Securities Registration: Employee Benefit Plan (s-8)

May 24 2013 - 5:27PM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on May 24, 2013

Registration No. __________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

WORLDS INC

.

(Exact name of registrant as specified in its

charter)

|

Delaware

(State or other jurisdic-

tion of incorporation or organization)

|

22-1848316

(IRS Employer

Identification No.)

|

11 Royal Road

Brookline,

MA 02445

(Address of Principal Executive Offices w/ Zip

Code)

Consulting Agreement with Ian Kelly

Consulting Agreement with Bora Bora Inc.

(Full

title of the plan)

Thomas Kidrin

President and CEO

Worlds Inc.

11 Royal Road

Brookline, MA 02445

(Name and address

of agent for service)

Copy to:

Feder Kaszovitz LLP

Attn: Irving Rothstein, Esq.

845 Third Avenue

New York, New York 10022

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (check one):

__ Large Accelerated Filer __ Accelerated

Filer __ Non-Accelerated Filer

x

Smaller

reporting company

(Do not check if a smaller

reporting company)

Approximate date of commencement of proposed

sale to the public:

FROM TIME TO TIME AFTER THE REGISTRATION STATEMENT BECOMES EFFECTIVE.

CALCULATION OF REGISTRATION FEE

|

TITLE OF SECURITIES TO BE REGISTERED

|

AMOUNT TO BE REGISTERED (1)

|

PROPOSED MAXIMUM OFFERING PRICE

PER

SHARE

|

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE

|

AMOUNT OF REGISTRATION FEE

|

|

|

|

|

|

|

|

Common Stock

|

125,000 par shares(2)

|

$0.47(3)

|

$58,750(4)

|

$8.02

|

|

($.001 par value)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

|

|

$8.02

|

(1) Pursuant to Rule 416(a) under the Securities

Act of 1933, as amended, this registration statement shall also cover any additional shares of the Registrant’s common stock

that become issuable by reason of any stock dividend, stock split, recapitalization or similar transaction effected without the

Registrant’s receipt of consideration which would increase the number of outstanding shares of the Registrant’s common

stock.

(2) Represents shares to be issued pursuant to the consulting agreements

listed above.

(3) Represents the closing price within five business days of this

filing.

(4) Estimated solely for purposes of calculating the registration

fee pursuant to Rules 457(h)(1) under the Securities Act of 1933, as amended, resulting from multiplying the registered shares

of Common Stock by $0.47, a closing sale price within five business days of this filing.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The following documents filed by us with the

Securities and Exchange Commission (the "Commission"), pursuant to the Securities Exchange Act of 1934, as amended (the

"Exchange Act") and the Securities Act of 1933, as amended (the "Securities Act"), are incorporated by reference

in this Registration Statement:

|

|

(a)

|

Our Annual Report on Form 10-K for the year ended December 31, 2012.

|

|

|

(b)

|

All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by Annual Report referred to in (a) above.

|

|

|

(c)

|

The description of our Common Stock set forth in our Registration Statement on Form SB-2 filed April 6, 1998 (File No. 333-49453).

|

All documents subsequently filed by us pursuant

to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that

all shares of Common Stock offered hereby have been sold or which deregisters all shares then remaining unsold, shall be deemed

to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently

filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement.

Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this

Registration Statement.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

The personal liability

of our directors is limited to the fullest extent permitted by the provisions of paragraph (7) of subsection (b) of Sec. 102 of

the General Corporation Law of the State of Delaware, as the same may be amended and supplemented. We shall, to the fullest extent

permitted by the provisions of Sec. 145 of the General Corporation Law of the State of Delaware, as the same may be amended and

supplemented, indemnify any and all persons whom we shall have power to indemnify under said section from and against any and all

of the expenses, liabilities, or other matters referred to, in or covered by said section, and the indemnification provided for

herein shall not be deemed exclusive of any other rights to which those indemnified may be entitled under any Bylaw, agreement,

vote of stockholders or disinterested directors or otherwise, both as to action in such person's official capacity and as to action

in another capacity while holding such office, and shall continue as to a person who has ceased to be a director, officer, employee,

or agent and shall inure to the benefit of the heirs, executors, and administrators of such person.

We may also purchase and

maintain insurance for the benefit of any director or officer which may cover claims for which we could not indemnify such person.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons pursuant

to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such

indemnification is against public policy as expressed in the Securities Act and is, therefore

unenforceable.

ITEM 8. EXHIBITS.

|

|

Exhibit Number

|

Description of Exhibit

|

|

|

|

|

|

|

4.1

|

Consulting Agreement dated May 1, 2013 with Ian Kelly

|

|

|

4.2

|

Consulting Agreement dated May 1, 2013 with Bora Bora Inc.

|

|

|

|

|

|

|

5

|

Opinion of Feder Kaszovitz LLP

|

|

|

|

|

|

|

23.1

|

Consent of Bongiovanni & Associates, PA

|

|

|

|

|

|

|

23.2

|

Consent of Feder Kaszovitz LLP (contained in Exhibit 5)

|

ITEM 9. UNDERTAKINGS

The undersigned Registrant hereby undertakes:

1.

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement to

include any material information with respect to the plan of distribution not previously disclosed in this registration statement

or any material change to such information in this registration statement.

2.

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

3.

To remove from registration by means of a post-effective amendment any of the securities being registered that remain unsold at

the termination of the offering.

4.

That, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant's annual report

pursuant to section 13(a) or section 15(d) of the Exchange Act of 1934 that is incorporated by reference in this registration statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

5.

That insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers

and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that

in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Brookline, State of Massachusetts, on May 23, 2013.

WORLDS INC.

By:

/s/ Thomas Kidrin

Thomas Kidrin

President and Chief Executive Officer

Pursuant to the requirements

of the Securities Exchange Act of 1933, this report has been signed below by the following persons on behalf of the Registrant

and in the capacities and on the dates indicated.

|

SIGNATURE

|

TITLE

|

DATE

|

|

|

|

|

|

/s/ Thomas Kidrin

|

Director, President and Chief Executive Officer (Principal Executive Officer)

|

May 23, 2013

|

|

Thomas Kidrin

|

|

|

|

|

|

|

|

/s/ Christopher Ryan

|

Chief Financial Officer (Principal Financial and Accounting Officer)

|

May 23, 2013

|

|

Christopher Ryan

|

|

|

|

|

|

|

|

/s/ Robert Fireman

|

Director

|

May 23, 2013

|

|

Robert Fireman

|

|

|

|

|

|

|

|

/s/ Bernard Stolar

|

Director

|

May 23, 2013

|

|

Bernard Stolar

|

|

|

INDEX TO EXHIBITS

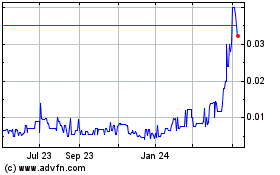

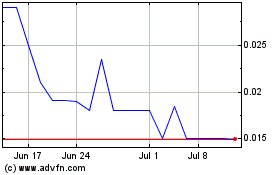

Worlds (PK) (USOTC:WDDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Worlds (PK) (USOTC:WDDD)

Historical Stock Chart

From Apr 2023 to Apr 2024