Investor Presentation May 2013 Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333 - 187625 May 23, 2013

2 Free Writing Prospectus Statement Vuzix Corporation (“ Vuzix ”, “we”, “our” or the “Company”) has filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates. The registrations statement is not yet effective. Before you invest, you should read the preliminary prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov . The preliminary prospectus, dated May 21, 2013, is available on the SEC Web site at: http://www.sec.gov/Archives/edgar/data/1463972/000114420413030797/v345641_s1a.htm Alternatively, the Company or any underwriter participating in the offering will arrange to send you the prospectus and/or supplements thereto if you contact Aegis Capital Corp., Prospectus Department, 810 Seventh Avenue, 18th Floor, New York, NY, 10019, telephone: 212 - 813 - 1010 or e - mail: prospectus@aegiscap.com.

3 Certain statements included in this presentation may be considered forward - looking . All statements in this presentation that are not historical facts are forward - looking statements . Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements, and therefore these statements should not be taken as guarantees of future performance or results . The forward - looking statements include statements concerning : our possible or assumed future results of operations ; our possible or assumed future results of operations ; our business strategies ; our ability to attract and retain customers ; our ability to sell additional products and services to customers ; our cash needs and financing plans ; our competitive position ; our industry environment ; our potential growth opportunities ; expected technological advances by us or by third parties and our ability to leverage them ; the effects of future regulation ; and the effects of competition . These statements are based on our management’s beliefs and assumptions and on information currently available to our management . It is important to note that forward - looking statements are not guarantees of future performance, and that our actual results could differ materially from those set forth in any forward - looking statements . Due to risks and uncertainties, actual events may differ materially from current expectations . For a more in depth discussion of these and other factors that could cause actual results to differ from those contained in forward - looking statements, see the discussions under the heading "Risk Factors" in our S - 1 /A registration statement and annual report on Form 10 - K filed by Vuzix Corporation with the SEC . Vuzix disclaims any intention or obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Cautionary Note Regarding Forward Looking Statements

4 Offering Details Issuer Vuzix Corporation Proposed Listing/Ticker TSX - V: VZX, OTC:BB: VUZI, FMB: V7X. Applied to list on Nasdaq under the symbols VUZI & VUZIW Offering Size Approximately $15 million (15% over - allotment) Securities Offered Common Stock & Warrants Use of Proceeds We expect to use the net proceeds received from this offering to complete commercialization of our waveguide, smart glasses and HD display engine technologies, repayment of debt in the amount of approximately $1,460,000 and for working capital and general corporate purposes Sole Bookrunner Aegis Capital Corp

5 Vuzix Background • Founded 1997 - World Wide Operations • One of the World’s Leading supplier of - Wearable display technology • Cornerstone IP and Patent Portfolio - 33 patents and 15 patents pending • Employees - 28 total with 8 engineering staff • Award Winning Technology and Design - Immersive Viewing, Virtual Reality, Augmented Reality • World Class Team with Global Partners - Technology, Channel, Manufacturing, Content , Applications • Revolutionary New Products - Smart Glasses for Mobility

6 Executive Management • Paul J. Travers – Founder and President and Chief Executive Officer; has more than 25 years experience in the consumer electronics field, and 20 years experience in the virtual reality and virtual display fields • Grant Russell – Chief Financial Officer; has over 30 years experience leading in the consumer electronics industry with experience such as co - founding Advanced Gravis Computer, the world’s largest PC and Macintosh joystick manufacturer at the time • Michael McCrackan – Vice President of Operations; has over 20 years experience as Director of R&D Eastman Kodak. With over 20 years experience in R&D, product management, and operations – including the delivery of products and services for over 15 countries in the Digital Special Effects Post Production industry, Digital Cinema and Digital Signage markets

