Methode Electronics, Inc. (NYSE: MEI), a

global developer of custom engineered and application specific

products and solutions, today announced financial results for the

Fiscal 2013 fourth quarter and year ended April 27, 2013.

Fourth-Quarter Fiscal 2013 Methode's

fourth-quarter Fiscal 2013 net sales increased $21.9 million, or

17.3 percent, to $148.3 million from $126.4 million in the same

quarter of Fiscal 2012.

Net income increased $4.3 million to $10.1 million, or $0.27 per

share, in the fourth quarter of Fiscal 2013 from $5.8 million, or

$0.15 per share, in the same period of Fiscal 2012. Year over year,

Fiscal 2013 fourth-quarter net income benefitted from:

- higher income tax benefit due to adjustment of the valuation

allowance related to Malta investment tax credits of $6.8

million;

- lower legal expense of $0.7 million;

- lower costs related to third-party inspection, premium freight

and over-time expenses of $0.4 million;

- higher Other segment income as a result of increased

torque-sensing product sales of $0.3 million; and

- higher sales.

Year over year, Fiscal 2013 fourth-quarter net income was

negatively impacted by:

- a goodwill impairment charge in the Power Products segment

related to Eetrex of $4.3 million;

- compensation expense related to the company's long-term

incentive program for performance-based tandem cash awards of $2.1

million;

- severance and building demolition costs in the Automotive

segment of $1.1 million;

- higher Other expense, related mainly to higher foreign currency

loss and the absence of a life insurance gain, of $1.1

million;

- higher costs related to the design, development, engineering

and launch of a large North American automotive program of $0.2

million; and

- costs related to the newly acquired Hetronic business in Italy

of $0.2 million.

Excluding the impact of the Malta valuation allowance, the

goodwill impairment charge and the compensation expense, Methode's

Fiscal 2013 fourth-quarter net income was $8.9 million, or $0.24

per share.

Consolidated gross margins as a percentage of sales were 18.7

percent in the Fiscal 2013 fourth quarter compared to 18.2 percent

in the same period of Fiscal 2012. The increase was due primarily

to higher sales, lower costs related to third-party inspection,

premium freight and over-time expenses, as well as higher sales and

lower material costs in the Other segment, partially offset by

increased design, development and engineering costs for a new

automotive program, increased sales of automotive product that has

a higher prime cost due to the current high percentage of purchased

content, severance and building demolition costs in the Automotive

segment and costs related to the newly acquired Hetronic business

in Italy in the Interconnect segment.

Selling and administrative expenses increased $1.8 million, or

10.0 percent, to $19.8 million in the Fiscal 2013 fourth quarter

compared to $18.0 million in the prior-year fourth quarter due

primarily to the compensation expense related to the tandem cash

awards, partially offset by lower headcount in Europe. As a

percentage of sales, selling and administrative expenses decreased

to 13.3 percent for the Fiscal 2013 fourth quarter compared to 14.2

percent in the same period last year.

In the Fiscal 2013 fourth quarter, income tax benefit was $7.0

million compared to a benefit of $0.2 million for the Fiscal 2012

period. For the Fiscal 2013 period, the net income tax expense of

$0.6 million related to income taxes on foreign profits was offset

by a $7.6 million Malta valuation allowance adjustment. For the

Fiscal 2012 period, the net income tax expense of $0.6 million

related to income taxes on foreign profits was offset by a $0.8

million Malta valuation allowance adjustment.

Fourth-Quarter Fiscal 2013 Segment

Comparisons Comparing the Automotive segment's fourth quarter

of Fiscal 2013 to the same period of Fiscal 2012,

- Net sales increased 12.1 percent attributable to

- an 18.6 percent sales increase in Europe primarily due to new

product launches; and

- a 26.9 percent sales increase in Asia due to increased demand

for transmission lead-frame assemblies, switches and sensors;

partially offset by

- a 6.2 percent sales decrease in North America due to lower

sales at AMD.

- Gross margins as a percentage of sales increased to 15.1

percent from 13.9 percent due to higher sales and lower costs

related to third-party inspection costs, premium freight and

over-time expenses, partially offset by increased design,

development and engineering costs for a North American automotive

program and the increased sales of automotive product that has

higher prime cost due to the current high percentage of purchased

content.

