dispositive power over shares held by IBC. On July 26, 2013, the Circuit Court in the 12

th

Judicial

Circuit in and for Sarasota County, Florida, entered an Order Granting Approval of Settlement Agreement approving a Settlement

Agreement between the Issuer and IBC whereby the Issuer, in lieu of cash payment, agreed to issue 650,000 shares of the Issuer’s

common stock (“Common Stock”) and, in one or more tranches, that number of shares of Common Stock equal to $197,630.64

upon conversion into Common Stock at a conversion rate equal to 65% of the lowest closing bid price of the Common Stock during

the ten trading days prior to the date the conversion is requested by IBC

minus

$0.002. However, pursuant to the

Settlement Agreement, the Issuer may not issue shares of Common Stock that would result in more than an aggregate 9.99% beneficial

ownership of the Issuer’s issued and outstanding Common Stock by IBC and its affiliates, including other entities managed

by Mr. Oshana.

|

|

|

(2)

|

Samuel Oshana is a Managing Member of Red Creek Group LLC, which is a Managing Member of CP US

Income Group LLC (“CPUS”) and may be deemed to hold shared voting and dispositive power over shares held by CPUS. On

July 22, 2013, CPUS acquired a Convertible Bridge Note of the Issuer in principal amount of $325,000 (the “Note”),

which Note was amended by agreement between the Issuer and CPUS to provide for its conversion at a conversion price equal to 60%

of the lowest closing bid price, as reported by Bloomberg, L.P., for the 10 trading days prior to the date CPUS requests conversion

of all or part of the Note. However, pursuant to the Note, the Issuer may not issue shares of Common Stock that would result in

more than an aggregate 9.99% beneficial ownership of the Issuer’s issued and outstanding Common Stock by CPUS and its affiliates,

including other entities managed by Mr. Oshana.

|

|

CUSIP NO. 88579F102

|

13G

|

Page 5 of 8 Pages

|

|

1.

|

NAME OF REPORTING PERSONS

CP US Income Group LLC

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

¨

(b)

¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Florida

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5.

|

SOLE VOTING POWER

(1)

|

|

6.

|

SHARED VOTING POWER

0

|

|

7.

|

SOLE DISPOSITIVE POWER

(1)

|

|

8.

|

SHARED DISPOSITIVE POWER

0

|

|

9.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

(1)

|

|

10.

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES

x

(1)

|

|

11.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%

(1)

|

|

12.

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

(1)

|

Bryan Collins and Samuel Oshana are Managing Members of Red Creek Group LLC, which is a Managing

Member of CP US Income Group LLC (“CPUS”) and may be deemed to hold shared voting and dispositive power over shares

held by CPUS. On July 22, 2013, CPUS acquired a Convertible Bridge Note of the Issuer in principal amount of $325,000 (the “Note”),

which Note was amended by agreement between the Issuer and CPUS to provide for its conversion at a conversion price equal to 60%

of the lowest closing bid price, as reported by Bloomberg, L.P., for the 10 trading days prior to the date CPUS requests conversion

of all or part of the Note. However, pursuant to the Note, the Issuer may not issue shares of Common Stock that would result in

more than an aggregate 9.99% beneficial ownership of the Issuer’s issued and outstanding Common Stock by CPUS and its affiliates,

including other entities managed by Mr. Collins and Mr. Oshana.

|

|

CUSIP NO. 88579F102

|

13G

|

Page 6 of 8 Pages

|

|

Item 1(a).

|

Name of Issuer:

|

|

|

3DICON

CORPORATION

|

|

|

|

|

Item 1(b).

|

Address of Issuer’s Principal Executive Offices:

|

|

|

6804 South Canton Avenue, Suite 150, Tulsa, Oklahoma 74136

|

|

|

|

|

Item 2(a).

|

Name of Person Filing:

|

|

|

This statement is filed by: (i) IBC Funds

LLC; (ii) Bryan Collins; (iii) Samuel Oshana; and (iv) CP US Income Group LLC with respect to shares beneficially owned by IBC

Funds LLC and CP US Income Group LLC.

IBC Funds LLC, Bryan Collins, Samuel Oshana

and CP US Income Group LLC have entered into an Joint Filing Agreement, a copy of which is filed with this Schedule 13G as Exhibit

99.1, pursuant to which they have agreed to file this Schedule 13G jointly in accordance with the provisions of Rule 13d-1(k) of

the Act.

|

|

|

|

|

Item 2(b).

|

Address of Principal Business Office or, if none, Residence:

|

|

|

1170 Kane Concourse, Suite 404

Bay Harbour, Florida 33154

|

|

|

|

|

Item 2(c).

|

Citizenship:

|

|

|

IBC Funds LLC is a Nevada limited liability corporation. Mr. Collins is a United States citizen. Mr. Oshana

is a United States citizen.