7 Mobility is c reating B illion D ollar M arkets • Gartner Research estimates 714 million smart phones sold in 2014 • ABI Research forecasts the wearable computing device market will grow to 485 million annual device shipments by 2018 - More than 75 million of these will be Smart G lasses • “Smart Glasses and Other Wearable Devices to be worth over $1.5 billion by 2014, finds Juniper” Global Smart Glasses Shipments Source: ABI Research - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 2013 2014 2015 2016 2017 2018 Shipments (000s) Retail Market Value of Smart Wearable Devices (2014) North America Latin America Western Europe Central & Eastern Europe Far east & China Indian Subcontinent Rest of Asia Pacific Africa & Middle East Source: Juniper Research

8 Smart Phones are Growing B eyond Text - Voice - Internet

9 Augmented Reality applications are expanding across many verticals Retail/Commerce E - learning Location Based Services Gaming Travel Social And delivering amazing experiences Understand what you are looking at… Make smarter choices…. Share your experiences….. Find your way there….. * Apps displayed are courtesy Wikitude Corporation

10 1983 1980s Email – 1972 Text msg – 1992 Internet www – 1995 Cloud connected apps from AR to gaming 1994 to now For Mobility, Gaming and AR – Need a New Device 1990 2000 2012 Smart Glasses

11 A Day in the Life of Cloud Connected You… http:// sidv.co /author/ sid / Images: Siddharth Vanchinathan

12 Smart Glasses • The Solution - Video glasses afford big screens in a compact, wearable package - Wearable interactive displays with private viewing anytime, anywhere - The perfect hands free mobile phone display screen • The Challenges - Make them like regular eyeglasses - Make them HD, smart and see - through

13 Vuzix Technology – IP for Smart Glasses GOVERNMENT Advanced Display and Optics Development Contracts. Supports Vuzix Business Strategy and Technology Paths • O ver $35 million invested – Vuzix IR&D and US Government • A strong IP portfolio consisting of more than 33 patents and 15 patents pending with other key technology licenses • Key technical competitive differentiators: - Passive and Dynamic Holographic waveguide optic for existing 2D displays - Hi contrast LED micro scanning display engine - Government SBIRs and development programs for curved surfaces, large FOVs and full color guides • All purpose built for eye glass form factors or (Built for the real world eyeglass environment) NOKIA + VUZIX Vuzix secures Nokia technology license for see - through optics

14 Patents and patents pending for Smart Glasses This is in addition to trade secrets, copyright, other licenses and proprietary technologies at Vuzix Count Thin optics for smart glasses Dynamic and passive waveguides 5 Display engine with optics Dynamic and scanning display engine 8 Smart Glasses and Video Eyewear Design and utility 26 Other Miscellaneous eyewear devices and optics 9 Total 48

15 Vuzix Proprietary Waveguide Optics • Waveguides are a revolutionary way of moving light - Image is injected into a 1.4mm thin waveguide like a fiber optic - Not bent through bulk material like conventional optics • Provides a significant improvement in - Mass, cost, volume, simplicity and optical performance Conventional Optics Waveguide Optics

16 Vuzix Proprietary Scanning Engine Display • Scanning display is a revolutionary way to create virtual displays - 1 thin line of LEDS and a MEMs scanner into a waveguide - Instead of three power hungry LEDs that are 100% on, with expensive large area megapixel microdisplays that then need to be magnified using bulky conventional optics • Built for wearable AR displays and provides significant advantages: - Less Silicon and only illuminate the area of the display we need - Lower cost , lower power, higher resolution, perfect form factor

17 Competition – Industrial and Early Adopters Only • Market has been constrained by bulky appearance, poor ergonomics and technical limitations of optics • No company dominates, but Vuzix has always led the field in optics, styling and wearability… Conventional Optics for Video Viewers & Gaming Vuzix Eyeglass Form Factor Conventional Options for Smart Glasses Carl Zeiss - Cinemizer Sony - HMZ Epson - Moverio Google - Glass Kopin - Golden - I Oculus - Rift