- Income from operations improved to $6.4 million from $3.3

million due to higher sales, lower costs related to third-party

inspection costs, premium freight and over-time expenses, as well

as lower legal and salary expense, partially offset by severance

and building demolition costs and higher design, development and

engineering costs.

Comparing the Interconnect segment's fourth quarter of Fiscal

2013 to the same period of Fiscal 2012,

- Net sales improved 26.4 percent attributable to

- a 42.1 percent sales improvement in North America due to higher

appliance and data solutions sales; partially offset by

- a 4.9 percent sales decrease in Europe and a 27.0 percent sales

decrease in Asia due primarily to lower radio remote control and

sensor sales.

- Gross margins as a percentage of sales decreased to 25.5

percent from 31.0 percent due primarily to increased sales of lower

margin products and decreased sales of higher margin products, as

well as costs related to the newly acquired business in Italy and

new sensor product development in North America.

- Income from operations improved to $6.3 million from $6.0

million due to improved sales, partially offset by costs related to

the newly acquired business in Italy and new product development in

North America.

Comparing the Power Products segment's fourth quarter of Fiscal

2013 to the same period of Fiscal 2012,

- Net sales increased 23.4 percent attributable to

- a 14.6 percent sales increase in North America driven by higher

cabling product sales;

- a 200.0 percent increase in sales in Europe due to new product

launches; and

- a 13.9 percent sales increase in Asia due to higher busbar

demand.

- Gross margins as a percentage of sales improved to 22.9 percent

from 12.9 percent due to favorable sales mix and higher sales.

- Income from operations decreased to a loss of $2.7 million from

a loss of $0.1 million due to a $4.3 million goodwill impairment

charge related to Eetrex. Without this impairment, income from

operations would have improved to $1.6 million.

Fiscal 2013 Methode's Fiscal 2013 net

sales increased $54.7 million, or 11.8 percent, to $519.8 million

from $465.1 million in Fiscal 2012.

In September 2012, the Company and various Delphi parties agreed

to settle all Delphi related litigation matters. In addition to

resolving all claims between the parties, the Company assigned

certain patents to Delphi and entered into a non-compete with

respect to the related technology. In exchange, the Company

received a payment of $20.0 million. The Company recorded the gain

in the income from settlement section of its consolidated statement

of operations for the fiscal year ended April 27, 2013.

Net income increased $32.3 million to $40.7 million, or $1.08

per share, in Fiscal 2013 compared to $8.4 million, or $0.22 per

share, in Fiscal 2012. Year over year, Fiscal 2013 net income

benefitted from:

- the gain recorded in connection with the legal settlement of

$20.0 million;

- higher income tax benefit due to adjustment of the valuation

allowance related to Malta investment tax credits of $6.8

million;

- higher Other segment income (primarily as a result of increased

torque-sensing product sales) of $3.7 million;

- lower legal expenses of $2.1 million;

- commodity pricing adjustments in the Automotive segment of $1.4

million;

- lower costs related to third-party inspection costs, premium

freight and over-time expenses of $1.3 million;

- the reversal of accruals related to a customer bankruptcy of

$1.1 million;

- lower stock-based compensation costs of $0.7 million; and

- higher sales.

Year over year, Fiscal 2013 net income was negatively affected

by:

- a goodwill impairment charge in the Power Products segment

related to Eetrex of $4.3 million;

- higher costs related to the design, development, engineering

and launch of a large North American automotive program of $2.5

million;

- compensation expense related to the company's long-term

incentive program for performance-based tandem cash awards of $2.1

million;

- severance and building demolition costs in the Automotive

segment of $1.1 million;

- higher Other expense, due to increased foreign currency loss,

the lack of a life insurance gain and the lack of a gain on the

acquisition of AMD, of $1.0 million;

- costs related to the delayed launch of a laundry program of

$0.6 million; and

- costs related to the newly acquired Hetronic business in Italy

of $0.5 million.

Excluding the impact of the pre-tax gain in connection with the

legal settlement, the Malta valuation allowance, the goodwill

impairment charge and the compensation expense, Methode's Fiscal

2013 net income was $19.5 million, or $0.52 per share, which is in

line with full-year Fiscal 2013 earnings per share guidance of

$0.45 to $0.60 per share.