CP US Income Group LLC is a Florida limited liability corporation.

|

|

|

|

|

Item 2(d).

|

Title of Class of Securities:

|

|

|

COMMON STOCK

|

|

|

|

|

Item 2(e).

|

CUSIP Number:

|

|

|

88579F102

|

|

|

|

|

Item 3.

|

Type of Person:

|

|

|

Not applicable

|

|

CUSIP NO. 88579F102

|

13G

|

Page 7 of 8 Pages

|

Provide the following information regarding

the aggregate number and percentage of class of securities of the issuer identified in Item 1.

|

|

(a)

|

Amount beneficially owned:

|

|

|

|

(1)(2)

|

|

|

|

|

|

|

(b)

|

Percent of Class:

|

|

|

|

9.99%

(1)(2)

|

|

|

|

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

|

|

|

|

|

|

|

|

|

(i)

|

sole power to vote or to direct the vote:

|

|

|

|

|

(1)(2)

|

|

|

|

|

|

|

|

|

(ii)

|

shared power to vote or to direct the vote:

|

|

|

|

|

(1)(2)

|

|

|

|

|

|

|

|

|

(iii)

|

sole power to dispose or to direct the disposition of:

|

|

|

|

|

(1)(2)

|

|

|

|

|

|

|

|

|

(iv)

|

shared power to dispose or to direct the disposition of:

|

|

|

|

|

(1)(2)

|

|

|

(1)

|

Bryan Collins and Samuel Oshana are Managing Members of IBC Funds LLC (“IBC”) and may

be deemed to hold shared voting and dispositive power over shares held by IBC. On July 26, 2013, the Circuit Court in the 12

th

Judicial

Circuit in and for Sarasota County, Florida, entered an Order Granting Approval of Settlement Agreement approving a Settlement

Agreement between the Issuer and IBC whereby the Issuer, in lieu of cash payment, agreed to issue 650,000 shares of the Issuer’s

common stock (“Common Stock”) and, in one or more tranches, that number of shares of Common Stock equal to $197,630.64

upon conversion into Common Stock at a conversion rate equal to 65% of the lowest closing bid price of the Common Stock during

the ten trading days prior to the date the conversion is requested by IBC

minus

$0.002. However, pursuant to the

Settlement Agreement, the Issuer may not issue shares of Common Stock that would result in more than an aggregate 9.99% beneficial

ownership of the Issuer’s issued and outstanding Common Stock by IBC and its affiliates, including other entities managed

by Mr. Collins and Mr. Oshana.

|

|

|

(2)

|

Bryan Collins and Samuel Oshana are Managing Members of Red Creek Group LLC, which is a Managing

Member of CP US Income Group LLC (“CPUS”) and may be deemed to hold shared voting and dispositive power over shares

held by CPUS. On July 22, 2013, CPUS acquired a Convertible Bridge Note of the Issuer in principal amount of $325,000 (the “Note”),

which Note was amended by agreement between the Issuer and CPUS to provide for its conversion at a conversion price equal to 60%

of the lowest closing bid price, as reported by Bloomberg, L.P., for the 10 trading days prior to the date CPUS requests conversion

of all or part of the Note. However, pursuant to the Note, the Issuer may not issue shares of Common Stock that would result in

more than an aggregate 9.99% beneficial ownership of the Issuer’s issued and outstanding Common Stock by CPUS and its affiliates,

including other entities managed by Mr. Collins and Mr. Oshana.

|

|

|

Item 5.

|

Ownership of Five Percent or Less of a Class:

|

If this statement

is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more

than 5 percent of the class of securities, check the following

¨

.

|

|

Item 6.

|

Ownership of More than Five Percent on Behalf of Another

Person:

|

NOT APPLICABLE

|

|

Item 7.

|

Identification and Classification of the Subsidiary

which Acquired the Security Being Reported on by the Parent Holding Company or Control Person:

|

NOT APPLICABLE

|

|

Item 8.

|

Identification and Classification of Members of the

Group:

|

NOT APPLICABLE

|

|

Item 9.

|

Notice of Dissolution of Group:

|

NOT APPLICABLE

By signing below,

I certify that, to the best of my knowledge and belief, the securities referred to above were acquired and are held in the ordinary

course of business and were not acquired and are not held for the purpose of or with the effect of changing or influencing the

control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction

having that purpose or effect.

|

CUSIP NO. 88579F102

|

13G

|

Page 8 of 8 Pages

|

SIGNATURE

After reasonable inquiry

and to the best of its knowledge and belief, I certify (the undersigned certifies) that the information set forth in this statement

is true, complete and correct.

|

|

|

IBC Funds LLC

|

|

|

Date: August 5, 2013

|

By:

|

/s/ Bryan Collins

|

|

|

|

|

Bryan Collins

|

|

|

Date: August 5, 2013

|

By:

|

/s/ Bryan Collins

|

|

|

|

|

Bryan Collins

|

|

|

|

|

|

|

|

Date: August 5, 2013

|

By:

|

/s/ Samuel Oshana

|

|

|

|

|

Samuel Oshana

|

|

|

|

|

|

|

|

|

|

CP US Income Group LLC

|

|

|

Date: August 5, 2013

|

By:

|

/s/ Samuel Oshana

|

|

|

|

|

Samuel Oshana, Managing Member, Red Creek Group LLC, Managing Member

|

|

The original statement

shall be signed by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed

on behalf of a person by his authorized representative other than an executive officer or general partner of the filing person,

evidence of the representative's authority to sign on behalf of such person shall be filed with the statement, provided, however,

that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name

and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional

misstatements or omissions of fact constitute Federal criminal violations

(

see

18 U.S.C. 1001).

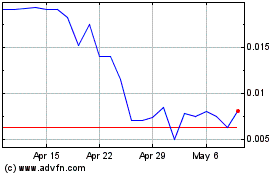

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coretec (QB) (USOTC:CRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024