18 Smart Glasses – M Series for Enterprise/ Prosumer • M100 – first of smart glasses line • Winner of CES 2013 Innovations Award • Shipping to developers with commercial production late summer • Smart & powerful computing device • Native Android OS – runs thousands of existing apps • WQVGA display & 1080p camera • Two SDKs $7.5k and $1k - Thousands of requests, hundreds buying - App Store under development

19 Competition – Google Glass M100 Smart Glasses 1) Shipping Summer 2013 2) Enterprise and prosumer centric 3) Runs standard Android OS 4) Standalone usage models are supported – no internet needed 5) Run apps onboard and real - time 6) Optics work in bright daylight 7) Built in GPS 8) Expandable to 64 Gig Google Glass 1) Shipping Summer 2014 2) Trying for consumer 3) Apps only run from the cloud 4) N o standalone operation 5) Apps can’t run real time so can’t support true AR content 6) Optical see thru – sunny days are difficult to see display 7) Must use Phones GPS 8) 12 gig fixed • There is a list of differences between Google and Vuzix • The number one, we are focused on enterprise first • Current solutions don’t fit mass consumer expectations

20 SAP / Vuzix Augmented Reality Solutions http://www.youtube.com/watch?v=9Wv9k_ssLcI

21 Vuzix smart glasses run native Android OS • Most Enterprise users NEED Open O/S • Works with thousands of existing and unmodified Android apps • Existing Android apps are easily modified for improved performance and functionality

22 Vuzix smart glasses are d esigned to connect with Bluetooth devices/sensors – Enterprise market centric

23 Vuzix Smart Glasses Standalone or Cloud Connected Native Apps run on M100 Standalone Enterprise Apps HMD Apps run on Smartphone iOS or Android Cooperative Related Apps run on Smartphone and M100 iOS or Android Cloud Optional, all modes

24 Smart Glasses • First binocular fashion - wear smart glasses • Hands - free operation by voice and gesturing • Run apps onboard or on a paired Android or iOS device • qHD displays and 1080p camera • W ireless connectivity with integrated power • True eyeglass styling with electro - tint • Builds on prior smart glasses SDK

25 Industrial See through – M2000 for enterprise • First waveguide based solution • Ruggedized for industrial applications • 720p display and 1080p camera • M2000AR – currently HDMI connection • Programmable electronic shutter adjusts for indoor/outdoor use • HDMI version shipping early summer • Will be transforming to smart glasses • Will run apps onboard or on a paired Android or iOS device

26 Personal Viewing and Gaming Smart Glasses • HDMI 3D and streaming WiFi ready • Designed for PC, Console, Smartphone • 720P - highest resolution with largest FOV at 55+ degrees (Front row of theater) • AR & VR Application ready with tracking, audio, microphone, camera • Runs Android OS and apps directly • High precision optics for gaming to work • Fully immersive video or VR experience • Wireless connectivity or HDMI plug - in

27 Smart Glasses – B Series Smart Glasses – M Series HD Gaming/Viewing 2000 – 2012 Starting in 2013 it’s all going Smart Glasses Bulky Legacy Solutions 2013 Forward A Step Change in Technology Going From Bulky Football Helmets to Fashionable Glasses

28 Growing Smart Glasses Development Partners • Many thousands of existing developers – AR, VR and Smart Glasses • Online developer portal and support • Smart Glasses SDK – $1k with annual fees • Fully open so enterprise users can customize to their needs

29 Global Technology and Channel Partners Technology Channel

30 • Wide Screen Video Glasses - 52 & 75 inch v irtual screens • Virtual Reality Glasses - Includes head tracker • Limited by technology to standard definition CE Industry Award - Winning Products Last 9 Years Current Line of Video Eyewear

31 Current Line of Augmented Reality Glasses • Wrap1200AR – all digital see through, stereo cameras • STAR 1200 series – optical see - through HD camera • Mainly research and commercial users Digital See Through Optical See Through AR at a Construction Site