Consolidated gross margins as a percentage of sales were 17.6

percent in Fiscal 2013 compared to 17.9 percent in the same period

of Fiscal 2012. The decrease was due primarily to higher design,

development and engineering costs for a new automotive program,

increased sales of automotive product that has higher prime cost

due to the current high percentage of purchased content, severance

and building demolition costs, as well as manufacturing

inefficiencies due to launch delays in the Interconnect segment,

partially offset by a favorable commodity pricing adjustment in the

Automotive segment, lower costs related to third-party inspection,

premium freight and over-time expenses, a favorable product mix in

the Power Products segment and higher sales and lower costs in the

Other segment.

Selling and administrative expenses decreased $3.6 million, or

5.2 percent, to $66.3 million in Fiscal 2013 compared to $69.9

million in the prior year due primarily to the reversal of customer

bankruptcy accruals, lower legal expenses, as well as lower salary

and stock-based compensation, partially offset by the compensation

expense. Selling and administrative expenses as a percentage of net

sales decreased to 12.8 percent in Fiscal 2013 from 15.0 percent in

Fiscal 2012.

In Fiscal 2013, income tax benefit/expense increased $5.7

million to a benefit of $2.5 million compared to an expense of $3.2

million for Fiscal 2012. For Fiscal 2013, the net income taxes on

foreign profits of $5.1 million were offset by a $7.6 million Malta

valuation allowance adjustment. For Fiscal 2012, the income tax

expense relates to net income taxes on foreign profits of $2.0

million and $2.0 million for taxes on a foreign dividend, partially

offset by a benefit of $0.8 million Malta valuation allowance

adjustment.

Fiscal 2013 Segment Comparison Comparing

the Automotive segment's Fiscal 2013 to Fiscal 2012,

- Net sales increased 14.2 percent attributable to

- a 37.5 percent sales improvement in North America due primarily

to higher sales for the Ford center console program and

transmission lead frame assembly; and

- a 12.8 percent sales increase in Europe primarily due to new

product launches; partially offset by

- a 4.1 percent sales decrease in Asia due to the planned partial

transfer of transmission lead frame assembly products to the

Company's Mexico facility.

- Gross margins as a percentage of sales decreased slightly to

14.0 percent in Fiscal 2013 from 14.1 percent in Fiscal 2012 and

were affected by increased design, development and engineering

costs for a North American automotive program, the increased sales

of automotive product that has higher prime cost due to the current

high percent of purchased content, as well as severance and

building demolition costs, partially offset by lower third-party

inspection costs, premium freight and over-time expenses as well as

commodity pricing adjustments.

- Income from operations improved to $38.8 million from $10.0

million due to the litigation settlement, increased sales,

favorable commodity pricing adjustments, lower third-party

inspection costs, premium freight and over-time expenses as well as

lower legal and other selling and administrative expenses,

partially offset by severance and building demolition costs, higher

design, development and engineering costs and higher prime

costs.

Comparing the Interconnect segment's Fiscal 2013 to Fiscal

2012,

- Net sales increased 9.8 percent attributable to

- higher North American sales of 20.7 percent due to improved

appliance and data solutions sales, partially offset by lower

safety radio remote control device sales; partially offset by

- lower European sales of 10.2 percent due to lower safety radio

remote control device and sensor sales; and

- lower Asian sales of 18.3 percent primarily due to lower legacy

product sales from the planned exit of a product line and lower

safety radio remote control device sales.

- Gross margins as a percentage of sales declined to 26.2 percent

from 28.3 percent due primarily to the increased sales of lower

margin products and decreased sales of higher margin products, as

well as costs related to the delayed launch of a laundry program

and North American sensor development costs.

- Income from operations increased to $19.0 million from $18.1

million primarily due to higher sales and lower selling and

administrative expenses, partially offset by costs related to the

delayed launch of a laundry program and higher development

costs.

Comparing the Power Products segment's Fiscal 2013 to Fiscal

2012,

- Net sales improved 1.3 percent driven by

- flat sales in North America impacted by lower busbar and heat

sink demand offset by higher demand for flexible cabling products;

and

- a 54.5 percent sales increase in Europe due to new product

launches; partially offset by

- a 3.2 percent sales decline in Asia due to lower busbar

demand.

