Lundin Mining Files NI 43-101 Technical Report for the Eagle Mine on SEDAR

July 26 2013 - 4:00PM

Marketwired Canada

Lundin Mining Corporation (TSX:LUN)(OMX:LUMI) ("Lundin Mining" or the "Company")

reports that an independent National Instrument 43-101 Technical Report (the

"Report") for its Eagle nickel/copper mine has been filed today on SEDAR

(www.sedar.com). The Report is titled "NI 43-101 Technical Report on the Eagle

Mine, Upper Peninsula of Michigan, USA" and was prepared by Mark Owen and Lewis

Meyer from Wardell Armstrong International ("WAI"), based in London, United

Kingdom.

Report Highlights:

-- Probable Ore Reserves (JORC) of 5.18Mt at 2.93% Ni and 2.49% Cu, with

gold, cobalt, platinum and palladium by-products;

-- Initial production is scheduled for late 2014, with full commercial

production by mid-2015;

-- Approximately US$400M initial capital expenditures remaining to be spent

as of July 31, 2013;

-- Average production in first three full years of 23ktpa nickel and 20ktpa

copper at estimated C1 cash costs of under US$2.00 per pound of nickel;

-- Average Life of Mine production of 17ktpa nickel and 17ktpa copper at

estimated C1 cash costs of approximately US$2.50 per pound of nickel;

and

-- Estimated 8 year mine life (late 2014 - 2022) with upside potential.

For further information on the Probable Ore Reserves and production estimates,

please see the Report under Lundin Mining's profile on SEDAR (www.sedar.com).

Qualified Person:

The Qualified Persons for the technical information contained herein are Mark

Owen, Technical Director and Lewis Meyer, Associate Director, Wardell Armstrong

International. Mark Owen and Lewis Meyer have reviewed and approved the contents

of this news release.

The reserve estimate reported in this release has been prepared using accepted

industry practice and classified in accordance with the JORC Code (2004). There

are no material differences between the definitions of Proven and Probable

Mineral Reserves under the applicable definitions adopted by the Canadian

Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards")

and the corresponding equivalent definitions in the JORC Code for Proved and

Probable Ore Reserves.

About Lundin Mining

Lundin Mining is a diversified base metals mining company with operations and

projects in Portugal, Sweden, Spain and the U.S.A producing copper, zinc, lead

and nickel. In addition, Lundin Mining holds a 24% equity stake in the

world-class Tenke Fungurume copper/cobalt mine in the Democratic Republic of

Congo and in the Freeport Cobalt Oy business, which includes a cobalt refinery

located in Kokkola, Finland.

On Behalf of the Board,

Paul Conibear, President and CEO

Forward-Looking Statements

Certain of the statements made and information contained herein is

"forward-looking information" within the meaning of the Ontario Securities Act.

Forward-looking statements are subject to a variety of risks and uncertainties

which could cause actual events or results to differ from those reflected in the

forward-looking statements, including, without limitation, risks and

uncertainties relating to the estimated cash costs, the timing and amount of

production from the Eagle Mine, the cost estimates for the Eagle Mine, foreign

currency fluctuations; risks inherent in mining including environmental hazards,

industrial accidents, unusual or unexpected geological formations, ground

control problems and flooding; risks associated with the estimation of mineral

resources and reserves and the geology, grade and continuity of mineral

deposits; the possibility that future exploration, development or mining results

will not be consistent with the Company's expectations; the potential for and

effects of labour disputes or other unanticipated difficulties with or shortages

of labour or interruptions in production; actual ore mined varying from

estimates of grade, tonnage, dilution and metallurgical and other

characteristics; the inherent uncertainty of production and cost estimates and

the potential for unexpected costs and expenses, commodity price fluctuations;

uncertain political and economic environments; changes in laws or policies,

foreign taxation, delays or the inability to obtain necessary governmental

permits; and other risks and uncertainties, including those described under Risk

Factors Relating to the Company's Business in the Company's Annual Information

Form and in each management discussion and analysis. Forward-looking information

is in addition based on various assumptions including, without limitation, the

expectations and beliefs of management, the assumed long term price of copper,

nickel, lead and zinc; that the Company can access financing, appropriate

equipment and sufficient labour and that the political environment where the

Company operates will continue to support the development and operation of

mining projects. Should one or more of these risks and uncertainties

materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from those described in forward-looking statements.

Accordingly, readers are advised not to place undue reliance on forward-looking

statements. Lundin Mining undertakes no obligation to update publicly or revise

any forward-looking information or statements, whether as a result of new

information, future events or otherwise, except as required by applicable

securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lundin Mining Corporation

Sophia Shane

Investor Relations North America

+1-604-689-7842

Lundin Mining Corporation

John Miniotis

Senior Business Analyst

+1-416-342-5565

Lundin Mining Corporation

Robert Eriksson

Investor Relations Sweden

+46 8 545 015 50

www.lundinmining.com

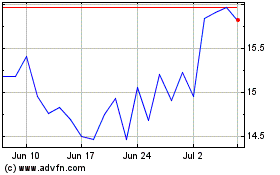

Lundin Mining (TSX:LUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

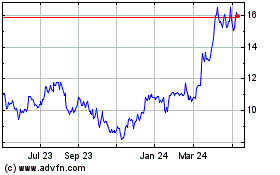

Lundin Mining (TSX:LUN)

Historical Stock Chart

From Apr 2023 to Apr 2024