32 Vuzix Products in Action Industry, Education, Gaming, VR and AR, Medical and More

33 Going to Market Globally • US – Direct and major national distributors • EMEA – Distributors in 30+ countries • Web store with fulfillment and warehouses in US, UK, EU, and Japan • Apple.com in over 22 countries (JP and EU) • Exploring new market sectors and geographic licensing

34 (USD, 000s) Dec 31, 2012 Dec 31, 2011 Sales $3,228 $4,826 Cost of Sales 2,341 3,615 Gross Margin 887 1,211 Operating Expenses 4,560 5,579 EBITDA (3,673) (4,368) Depreciation and Amortization 534 504 (Loss) from Continuing Operations (4,206) (4,872) Taxes and Other Income (Expense) (541) (461) Net (Loss) from Continuing Operations (4,747) (5,333) Income (Loss) from Discontinued Operations (1) (748) 1,453 Gain (Loss) on Sale of Discontinued Operations (1) 5,818 0 Net Income (Loss) $323 ($3,880) Historical Financial Data 1. Discontinued Operations: TDG Assets sold June 2012 (Tac - Eye, Night Vision, General Defense engineering services)

35 (USD, 000s) Mar 31, 2013 Mar 31, 2012 Sales $739 $1,110 Cost of Sales 337 751 Gross Margin 402 359 Operating Expenses 1,009 1,165 EBITDA (607) (806) Depreciation and Amortization 98 145 (Loss) from Continuing Operations (706) (951) Taxes and Other Income (Expense) (231) (117) Net (Loss) from Continuing Operations (936) (1,068) Income (Loss) from Discontinued Operations (1) 0 223 Gain (Loss) on Sale of Discontinued Operations (1) 0 0 Net Income (Loss) (936) (844) Q1 2013 Financial Data 1. Discontinued Operations: TDG Assets sold June 2012 ( Tac - Eye, Night Vision, General Defense engineering services)

36 (USD, 000s) Dec. 31, 2012 Mar. 31, 2013 Pro-Forma Assets Cash $67 $532 $12,024 Accounts Receivable 171 224 224 Inventory & Prepaids 972 957 957 Current Assets 1,210 1,713 13,205 Net Fixed Asset & Intangibles 1,216 1,371 1,145 Total Assets 2,426 3,084 14,350 Current Liabilities 5,150 6,596 4,394 Long-term Debt 3,485 3,548 1,560 Total Liabilities 8,635 10,144 5,954 Share Capital 19,937 20,023 35,846 (Deficit) (26,146) (27,083) (27,450) Stockholder's Equity (Deficit) (6,209) (7,060) 8,396 Total Liabilities & Stockholders Equity $2,426 $3,084 $14,350 Vuzix Historical Balance Sheet • Conversion of $2,870 in long - term debt at offering price, repayment of $500 in notes and bank line, and repayment of the $800 debt PP from March 2013 • Gross offering proceeds of $15,000 at an assumed offering price of $7.30 per share/warrant

37 Use of Proceeds • Repayment of approximately $1.5 million of debt (senior, short - term and bank line) • Bring trade payables current • Commercialization of M100 Smart Glasses for volume production late Q3 • New waveguide optics with production of Gen 2 Version by Fall 13 • Introduction of binocular Smart Glasses for CES 2014 • Production tooling of VFX720 headphone • HD display engine proto spring 2014 • Working capital and general corporate purposes

38 Capitalization Table (3, 4, 5) 1. Senior term debt, term deferred trade payables and all accrued interest totaling $2,870,642 as of Mar 31, 2013 converting on close of offering 2. Warrant termination of 533,333 warrants in exchange for 200,000 common shares 3. Gross offering to raise $15,000,000 at an assumed offering price of $7.30 per share/warrant 4. Offering warrants – half warrants at 125% of Offering price with 5 year term 5. Deferred Compensation totaling $1,532,051 convertible at Offering price Security Average Exercise Price As of Mar 31, 2013 Pro Forma Post Offering % Fully Diluted Free Trading Common Shares 3,536,865 3,536,865 45.5% 1,242,646 2,294,219 Offering Shares 2,054,795 26.5% 2,054,795 Debt Conversions (1) 393,239 5.1% 393,239 - Warrant Exchange (2) 200,000 2.6% 200,000 - Basic Shares Outstanding 6,184,899 4,349,014 Outstanding Warrants $6.84 863,121 329,788 4.2% Outstanding Options $10.68 192,729 222,729 2.9% Offering Warrants 1,027,397 13.2% Fully Diluted Shares Outstanding 4,592,715 7,764,813 100% 1,835,885 4,349,014 Under Lock-up Agreement