- Gross margins as a percentage of sales increased to 17.3

percent from 16.5 percent due primarily to sales mix partially

offset by development costs.

- Income from operations decreased to a loss of $2.1 million from

income of $1.7 million due to a $4.3 million impairment of goodwill

related to Eetrex and increased development costs, partially offset

by higher sales. Without this impairment, income from operations

would have improved to $2.2 million.

Management Comments President and Chief

Executive Officer Donald W. Duda said, "We ended Fiscal 2013 on a

strong note, with fourth-quarter sales improving over 17 percent

and improved gross margins in our Automotive and Power Products

segments. Additionally, we are proud of our achievements in Fiscal

2013, including sales improvement of nearly 12 percent, the

successful launch of the first high volume laundry platform

utilizing touch technology, a significant number of automotive

launches in Europe, as well as the launch of the GM center console

program."

Guidance For Fiscal 2014, Methode

anticipates sales in the range of $630 to $660 million and earnings

per share in the range of $0.91 to $1.11. The Company currently

expects that the fourth quarter will be the strongest quarter of

Fiscal 2014. The guidance ranges for Fiscal 2014 are based upon

management's expectations regarding a variety of factors and

involve a number of risks and uncertainties, including the

following significant factors considered by management in preparing

this guidance:

- the launch of significant awards previously announced and the

corresponding sales volumes and timing thereof for certain makes

and models of automobiles and trucks for Fiscal 2014;

- the uncertainty of the European economy;

- foreign exchange translation rates;

- a mid-teen tax effective tax rate, assuming no changes in tax

valuation allowances;

- an increase in diluted shares outstanding;

- compensation expense related to tandem cash awards; and

- no unusual or one-time items.

Conference Call The Company will conduct a

conference call and Webcast to review financial and operational

highlights led by its President and Chief Executive Officer, Donald

W. Duda, and Chief Financial Officer, Douglas A. Koman, at 10:00

a.m. Central time today.

To participate in the conference call, please dial (877)

407-8031 (domestic) or (201) 689-8031 (international) at least five

minutes prior to the start of the event. A simultaneous Webcast can

be accessed through the Company's Web site, www.methode.com, by

selecting the Investor Relations page, and then clicking on the

"Webcast" icon.

A replay of the conference call, as well as an MP3 download,

will be available shortly after the call through July 4 by dialing

(877) 660-6853 (domestic) or (201) 612-7415 (international) and

providing Conference ID number 415939. On the Internet, a replay

will be available for 90 days through the Company's Web site,

www.methode.com, by selecting the Investor Relations page and then

clicking on the "Webcast" icon.

About Methode Electronics, Inc. Methode

Electronics, Inc. (NYSE: MEI) is a global developer of custom

engineered and application specific products and solutions with

manufacturing, design and testing facilities in China, Germany,

India, Italy, Lebanon, Malta, Mexico, the Philippines, Singapore,

Switzerland, the United Kingdom and the United States. We design,

manufacture and market devices employing electrical, electronic,

wireless, safety radio remote control, sensing and optical

technologies to control and convey signals through sensors,

interconnections and controls. Our business is managed on a segment

basis, with those segments being Automotive, Interconnect, Power

Products and Other. Our components are in the primary end markets

of the automobile, computer, information processing and networking

equipment, voice and data communication systems, consumer

electronics, appliances, aerospace vehicles and industrial

equipment industries. Further information can be found on Methode's

Web site www.methode.com.

