Plumas Bancorp Exits TARP With Repurchase of Warrant From U.S. Treasury

May 23 2013 - 12:49PM

Marketwired

Plumas Bancorp (NASDAQ: PLBC), a bank holding company and the

parent company of Plumas Bank, announced today that on May 22, 2013

it completed the repurchase of the warrant issued to the United

States Department of the Treasury (the "Treasury") in 2009 as part

of the Treasury's Troubled Asset Relief Program's (TARP) Capital

Purchase Program. The warrant provided the Treasury the right to

purchase 237,712 shares of the Plumas Bancorp's common stock at a

price of $7.54 per share. Plumas Bancorp (the "Company") and the

Treasury agreed upon a repurchase price of $234,500 for the

warrant. As a result of the Company's repurchase of the warrant,

the Treasury no longer has any equity interest in the Company.

In April 2013, the Company repurchased, at auction, 7,000 of the

11,949 shares of preferred stock originally sold to the Treasury in

2009. The remaining 4,949 shares were sold by the Treasury to

investment firms unrelated to the Company. The Company paid $7.6

million for the 7,000 shares, resulting in a discount of

approximately 7% on the face value of the preferred shares, plus

related outstanding dividends.

Andrew J. Ryback, president and chief executive officer of

Plumas Bancorp and Plumas Bank, commented, "We are pleased that we

were able to repurchase our warrant at a fair price. The repurchase

of our warrant not only protects our shareholders against dilution

but also brings our relationship with the Treasury to a close. The

conclusion of our participation in the TARP program will allow us

to focus on the critical tasks of strengthening our customer

relationships and maximizing long-term shareholder value."

Founded in 1980, Plumas Bank is a locally owned and managed

full-service community bank based in Northeastern California. The

Bank operates eleven branches located in the counties of Plumas,

Lassen, Placer, Nevada, Modoc and Shasta. Plumas Bank offers a wide

range of financial and investment services to consumers and

businesses and has received nationwide Preferred Lender status with

the United States Small Business Administration. For more

information on Plumas Bancorp and Plumas Bank, please visit our

website at www.plumasbank.com.

This news release includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act of 1934, as amended and Plumas

Bancorp intends for such forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

Future events are difficult to predict, and the expectations

described above are necessarily subject to risk and uncertainty

that may cause actual results to differ materially and

adversely.

Forward-looking statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

often include the words "believe," "expect," "anticipate,"

"intend," "plan," "estimate," or words of similar meaning, or

future or conditional verbs such as "will," "would," "should,"

"could," or "may." These forward-looking statements are not

guarantees of future performance, nor should they be relied upon as

representing management's views as of any subsequent date.

Forward-looking statements involve significant risks and

uncertainties and actual results may differ materially from those

presented, either expressed or implied, in this news release.

Factors that might cause such differences include, but are not

limited to: the Company's ability to successfully execute its

business plans and achieve its objectives; changes in general

economic and financial market conditions, either nationally or

locally in areas in which the Company conducts its operations;

changes in interest rates; continuing consolidation in the

financial services industry; new litigation or changes in existing

litigation; increased competitive challenges and expanding product

and pricing pressures among financial institutions; legislation or

regulatory changes which adversely affect the Company's operations

or business; loss of key personnel; and changes in accounting

policies or procedures as may be required by the Financial

Accounting Standards Board or other regulatory agencies.

In addition, discussions about risks and uncertainties are set

forth from time to time in the Company's publicly available

Securities and Exchange Commission filings. The Company undertakes

no obligation to publicly revise these forward-looking statements

to reflect subsequent events or circumstances.

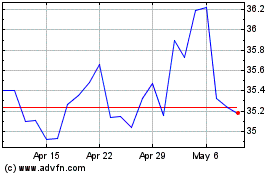

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Apr 2023 to Apr 2024