39 Comparable Companies (figures in millions, except per share data) Price (1) 52 - Week Equity Firm Firm Value / Revenue Firm Value / EBITDA Company @ 05/20/13 High Low Value Value (2) LTM CY 2013E CY 2014E LTM CY 2013E CY 2014E Plantronics, Inc. $46.54 $47.48 $28.76 $1,983 $1,637 2.1 x 2.0 x 1.9 x 10.5 x 9.2 x 8.4 x Synaptics Inc. 43.12 45.40 22.58 1,401 1,088 1.9 1.4 1.4 14.7 6.6 6.0 Logitech International SA 6.57 11.17 5.92 1,037 723 0.3 0.4 0.4 9.6 6.6 5.6 Astronics Corporation 33.27 33.35 19.25 481 491 1.8 1.6 1.4 11.8 9.8 7.9 Uni-Pixel, Inc. 27.19 41.42 5.27 327 311 60.5 7.2 2.0 - 10.5 3.1 Kopin Corp. 3.51 3.95 2.78 233 96 3.2 - - - - - eMagin Corp. 3.62 4.98 2.80 86 71 2.2 2.0 1.5 22.4 - 4.9 Microvision Inc. 2.65 3.63 1.18 67 64 7.6 9.5 - - - - Densitron Technologies plc 0.10 0.16 0.09 7 7 0.2 - - 6.3 - - Median $327 $311 2.1 x 2.0 x 1.5 x 11.2 x 9.2 x 5.8 x Mean 625 499 8.9 3.4 1.4 12.6 8.5 6.0 Vuzix Corporation $6.75 $9.75 $1.65 $25 $29 9.1 x - - - - - Source: Bloomberg and Wall Street Research Note: LTM = Latest Twelve Months NM = Not Meaningful; NA = Not Available (1) Stock price as of May 20, 2013 (2) Firm Value (FV) equals Equity Value plus debt less cash

40 Vuzix Investment Highlights • A cknowledged as one the world leaders in Smart Glasses, established over the last 20 years, and at the front end of market opportunities in the billions of dollars • A clear vision of the important role that mobile displays will play in the future • Strong R&D plan to commercialize its next generation technology for both Vuzix and potential third party OEMs and licensees • A comprehensive roadmap for the future of Smart Glasses • Strong new product portfolio being unveiled in 2013/14 • Pursuing high growth and margin opportunities in burgeoning wearable tech markets

41 Thank You

42 Appendix of Vuzix Materials

43 Vuzix Manufacturing • Capable of ~30K units/quarter • Asian suppliers capable of high volume – supply to Logitech, Belkin , etc.

44 Waveguide Optics - Tools to Production Laser Lithography Reactive Ion Beam Etch UV Replication

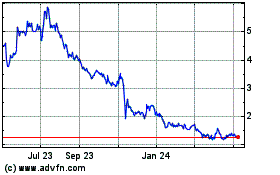

Vuzix (NASDAQ:VUZI)

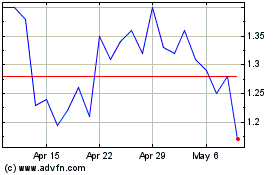

Historical Stock Chart

From Mar 2024 to Apr 2024

Vuzix (NASDAQ:VUZI)

Historical Stock Chart

From Apr 2023 to Apr 2024