Forward-Looking Statements This press

release contains certain forward-looking statements, which reflect

management's expectations regarding future events and operating

performance and speak only as of the date hereof. These

forward-looking statements are subject to the safe harbor

protection provided under the securities laws. Methode undertakes

no duty to update any forward-looking statement to conform the

statement to actual results or changes in Methode's expectations on

a quarterly basis or otherwise. The forward-looking statements in

this press release involve a number of risks and uncertainties. The

factors that could cause actual results to differ materially from

our expectations are detailed in Methode's filings with the

Securities and Exchange Commission, such as our annual and

quarterly reports. Such factors may include, without limitation,

the following: (1) dependence on a small number of large customers,

including two large automotive customers; (2) dependence on the

automotive, appliance, computer and communications industries; (3)

customary risks related to conducting global operations; (4) the

ability to successfully launch a significant number of programs;

(5) ability to avoid design or manufacturing defects (6) ability to

compete effectively; (7) dependence on the availability and price

of raw materials; (8) dependence on our supply chain; (9) further

downturns in the automotive industry or the bankruptcy of certain

automotive customers; (10) ability to keep pace with rapid

technological changes; (11) ability to protect our intellectual

property; (12) ability to withstand price pressure; (13) location

of a significant amount of cash outside of the U.S.; (14) currency

fluctuations; (15) ability to successfully benefit from

acquisitions and divestitures; (16) ability to withstand business

interruptions; (17) income tax rate fluctuations; and (18) the cost

and implementation of SEC disclosure and reporting requirements

regarding conflict minerals.

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

------------------------------------

Fiscal Quarter Ended

------------------------------------

April 27, 2013 April 28, 2012

----------------- -----------------

Net sales $ 148,358 $ 126,400

Cost of products sold 120,514 103,441

----------------- -----------------

Gross margins 27,844 22,959

Impairment of goodwill 4,326 -

Selling and administrative expenses 19,880 18,077

----------------- -----------------

Income from operations 3,638 4,882

Interest income, net (57) (129)

Other (income)/expense, net 649 (494)

----------------- -----------------

Income before income taxes 3,046 5,505

Income tax benefit (7,012) (187)

----------------- -----------------

Net Income 10,058 5,692

Less: Net loss attributable to

noncontrolling interest (104) (76)

NET INCOME ATTRIBUTABLE TO METHODE

ELECTRONICS, INC. $ 10,162 $ 5,768

================= =================

Net income per share:

Basic $ 0.27 $ 0.15

Diluted $ 0.27 $ 0.15

Basic shares 37,490,370 37,376,936

Diluted shares 38,210,800 37,634,313

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

Fiscal Year Ended

-----------------------------

April 27, April 28,

2013 2012

------------- -------------

Net sales $ 519,836 $ 465,095

Cost of products sold 428,200 381,981

------------- -------------

Gross margins 91,636 83,114

Impairment of goodwill 4,326 -

Income from settlement (20,000) -

Selling and administrative expenses 66,338 69,946

Amortization of intangibles 1,794 1,811

------------- -------------

Income from operations 39,178 11,357

Interest (income)/expense, net (30) (288)

Other expense 1,257 272

------------- -------------

Income before income taxes 37,951 11,373

Income tax expense/(benefit) (2,493) 3,236

------------- -------------

Net income 40,444 8,137

------------- -------------

Less: Net loss attributable to noncontrolling

interest (294) (246)

------------- -------------

NET INCOME ATTRIBUTABLE TO METHODE

ELECTRONICS, INC. $ 40,738 $ 8,383

============= =============

Net income per share:

Basic $ 1.09 $ 0.22

Diluted $ 1.07 $ 0.22

Basic shares 37,466,221 37,366,505

Diluted shares 38,120,462 37,591,980

METHODE ELECTRONICS, INC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

April 27, April 28,

2013 2012

----------- -----------

ASSETS

CURRENT ASSETS

Cash and cash equivalents 65,811 86,797

Accounts receivable, less allowance (2013 - $1,022;

2012 -$1,279) 119,816 98,359

Inventories:

Finished products 11,736 7,001

Work in process 10,220 14,235

Materials 37,973 22,325

----------- -----------

59,929 43,561

Deferred income taxes 3,313 3,529

Prepaid and refundable income taxes 326 1,015

Prepaid expenses and other current assets 9,459 7,172

----------- -----------

TOTAL CURRENT ASSETS 258,654 240,433

PROPERTY, PLANT AND EQUIPMENT

Land 3,135 3,135

Buildings and building improvements 43,159 44,051

Machinery and equipment 250,961 230,265

----------- -----------

297,255 277,451

Less allowances for depreciation 198,897 200,299

----------- -----------

98,358 77,152

OTHER ASSETS

Goodwill 12,907 16,422

Other intangibles, less accumulated amortization 16,466 16,620

Cash surrender value of life insurance 9,351 8,802

Deferred income taxes 14,767 15,072

Pre-production costs 11,511 16,215

Other 12,925 12,932

----------- -----------

77,927 86,063

----------- -----------

TOTAL ASSETS 434,939 403,648

=========== ===========

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES

Accounts payable 61,541 54,775

Salaries, wages and payroll taxes 9,673 9,554

Other accrued expenses 14,827 14,964

Deferred income taxes 628 9,131

Income tax payable 3,802 3,453

----------- -----------

TOTAL CURRENT LIABILITIES 90,471 91,877

LONG-TERM DEBT 43,500 48,000

OTHER LIABILITIES 3,294 3,413

DEFERRED COMPENSATION 8,090 4,801

NON-CONTROLLING INTEREST - 333

SHAREHOLDERS' EQUITY

Common stock, $0.50 par value, 100,000,000 shares

authorized, 38,455,853 and 38,375,678 shares

issued as of April 27, 2013 and April 28, 2012,

respectively 19,228 19,188

Additional paid-in capital 81,472 77,652

Accumulated other comprehensive income 15,680 15,573

Treasury stock, 1,342,188 as of April 27, 2013

and April 28, 2012 (11,377) (11,377)

Retained earnings 184,368 154,008

----------- -----------

TOTAL METHODE ELECTRONICS, INC. SHAREHOLDERS'

EQUITY 289,371 255,044

Noncontrolling interest 213 180

----------- -----------

TOTAL EQUITY 289,584 255,224

----------- -----------

TOTAL LIABILITIES AND EQUITY 434,939 403,648

=========== ===========

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Fiscal Year Ended

--------------------------------

April 27, 2013 April 28, 2012

--------------- ---------------

OPERATING ACTIVITIES

Net income $ 40,444 $ 8,137

Adjustments to reconcile net income to

net cash provided by/(used in)

operating activities:

Loss on sale of fixed assets - 118

Impairment of goodwill 4,326 -

Gain on bargain purchase - (255)

Provision for depreciation 17,012 14,348

Amortization of intangible assets 1,794 1,811

Stock-based compensation 3,252 3,976

Provision for bad debt 106 495

Deferred income taxes (7,206) (1,939)

Changes in operating assets and

liabilities:

Accounts receivable (21,198) (13,525)

Inventories (16,138) (3,278)

Prepaid expenses and other current

assets 9,175 (10,255)

Accounts payable and accrued

expenses 1,678 25,192

--------------- ---------------

NET CASH PROVIDED BY OPERATING

ACTIVITIES 33,245 24,825

INVESTING ACTIVITIES

Purchases of property, plant and

equipment (38,555) (25,744)

Acquisition of businesses (1,434) (6,353)

--------------- ---------------

NET CASH USED IN INVESTING ACTIVITIES (39,989) (32,097)

FINANCING ACTIVITIES

Proceeds from exercise of stock options 608 263

Cash dividends (10,378) (10,364)

Proceeds from borrowings 37,000 52,000

Repayment of borrowings (41,500) (4,000)

--------------- ---------------

NET CASH PROVIDED BY/ (USED IN)

FINANCING ACTIVITIES (14,270) 37,899

Effect of foreign currency exchange rate

changes on cash 28 (1,275)

--------------- ---------------

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS (20,986) 29,352

Cash and cash equivalents at beginning of

year 86,797 57,445

CASH AND CASH EQUIVALENTS AT END OF YEAR $ 65,811 $ 86,797

=============== ===============

For Methode Electronics, Inc. - Investor Contacts:

Kristine Walczak Dresner Corporate Services 312-780-7205

kwalczak@dresnerco.com Philip Kranz Dresner Corporate Services

312-780-7240 pkranz@dresnerco.com

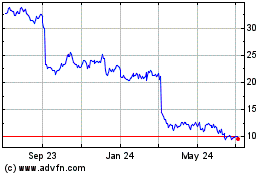

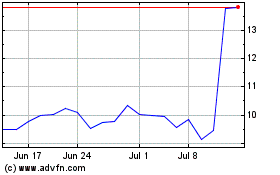

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Apr 2023 to Apr 2024